A Comprehensive Guide to Reporting Bitcoin Fraud in Quebec

In the ever-evolving landscape of digital finance, cryptocurrencies like Bitcoin have emerged as groundbreaking innovations, reshaping how we think about

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

Bitcoin mining, a cornerstone process in the digital currency world, is as fascinating as it is crucial. At its core, Bitcoin mining is the engine that keeps the Bitcoin network running. It involves validating transactions and embedding them into the blockchain, the digital ledger that underpins Bitcoin. This process not only ensures the integrity and chronological order of transactions but also introduces new bitcoins into the system, akin to a digital form of mining gold.

Since Bitcoin’s inception in 2009 by the enigmatic Satoshi Nakamoto, mining has evolved dramatically. What began as a simple task executable on a regular desktop computer has transformed into a highly competitive, resource-intensive operation. This evolution mirrors the growing complexity and sophistication of the blockchain network and reflects the increasing value and mainstream acceptance of Bitcoin itself. As we delve deeper into the world of Bitcoin mining, we uncover not only the technicalities of this process but also its significant impact on the digital currency landscape.

Bitcoin mining is the backbone of the Bitcoin network. It’s a complex computational process that serves multiple critical functions. Primarily, mining is the method by which the Bitcoin network processes transactions and secures its blockchain. Miners, using powerful computers, solve intricate mathematical puzzles to validate and confirm groups of transactions (known as blocks). Once a block is verified, it is added to the blockchain, a transparent and immutable record of all Bitcoin transactions.

How Bitcoin Mining Works

The process of mining involves compiling recent transactions into blocks and trying to solve a computationally difficult puzzle, as detailed by Investopedia. The first participant who solves the puzzle gets to place the next block on the blockchain and claim the rewards. These rewards include transaction fees paid by users for faster transaction processing and newly created bitcoins issued according to a fixed formula.

This puzzle-solving aspect is crucial for maintaining the network’s security. It ensures that no single individual or group can control what is included in the blockchain or replace parts of the blockchain to roll back their own spends, which could potentially lead to double-spending.

Role in Introducing New Bitcoins

One of the most significant roles of Bitcoin mining is the introduction of new bitcoins into circulation. This aspect of mining is akin to gold miners extracting gold from the earth. Just as gold must be mined from the ground, bitcoins must be “mined” via computational means. The Bitcoin protocol rewards miners with a certain number of bitcoins for each block added to the blockchain, which halves approximately every four years in an event known as the “halving.” This controlled rate of monetary inflation is one of the key features that define Bitcoin’s economic model and its scarcity.

Through mining, Bitcoin not only processes transactions but also generates new currency, maintaining a controlled flow of new tokens into the system. This process will continue until the maximum supply of 21 million bitcoins has been reached, making mining an essential mechanism for the growth and sustainability of Bitcoin’s ecosystem.

The core of Bitcoin mining lies in the process of block discovery and transaction verification. As explained by CoinDesk, miners are tasked with discovering new blocks by solving complex mathematical problems. This process begins with the aggregation of pending transactions. Miners select these transactions based on factors like transaction fees and start forming a new block.

The key to block discovery is finding a solution to a cryptographic hash puzzle. This puzzle requires miners to produce a hash – a fixed-length string of characters – that is less than or equal to the target hash set by the Bitcoin network. The difficulty of this puzzle adjusts approximately every two weeks to ensure that a new block is added approximately every ten minutes, maintaining the network’s consistent transaction history.

