A Deep Dive into Braiins and Luxor’s Remote Installation Tools and Firmware

The landscape of Bitcoin mining has undergone a remarkable transformation over the past decade. What began as a niche activity

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

Bitcoin, the first and most renowned cryptocurrency, has captivated the financial world since its inception in 2009. Emerging as a decentralized digital currency, Bitcoin promised a new era of financial transactions, free from the constraints of traditional banking systems. Its unique nature, underpinned by blockchain technology, has not only revolutionized the way we think about money but has also become a significant player in the global financial markets.

However, one characteristic of Bitcoin that continually garners attention is its price volatility. Unlike traditional currencies or even many stocks, the price of Bitcoin can swing dramatically over short periods. This volatility, while a source of opportunity for some, remains a puzzle and a point of concern for others. In this article, we delve into the myriad factors contributing to these fluctuations, aiming to demystify the reasons behind Bitcoin’s often unpredictable price movements.

At D-Central Technologies, a leader in the Bitcoin mining industry, we have a front-row seat to the ebbs and flows of Bitcoin’s market dynamics. Our extensive experience in mining, ASIC repairs, and comprehensive support for Bitcoin enthusiasts and professionals alike positions us uniquely to offer insights into this complex topic. As we explore the various factors influencing Bitcoin’s price, we draw not only from broad market analysis but also from our hands-on experiences and deep understanding of the cryptocurrency landscape.

One of the fundamental aspects of Bitcoin that sets it apart from traditional fiat currencies is its limited supply. Bitcoin’s protocol, as designed by its anonymous creator Satoshi Nakamoto, caps the total number of bitcoins that can ever be mined at 21 million. This scarcity is akin to precious metals like gold, which have historically been valued for their rarity.

The impact of this capped supply on Bitcoin’s price cannot be overstated. As more bitcoins are mined and the number of new bitcoins entering the market decreases over time – particularly through events known as “halvings” where the reward for mining new blocks is cut in half – the scarcity of Bitcoin increases. This built-in deflationary mechanism contrasts sharply with fiat currencies, which can be printed in unlimited quantities by governments, leading to inflation.

In the world of Bitcoin, this limited supply creates a sense of urgency and a ‘digital scarcity’ that can drive up the price, especially as demand increases. The concept of having a finite supply means that, as long as Bitcoin remains in demand, its value could potentially continue to increase as the availability decreases.

While Bitcoin’s supply is capped and predictable, the demand side of the equation is far more dynamic and uncertain. Investor interest in Bitcoin can be influenced by a myriad of factors, ranging from technological advancements in the blockchain space to global economic trends, and even changes in regulatory landscapes.

The adoption rate of Bitcoin plays a crucial role in its price fluctuations. As more individuals and institutions recognize the potential of Bitcoin as a store of value, a medium of exchange, or even as a hedge against inflation, demand rises. This increased demand, against the backdrop of limited supply, naturally drives up the price.

However, the market demand for Bitcoin is also subject to rapid changes. Positive news, such as a country legalizing Bitcoin or a major corporation investing in it, can lead to a surge in demand. Conversely, negative news or regulatory crackdowns in key markets can lead to sudden drops in demand and, consequently, price.

At D-Central Technologies, we closely monitor these market dynamics. Our understanding of both the fixed nature of Bitcoin’s supply and the fluidity of its demand helps us provide informed and timely advice to our clients, whether they are seasoned miners or newcomers to the Bitcoin world.

Bitcoin’s position in the financial world is unique, not only because of its technological underpinnings but also due to its sensitivity to global economic events. Unlike traditional currencies, whose values are often directly influenced by the economic policies of their respective governments, Bitcoin operates independently of any central authority. However, this does not make it immune to the effects of global economic shifts.

Financial Crises and Bitcoin: During times of financial instability or crises, Bitcoin has often been observed to behave like a ‘digital gold’. Investors looking for safe-haven assets to protect their wealth from market volatility and currency devaluation tend to turn to Bitcoin. This was notably evident during economic downturns, where Bitcoin’s price sometimes increased as traditional markets struggled.

Inflation and Monetary Policies: Inflation, especially in countries with unstable economies, can lead to a decrease in the value of fiat currencies. In such scenarios, Bitcoin has emerged as an alternative investment to preserve value. Furthermore, the monetary policies of major economies, such as interest rate adjustments and quantitative easing, can also influence investor sentiment towards Bitcoin. For instance, low interest rates often drive investors towards riskier assets, including cryptocurrencies like Bitcoin.

