Bitcoin Independence Day: UASF’s Impact on Bitcoin’s Evolution

In the ever-evolving world of Bitcoin, the User Activated Soft Fork (UASF) emerges as a beacon of spontaneous order amidst

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

In the digital age, two revolutionary concepts have emerged as the vanguards of financial and technological innovation: Bitcoin and blockchain technology. At first glance, Bitcoin, the first and most well-known cryptocurrency, presents a radical approach to traditional currency and financial transactions. Its underlying technology, blockchain, is a groundbreaking ledger system that has far-reaching implications beyond cryptocurrency, influencing sectors from banking to supply chain management.

Understanding the symbiotic relationship between Bitcoin and blockchain is crucial for anyone navigating the modern digital landscape. This interdependence is not merely technical; it represents a shift in how we perceive trust, security, and decentralization in the digital world. Bitcoin, with its decentralized nature, challenges conventional financial systems, while blockchain offers a new paradigm for secure, transparent, and tamper-proof record-keeping.

This article aims to delve deep into the essence of Bitcoin and blockchain, exploring how they rely on each other to function and thrive. We will begin by unpacking the fundamentals of blockchain technology, laying the groundwork to appreciate its role as the backbone of Bitcoin. Following this, we will trace the genesis and evolution of Bitcoin, highlighting its milestones and the challenges it has faced. The core of our discussion will focus on their symbiotic relationship, elucidating how blockchain’s characteristics of trust and transparency are pivotal to Bitcoin’s success.

Moreover, we will spotlight D-Central Technologies’ significant contributions to the Bitcoin ecosystem, showcasing innovative mining solutions and educational initiatives that underscore the importance of this interdependence. By the conclusion, readers will have a comprehensive understanding of the intricate dance between Bitcoin and blockchain, equipped with insights into their future trajectory and the continuous innovations shaping their journey.

Blockchain technology is often described as a distributed ledger or a decentralized database that records transactions across multiple computers in such a way that the registered transactions cannot be altered retroactively. This technology underpins the essence of trust and transparency in digital transactions, ensuring that each entry in the ledger is immutable and time-stamped. At its core, a blockchain is a chain of blocks, where each block contains a number of transactions that are verified and agreed upon by a network consensus.

The Concept of Decentralization in Blockchain

Decentralization is a hallmark of blockchain technology, distinguishing it from traditional centralized databases. In a decentralized blockchain network, there is no central authority or single point of control. Instead, the power and control are distributed across the network participants, known as nodes. This decentralization ensures that the system is more resistant to censorship and tampering, as altering any information would require consensus across the majority of the network, making fraudulent activities significantly more challenging.

How Blockchain Acts as the Backbone for Bitcoin Transactions

Blockchain serves as the foundational technology for Bitcoin, acting as the public ledger for all transactions within the network. When a Bitcoin transaction is made, it is broadcasted to the network and grouped with other transactions into a block. This block is then verified by miners through a process known as proof of work, and once confirmed, it is added to the blockchain. This process ensures that all transactions are recorded in a linear, chronological order, making the history of each Bitcoin transparent and traceable.

The Immutable Nature of Blockchain and Its Significance for Bitcoin’s Security

The immutability of the blockchain is one of its most critical features, particularly for the security and integrity of Bitcoin. Once a block is added to the chain, it is computationally infeasible to alter its contents due to the cryptographic linkage between blocks. Each block contains a hash of the previous block, creating a secure chain of blocks that is resistant to modification. This immutability ensures that once a transaction is recorded in the blockchain, it cannot be reversed or tampered with, providing a robust layer of security for Bitcoin transactions.

Brief Overview of Blockchain Applications Beyond Cryptocurrencies

While Bitcoin introduced the world to blockchain, the technology’s potential applications extend far beyond cryptocurrencies. Blockchain is being explored and adopted in various industries for its ability to provide secure, transparent, and efficient solutions to traditional problems. Some notable applications include supply chain management, where blockchain can track the provenance of goods; healthcare, for secure and immutable patient records; and finance, for streamlined and transparent transactions.

