The Power of Bitcoin Mining: Fueling the Free Financial World and Surpassing Ethereum’s Limits

Cryptocurrencies have taken the world by storm, offering a decentralized platform for financial transactions, free from government interference or central

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

Bitcoin mining, often visualized as the backbone of the cryptocurrency ecosystem, plays a pivotal role in validating and adding transactions to the decentralized public ledger known as the blockchain. This intricate process involves miners using computational power to solve complex mathematical puzzles, ensuring the integrity and security of Bitcoin transactions. Successful miners are rewarded with newly minted Bitcoin, making it not just a crucial aspect of the network’s functionality but also a lucrative endeavor for many.

However, like many industries, the world of Bitcoin mining is not immune to change. Over the years, the landscape has evolved, with technological advancements, market dynamics, and economic factors shaping its course. One of the most significant shifts in recent times has been the rise of public miners. These are mining entities that have gone public, offering shares on stock exchanges, thereby intertwining the realms of traditional finance and the avant-garde world of cryptocurrency. This development has not only introduced a new dimension to the mining game but has also raised intriguing questions about the future of Bitcoin mining, its economic implications, and the broader impact on the cryptocurrency ecosystem.

As we delve deeper into this topic, we’ll explore the nuances of this transformation, understanding the challenges and opportunities it presents, and what it means for miners, investors, and the global Bitcoin community.

At its core, Bitcoin mining is the process by which new bitcoins are introduced into circulation and is also a critical component of the maintenance and development of the blockchain ledger. Miners use powerful computers to solve complex mathematical problems, and when these problems are solved, a new block is added to the blockchain. For every block mined, miners are rewarded with a certain number of bitcoins, serving as an incentive for more people to mine.

The Role of Miners in Ensuring Transaction Integrity and Network Security: Miners play an indispensable role in the Bitcoin ecosystem. Beyond the creation of new bitcoins, they validate and verify transactions, ensuring that no fraudulent activity takes place. By solving the cryptographic puzzles, miners make it extremely difficult for attackers to alter any part of the blockchain, as doing so would require changing all subsequent blocks, a feat that is practically impossible given the network’s decentralized nature. This process ensures the integrity of transactions and fortifies the network against potential threats.

High-Cost Miners and the Challenges of Negative Cash Flows: In the early days of Bitcoin, mining could be done using simple personal computers. However, as the puzzles became more complex and the competition fiercer, the need for more powerful and specialized hardware grew. This transition led to increased costs associated with mining, from equipment to electricity. High-cost miners, especially those operating in regions with higher electricity prices, found themselves grappling with the challenges of negative cash flows. If the rewards from mining did not offset the operational costs, these miners ran the risk of incurring losses. This economic challenge became a defining factor in the survival of miners, with those unable to operate at the lowest costs facing potential shutdowns.

The advent of public miners has ushered in a new era for the Bitcoin mining industry. Unlike traditional miners who operated in relative obscurity, public miners are entities that have taken their operations public, offering shares on stock exchanges. This move has brought a level of transparency and scrutiny previously unseen in the mining domain. With access to public capital markets, these miners have been able to secure significant funding, allowing them to scale operations, invest in cutting-edge technology, and even weather downturns in the cryptocurrency market more effectively than their private counterparts.

The Strategic Leveraging of Broader Market Dynamics by Public Miners: Public miners, with their unique position at the intersection of traditional finance and the cryptocurrency world, have been adept at leveraging broader market dynamics to their advantage. By offering shares, they tap into the vast pools of capital available in the stock markets, providing them with resources to expand and innovate. Furthermore, their public status often grants them a level of credibility and trust, making partnerships, collaborations, and business deals more accessible. This strategic positioning allows public miners to navigate the volatile world of cryptocurrency with a level of agility and foresight.

The Influence of the Fiat Financial System in Propping Up Mining Operations: One of the most intriguing aspects of public miners is their relationship with the fiat financial system. While Bitcoin and other cryptocurrencies often position themselves as alternatives to traditional finance, public miners find themselves intertwined with it. Access to fiat capital means that even when the cryptocurrency market faces downturns, these miners can continue their operations, buoyed by the financial support from traditional markets. This dynamic has introduced a safety net for public miners, allowing them to take calculated risks and pursue long-term strategies without the immediate pressures of profitability that private miners might face.

In the ever-evolving world of Bitcoin mining, high-cost miners face a unique set of challenges. With the increasing complexity of mining algorithms and the need for more powerful, energy-intensive equipment, operational costs have soared. For miners operating in regions with high electricity costs or those without access to the latest technology, the margins can be razor-thin. The sustainability of such miners becomes a pressing concern, especially during periods of market downturns or when the rewards for mining decrease post-halving events. While some manage to adapt by optimizing operations or relocating to areas with cheaper energy, others face the grim prospect of shutting down.

