L’impact des défaillances matérielles sur la maintenance de l’ASIC.

À mesure que les réseaux de communication numériques progressent et deviennent plus complexes, la maintenance de ces systèmes devient de

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

The world of cryptocurrency mining has witnessed a substantial upswing in popularity over the past several years, marking a new era of digital entrepreneurship. As Bitcoin solidifies its standing as the pre-eminent cryptocurrency, it continues to drive this fascinating trend. Central to this journey of digital gold prospecting is the role of powerful hardware, specifically devices like the Antminer S19.

Bitcoin, often referred to as digital gold, has been at the forefront of this surge in interest. Its rising market value and growing acceptance as a legitimate financial instrument have made mining an increasingly attractive and potentially profitable venture. Bitcoin mining, in essence, is the process of validating transactions on the blockchain network, earning a reward in the form of newly minted Bitcoins. As such, the allure of tapping into this stream of digital wealth has led to a significant demand for advanced mining hardware, capable of streamlining this complex process.

In the rapidly evolving world of Bitcoin mining, understanding the potential profitability of mining equipment is crucial. This guide will provide an in-depth analysis of the profitability of mining Bitcoin using one of the most renowned and capable pieces of hardware in the field, the Antminer S19.

The Antminer S19 hails from the esteemed production lines of Bitmain, a global frontrunner in the manufacture of cryptocurrency mining equipment. Bitmain has been a central figure in the crypto mining industry, earning a strong reputation for its relentless focus on technological innovation and unparalleled product quality.

When it comes to raw power and efficiency, the Antminer S19 stands tall as one of the most potent devices available to miners. Armed with a formidable hash rate of 110 TH/s (Tera hashes per second), the Antminer S19 has been designed to solve the intricate mathematical problems in Bitcoin mining at an astonishing pace. What truly sets this powerhouse apart is its exceptional energy efficiency. Despite its high hash rate, it consumes just 3250 watts, which is comparatively low, thus optimizing the return on investment (ROI) for miners.

The Antminer S19 has been meticulously crafted for Bitcoin mining. The rationale behind this lies in the rigorous demands of Bitcoin’s Proof-of-Work (PoW) algorithm, which requires substantial computational power and energy efficiency. The PoW algorithm is the bedrock of Bitcoin’s blockchain, providing security and maintaining transactional integrity. The Antminer S19, with its high hash rate and efficient power consumption, is thus adept at tackling this computational challenge, making it an ideal candidate for profitable Bitcoin mining. This specialized piece of equipment embodies the perfect marriage of power and precision, designed to maximize the Bitcoin mining profits.

The profitability of mining with the Antminer S19, like any Bitcoin mining endeavor, is influenced by a confluence of variables. Three primary factors worth highlighting are the price of Bitcoin, the mining difficulty, and the electricity cost.

Understanding these key factors can provide a clearer picture of what to expect from your Bitcoin mining operation with the Antminer S19, enabling you to make more informed decisions and potentially maximize your return on investment.

Estimating potential earnings from Bitcoin mining with the Antminer S19 involves a careful consideration of the factors mentioned above. The best way to accomplish this is by using a Bitcoin mining calculator. Here’s a step-by-step guide on how to use one:

Once you input these variables, the Bitcoin mining calculator will give you an estimate of your potential profits.

Remember, these are potential earnings, and the actual results can vary based on the fluctuating price of Bitcoin, changes in mining difficulty, and variations in electricity costs. It’s crucial to keep these variables in mind when making your Bitcoin mining plans with the Antminer S19.

When considering the profitability of the Antminer S19, it’s crucial to understand that it depends heavily on the factors discussed previously – namely, the price of Bitcoin, mining difficulty, and electricity costs. Each of these variables can significantly impact your potential earnings, and they require careful consideration to ensure a profitable mining operation.

A vital aspect of Bitcoin mining that one must not overlook is the significant investment of time and money involved. Acquiring an Antminer S19 and setting up a mining rig requires a sizeable upfront investment. Additionally, maintaining the mining hardware and ensuring its smooth operation demands a substantial commitment of time and resources.