The regulatory environment for Bitcoin varies significantly across different countries, and these regulations can have profound impacts on its price. Government policies towards cryptocurrencies are often a reflection of their stance on issues such as financial security, taxation, and control over monetary systems.

Positive Regulations: In countries where the government adopts a positive or even a neutral stance towards Bitcoin, legitimizing its use through clear regulations, there is typically an increase in investor confidence. This can lead to higher adoption rates and, consequently, an increase in price. Examples include countries that have clarified tax laws regarding Bitcoin or have recognized it as a legal form of payment.

Negative Regulations: Conversely, when governments impose strict regulations, or outright bans, it can lead to a decrease in demand and a drop in price. This is often due to the increased difficulty for residents of these countries to buy, sell, or use Bitcoin legally. News of potential crackdowns or regulatory uncertainties in major markets can cause significant market turbulence.

At D-Central Technologies, we understand the importance of staying abreast of these economic and regulatory developments. Our expertise not only lies in the technical aspects of Bitcoin mining but also in navigating the complex global landscape in which Bitcoin operates. This holistic understanding enables us to provide valuable insights and strategies to our clients, helping them make informed decisions in their Bitcoin-related ventures.

The technological framework of Bitcoin is not static; it evolves, and these changes can significantly impact its market value. Two key aspects in this regard are the Bitcoin halving events and ongoing technological advancements in the blockchain.

Bitcoin Halving Events: Approximately every four years, the Bitcoin network undergoes a ‘halving’ event, where the reward for mining new blocks is halved. This means that the rate at which new bitcoins are created and entered into circulation is reduced by 50%. These halving events are significant because they directly affect the supply of new bitcoins. As the reward decreases, the rate of new supply slows down, which, if demand remains constant or increases, can lead to an increase in Bitcoin’s price. Historically, halving events have been followed by substantial price increases, although this is influenced by a myriad of other factors as well.

Technological Advancements: The Bitcoin blockchain is also subject to continuous technological updates and improvements. These can range from enhancements in transaction efficiency to increased security measures. For instance, the implementation of the Lightning Network aims to speed up transactions and reduce costs, potentially making Bitcoin more attractive for everyday transactions. Such advancements can increase Bitcoin’s utility and appeal, thereby affecting its demand and price.

While technological advancements generally have a positive impact on Bitcoin’s value, the cryptocurrency is not immune to challenges that can lead to price volatility.

Security Breaches: The decentralized nature of Bitcoin provides a high level of security. However, the broader cryptocurrency ecosystem, including exchanges and wallets, is not impervious to security breaches. High-profile hacks and security breaches can shake investor confidence and lead to significant price drops. For instance, the infamous Mt. Gox hack in 2014 saw the exchange lose 850,000 bitcoins, leading to a substantial price crash.

Market Manipulation: The cryptocurrency market, being relatively new and less regulated than traditional financial markets, is susceptible to various forms of market manipulation. Practices like wash trading, pump and dump schemes, and spoofing can create artificial price movements that lead to volatility. While these practices are not unique to Bitcoin, the relatively lower market capitalization and liquidity compared to traditional markets make it more susceptible to manipulation.

At D-Central Technologies, we recognize the importance of these technological and security aspects in understanding Bitcoin’s market behavior. Our expertise in Bitcoin mining and blockchain technology provides us with a deep understanding of these factors, enabling us to offer valuable insights and guidance to our clients. We emphasize the importance of security and staying informed about technological developments in the blockchain space, ensuring our clients are well-equipped to navigate the dynamic world of Bitcoin.

The price of Bitcoin is not only influenced by tangible factors like supply and demand or technological advancements but also significantly swayed by psychological and social elements, particularly investor sentiment and media influence.

Investor Sentiment: The collective mood and perceptions of investors play a critical role in the cryptocurrency market. Positive sentiment, often driven by bullish market trends or favorable news, can lead to increased buying activity, pushing prices up. Conversely, negative sentiment, fueled by bearish trends or adverse events, can result in selling pressure, leading to price declines. This sentiment is often a reflection of investors’ expectations about future prices and the general health of the Bitcoin market.