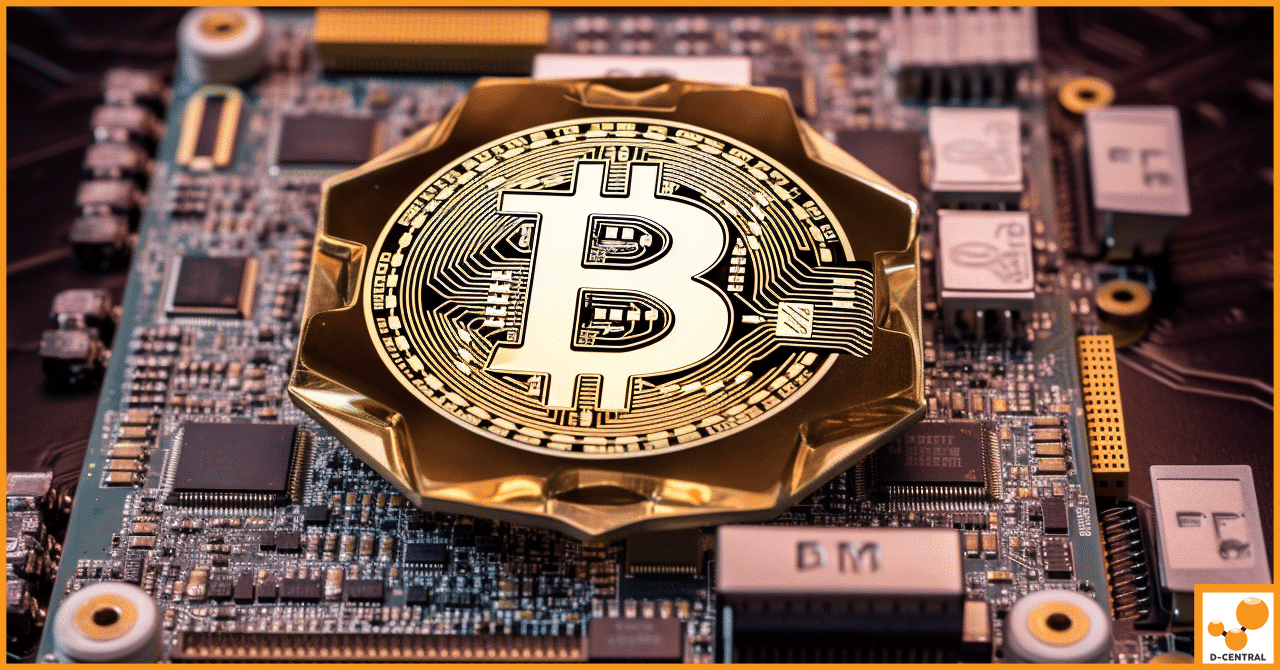

Mining Hardware: ASICs

The evolution of mining hardware has been pivotal in the advancement of Bitcoin mining. Initially, mining was possible with simple CPUs and then GPUs. However, as the difficulty of mining increased, the need for more efficient hardware led to the development of Application-Specific Integrated Circuits (ASICs), designed solely for Bitcoin mining.

A prime example, as noted by NerdWallet, is the AntMiner S9, a popular ASIC model. The AntMiner S9 and similar ASICs offer significant advantages over earlier hardware in terms of processing power and energy efficiency. These devices are equipped with custom-built chips optimized for the SHA-256 algorithm used in Bitcoin mining, enabling them to solve hash puzzles at an unprecedented rate while minimizing power consumption.

Mining Algorithms and Computational Process

The computational process of mining is governed by the SHA-256 hashing algorithm. This algorithm converts input data into a unique 256-bit signature. In the context of Bitcoin mining, the input includes the new block’s data and a nonce – a random number that miners alter to change the hash output.

Miners continuously adjust the nonce and recompute the hash until they find a solution that meets the network’s difficulty criteria. This trial-and-error process requires immense computational power and energy, as the probability of finding the correct nonce is extremely low. The first miner to find a valid hash wins the right to add the new block to the blockchain, receiving the block reward and transaction fees as incentives.

This intricate dance of hardware and algorithm defines the technical landscape of Bitcoin mining, making it a highly specialized and competitive field.

For those interested in entering the world of Bitcoin mining, building a mining rig is the first step. A mining rig is essentially a computer system specifically designed for mining cryptocurrencies. The key components of a mining rig include a motherboard, a powerful processor, high-end graphics cards (for GPU mining), or specialized ASICs (for Bitcoin mining), sufficient RAM, and a robust power supply to handle the load.

The choice between GPU and ASIC mining depends on the cryptocurrency you plan to mine. For Bitcoin, ASICs are the preferred choice due to their superior efficiency and processing power. Building a rig requires some technical knowledge, especially in assembling the hardware components and setting up the mining software. However, numerous online resources and communities are available to assist newcomers in this process.

Considerations for Individual Miners and Joining Mining Pools

As Bitcoin mining has become more competitive, individual miners face challenges in achieving profitability due to high equipment costs and electricity expenses. CoinDesk highlights the viability of joining mining pools as a solution. A mining pool is a group of miners who combine their computational resources over a network to increase their chances of finding a block and earning rewards. The rewards are then distributed among pool members proportionally to the amount of hashing power contributed.

Joining a pool can significantly reduce the variance of mining rewards and provide a more steady income stream, especially for miners with limited resources. However, it’s essential to research and choose a reputable mining pool that aligns with your goals and values, considering factors like pool fees, payout structures, and the pool’s size.

Factors to Consider When Setting Up a Mining Operation

Several critical factors must be considered when setting up a mining operation:

By carefully considering these factors, individuals can set up a successful and profitable Bitcoin mining operation, contributing to the security and robustness of the Bitcoin network.

The profitability of Bitcoin mining is a dynamic and multifaceted aspect, influenced by several key factors. At its core, the profitability equation involves assessing the revenue generated from mining against the operational costs incurred.

Impact of Market Dynamics

The economics of Bitcoin mining are also significantly influenced by broader market dynamics:

Bitcoin mining is an intricate balance of operational efficiency, market conditions, and network dynamics. Successful mining operations require not only technical proficiency but also a keen understanding of these economic factors.

Bitcoin mining, while lucrative, is not without its challenges. These challenges range from operational to regulatory, each impacting miners in different ways.

