How Bitcoin Mining Can Enhance Power Grid Stability

In the ever-evolving landscape of digital currencies, Bitcoin stands as a pioneering force, reshaping not just financial transactions but also

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

Inflation, a term that often stirs concern among economists, investors, and everyday consumers, refers to the rate at which the general level of prices for goods and services is rising, and, subsequently, eroding purchasing power. It’s a phenomenon that can quietly diminish the value of currency, affecting how much we can buy with a dollar tomorrow compared to today. While moderate inflation is a sign of a growing economy, unchecked inflation can lead to economic instability, making it a critical factor for financial planning and investment strategies.

Enter Bitcoin, the first and most well-known digital asset, which has been proposed as a modern solution to an age-old problem. Since its inception in 2009, Bitcoin has not only challenged the traditional financial system but has also been touted as a potential hedge against inflation. Unlike fiat currencies, which can be printed without limit and are subject to the whims of monetary policy, Bitcoin boasts a fixed supply capped at 21 million coins. This inherent scarcity is a feature that many believe could shield it from inflation’s erosive effects.

This article aims to delve into the heart of the matter: Is Bitcoin an effective inflation hedge? To answer this, we will compare Bitcoin’s performance and characteristics against traditional assets like gold, real estate, and treasury bonds, which have historically played the role of inflation hedges. Through this examination, we seek to uncover whether Bitcoin stands as a digital fortress against the silent thief of inflation or if it’s just another speculative asset in the vast financial landscape.

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in the purchasing power of a currency. It’s a phenomenon that reflects on how much less we can buy with the same amount of money over time. Several factors can cause inflation, but they are primarily categorized into two types: cost-push inflation and demand-pull inflation. Cost-push inflation occurs when the cost of production increases (such as wages or materials), leading producers to charge more for their products. Demand-pull inflation happens when demand for goods and services exceeds supply, causing prices to rise.

One of the most infamous examples of inflation is the hyperinflation experienced by the Weimar Republic (Germany) in the early 1920s, where prices doubled every few days, and the currency became virtually worthless. This period of hyperinflation led to severe social and economic instability. Another notable example is Zimbabwe in the late 2000s, where hyperinflation reached an astronomical rate, peaking at an estimated 89.7 sextillion percent month-on-month. These instances of hyperinflation resulted in a complete loss of confidence in the affected currencies, with profound impacts on savings, pensions, and the broader economy, leading to widespread poverty and social unrest.

To protect against inflation, investors have traditionally turned to assets believed to maintain or increase their value over time.

Each of these traditional hedges serves a role in protecting investors against the loss of purchasing power due to inflation, offering a mix of security, stability, and potential for appreciation in real terms.

Bitcoin emerged in 2009, introduced to the world in a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” by an individual or group under the pseudonym Satoshi Nakamoto. The creation of Bitcoin was motivated by the desire to establish a decentralized digital currency, free from the control of governments and financial institutions. At its core, Bitcoin was designed to enable direct transactions between parties, securely and without the need for a central authority. This revolutionary idea was born in the wake of the 2008 financial crisis, highlighting a growing distrust in traditional banking systems and the management of fiat currencies.

The case for Bitcoin as an inflation hedge largely rests on its fixed supply and the global accessibility it offers. Unlike fiat currencies, which central banks can print in unlimited quantities, leading to devaluation and inflation, Bitcoin’s supply is predetermined and cannot be altered. This scarcity mimics the properties of traditional inflation hedges like gold, providing a “digital gold” that can be accessed by anyone with an internet connection.

Furthermore, Bitcoin’s global nature means it is not tied to the economic conditions or inflation rates of any single country. This makes it an attractive option for individuals in countries experiencing high inflation rates, offering a store of value that transcends national borders. As more people and institutions recognize these attributes, the argument for Bitcoin’s role as an inflation hedge strengthens, positioning it as a modern alternative to traditional assets in the fight against the erosion of purchasing power.

The debate over the most effective inflation hedge has intensified with Bitcoin’s rise as a potential contender against traditional assets like gold, real estate, and treasury bonds. Each asset class offers unique advantages and disadvantages as a store of value during inflationary periods. Here, we delve into a comparative analysis to understand how Bitcoin stacks up against these time-tested hedges.

While Bitcoin presents an intriguing option as an inflation hedge with its unique attributes of decentralization, fixed supply, and global accessibility, its volatility and short history require careful consideration. Traditional hedges like gold, real estate, and treasury bonds continue to play a vital role in diversified portfolios designed to protect against inflation, each offering a balance of risk, return, and stability suited to different investor preferences.

The narrative surrounding Bitcoin as a potential hedge against inflation has been bolstered by its impressive price appreciation since inception. However, to assess its effectiveness as an inflation hedge, it’s crucial to examine empirical evidence, including case studies of Bitcoin’s price movement in response to inflationary trends, its correlation with inflation rates, and insights from experts and economic analyses.