Media Influence: Media coverage, both traditional and social media, has a profound impact on Bitcoin’s price. Positive news stories, such as announcements of large-scale institutional investments in Bitcoin or technological breakthroughs, can lead to increased investor interest and higher prices. On the other hand, negative coverage, such as reports of regulatory crackdowns or security breaches, can cause panic selling and price drops. The rapid spread of information (and misinformation) through social media platforms can amplify these effects, leading to more pronounced price volatility.

Another psychological aspect driving Bitcoin’s price is speculative trading and the phenomenon known as the Fear of Missing Out (FOMO).

Speculative Trading: Much of the trading activity in the Bitcoin market is speculative, driven by traders and investors looking to profit from price fluctuations. Speculators often react quickly to market news and trends, contributing to Bitcoin’s price volatility. Their trading decisions are based not only on fundamental analysis but also on technical analysis and market sentiment, leading to rapid buy and sell orders that can cause price swings.

Fear of Missing Out (FOMO): FOMO is a powerful driver in the cryptocurrency market. When the price of Bitcoin starts rising rapidly, it can create a sense of urgency among investors who fear missing out on potential profits. This can lead to a buying frenzy, further driving up the price in the short term. Conversely, when prices start falling, FOMO can lead to rapid selling as investors rush to avoid losses, exacerbating the price decline.

At D-Central Technologies, we understand the importance of these psychological and social factors in the Bitcoin market. Our expertise allows us to provide balanced and informed perspectives to our clients, helping them navigate the often emotionally charged cryptocurrency market. We emphasize the importance of informed decision-making, grounded in a comprehensive understanding of both the tangible and intangible factors that influence Bitcoin’s price.

While Bitcoin is renowned for its volatility, it’s important to place this characteristic in the context of the broader cryptocurrency market. Comparing Bitcoin’s volatility with that of other major cryptocurrencies offers valuable insights into its market behavior.

Volatility Comparison: Bitcoin, often regarded as the most stable among cryptocurrencies, still exhibits significant price fluctuations. However, when compared to newer or smaller cryptocurrencies, often referred to as “altcoins,” Bitcoin’s volatility is generally lower. These altcoins can experience even more dramatic price swings due to factors like lower market capitalization, lesser liquidity, and higher susceptibility to market sentiment and speculative trading.

Market Maturity and Adoption: Bitcoin’s relatively lower volatility compared to other cryptocurrencies can be attributed to its greater market maturity and wider adoption. Being the first and most established cryptocurrency, it has a more extensive user base, greater visibility, and more integration into financial systems. This maturity offers a bit more stability compared to newer cryptocurrencies, which can be more reactive to market news and investor sentiment.

Contrasting Bitcoin’s price behavior with traditional financial assets, such as stocks and gold, provides another perspective on its unique position in the financial landscape.

Bitcoin vs. Stocks: The stock market, while also subject to volatility, is generally more stable than the Bitcoin market. Stocks represent ownership in companies and are influenced by factors like corporate performance, economic indicators, and market regulations. Bitcoin, on the other hand, is influenced more by technological developments, regulatory news, and market sentiment. Additionally, the stock market has more established risk management and regulatory frameworks, which can mitigate extreme volatility.

Bitcoin vs. Gold: Gold has historically been viewed as a safe-haven asset, often showing stability in times of economic uncertainty. Bitcoin has been compared to gold, with some labeling it “digital gold” due to its store-of-value properties. However, Bitcoin’s price fluctuations are much more pronounced than gold’s. While both are seen as hedges against inflation and currency devaluation, gold’s long history as a valued asset contributes to its stability compared to the relatively new and evolving Bitcoin.

At D-Central Technologies, our deep understanding of Bitcoin’s unique market dynamics, compared to other cryptocurrencies and traditional financial assets, enables us to provide nuanced and informed advice to our clients. We help them appreciate the distinct nature of Bitcoin’s volatility, guiding them in making strategic decisions that align with their investment goals and risk tolerance.

