The Role of Blockchain Technology in Cryptocurrency Transactions

In the digital age, the concept of currency has evolved beyond physical money to include digital currencies, a revolutionary form

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

In the ever-evolving landscape of digital currencies, Bitcoin stands as a pioneering force, a beacon that has illuminated the path for a myriad of cryptocurrencies following in its wake. Conceived by the enigmatic Satoshi Nakamoto in 2009, Bitcoin emerged not just as a new form of currency but as a revolutionary concept challenging traditional financial paradigms. At its core, Bitcoin is a decentralized digital currency, free from the control of any government or financial institution, powered by a technology known as blockchain. This technology ensures transparency, security, and immutability of transactions, making Bitcoin a unique player in the financial world.

Central to the lifeblood of Bitcoin is the process known as mining. Far removed from the physical exertion associated with traditional mining, Bitcoin mining is a digital process where powerful computers solve complex mathematical problems. These problems, integral to the process of transaction verification, maintain the ledger of the Bitcoin network, known as the blockchain. Miners, in their quest to solve these problems, validate and secure transactions, playing a crucial role in the Bitcoin ecosystem. In return for their efforts, miners are rewarded with new bitcoins, a process that not only incentivizes the maintenance of the network but also controls the introduction of new bitcoins into circulation, mimicking the scarcity and value of precious metals.

However, beneath the surface of this digital gold rush lies a contentious debate: the energy consumption of Bitcoin mining. As miners around the globe race to solve these complex problems, the computational power required has skyrocketed, leading to an immense consumption of electricity. Critics argue that the energy expenditure of Bitcoin mining is exorbitant, drawing parallels with the electricity usage of entire nations and raising alarms about its environmental impact. This concern has sparked a global debate, juxtaposing the innovative strides of cryptocurrency against the backdrop of an increasingly energy-conscious world.

In this debate, two critical questions emerge: Is the electricity consumption of Bitcoin mining justifiable in the grand scheme of its technological and financial benefits? And more importantly, can this energy-intensive process coexist with the goals for environmental sustainability? As we delve deeper into the realms of Bitcoin mining, these questions stand at the forefront, challenging us to weigh the scales of innovation against the imperatives of our planet’s health.

Bitcoin mining is the backbone of the Bitcoin network, a process as complex as it is crucial. At its essence, mining involves the use of sophisticated hardware to solve highly complex mathematical problems. These problems are cryptographic puzzles that are integral to the process of validating and securing Bitcoin transactions. Each puzzle solved is akin to closing a block of transactions, which is then added to the blockchain, the public ledger that records all Bitcoin transactions.

The process begins when transactions are broadcast to the Bitcoin network. Miners collect these transactions into a block and then apply a mathematical formula to transform this block into something much smaller and more manageable, known as a hash. This hash is what gets stored at the end of the blockchain.

The key challenge in mining is to produce a valid hash. Bitcoin uses the SHA-256 hashing algorithm, which generates a 256-bit signature for the text, a string of 64 characters (0-9 and a-f). For a hash to be accepted onto the blockchain, it must have a certain number of leading zeroes. The only way to arrive at a hash matching the correct criteria is to make millions or even billions of guesses. This process requires immense computational power.

In summary, Bitcoin mining is not just about creating new bitcoins. It is a critical process that maintains the integrity and security of the Bitcoin network, ensuring that all transactions are verified and recorded in a decentralized and tamper-proof manner. This process, while energy-intensive, is the cornerstone of the trust and security that underpins the Bitcoin ecosystem.

Bitcoin mining, a process integral to the functioning of the Bitcoin network, is known for its high energy consumption. The exact figures fluctuate due to the dynamic nature of mining activity, but recent data provides a startling perspective on the scale of this consumption.

As of the latest reports, the Bitcoin network’s energy consumption is staggering. It is estimated that the global Bitcoin mining industry consumes around 71.24 terawatt-hours (TWh) annually. To put this into perspective, this amount of energy is more than what is used by many individual countries. The sheer scale of this consumption highlights the intensive nature of the computational work involved in mining.

The comparison of Bitcoin mining’s energy usage with that of entire countries offers a vivid illustration of its magnitude. For instance, Bitcoin’s energy consumption surpasses that of countries like Argentina, which consumes about 121 TWh annually, and the Netherlands, with an annual consumption of approximately 108.8 TWh. This comparison is often cited in discussions about the sustainability and environmental impact of Bitcoin mining.