Empirical evidence on Bitcoin’s performance during inflationary periods presents a complex picture. While there are instances where Bitcoin’s price movements have aligned with inflationary trends, suggesting its potential as an inflation hedge, its overall correlation with inflation remains uncertain. Expert opinions vary widely, reflecting the ongoing debate about Bitcoin’s role in hedging against inflation. Investors considering Bitcoin as part of their strategy to combat inflation should weigh these factors carefully, taking into account Bitcoin’s volatility and the broader economic context.

The narrative surrounding Bitcoin’s role as an inflation hedge is continuously evolving, influenced by global economic conditions, regulatory landscapes, and technological advancements. As we look to the future, several potential scenarios could further define Bitcoin’s position in the financial world and its effectiveness as a tool against inflation.

The global economy is subject to cycles of expansion and contraction, influenced by factors such as monetary policy, geopolitical events, and technological innovation. In periods of economic uncertainty or high inflation, traditional stores of value like gold have historically played a crucial role in protecting wealth. Bitcoin, with its fixed supply and independence from central bank policies, presents a modern alternative that could either complement or challenge traditional hedges. Its performance during the COVID-19 pandemic, characterized by significant price increases amid expansive monetary policies, has reignited discussions about its potential as an inflation hedge. However, its relatively short existence means it has yet to be tested across multiple economic cycles.

The debate over Bitcoin’s long-term role in investment portfolios is marked by divergent views. Some investors and analysts see Bitcoin as a revolutionary asset that offers a unique combination of scarcity, portability, and independence from fiat currency systems, making it an essential component of a diversified investment strategy. They argue that, despite its volatility, Bitcoin’s potential for high returns and its properties as a hedge against inflation justify its inclusion in investment portfolios.

On the other hand, skeptics point to Bitcoin’s price volatility, regulatory uncertainties, and the speculative nature of its market as reasons for caution. They question Bitcoin’s ability to serve as a reliable store of value, particularly during times of economic stress, and suggest that its role in investment portfolios should be limited.

The future of Bitcoin as an inflation hedge is contingent upon a complex interplay of factors, including global economic conditions, regulatory developments, and technological progress. While its potential to serve as a modern-day hedge against inflation is promising, investors must navigate a landscape of uncertainty and divergent opinions. As the narrative unfolds, the financial community will be watching closely to see whether Bitcoin can truly cement its place alongside traditional inflation hedges in the annals of economic history.

As Bitcoin continues to capture the imagination of investors worldwide, it’s crucial to approach its inclusion in your investment portfolio with a well-thought-out strategy. Here are some practical considerations to keep in mind:

Investing in Bitcoin requires a careful assessment of your financial goals, risk tolerance, and a commitment to ongoing education. By considering Bitcoin’s place within a diversified portfolio and staying informed about market trends and regulatory shifts, investors can navigate the complexities of the cryptocurrency market with greater confidence and strategic insight.

Throughout this article, we’ve embarked on a comprehensive exploration of Bitcoin’s role as a potential hedge against inflation, juxtaposing it with traditional assets like gold, real estate, and treasury bonds. We delved into Bitcoin’s foundational principles, its unique attributes such as decentralization, fixed supply, and blockchain technology, and examined empirical evidence of its performance during inflationary periods. We also considered the evolving narrative of Bitcoin amidst changing global economic conditions and outlined practical considerations for investors contemplating its inclusion in their portfolios.

The journey through Bitcoin’s landscape reveals its intriguing potential as part of a broader strategy to hedge against inflation. Its fixed supply and global accessibility position it as a modern counterpart to traditional stores of value, offering a digital alternative in an increasingly interconnected world. However, the path is lined with volatility, regulatory uncertainties, and the need for technological advancements to enhance its stability and usability.

Adopting a stance of cautious optimism seems prudent when considering Bitcoin’s place in investment strategies aimed at combating inflation. The asset’s relatively short history, coupled with its susceptibility to market sentiments and external factors, underscores the importance of further observation and research. As the global economic environment evolves and Bitcoin continues to mature, its role as an inflation hedge may become clearer.

For investors intrigued by Bitcoin’s potential, conducting thorough research is paramount. The cryptocurrency market’s complexity and rapid pace of change demand a well-informed approach to investment. Consulting with financial advisors who understand both traditional and digital assets can provide valuable insights tailored to individual financial goals and risk tolerance.

For those eager to deepen their understanding, a wealth of resources is available on Bitcoin, inflation, and investment strategies. Exploring reputable financial publications, scholarly articles, and educational platforms can enrich your knowledge and equip you with the tools needed to navigate the investment landscape with confidence.

In conclusion, Bitcoin presents a fascinating option for those looking to diversify their inflation-hedging strategies. Its journey from a novel digital currency to a subject of serious financial consideration reflects the dynamic nature of the investment world. As we continue to witness the unfolding story of Bitcoin and its impact on the global financial system, staying informed, open-minded, and cautious will be key to harnessing its potential while navigating its challenges.