The Role of Financial Support from Traditional Markets: The emergence of public miners has highlighted a potential lifeline for high-cost miners: the fiat financial system. By going public or forming strategic partnerships with entities in traditional markets, miners can access much-needed capital. This financial infusion can be used to upgrade equipment, invest in research and development, or even hedge against unfavorable market conditions. Moreover, the credibility and legitimacy associated with being publicly listed or having ties to established financial institutions can open doors to further business opportunities and collaborations.

Potential Long-Term Impacts on the Business Models of High-Cost Miners: The intertwining of Bitcoin mining with traditional finance is not without its implications. High-cost miners, in their quest for sustainability, might find their business models evolving. There could be a shift towards more diversified operations, with miners exploring related ventures like cryptocurrency trading, financial services, or blockchain solutions. Additionally, the accountability and transparency required in public markets might lead to more standardized and professionalized mining operations. While these changes offer growth and stability, they also come with challenges, especially in balancing the decentralized ethos of cryptocurrencies with the demands of traditional finance.

How the Rise of Public Miners Affects the Overall Health and Security of the Bitcoin Network: The emergence of public miners, with their substantial capital and resources, has undeniably influenced the Bitcoin mining landscape. Their ability to invest in advanced mining equipment and infrastructure has contributed to a surge in the network’s hash rate. This heightened computational power enhances the security of the Bitcoin blockchain, making it more resilient against potential malicious attacks. However, this concentration of mining prowess among a few dominant entities can also introduce concerns. If too much mining power is centralized, it could pose risks to the network’s democratic ethos and its resistance to manipulation.

Implications for Decentralization and Network Integrity: Decentralization stands as a cornerstone of Bitcoin’s philosophy, ensuring that no single entity can exert undue influence over the network. The ascendancy of large public miners, with their significant hash power, challenges this principle. While they bolster the network’s security, their potential dominance could lead to centralization, where a few entities hold disproportionate sway over mining outcomes. Such a scenario could, in extreme cases, make the network vulnerable to a 51% attack or influence transaction validations. It’s imperative for the Bitcoin community to champion measures that maintain decentralization and safeguard the network’s integrity.

The Future of Bitcoin Mining in Light of These Changes: The interplay between traditional finance and the world of Bitcoin mining, especially with the rise of public miners, hints at a future where mining operations might lean towards institutionalization. We could witness a trend of consolidations, partnerships, and the formation of mining conglomerates. While these developments could enhance efficiency and security, they also emphasize the need for vigilance. The community must advocate for innovations and practices that ensure the Bitcoin network remains robust, decentralized, and in line with its foundational principles.

A Look at Prominent Public Miners like RIOT and MARA: Two of the most notable public miners that have made significant waves in both the cryptocurrency and traditional financial sectors are RIOT Blockchain (RIOT) and Marathon Patent Group (MARA). Both companies have successfully transitioned from their initial ventures to focus primarily on Bitcoin mining, and their public status has provided them with a platform to scale their operations significantly.

Their Influence on the Bitcoin Mining Landscape and Stock Market Dynamics: RIOT and MARA, with their vast resources and public backing, have been instrumental in shaping the contemporary Bitcoin mining landscape. Their ability to invest in state-of-the-art mining equipment and infrastructure has not only bolstered their individual mining capacities but has also contributed to the overall security and robustness of the Bitcoin network. Furthermore, their presence in the stock market has created a unique dynamic where traditional investors can gain exposure to Bitcoin mining without directly participating in it. The stock prices of both companies often mirror the volatility of Bitcoin prices, making them barometers for broader market sentiment towards cryptocurrency.

Challenges and Opportunities Faced by These Public Miners: Being at the intersection of cryptocurrency and traditional finance is not without its challenges. RIOT and MARA face the dual pressures of delivering value to their shareholders while navigating the volatile world of Bitcoin mining. Fluctuations in Bitcoin prices, regulatory uncertainties, and the ever-evolving mining technology landscape are just some of the challenges they grapple with. However, their public status also presents unique opportunities. Access to capital markets allows them to fund expansions, research, and innovations. Their visibility offers them a platform to advocate for cryptocurrency adoption, and their scale provides them with leverage in shaping industry standards and practices.

Predictions for the Future Evolution of Bitcoin Mining: As we gaze into the horizon, the future of Bitcoin mining appears to be a blend of challenges and opportunities. With each halving event, the rewards for mining decrease, making efficiency and cost-effectiveness paramount. We can anticipate a continued trend towards consolidation, with larger mining entities potentially absorbing smaller players to achieve economies of scale. Additionally, as public interest in cryptocurrencies grows, we might see more miners transitioning to public markets, further intertwining the realms of traditional finance and cryptocurrency.

