The Next Big Thing in AI: OpenAI and NVIDIA’s 10 Million GPU Model

The realm of Artificial Intelligence (AI) has been expanding at an unprecedented pace, transforming industries and reshaping the way we

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

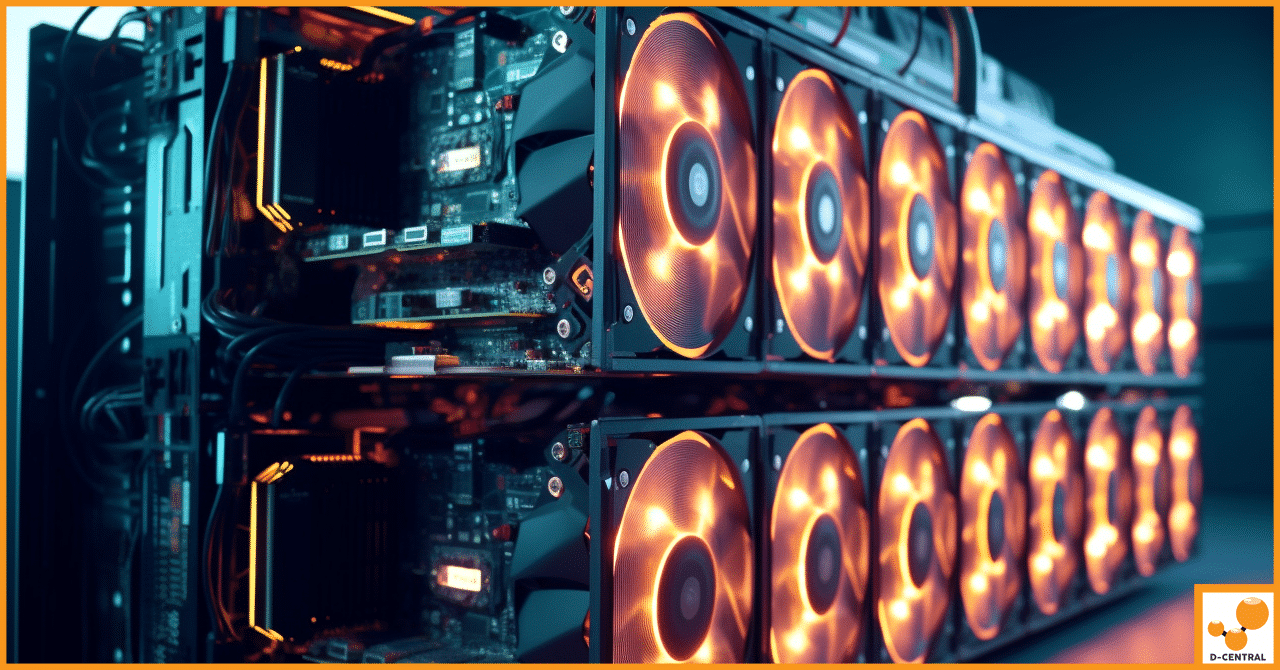

The world of cryptocurrency mining has evolved significantly since the inception of Bitcoin in 2009. With the increasing popularity of digital currencies, dedicated mining hardware has become a necessity for those looking to profit from the crypto economy. One such specialized mining equipment is the ASIC miner, which stands for Application-Specific Integrated Circuit. These powerful devices are specifically designed to mine cryptocurrencies at a much higher efficiency and performance compared to traditional mining methods, such as GPU mining.

ASIC mining has played a crucial role in the crypto economy by providing a stable and secure network for various cryptocurrencies, such as Bitcoin and Litecoin. With an increase in mining power, the blockchain becomes more secure, and the overall speed of transactions is improved. Furthermore, ASIC miners contribute to the decentralization of the cryptocurrency ecosystem by allowing individuals and small-scale miners to compete with large mining farms and corporations.

In this comprehensive guide, we will discuss the ASIC miner market, the factors to consider when selecting the ideal mining hardware, and the top brands and models available today. We will also delve into setting up your mining rig and operation, calculating mining profitability, managing and optimizing your mining activities, and the risks and challenges associated with the ASIC miner market.

The ASIC miner market is a dynamic and competitive space, with new mining hardware being introduced regularly to meet the ever-changing demands of the cryptocurrency mining industry. As a result, selecting the right ASIC miner can be a challenging task, especially for those new to the world of digital currency mining.

