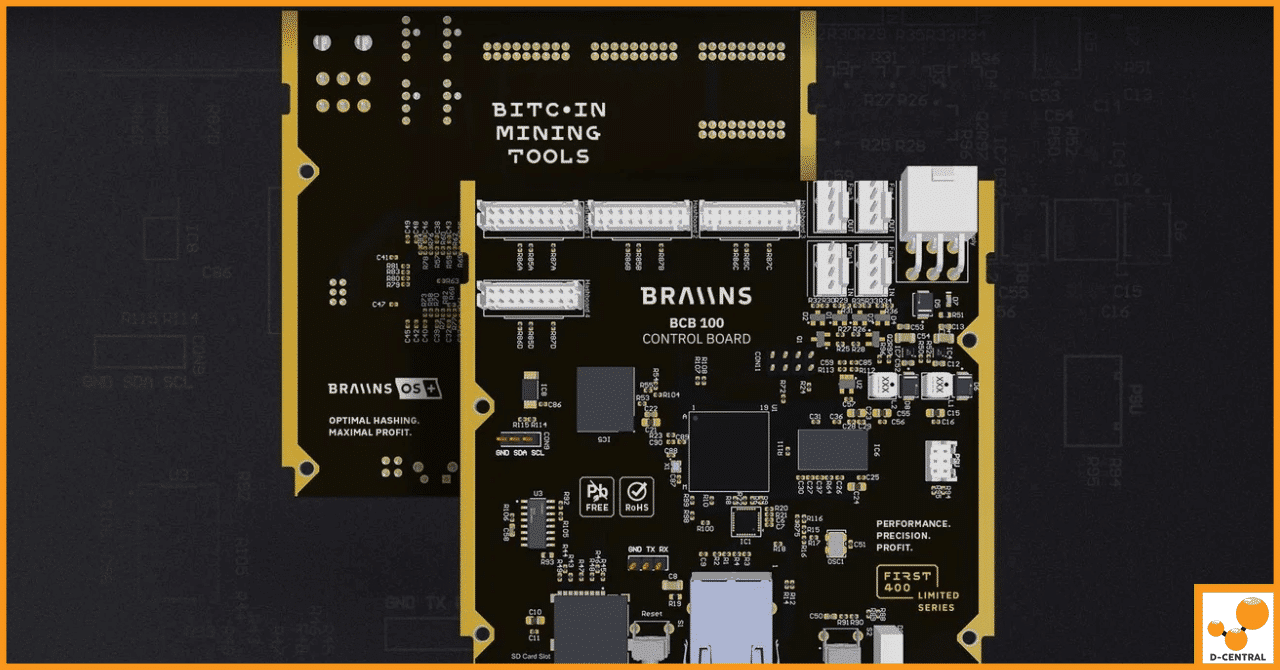

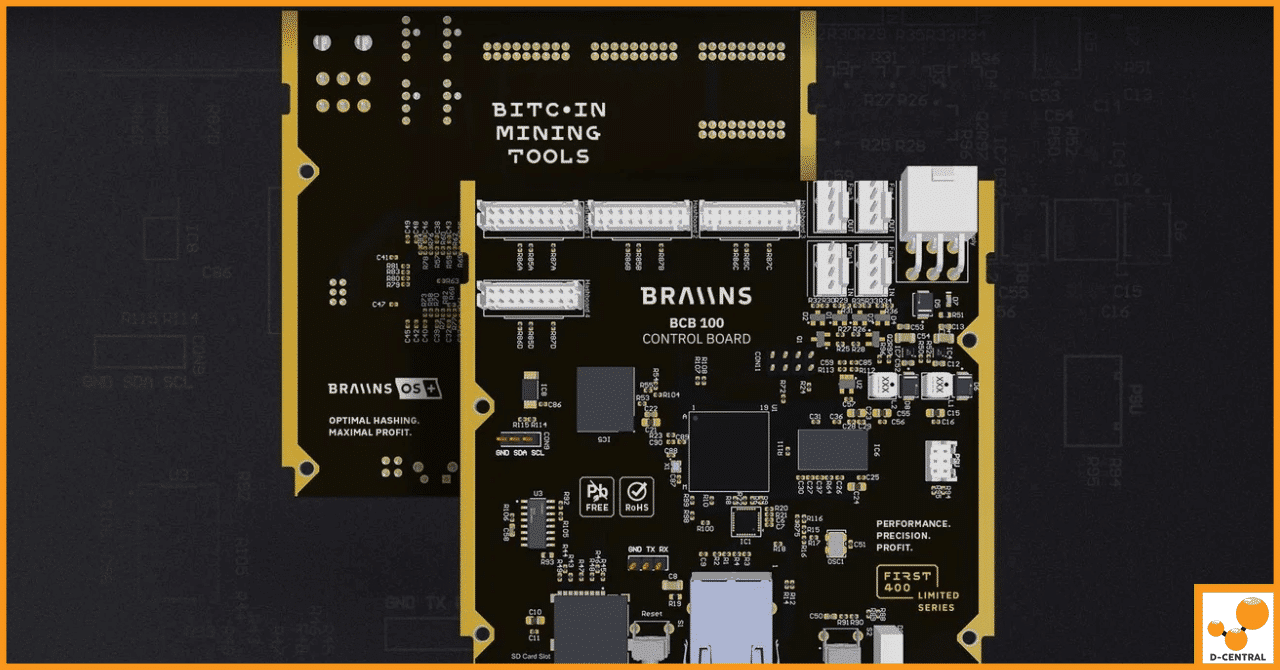

The Future of Efficient Bitcoin Mining: The Braiins BCB 100 Control Board

At the heart of Bitcoin mining is the sophisticated hardware used to solve complex computational puzzles. This is no casual

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

In the world of cryptocurrencies and digital currencies, there are two leading names that have captured the attention of investors, traders, and enthusiasts alike: BUSD and Bitcoin. BUSD, or Binance USD, is a stablecoin pegged to the US dollar and was created by Binance, the world’s largest cryptocurrency exchange. On the other hand, Bitcoin is the first and most well-known cryptocurrency, which was introduced to the world in 2009 by an anonymous entity known as Satoshi Nakamoto.

Both of these digital assets have their own unique features, benefits, and shortcomings, but in this article, we will focus on their approach to sovereignty, financial independence, and decentralized finance. We will also look at the role they play in challenging the traditional monetary systems and how they stack up against each other in terms of key features and potential impact.

Before diving into the core concept of sovereignty in the context of cryptocurrencies, it is essential to understand the basics of cryptocurrency and digital currency. A cryptocurrency is a type of digital currency that uses cryptography to secure transactions, control the creation of new units, and verify the transfer of assets.

Digital currencies, on the other hand, are currencies that are stored and transacted electronically using computers, mobile phones, or other electronic devices. Cryptocurrencies are a subset of digital currencies but are distinguished by their decentralized nature and reliance on blockchain technology. Blockchain technology provides a transparent, trustless system for verifying transactions and maintaining a public ledger of all transactions that have ever taken place.

Sovereignty, in the context of cryptocurrencies, refers to the idea of financial independence and freedom from centralized control. This concept is closely tied to the decentralized nature of cryptocurrencies, as they are not issued or controlled by any central authority like a government or a financial institution. Instead, they operate on a decentralized network of computers, allowing users to transact directly with one another without the need for intermediaries. This decentralization provides a level of financial sovereignty that is not possible with traditional, centralized currencies.

As mentioned earlier, BUSD is a stablecoin pegged to the US dollar, which means its value is intended to remain stable relative to the dollar. This stability is achieved by maintaining a reserve of US dollars that back each BUSD token. This approach provides some benefits, such as reduced price volatility and a reliable store of value. However, with this stability comes some limitations that hinder BUSD’s ability to rival Bitcoin’s commitment to sovereignty.

One of the main limitations of BUSD is its dependency on the US dollar and the traditional financial system. Since its value is pegged to the dollar, BUSD is inherently linked to the monetary policies and inflation rates of the US government. Furthermore, the reserves backing BUSD must be held in traditional financial institutions, which means that BUSD users are ultimately relying on these centralized entities for the stability of their digital assets. This reliance on centralized systems goes against the core principles of financial sovereignty and decentralization that cryptocurrencies like Bitcoin embody.