The Cambridge Bitcoin Electricity Consumption Index (CBECI) provides a more nuanced view of this issue. The CBECI offers real-time estimates of the total electricity consumption of the Bitcoin network. As per the CBECI, the estimated annualized consumption stands at around 150.39 TWh, with a theoretical upper bound of 355.34 TWh. This data is crucial in understanding the fluctuating nature of Bitcoin mining’s energy usage, which can vary based on factors like the price of Bitcoin, the efficiency of mining hardware, and the geographical distribution of miners.

The CBECI also sheds light on the potential for improvement in energy sourcing. While a significant portion of Bitcoin mining relies on non-renewable energy sources, there is a growing trend towards the use of renewable energy. This shift is driven by both environmental concerns and economic factors, as renewable energy sources can be more cost-effective in the long run.

The energy consumption of Bitcoin mining is a topic of considerable debate, primarily due to its large scale and comparison with the energy usage of entire nations. The insights provided by the CBECI are invaluable in understanding the complexities of this issue. They highlight not only the challenges posed by the current state of Bitcoin mining’s energy usage but also the potential for a more sustainable and environmentally friendly approach in the future

The environmental impact of Bitcoin mining, primarily due to its high energy consumption, has become a subject of significant concern. The process of mining, which requires extensive computational power, leads to substantial electricity usage, raising questions about its sustainability and environmental footprint. The primary concern revolves around the source of this electricity, particularly when it is derived from fossil fuels, contributing to greenhouse gas emissions and exacerbating climate change.

The carbon footprint of Bitcoin mining is closely tied to the energy sources used. When mining operations are powered by coal or other fossil fuels, the carbon emissions are considerable. However, the exact carbon footprint varies significantly across different regions and mining setups, depending on their energy mix. The shift towards renewable energy sources in some mining operations has started to mitigate these concerns, but the overall carbon footprint remains a topic of intense debate and analysis.

When compared to traditional banking systems and other industries, the environmental impact of Bitcoin mining presents a complex picture. Traditional banking systems, with their extensive physical infrastructure, including branches, ATMs, and data centers, also consume significant amounts of energy. However, the decentralized nature of Bitcoin eliminates many of these physical requirements, potentially reducing its overall environmental impact in comparison. Additionally, industries like manufacturing, transportation, and agriculture have considerably larger carbon footprints, suggesting that the focus on Bitcoin mining’s environmental impact should be viewed within a broader context of global energy consumption.

The environmental impact of Bitcoin mining is a multifaceted issue, encompassing concerns about high energy consumption and carbon emissions. However, through innovative initiatives like Bitcoin space heaters, methane mitigation, and the subsidization of renewable energy, the industry is making strides towards not only reducing its environmental footprint but also contributing positively to global sustainability efforts. These developments suggest a future where Bitcoin mining could play a pivotal role in achieving environmental goals and advancing the use of renewable energy sources

In recent years, the Bitcoin mining industry has witnessed a significant shift towards renewable energy sources. This transition is driven by a combination of environmental responsibility, economic incentives, and increasing scrutiny from both the public and regulators. Renewable energy, being more sustainable and often more cost-effective in the long run, presents an attractive alternative to traditional fossil fuels. This shift is not just a response to environmental concerns but also a strategic move for the long-term viability and acceptance of Bitcoin mining.

Recent studies and reports indicate a growing trend in the use of renewable energy within the Bitcoin mining sector. According to a 2020 report by the University of Cambridge, approximately 76% of cryptocurrency miners use electricity from renewable sources to some extent. However, the extent of renewable energy usage varies, with renewables accounting for about 39% of the total power used for Bitcoin mining. This percentage reflects a significant portion of the industry’s commitment to reducing its carbon footprint and enhancing sustainability.

The integration of renewable energy sources in Bitcoin mining is a positive development, showcasing the industry’s ability to adapt and innovate in response to environmental challenges. While the percentage of renewable energy usage in mining is on the rise, there is still room for growth and improvement. The case studies of mining farms utilizing solar, wind, hydroelectric, and geothermal power are testament to the industry’s commitment to sustainability. These initiatives not only help in reducing the carbon footprint of Bitcoin mining but also set a precedent for other industries to follow in the transition towards a more sustainable future.

Bitcoin mining, at its core, is an economic activity driven by the potential for profit. The profitability of mining depends on various factors, including the price of Bitcoin, the cost of electricity, and the efficiency of mining hardware. When the price of Bitcoin is high, and energy costs are low, mining can be highly profitable. However, this equation can shift dramatically with changes in the Bitcoin market or energy prices.