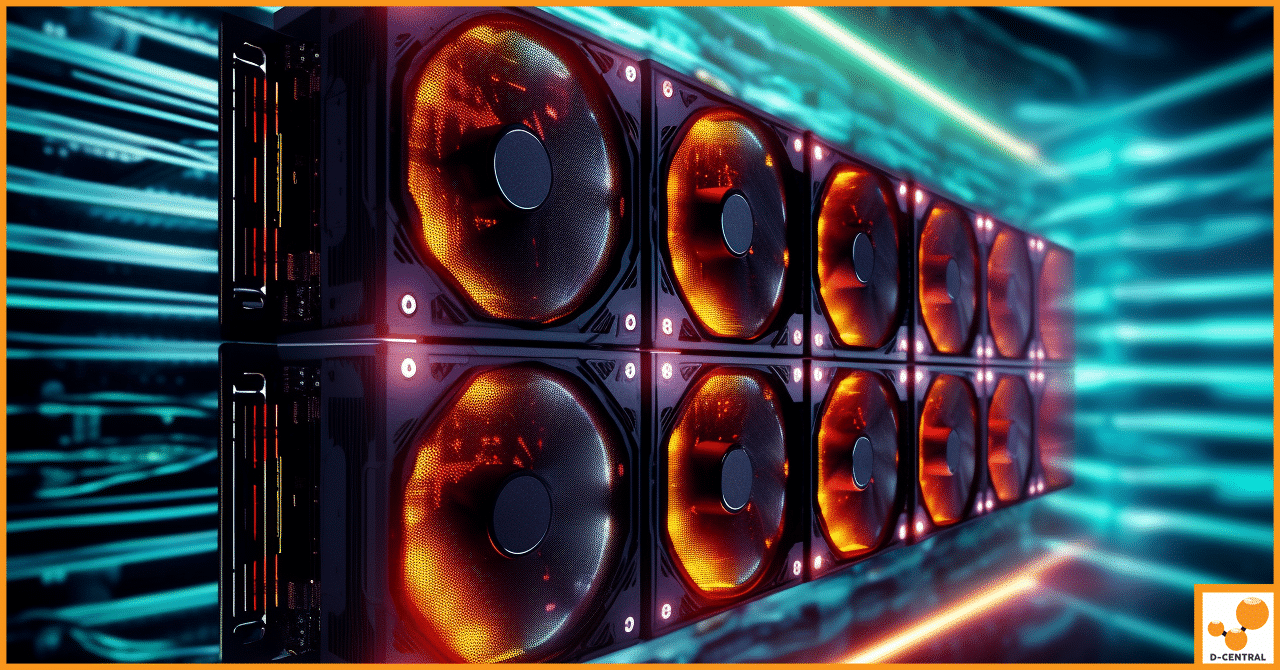

At D-Central Technologies, our extensive involvement in the Bitcoin mining industry has provided us with a unique vantage point from which to observe and understand the factors driving Bitcoin’s price volatility. Our experience as Canada’s premier ASIC repair center and a leader in Bitcoin mining services has equipped us with deep insights that we are eager to share.

Mining Trends and Market Insights: Our journey in the Bitcoin mining sector has shown us how closely tied the health of the mining industry is to Bitcoin’s market performance. We’ve observed firsthand how changes in Bitcoin’s price can impact mining profitability, influencing decisions on mining hardware investments and operations. For instance, during periods of high Bitcoin prices, there’s a surge in demand for mining equipment and an increase in mining activities, while the opposite is true during market downturns.

Technological Evolution and Adaptation: Our experience has also highlighted the importance of staying abreast of technological advancements in mining hardware and blockchain protocols. We’ve seen how innovations in ASIC technology and improvements in mining efficiency can affect the overall health and sustainability of the Bitcoin network, which in turn influences investor sentiment and market prices.

D-Central Technologies prides itself on offering innovative solutions and services that cater to a wide range of needs in the Bitcoin mining ecosystem.

Bitcoin Space Heaters: One of our unique offerings is the Bitcoin Space Heater, created from refurbished ASICs. This innovative solution not only provides a source of heat but also allows for Bitcoin mining, showcasing our commitment to sustainability and efficiency in the use of resources.

ASIC Repairs and Custom Solutions: As the largest ASIC repair center in Canada, we offer unparalleled expertise in repairing and maintaining mining equipment. Our services extend beyond standard repairs, as we provide custom solutions and modifications to mining hardware. This includes adjustments to stock settings and parts to make them more suitable for specific mining operations, such as silent fans for home mining and Antminer Slim Edition for 120V compatibility.