In contrast to BUSD, Bitcoin is not pegged to any traditional currency and operates on a completely decentralized network. This independence from centralized control is a key aspect of Bitcoin’s dedication to financial sovereignty. Bitcoin was designed to be a decentralized, borderless currency that allows individuals to transact freely without the need for intermediaries, such as banks or governments.

Another essential aspect of Bitcoin’s commitment to sovereignty is its limited supply. There will only ever be 21 million bitcoins, which means that it cannot be arbitrarily inflated by a central authority. This limited supply provides an inherent inflation hedge and store of value, which is not present in stablecoins like BUSD.

Decentralized finance, or DeFi, is a rapidly growing sector within the cryptocurrency space that aims to provide financial services without the need for traditional centralized institutions. DeFi platforms leverage blockchain technology to create trustless, transparent, and permissionless financial systems that empower individuals to take control of their own financial futures.

This emerging sector has the potential to disrupt traditional monetary systems by offering alternative financial products and services that provide greater financial independence and sovereignty. Both BUSD and Bitcoin play a role in this disruption, with Bitcoin acting as a decentralized store of value and medium of exchange, while BUSD offers stability and accessibility for those looking to enter the world of digital assets.

Censorship resistance is a crucial aspect of financial sovereignty, as it ensures that transactions cannot be blocked or controlled by a central authority. Bitcoin’s decentralized network and reliance on cryptographic principles make it highly resistant to censorship, allowing users to transact freely without fear of interference.

On the other hand, BUSD’s ties to the traditional financial system and centralized control make it more susceptible to censorship. For example, the reserves backing BUSD could be frozen or seized by a government, effectively undermining the value and stability of the stablecoin.

As mentioned earlier, Bitcoin’s limited supply makes it an effective inflation hedge and store of value. The scarcity of bitcoin ensures that its value is not subject to the same inflationary pressures as traditional currencies, making it an attractive asset for those seeking to protect their wealth from inflation.

BUSD, on the other hand, is pegged to the US dollar and is therefore subject to the same inflationary pressures. While it may offer stability in the short term, BUSD does not provide the same level of protection against inflation as Bitcoin.

Financial privacy and security are essential aspects of financial sovereignty, as they allow individuals to transact without fear of surveillance or theft. Bitcoin’s cryptographic nature provides a high level of privacy and security, with users able to transact pseudonymously and without the need for a trusted third party.

BUSD, however, is subject to the same regulatory requirements and oversight as traditional financial institutions. This means that users must often undergo identity verification processes and are subject to potential surveillance by governments or other entities. This lack of privacy and security is a significant drawback for those seeking financial sovereignty.

Bitcoin’s decentralized nature and its potential to serve as an alternative currency are key aspects of its commitment to financial sovereignty. The decentralized network of nodes and miners that secure the Bitcoin blockchain ensures that no single entity has control over the currency, making it a truly decentralized and borderless form of money.

BUSD, on the other hand, relies on the traditional financial system and centralized control. Its value is tied to the US dollar, and its reserves are held in centralized institutions. This reliance on centralized systems makes it difficult for BUSD to serve as a truly decentralized and alternative form of currency.

Government control is a significant factor when considering the financial sovereignty of any digital asset. As discussed earlier, BUSD is inherently more susceptible to government control due to its ties to the traditional financial system and centralized control. This susceptibility could potentially undermine the stability and value of the stablecoin, making it a less attractive option for those seeking financial independence and sovereignty.

Bitcoin, on the other hand, is designed to be resistant to government control. Its decentralized network, limited supply, and cryptographic security make it difficult for governments to seize, censor, or manipulate the currency. While there are concerns about potential regulation or intervention, Bitcoin’s core principles and design make it a formidable contender in the fight for financial sovereignty.

The growing popularity of digital assets and decentralized finance indicates a shift towards a more borderless and financially sovereign future. As technology continues to advance and disrupt traditional systems, both BUSD and Bitcoin have roles to play in shaping the future of digital transactions and borderless finance.

While BUSD may offer stability and accessibility for new users, its limitations in terms of sovereignty and decentralization make it difficult to rival Bitcoin’s unwavering dedication to these principles. Bitcoin, with its decentralized nature and commitment to financial independence, is likely to continue leading the charge in challenging the traditional monetary system and paving the way for a more sovereign financial future.