From an economic impact standpoint, Bitcoin mining has created a new industry. It has spurred the development of specialized hardware, created jobs, and even revitalized certain regions with abundant but underutilized energy resources. For instance, areas with surplus hydroelectric power have attracted miners, bringing economic activity to these regions.

Economists and financial experts have varied views on the sustainability of Bitcoin mining. Some raise concerns about its long-term viability, especially as the block reward decreases over time and the competition for mining new blocks intensifies. Others point out the potential for Bitcoin mining to drive innovation in renewable energy sources, as miners seek out the cheapest and most sustainable power options.

There are also discussions about the broader economic impact of Bitcoin mining, such as its effect on energy markets and potential to contribute to financial inclusion by providing an alternative to traditional banking systems.

From a cost-benefit perspective, Bitcoin mining presents a complex picture. On the cost side, there are direct expenses like electricity and hardware, as well as indirect costs related to environmental impacts and potential regulatory changes. The benefits, however, extend beyond the immediate financial returns from mining new bitcoins. These include:

The economic perspectives on Bitcoin mining are as diverse as the activity itself. While there are valid concerns about its long-term sustainability and environmental impact, Bitcoin mining also offers significant economic benefits and opportunities for innovation. The industry’s move towards more sustainable energy sources and the continuous evolution of mining technology are likely to shape its economic impact in the years to come. As with any emerging industry, the balance of costs and benefits will continue to evolve, reflecting changes in technology, market dynamics, and regulatory environments.

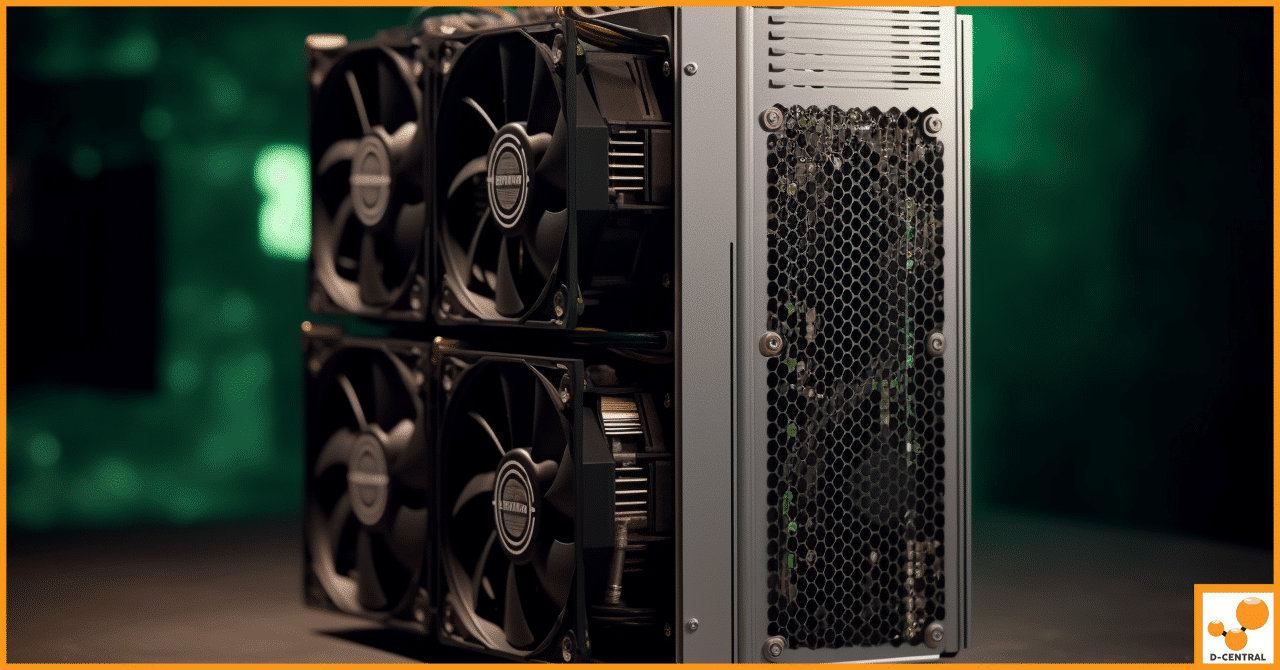

The journey of Bitcoin mining hardware is a tale of relentless pursuit of efficiency and power. In the early days of Bitcoin, mining was possible using CPUs (Central Processing Units) found in ordinary desktop computers. However, as the network grew and the mining difficulty increased, the need for more efficient hardware became apparent.