Potential Impact on Various Industries

The impact of blockchain technology on various industries could be transformative, offering a new paradigm for operations and data management. In supply chain management, for example, blockchain can enhance transparency, allowing consumers to verify the authenticity and origin of products. In healthcare, it can secure patient data while providing accessibility to authorized parties. For the financial industry, blockchain offers the promise of faster, cheaper, and more secure transactions, potentially reducing the need for intermediaries and lowering costs for businesses and consumers alike. As industries continue to explore and integrate blockchain solutions, the potential for innovation and efficiency improvements is vast, signaling a significant shift in how data and transactions are managed globally.

The inception of Bitcoin can be traced back to the tumultuous landscape of the 2008 financial crisis, a period marked by a growing distrust in traditional banking systems and financial institutions. It was in this climate of financial uncertainty that Bitcoin emerged as a radical alternative, proposing a decentralized form of currency free from government or institutional control.

Satoshi Nakamoto’s Vision and the Publication of the Bitcoin Whitepaper

In October 2008, an individual or group under the pseudonym Satoshi Nakamoto published the Bitcoin whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This seminal document outlined a revolutionary decentralized digital currency system, leveraging blockchain technology to enable secure, peer-to-peer transactions without the need for intermediaries. Nakamoto’s vision was to create a system where financial transactions are transparent, secure, and accessible to everyone, laying the groundwork for what would become the world’s first cryptocurrency.

Milestones in Bitcoin’s History

Bitcoin’s journey from an obscure cryptographic experiment to a globally recognized currency is dotted with significant milestones. The first known commercial transaction using Bitcoin occurred in May 2010, when 10,000 bitcoins were used to purchase two pizzas, an event now celebrated as Bitcoin Pizza Day. This was followed by the establishment of the first Bitcoin exchange, the surge in Bitcoin’s value, and its adoption by merchants and businesses worldwide. Each milestone not only marked Bitcoin’s growing acceptance but also its resilience as a new form of currency.

Factors Contributing to Its Widespread Adoption

Several factors have contributed to Bitcoin’s widespread adoption. Its decentralized nature offers a level of security and privacy not typically available in traditional banking. The finite supply of Bitcoin, capped at 21 million, contrasts with traditional fiat currencies that can be printed at will, making Bitcoin an attractive hedge against inflation. Additionally, the global and digital nature of Bitcoin allows for borderless transactions, appealing to a digitally native and globalized generation.

Key Challenges Faced by Bitcoin Over the Years

Bitcoin’s journey has not been without its challenges. Regulatory scrutiny, security concerns, and high-profile hacks of cryptocurrency exchanges have posed significant hurdles. The debate over Bitcoin’s scalability led to community divisions and the creation of Bitcoin Cash following a hard fork in 2017. Moreover, Bitcoin’s association with illicit transactions in the early days and its environmental impact due to energy-intensive mining processes have also sparked criticism.

How the Community and Technology Have Evolved to Address These Challenges

In response to these challenges, the Bitcoin community and underlying technology have undergone significant evolution. Innovations such as the Lightning Network have been developed to address scalability issues, enabling faster and cheaper transactions. The community has also rallied to enhance security measures and promote responsible mining practices that consider environmental impacts. Despite the hurdles, Bitcoin has shown remarkable resilience, adapting and growing stronger with each challenge, a testament to the robustness of Nakamoto’s original vision and the enduring commitment of the Bitcoin community.

At the heart of Bitcoin lies the blockchain, a public ledger that records every transaction ever made in the Bitcoin network. When a Bitcoin transaction occurs, it is broadcast to the network and validated by nodes, known as miners. These transactions are then grouped together into a block. Each block contains a unique code called a hash, which links it to the previous block, forming an unbreakable chain. This process ensures the integrity and chronological order of the blockchain, making it virtually impossible to alter any single transaction without altering all subsequent blocks, which would require the consensus of the majority of the network.

The Role of Miners and Mining in Maintaining and Securing the Blockchain

Miners play a crucial role in the Bitcoin ecosystem by validating and securing transactions. They use powerful computers to solve complex mathematical puzzles, a process known as proof of work. The first miner to solve the puzzle gets the right to add the new block to the blockchain and is rewarded with newly minted bitcoins and transaction fees. This incentivizes miners to contribute their computational power to maintain and secure the network, making the blockchain resistant to attacks and fraud.