Predictions and Trends for the Future of Bitcoin Mining

Looking ahead, the future of Bitcoin mining is poised for continued evolution, shaped by technological advancements and market dynamics. According to insights from D-Central’s own article, several key trends and predictions can be highlighted:

While challenges exist, the future of Bitcoin mining holds promise, with opportunities for innovation, growth, and greater sustainability. As the industry evolves, miners who adapt to these changes and embrace new technologies and practices are likely to find continued success.

Embarking on a Bitcoin mining journey can be both exciting and daunting for beginners. Here are some practical steps and advice to help you get started:

Resources and Platforms for Learning and Participating in Bitcoin Mining

Several online platforms and resources can help beginners learn more about Bitcoin mining and participate effectively:

By leveraging these resources and platforms, beginners can gain the knowledge and skills needed to start and succeed in Bitcoin mining.

In this comprehensive exploration of Bitcoin mining, we’ve delved into the intricate world that powers the backbone of the Bitcoin network. From understanding the fundamental role of mining in transaction verification and the introduction of new bitcoins, to the technicalities of the mining process, hardware, and algorithms, we’ve covered the essential aspects that define this critical component of the digital currency world.

We’ve also navigated through the practical steps of setting up a mining operation, highlighting the importance of hardware selection, the benefits of joining mining pools, and the various factors that influence the profitability and sustainability of mining activities. The challenges and future prospects of Bitcoin mining were also discussed, underscoring the dynamic nature of this field and its continuous evolution driven by technological advancements and market dynamics.

As we conclude, it’s clear that Bitcoin mining is not just a pursuit of financial rewards; it’s a crucial part of maintaining the security and integrity of the Bitcoin network. It’s an ever-evolving landscape that requires both technical acumen and a keen understanding of the market and regulatory environments.

For those intrigued by the world of Bitcoin mining and eager to learn more or participate, there is a wealth of resources and communities available to support your journey. Whether you’re a beginner looking to start your first mining operation or an experienced miner seeking to optimize your existing setup, the journey into Bitcoin mining is a rewarding and intellectually stimulating endeavour.

We encourage you to continue exploring the fascinating world of Bitcoin mining and its significant role in the broader digital currency ecosystem. For expert guidance, state-of-the-art services, and comprehensive support in Bitcoin mining, consider D-Central Technologies as your go-to resource. With our expertise and commitment to the Bitcoin community, we are here to help you navigate the complexities of Bitcoin mining and achieve success in this exciting field.

What is Bitcoin mining?

Bitcoin mining is the process by which transactions are verified and added to the public ledger, known as the blockchain, and also the means through which new bitcoin are released.

How does Bitcoin mining work?

Miners solve complex computational mathematical puzzles to validate and confirm groups of transactions (blocks), which are then added to the blockchain. Miners are rewarded with transaction fees and newly created bitcoins.

What is the role of Bitcoin mining in introducing new bitcoins?

Mining is analogous to gold mining, but instead of physical extraction, miners “mine” new bitcoins by using computational power to solve puzzles, introducing controlled amounts of new tokens into the system up to a maximum of 21 million bitcoins.

What kind of hardware is used for Bitcoin mining?

Bitcoin mining is now conducted using Application-Specific Integrated Circuits (ASICs), which are highly specialized and efficient devices designed specifically for mining bitcoin.

What factors should be considered when setting up a Bitcoin mining operation?

Considerations include hardware selection, electricity costs, location benefits (such as cooler climates), hardware maintenance, legal and regulatory compliance, and cybersecurity.

How do mining pools work?

Mining pools are groups of miners who combine their computational power to increase their chances of finding a block and earning rewards. Rewards are then split among pool members proportional to their contributed hashing power.

What are the challenges faced by Bitcoin miners?

Challenges for miners include regulatory risks, market risks, high operation costs, energy consumption concerns, and the increasing difficulty level of puzzles.

Can beginners participate in Bitcoin mining, and how?

Beginners can participate by educating themselves about Bitcoin and blockchain technology, assessing their resources, choosing appropriate hardware, setting up a digital wallet, joining mining pools, and using compatible mining software to start mining.

Where can beginners learn more about Bitcoin mining?

Beginners can refer to cryptocurrency forums and communities, online courses and tutorials, mining software websites, YouTube channels, and mining pool forums and support for learning and advice.

What does the future of Bitcoin mining look like?

The future of mining is expected to involve technological advancements in mining hardware, a move towards more decentralized operations, increased institutional involvement, a focus on sustainability, clearer regulatory frameworks, and innovative integration with renewable energy projects.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

In the ever-evolving landscape of digital finance, cryptocurrencies like Bitcoin have emerged as groundbreaking innovations, reshaping how we think about

In the dynamic world of cryptocurrencies, few processes have undergone as much transformation as Bitcoin mining. From its humble beginnings,

In our previous article, Complete Guide to BM1397 ASIC Chip Selection and Replacement for Antminer 17 Series, we introduced you