The next phase saw the adoption of GPUs (Graphics Processing Units), which offered a significant improvement over CPUs in terms of processing power and energy efficiency. GPUs, commonly used for gaming and graphic-intensive applications, were better suited to handle the parallel processing required for Bitcoin mining.

The quest for efficiency didn’t stop there. FPGAs (Field-Programmable Gate Arrays) entered the scene, offering further improvements. These devices could be configured specifically for mining, providing a balance between versatility and efficiency.

The most significant leap in mining technology came with the introduction of ASICs (Application-Specific Integrated Circuits). Designed exclusively for Bitcoin mining, ASICs represent the pinnacle of mining efficiency. These devices are tailored to compute mining algorithms with maximum efficiency, drastically reducing the power consumption per hash compared to their predecessors.

The evolution of mining hardware has had a profound impact on energy consumption in the Bitcoin mining industry. ASICs, being highly specialized, consume significantly less energy per unit of mining power compared to CPUs, GPUs, and FPGAs. This increased efficiency means that more hashes can be computed for the same amount of energy, making the mining process more environmentally friendly and cost-effective.

However, the increased efficiency also led to an arms race among miners, as lower operating costs allowed for larger scale operations, which in turn increased the total energy consumption of the Bitcoin network. This paradox highlights the complex relationship between hardware efficiency and overall energy usage in Bitcoin mining.

Looking to the future, several technological innovations hold the promise of further reducing the electricity usage of Bitcoin mining:

The technological advancements in Bitcoin mining hardware, from CPUs to ASICs, have significantly improved energy efficiency. However, the challenge of balancing increased efficiency with overall energy consumption remains. Future innovations, both in hardware and blockchain technology, are poised to further reduce the electricity usage of Bitcoin mining, contributing to a more sustainable and environmentally conscious approach to this critical aspect of the Bitcoin ecosystem.

The comparison of energy consumption between Bitcoin mining and traditional banking systems is a subject of intense debate. Bitcoin mining, as established, is an energy-intensive process due to the computational power required for securing the blockchain and processing transactions. However, when compared to the traditional banking system, the picture becomes more nuanced.

Traditional banking systems encompass a vast array of physical infrastructures, such as bank branches, ATMs, data centers, and the transportation network for cash distribution and management. Each of these components consumes energy. Additionally, the banking system relies heavily on data centers that, much like Bitcoin mining farms, require significant amounts of electricity to run and cool servers.

Studies and reports suggest that when all these factors are considered, the traditional banking system’s energy consumption surpasses that of Bitcoin mining. However, these comparisons can be challenging due to the different natures and scales of these systems.

Operational costs in both Bitcoin mining and traditional banking systems are substantial but stem from different sources. In Bitcoin mining, the primary costs are electricity, mining hardware, and network infrastructure. The cost-effectiveness of mining is closely tied to the efficiency of the hardware and the cost of electricity, which can vary significantly based on geographic location.

In contrast, traditional banking systems incur operational costs from physical infrastructure maintenance, labor, logistics, and IT infrastructure. These costs are persistent and less variable than those in Bitcoin mining. The banking system also faces costs related to compliance, security, and fraud prevention, which are different in nature from those in the cryptocurrency domain.

Bitcoin, with its decentralized nature, poses a potential disruptive challenge to traditional financial models. Its blockchain technology offers a level of security, transparency, and efficiency that traditional systems struggle to match. Bitcoin eliminates the need for intermediaries, reducing transaction times and potentially lowering costs.

Furthermore, Bitcoin’s global accessibility presents opportunities for financial inclusion, especially in underbanked or unbanked regions. Its ability to facilitate cross-border transactions with relative ease and lower fees challenges the existing financial paradigms and offers an alternative model that could reshape how global financial transactions are conducted.

Bitcoin’s limited supply also contrasts with the traditional banking system’s ability to print money, offering a hedge against inflation and currency devaluation. This aspect of Bitcoin is particularly appealing in countries experiencing economic instability.

The comparison between Bitcoin mining and traditional financial systems in terms of energy consumption and operational costs reveals a complex landscape. While Bitcoin mining is energy-intensive, the traditional banking system also consumes substantial energy through its vast and multifaceted infrastructure. The potential of Bitcoin to disrupt traditional financial models lies in its decentralized nature, efficiency, and the promise of greater financial inclusion. As both systems evolve, their energy dynamics and operational costs will continue to be key factors in their long-term sustainability and impact.