When comparing BUSD and Bitcoin in terms of financial sovereignty, it becomes apparent that BUSD fallsshort in several key areas. While BUSD may offer stability and accessibility, it is ultimately limited by its ties to the traditional financial system and centralized control. In contrast, Bitcoin’s commitment to sovereignty and financial independence is unwavering, making it a formidable contender in the world of digital assets.

As the world of cryptocurrencies and digital assets continues to evolve, the role of sovereignty and decentralization will become increasingly important. BUSD and Bitcoin both play a role in this evolution, but it is Bitcoin’s dedication to these principles that sets it apart from other digital assets.

The future of digital transactions and borderless finance is exciting, and both BUSD and Bitcoin are likely to play a significant role in shaping it. However, for those seeking true financial sovereignty and independence, Bitcoin’s unwavering commitment to these principles makes it the clear choice.

Q: What is the concept of sovereignty in the context of cryptocurrencies?

A: Sovereignty, in the context of cryptocurrencies, refers to the idea of financial independence and freedom from centralized control. This concept is closely tied to the decentralized nature of cryptocurrencies, as they are not issued or controlled by any central authority like a government or a financial institution. Instead, they operate on a decentralized network of computers, allowing users to transact directly with one another without the need for intermediaries. This decentralization provides a level of financial sovereignty that is not possible with traditional, centralized currencies.

Q: What are the limitations of BUSD in terms of financial sovereignty?

A: One of the main limitations of BUSD is its dependency on the US dollar and the traditional financial system. Since its value is pegged to the dollar, BUSD is inherently linked to the monetary policies and inflation rates of the US government. Furthermore, the reserves backing BUSD must be held in traditional financial institutions, which means that BUSD users are ultimately relying on these centralized entities for the stability of their digital assets. This reliance on centralized systems goes against the core principles of financial sovereignty and decentralization that cryptocurrencies like Bitcoin embody.

Q: How does Bitcoin’s commitment to sovereignty and financial independence compare to BUSD?

A: In contrast to BUSD, Bitcoin is not pegged to any traditional currency and operates on a completely decentralized network. This independence from centralized control is a key aspect of Bitcoin’s dedication to financial sovereignty. Bitcoin was designed to be a decentralized, borderless currency that allows individuals to transact freely without the need for intermediaries, such as banks or governments. Another essential aspect of Bitcoin’s commitment to sovereignty is its limited supply. There will only ever be 21 million bitcoins, which means that it cannot be arbitrarily inflated by a central authority. This limited supply provides an inherent inflation hedge and store of value, which is not present in stablecoins like BUSD.

Q: What is the difference between censorship resistance in Bitcoin and BUSD?

A: Censorship resistance is a crucial aspect of financial sovereignty, as it ensures that transactions cannot be blocked or controlled by a central authority. Bitcoin’s decentralized network and reliance on cryptographic principles make it highly resistant to censorship, allowing users to transact freely without fear of interference. On the other hand, BUSD’s ties to the traditional financial system and centralized control make it more susceptible to censorship. For example, the reserves backing BUSD could be frozen or seized by a government, effectively undermining the value and stability of the stablecoin.

Q: Can BUSD rival Bitcoin’s commitment to financial sovereignty?

A: When comparing BUSD and Bitcoin in terms of financial sovereignty, it becomes apparent that BUSD falls short in several key areas. While BUSD may offer stability and accessibility, it is ultimately limited by its ties to the traditional financial system and centralized control. In contrast, Bitcoin’s commitment to sovereignty and financial independence is unwavering, making it a formidable contender in the world of digital assets. As the world of cryptocurrencies and digital assets continues to evolve, the role of sovereignty and decentralization will become increasingly important. BUSD and Bitcoin both play a role in this evolution, but it is Bitcoin’s dedication to these principles that sets it apart from other digital assets.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

At the heart of Bitcoin mining is the sophisticated hardware used to solve complex computational puzzles. This is no casual

The advent of cryptocurrency has revolutionized the financial landscape, introducing a new realm of digital assets that are decentralized, secure,

One of the most crucial, yet often overlooked, aspects of mining operations is the ability to understand and interpret mining