To make an informed decision, it is crucial to stay up-to-date with the latest mining technology and industry trends, as well as to understand the various factors that impact mining profitability and performance. This includes factors such as mining algorithms, hashing power, mining efficiency, mining profitability, mining difficulty, and block rewards, which we will discuss in detail in the following sections.

One of the first factors to consider when selecting an ASIC miner is the mining algorithm it supports. Different cryptocurrencies utilize different mining algorithms, which require specific types of mining hardware. For example, Bitcoin uses the SHA-256 algorithm, while Ethereum employs the Ethash algorithm. Therefore, it is essential to choose an ASIC miner that is compatible with the cryptocurrency you intend to mine.

Once you have identified the appropriate mining algorithm, the next factor to consider is the hashing power of the ASIC miner. Hashing power, measured in terahashes per second (TH/s) or hashes per second (H/s), is the speed at which a mining device can perform cryptographic calculations. A higher hashing power indicates a higher mining performance, which in turn, increases the probability of successfully mining a block and earning rewards.

Mining efficiency is another crucial factor to consider when selecting an ASIC miner. Since mining consumes a significant amount of electricity, it is essential to choose a mining device that is energy-efficient. Mining efficiency is typically expressed in terms of the number of joules consumed per terahash (J/TH) or per hash (J/H). A lower J/TH or J/H value indicates a more energy-efficient miner.

Additionally, the performance of the ASIC miner should be considered. This involves assessing the device’s build quality, cooling system, and overall stability. A well-built miner with an effective cooling system can operate at optimal conditions, ensuring higher performance and a longer lifespan.

When investing in an ASIC miner, one of the primary goals is to achieve profitability and a positive return on investment (ROI). Factors such as the initial cost of the mining hardware, electricity consumption, mining difficulty, and block rewards all contribute to determining mining profitability.

Before purchasing an ASIC miner, it is essential to calculate the potential ROI by taking into account these factors. A mining profitability calculator can be a useful tool to help estimate your earnings and determine whether a particular mining device is worth the investment.

Mining difficulty refers to the complexity of the mathematical problems that need to be solved to mine a block successfully. As more miners join the network, the mining difficulty increases, making it harder to mine new blocks and earn rewards. Therefore, it is essential to consider the current and future mining difficulty when selecting an ASIC miner.

Block rewards, on the other hand, refer to the number of new coins awarded to a miner for successfully mining a block. These rewards can vary depending on the cryptocurrency being mined, and they may decrease over time due to factors such as halving events. It is crucial to factor in the current and future block rewards when evaluating the potential profitability of a mining device.

Several brands and manufacturers produce high-quality ASIC miners, but some of the most reputable and popular options include Bitmain, MicroBT, Canaan, and Innosilicon. Bitmain’s Antminer series, for instance, is well-known for its efficiency and performance, making it a popular choice among cryptocurrency miners. Other notable models include MicroBT’s Whatsminer series, Canaan’s AvalonMiner series, and Innosilicon’s A10 Pro series.

When selecting an ASIC miner, it is essential to compare the specifications, efficiency, performance, and profitability of various models and choose one that best aligns with your mining goals and budget.

Once you have selected the ideal ASIC miner, the next step is to set up your mining rig and operation. This involves installing the appropriate mining software, which allows you to connect your miner to the blockchain network and start mining. The choice of mining software typically depends on the mining algorithm and the cryptocurrency you intend to mine. Some popular mining software options include CGMiner, BFGMiner, and EasyMiner.

After installing the mining software, you will need to configure it by entering your mining pool and wallet information. This will enable the software to mine cryptocurrencies and direct the rewards to your designated wallet.

Joining a mining pool or mining farm can significantly increase your chances of earning rewards, as they combine the mining power of multiple miners to solve the mathematical problems associated with mining. Pooled mining allows miners to work together and share the block rewards proportionally based on their contributed mining power. Some popular mining pools include Slush Pool, F2Pool, and Antpool.

Alternatively, you can join a mining farm, which is a large-scale mining operation that typically offers mining contracts to individual miners. These contracts allow you to rent mining power from the farm and receive a share of the profits based on the amount of mining power you have rented.

Mining profitability calculators can be a valuable tool for assessing the potential earnings and ROI of your ASIC miner. These calculators take into account factors such as mining difficulty, electricity consumption, block rewards, and hardware costs to estimate your earnings and determine whether a particular mining device is worth the investment.