Considering the comprehensive analysis, it is clear that categorizing Bitcoin mining as merely a waste of electricity oversimplifies a complex issue. While it is energy-intensive, the industry’s shift towards renewable energy sources, advancements in mining technology, and innovative practices like methane mitigation indicate a move towards more sustainable and environmentally responsible operations. The comparison with traditional banking systems also provides a broader context for understanding Bitcoin mining’s energy use.

Looking ahead, the future of Bitcoin mining appears to be on a trajectory towards greater efficiency and sustainability. As technological advancements continue to improve hardware efficiency and renewable energy becomes more integrated into mining operations, the industry is poised to reduce its environmental impact significantly. The potential for Bitcoin mining to act as a catalyst for renewable energy development and its role in advancing global sustainability goals cannot be understated.

For those intrigued by the world of Bitcoin mining and its evolving landscape, there is much more to discover and opportunities to engage. D-Central Technologies stands as a resource and a leader in this field, offering insights, services, and solutions for those interested in sustainable Bitcoin mining practices.

To learn more about Bitcoin mining, explore sustainable practices, or inquire about services, visit D-Central Technologies’ website. For direct inquiries or to discuss potential collaborations, feel free to contact D-Central Technologies through their contact page.

Bitcoin mining is at a pivotal juncture, balancing the demands of energy consumption with the imperative of sustainability. As the industry continues to innovate and evolve, it holds the potential not only to redefine its own environmental footprint but also to influence the broader narrative around renewable energy and technological advancement. D-Central Technologies remains at the forefront of this evolution, championing practices and technologies that pave the way for a more sustainable and efficient future in Bitcoin mining.

What is Bitcoin mining?

Bitcoin mining is a digital process where powerful computers solve complex mathematical problems to maintain the ledger of the Bitcoin network (blockchain). Miners validate and secure transactions, and in return, earn new bitcoins.

What is the environmental impact of Bitcoin mining?

Bitcoin mining’s environmental impact is significant due to its substantial energy consumption, often sourced from fossil fuels, which contributes to greenhouse gas emissions and climate change.

How does the energy consumption of Bitcoin mining compare with that of entire countries?

Bitcoin mining consumes an estimated 71.24 terawatt-hours (TWh) annually, more than the annual electricity use of some countries like the Netherlands and Argentina.

What percentage of Bitcoin mining uses renewable energy?

Approximately 39% of the total power used for Bitcoin mining is sourced from renewable energy, and around 76% of miners use some form of renewable energy in their operations.

Are there any innovative initiatives to mitigate the environmental impact of Bitcoin mining?

Yes, initiatives include using recycled heat from mining operations for heating (Bitcoin space heaters), methane mitigation processes, and the use of renewable energy to reduce the carbon footprint.

How do the operational costs of Bitcoin mining compare with those of traditional banking systems?

Bitcoin mining operational costs are primarily related to electricity and hardware, whereas traditional banking systems incur maintenance for physical infrastructure, labor, logistics, and IT, among other expenses.

Does Bitcoin mining have the potential to disrupt traditional financial models?

Yes, Bitcoin’s decentralized nature, efficiency, and global accessibility offer alternatives to traditional banking, with potential for greater financial inclusion and reduced costs for cross-border transactions.

What advancements are being made in mining technology to improve efficiency?

Continual improvements in ASICs, better cooling systems, energy recovery, and integration with renewable energy are all contributing to the increased efficiency of Bitcoin mining operations.

How does D-Central Technologies contribute to sustainable Bitcoin mining?

D-Central Technologies provides insights, services, and solutions geared towards sustainable Bitcoin mining practices, including advancing the use of renewable energy and supporting innovative mining technology.

How can I learn more about Bitcoin mining or engage with D-Central Technologies?

You can visit D-Central Technologies’ website for more information on Bitcoin mining or contact them directly through their contact page for inquiries and discussions about collaborations in sustainable mining practices.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

In the digital age, the concept of currency has evolved beyond physical money to include digital currencies, a revolutionary form

In the ever-evolving landscape of digital currencies, Bitcoin stands as a pioneering force that has reshaped our understanding of financial

If you are familiar with the cryptocurrency mining industry, chances are you’ve heard about the Antminer S9. As one of