How Blockchain’s Transparency and Security Foster Trust in Bitcoin

Blockchain technology fosters trust in the Bitcoin network through its inherent transparency and security features. Every transaction on the blockchain is visible to all participants, ensuring transparency and enabling users to track the history of bitcoins from their creation. This level of openness helps prevent fraud and unauthorized spending. Furthermore, the cryptographic security measures employed by the blockchain, such as hash functions and public-private key encryption, ensure that transactions are secure and tamper-proof, building a foundation of trust in the digital currency.

The Concept of Trustlessness and Its Importance in the Cryptocurrency World

The concept of trustlessness is fundamental to the cryptocurrency world, meaning that transactions can occur directly between parties without the need for a trusted intermediary, such as a bank. This is made possible by the blockchain, which provides a decentralized verification mechanism through consensus among network participants. Trustlessness reduces the risk of fraud and corruption, lowers transaction costs, and increases efficiency, making Bitcoin an attractive alternative to traditional financial systems.

Ongoing Developments in Blockchain Technology to Support Bitcoin

The Bitcoin blockchain continues to evolve through ongoing developments aimed at enhancing its functionality and scalability. Developers and researchers are constantly working on new protocols, features, and improvements to address the challenges faced by the network, such as transaction speed and scalability.

How Innovations Like the Lightning Network and SegWit Improve Bitcoin’s Scalability and Efficiency

Innovations such as the Lightning Network and Segregated Witness (SegWit) are pivotal in improving Bitcoin’s scalability and efficiency. The Lightning Network is a second-layer protocol that enables off-chain transactions, allowing for instant and low-cost payments without burdening the main blockchain. This significantly increases the network’s capacity to handle transactions. SegWit, on the other hand, is an upgrade to the Bitcoin protocol that increases block capacity by removing certain data from transactions, thereby allowing more transactions to be included in each block. These innovations exemplify the dynamic nature of Bitcoin and blockchain technology, showcasing their ability to adapt and improve in response to the needs of the user base and the broader digital economy.

D-Central Technologies stands at the forefront of the Bitcoin mining industry, offering a suite of services and solutions that enhance the efficiency and sustainability of mining operations. As a leader in the field, D-Central provides expertise in ASIC repairs, mining hosting, and the supply of mining hardware, catering to a diverse clientele ranging from individual enthusiasts to large-scale operations. The company’s commitment to innovation and quality has solidified its reputation as a trusted partner in the mining community.

D-Central Technologies is dedicated to pushing the boundaries of traditional mining practices through innovative solutions such as methane mitigation and dual-purpose mining. By converting surplus methane into electricity, D-Central not only harnesses a previously wasted resource but also contributes to environmental sustainability. Furthermore, the development of dual-purpose mining solutions, such as Bitcoin space heaters, exemplifies D-Central’s commitment to maximizing energy efficiency and utility, transforming mining operations into a source of both financial and practical value.

ducation is a cornerstone of D-Central Technologies’ mission, with the company actively engaging in initiatives to demystify Bitcoin and blockchain technology for the public and its clients. Through workshops, seminars, and online resources, D-Central empowers individuals and organizations with the knowledge needed to navigate the complexities of the cryptocurrency landscape, fostering a well-informed and engaged community.

D-Central Technologies is a vocal advocate for Bitcoin maximalism, championing the belief in Bitcoin’s superiority as the definitive cryptocurrency. This stance is rooted in a deep appreciation for the principles of decentralization, privacy, and security that underpin the Bitcoin network. In alignment with the cypherpunk ethos, D-Central promotes the use of cryptographic technologies as a means to achieve greater personal and financial autonomy, advocating for a future where individuals have greater control over their digital identities and assets.

Looking to the future, D-Central Technologies is poised to expand its influence within the Bitcoin ecosystem through a range of ambitious projects and collaborations. The company is exploring advanced mining technologies, blockchain applications, and partnerships that leverage the full potential of Bitcoin’s blockchain, aiming to contribute to the network’s growth and resilience.