Flexible and Inclusive Services: Our approach is characterized by flexibility and inclusiveness, catering to both large-scale mining operations and individual miners. We believe in supporting the ‘Bitcoin plebs’ by offering services that accommodate even those with a single ASIC miner.

At D-Central Technologies, we are more than just a service provider; we are partners in our clients’ Bitcoin journey. Our expertise, coupled with our innovative and client-centric approach, positions us uniquely to support and guide those involved in the Bitcoin mining industry, whether they are seasoned miners or newcomers.

In this exploration of “Why Do Bitcoin Prices Fluctuate So Much?”, we have delved into the multifaceted and complex nature of Bitcoin’s market behavior. From the inherent design of its limited supply to the ever-changing dynamics of market demand, the factors influencing Bitcoin’s price are as diverse as they are intricate.

At D-Central Technologies, we understand that navigating the Bitcoin market requires not only an understanding of these diverse factors but also a partner who can provide expertise and support. Our experience in the Bitcoin mining industry, combined with our innovative solutions like Bitcoin Space Heaters and specialized ASIC repair services, positions us uniquely to assist both newcomers and veterans in the cryptocurrency space.

We invite you to explore the world of Bitcoin mining with D-Central Technologies. Whether you are looking to understand the nuances of Bitcoin’s price fluctuations, seeking advice on mining hardware, or require expert repair services, our team is here to provide you with the insights and support you need. Visit us at D-Central Technologies to learn more about our services and how we can help you succeed in the dynamic and exciting world of Bitcoin mining.

What factors contribute to Bitcoin’s price volatility?

Factors contributing to Bitcoin’s volatility include its limited supply, market demand fluctuations, global economic factors, regulatory influences, technological and network changes, security issues, psychological elements such as investor sentiment and media influence, as well as speculative trading and the Fear of Missing Out (FOMO).

How does Bitcoin’s limited supply affect its price?

Bitcoin’s limited supply of 21 million coins introduces digital scarcity, which can drive up the price, especially when demand increases. Bitcoin’s deflationary nature contrasts with fiat currencies that can lead to inflation, potentially enhancing Bitcoin’s value as demand continues to rise.

What role do Bitcoin halving events play in its price changes?

Bitcoin halving events reduce the reward for mining new blocks by half, decreasing the rate at which new bitcoins are created. If demand remains constant or increases, the reduced rate of new supply can potentially lead to an increase in Bitcoin’s price. Past halving events have been followed by substantial increases in price.

How does market demand affect the price of Bitcoin?

Market demand for Bitcoin is dynamic, influenced by technological advancements, global economic trends, and regulatory changes. Increased adoption and positive news can drive up demand and price, while negative news and regulatory uncertainties can trigger declines.

In what way do economic and global events impact Bitcoin’s price?

During financial crises and inflation, Bitcoin may act as a ‘digital gold’, with investors viewing it as a safe-haven asset. Monetary policies and financial market dynamics also affect investor sentiment and subsequently Bitcoin’s price.

Can regulatory stances of different countries affect Bitcoin’s price?

Absolutely. Positive regulations can increase investor confidence and demand, leading to price rises. On the other hand, strict regulations or bans can suppress demand and cause price drops. Regulatory developments can cause significant market fluctuations.

How do technological advancements in the blockchain impact Bitcoin’s value?

Technological updates, such as improvements in transaction efficiency and security or the implementation of the Lightning Network, can enhance Bitcoin’s utility and attractiveness, influencing its demand and market value.

What psychological and social factors influence Bitcoin’s price?

Bitcoin’s price is significantly swayed by investor sentiment and media influence. Positive news and bullish trends can lead to price increases, while negative news and bearish trends can cause declines. Social media can amplify these effects due to the rapid spread of information.

What does D-Central Technologies offer in terms of Bitcoin mining and services?

D-Central Technologies offers a range of services including Bitcoin mining, ASIC repairs, and supportive advice for Bitcoin enthusiasts and professionals. They also provide innovative solutions like Bitcoin Space Heaters and specialized repair and customization services for mining equipment.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

The landscape of Bitcoin mining has undergone a remarkable transformation over the past decade. What began as a niche activity

As the world of cryptocurrency continues to grow and evolve, so does the need for efficient and effective mining hardware

Are you banging your head on the table to understand Bitmain’s Antminer 19th Series? If so, you’ve probably encountered the