To use a mining profitability calculator, you will need to input information such as the hashing power of your miner, the mining algorithm, the electricity cost, and any additional fees, such as pool or farm fees. The calculator will then provide an estimate of your daily, weekly, monthly, and yearly earnings, as well as the time it will take to achieve a positive ROI.

Some popular mining profitability calculators include CryptoCompare, WhatToMine, and CoinWarz.

To ensure the success of your mining operation, it is essential to monitor the performance of your ASIC miner regularly. This includes keeping track of the miner’s hashing power, mining efficiency, temperature, and overall stability. Monitoring your mining performance will help you identify any potential issues or inefficiencies, enabling you to make adjustments and optimize your mining activities.

Several mining software options provide built-in monitoring features, while other third-party tools, such as Awesome Miner and Minerstat, can also be used for this purpose.

Maintaining and upgrading your mining equipment is crucial for ensuring the longevity and efficiency of your ASIC miner. This includes cleaning the miner regularly to prevent dust buildup, which can affect its cooling system and performance. Additionally, it is essential to monitor and replace any worn-out or damaged components, such as fans and power supplies.

As mining technology continues to advance, it may also be necessary to upgrade your mining hardware to remain competitive in the market. Upgrading your ASIC miner can help you maintain or increase your mining performance and profitability.

Investing in the ASIC miner market comes with its share of risks and challenges. Some of these include:

As the cryptocurrency market continues to mature, the demand for powerful and efficient mining hardware is expected to grow. Advances in mining technology will likely lead to the development of even more efficient ASIC miners, which could further enhance mining performance and profitability.

Additionally, the increasing adoption of cryptocurrencies by mainstream financial institutions and businesses may lead to a more stable and regulated market, presenting new opportunities for mining operations. However, it is essential to remain vigilant of the ever-changing landscape of the cryptocurrency and mining industries, as new risks and challenges may emerge.

Mastering the ASIC miner market requires a comprehensive understanding of the various factors that can impact mining profitability and performance. By considering factors such as mining algorithms, hashing power, mining efficiency, mining difficulty, and block rewards, you can select the ideal ASIC miner for your goals and budget.

Furthermore, setting up and managing your mining operation effectively, including monitoring your mining performance, maintaining your mining equipment, and optimizing your mining activities, can help you achieve success in the competitive world of cryptocurrency mining.

By staying informed and adapting to the ever-changing landscape of the ASIC miner market, you can maximize your mining profits and contribute to the growth and stability of the crypto economy.

What is ASIC mining?

ASIC mining stands for Application-Specific Integrated Circuit mining. It refers to the use of specialized hardware specifically designed to mine cryptocurrencies with high efficiency and performance compared to traditional mining methods.

What factors should I consider when selecting an ASIC miner?

When selecting an ASIC miner, there are several factors to consider. These include the mining algorithm it supports, the hashing power, mining efficiency and performance, mining profitability and ROI, as well as mining difficulty and block rewards.

Which brands and models are the top ASIC mining hardware?

Some of the top brands and models of ASIC mining hardware include Bitmain’s Antminer series, MicroBT’s Whatsminer series, Canaan’s AvalonMiner series, and Innosilicon’s A10 Pro series. These brands are known for their efficiency, performance, and reliability.

How do I set up a mining rig and operation?

To set up a mining rig and operation, you will need to install the appropriate mining software, configure it by entering your mining pool and wallet information, consider joining a mining pool or farm, and ensure you have the necessary cooling and power infrastructure for your mining hardware.

How do I calculate mining profitability?

Mining profitability can be calculated using mining profitability calculators. These calculators take into account factors such as mining difficulty, electricity consumption, block rewards, and hardware costs to estimate your earnings and determine whether a particular mining device is worth the investment.

How can I optimize my mining operation?

To optimize your mining operation, you should regularly monitor your mining performance, including hashing power, efficiency, temperature, and stability. Additionally, maintaining and upgrading your mining equipment when necessary can help improve your mining performance and profitability.

What are the risks and challenges in the ASIC miner market?

Some of the risks and challenges in the ASIC miner market include market volatility, regulatory changes, technological advancements, and electricity costs. These factors can significantly impact mining profitability and the viability of mining operations.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

The realm of Artificial Intelligence (AI) has been expanding at an unprecedented pace, transforming industries and reshaping the way we

In the dynamic world of Bitcoin investment, a unique strategy known as “HODLing” has gained prominence among enthusiasts and investors

Cryptocurrencies have taken the world by storm, offering a decentralized platform for financial transactions, free from government interference or central