Sustainability and efficiency remain at the heart of D-Central Technologies’ vision for the future of Bitcoin mining. The company is dedicated to developing and implementing mining practices that minimize environmental impact while maximizing operational efficiency. This commitment reflects a broader vision for a cryptocurrency industry that not only thrives economically but also contributes positively to global sustainability efforts, ensuring a harmonious balance between innovation and environmental stewardship.

The journey through the intricate relationship between Bitcoin and blockchain technology reveals a symbiotic partnership where each element reinforces and enhances the other. Bitcoin, as the pioneering digital currency, brought blockchain technology into the limelight, demonstrating its potential to revolutionize how we conceive of and interact with money. Conversely, blockchain serves as the bedrock upon which Bitcoin rests, providing a secure, transparent, and decentralized framework that ensures the integrity and reliability of cryptocurrency transactions.

The evolution of Bitcoin and blockchain is not solely a technological narrative but also a testament to the power of community, innovation, and education. The vibrant community of developers, miners, enthusiasts, and businesses like D-Central Technologies plays a pivotal role in driving forward the technology, addressing challenges, and fostering an ecosystem that is both inclusive and forward-thinking. Innovation, particularly in addressing scalability, security, and sustainability issues, continues to be the engine of growth for Bitcoin and blockchain, ensuring their relevance and utility in an ever-changing digital landscape.

Education remains a cornerstone in the widespread adoption and understanding of Bitcoin and blockchain. By demystifying these technologies and advocating for their potential, entities like D-Central Technologies empower individuals and organizations to participate in the cryptocurrency revolution, making informed decisions that shape the future of finance and technology.

As we look ahead, the future of Bitcoin and blockchain technology appears bright, filled with untapped potential and opportunities for transformative change. The ongoing developments in this space promise not only to enhance the efficiency and security of digital transactions but also to pave the way for innovative applications that extend far beyond the financial sector.

We encourage readers to delve deeper into the world of Bitcoin and blockchain, exploring the services and educational resources offered by D-Central Technologies. Whether you are a seasoned miner, a curious newcomer, or a business looking to integrate blockchain solutions, D-Central provides the expertise and support needed to navigate this dynamic field.

Join us in the conversation about the future of Bitcoin and blockchain technology. Together, we can contribute to shaping a digital ecosystem that values security, transparency, and inclusivity, heralding a new era of technological empowerment and financial freedom.

What is the relationship between Bitcoin and blockchain technology?

Bitcoin and blockchain technology share a symbiotic relationship, with blockchain serving as the underlying ledger that records all transactions in the Bitcoin network. This partnership emphasizes decentralization, security, and trust in the digital financial landscape.

How does blockchain technology work?

Blockchain technology operates as a decentralized database or distributed ledger that records transactions across numerous computers. Its design ensures that each recorded transaction is immutable and time-stamped, fostering an environment of trust and transparency.

Why is decentralization important in blockchain technology?

Decentralization is a key feature of blockchain technology, eliminating the need for a central authority and distributing control across the network’s participants. This attribute enhances the system’s resistance to censorship and makes fraudulent activities significantly more challenging.

What are the key milestones in Bitcoin’s history?

Significant milestones in Bitcoin’s history include the first known commercial transaction (Bitcoin Pizza Day), the establishment of the first Bitcoin exchange, and widespread adoption by merchants and businesses, demonstrating its resilience and growing acceptance as a new form of currency.

What challenges has Bitcoin faced, and how have they been addressed?

Bitcoin has navigated regulatory scrutiny, security concerns, and environmental criticisms. The community has responded with innovations like the Lightning Network for scalability and strengthened security measures, showcasing Bitcoin’s adaptability and the community’s commitment to its success.

How do miners contribute to the Bitcoin network?

Miners validate and secure Bitcoin transactions through a computationally intensive process called proof of work. Successful miners are rewarded with newly minted bitcoins and transaction fees, incentivizing them to maintain and secure the network.

What innovations are improving Bitcoin’s scalability and efficiency?