What is inflation?

Inflation refers to the rate at which the general level of prices for goods and services rises, leading to a decrease in purchasing power.

How has Bitcoin been proposed as a solution to inflation?

Bitcoin, with its fixed supply cap of 21 million coins, has been proposed as a modern solution to inflation. Its inherent scarcity could potentially shield it from inflation’s erosive effects on currency value.

What traditional assets have been used as inflation hedges?

Gold, real estate, and treasury bonds, particularly Treasury Inflation-Protected Securities (TIPS), have traditionally been used as inflation hedges due to their ability to maintain or increase value over time.

What are the unique attributes of Bitcoin?

Bitcoin’s unique attributes include decentralization, a fixed supply, and the use of blockchain technology, making it resistant to censorship and government manipulation, and ensuring transaction security and transparency.

Can Bitcoin be considered an effective inflation hedge?

The debate on Bitcoin’s effectiveness as an inflation hedge continues, involving analysis of its performance against inflation, comparison with traditional hedges, and consideration of its volatility and market dynamics.

What factors could influence Bitcoin’s future as an inflation hedge?

Factors include global economic conditions, regulatory clarity, technological advancements, market adoption, and Bitcoin’s performance across multiple economic cycles.

What practical considerations should investors keep in mind regarding Bitcoin?

Investors should assess their risk tolerance, set clear investment goals, consider Bitcoin’s role in a diversified portfolio, allocate a proportionate share, and stay informed about market trends and regulations.

What is the conclusion on Bitcoin as an inflation hedge?

While Bitcoin presents an intriguing option for diversification in inflation-hedging strategies, its role is still evolving. Investors are advised to approach with cautious optimism, conducted thorough research, and consider consulting financial advisors.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

In the ever-evolving landscape of digital currencies, Bitcoin stands as a pioneering force, reshaping not just financial transactions but also

In the ever-evolving world of digital currencies, Bitcoin stands out as a pioneering and dominant force. Since its inception, Bitcoin

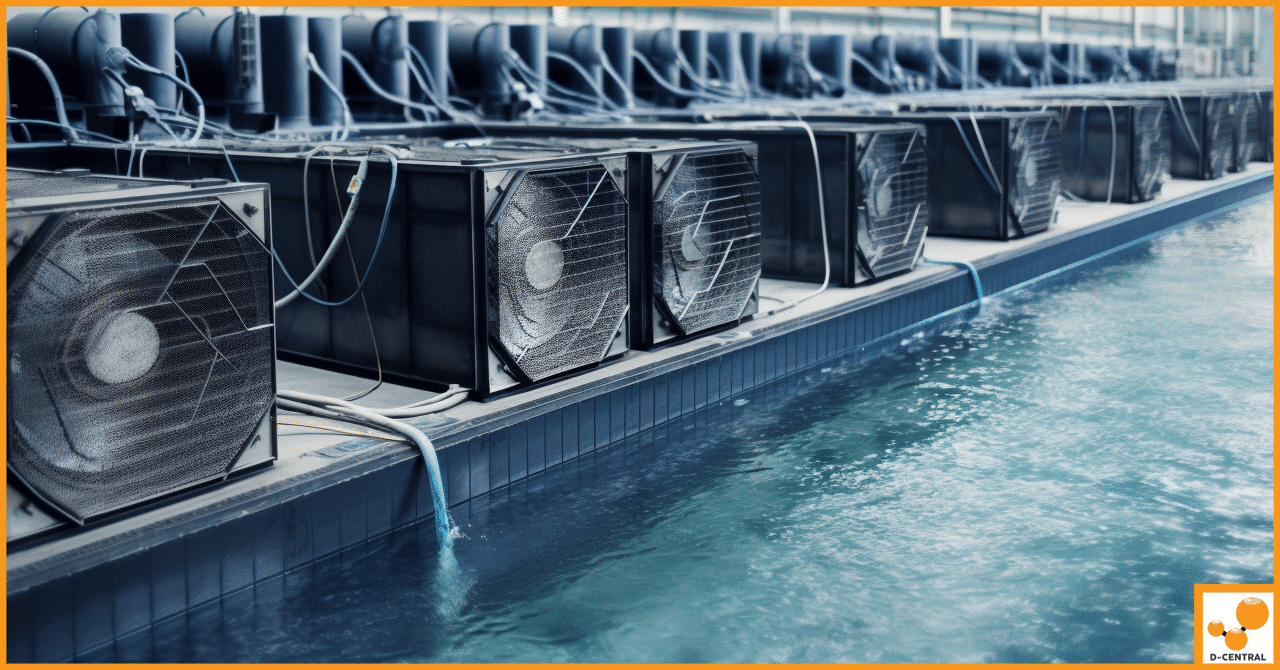

The aquaculture industry is facing an ongoing challenge of maintaining the optimal temperature for aquatic organisms, which can be a