Despite these considerations, the Antminer S19 remains a compelling piece of mining hardware, thanks to its impressive power and efficiency. If managed wisely, it holds the potential to become a lucrative tool in the Bitcoin mining endeavor. For individuals willing to navigate the complexities of mining and embrace the risks associated with it, the Antminer S19 could potentially offer significant returns in the form of mined Bitcoin.

In conclusion, the profitability of the Antminer S19 isn’t a simple ‘yes’ or ‘no’. It’s a dynamic equation that varies based on several influential factors. However, with careful planning, a keen eye on the market, and a willingness to invest time and resources, mining Bitcoin with the Antminer S19 could prove to be a profitable venture.

Avis de non-responsabilité : les informations fournies sur ce blog sont fournies à titre informatif uniquement et ne doivent en aucun cas être considérées comme une forme de conseil.

Articles Similaires

À mesure que les réseaux de communication numériques progressent et deviennent plus complexes, la maintenance de ces systèmes devient de

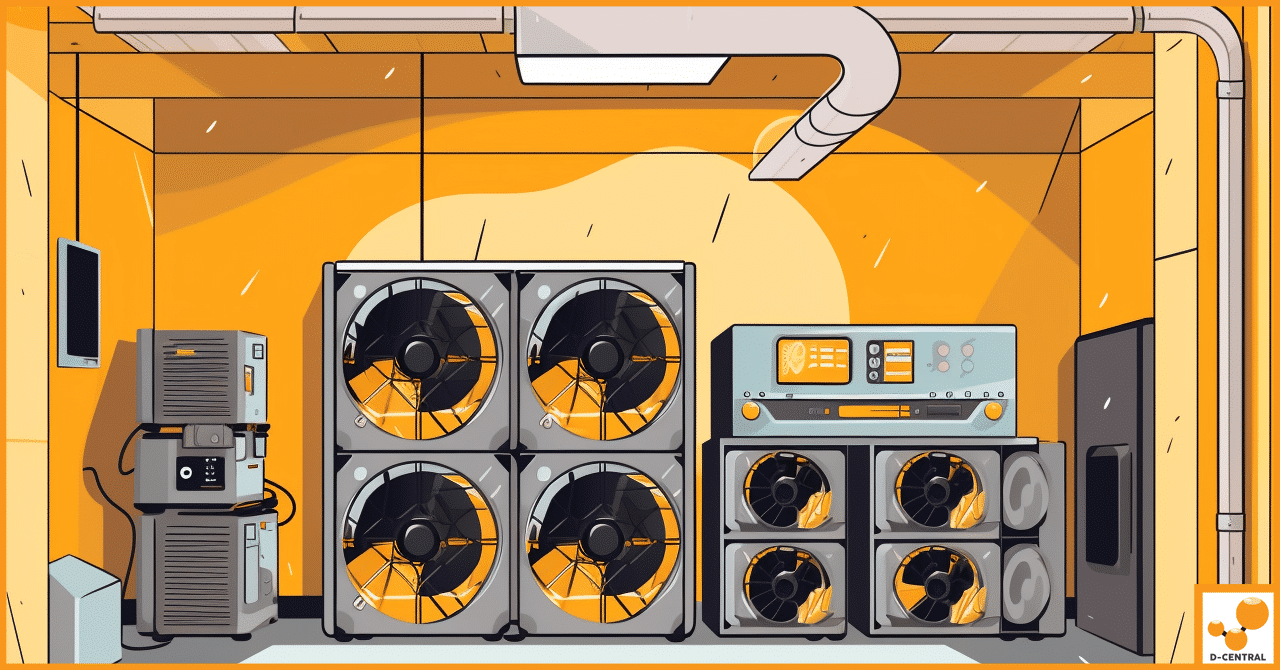

Welcome to our comprehensive guide to minimizing noise with the Antminer S19, a machine at the forefront of Bitcoin mining

Êtes-vous à la recherche d’une façon d’augmenter la rentabilité de votre grande opération minière ASIC ? Si c’est le cas,