Technological advancements such as the Lightning Network and Segregated Witness (SegWit) have been instrumental in enhancing Bitcoin’s scalability and efficiency. These innovations facilitate faster transactions and increase the network’s capacity to handle them.

What role does D-Central Technologies play in the Bitcoin ecosystem?

D-Central Technologies is at the forefront of the Bitcoin mining industry, offering specialized services, advocating for Bitcoin maximalism, and contributing to the network’s growth and sustainability through innovative mining solutions.

How does education and advocacy contribute to the adoption of Bitcoin and blockchain?

Education demystifies Bitcoin and blockchain technology for the public, fostering informed participation in the cryptocurrency ecosystem. Advocacy promotes the values of decentralization and financial autonomy, encouraging wider acceptance and use of these technologies.

What does the future hold for Bitcoin and blockchain technology?

The future of Bitcoin and blockchain technology is marked by continuous innovation, with potential applications extending beyond finance. The ongoing development aims to enhance transaction efficiency, security, and sustainability, promising transformative changes across various industries.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

In the ever-evolving world of Bitcoin, the User Activated Soft Fork (UASF) emerges as a beacon of spontaneous order amidst

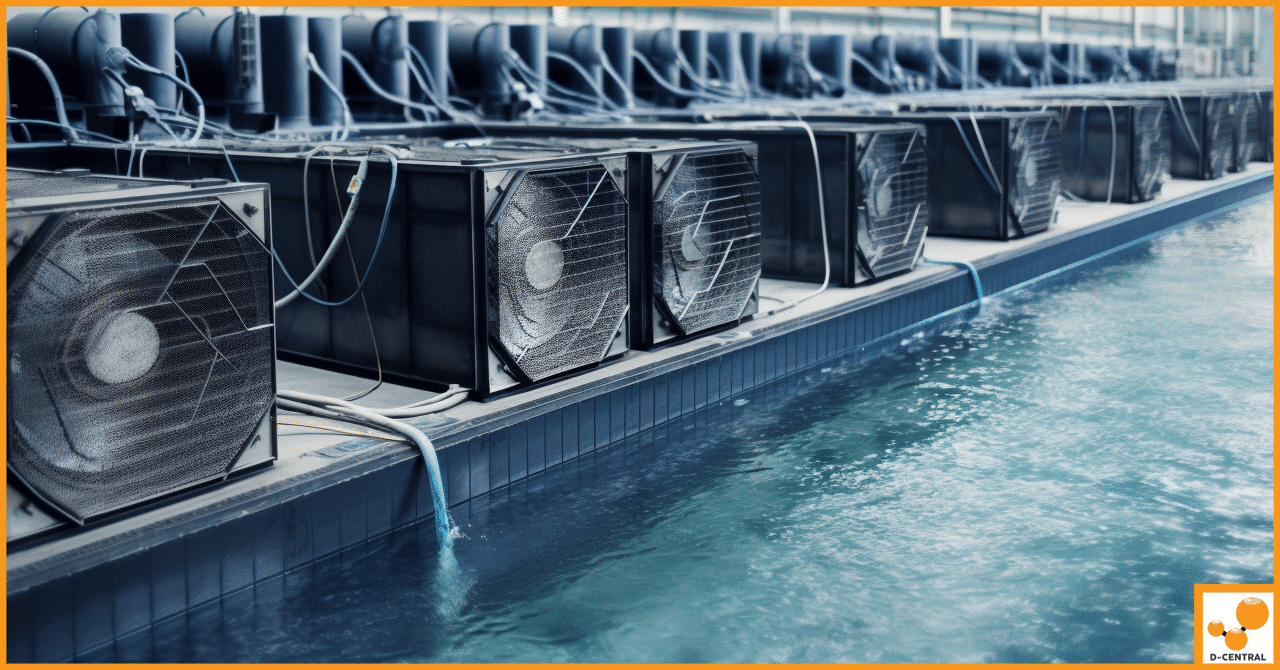

The aquaculture industry is facing an ongoing challenge of maintaining the optimal temperature for aquatic organisms, which can be a

Discover how to maximize your cryptocurrency mining profits by leveraging dynamic electricity pricing and cutting-edge hardware solutions. In this comprehensive