The Potential Role of Technological Advancements and Energy Sources: Technology will undoubtedly play a pivotal role in shaping the future of Bitcoin mining. As the mathematical problems associated with mining become more complex, there will be a pressing need for more advanced and efficient hardware. Quantum computing, though still in its nascent stages, could revolutionize the mining process. On the energy front, there’s a growing emphasis on sustainable and renewable energy sources. Solar, wind, and hydroelectric power are becoming more prevalent in mining operations, addressing environmental concerns and potentially reducing operational costs.

Strategies for Miners to Stay Competitive in an Ever-Evolving Landscape: For miners to thrive in this dynamic landscape, adaptability will be key. Continuous investment in research and development, staying abreast of technological advancements, and forging strategic partnerships will be crucial. Diversifying operations, exploring related ventures in the cryptocurrency ecosystem, and optimizing energy consumption will also be vital. For public miners, maintaining transparency, building trust with shareholders, and navigating regulatory landscapes will be additional areas of focus.

The Bitcoin mining landscape is undergoing a transformative shift, marked by the rise of public miners, technological advancements, and evolving economic dynamics. These changes are not just pertinent for miners but have broader implications for investors and the entire cryptocurrency community. Understanding these shifts is crucial for making informed decisions, whether you’re an investor gauging market sentiments, a miner strategizing operations, or a cryptocurrency enthusiast keen on understanding the underpinnings of the network.

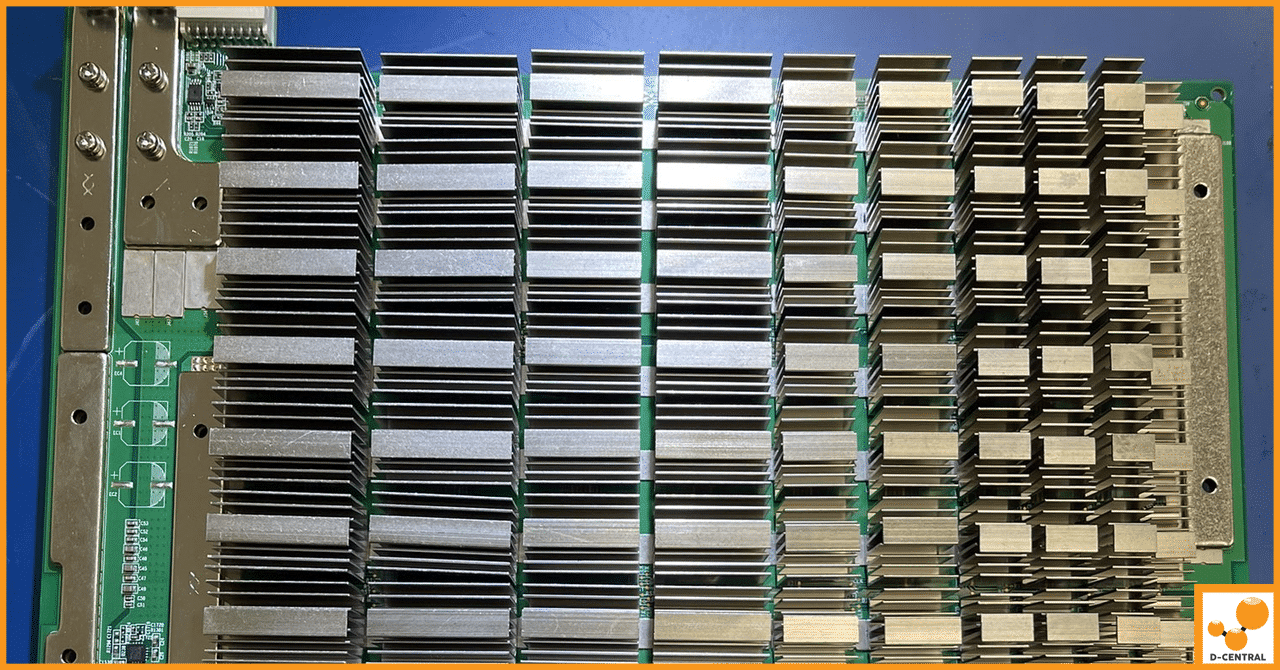

For those eager to delve deeper into the intricacies of Bitcoin mining or seeking cutting-edge mining solutions, look no further than D-Central Technologies. As the premier ASIC repair center in Canada, our expertise spans a wide spectrum. From consultation and hardware sourcing to hosting mining operations and maintenance training, we are your one-stop destination for all things Bitcoin mining.

What is Bitcoin mining?

Bitcoin mining is the process by which new bitcoins are introduced into circulation and transactions are validated and added to the blockchain. Miners use powerful computers to solve complex mathematical problems, ensuring the integrity and security of Bitcoin transactions.

What role do miners play in the Bitcoin network?

Miners play an indispensable role in the Bitcoin ecosystem. In addition to creating new bitcoins, they validate and verify transactions, making it exceedingly difficult for fraudulent activities to take place within the network.

What are the challenges faced by high-cost miners?

High-cost miners face several challenges, including the high costs associated with mining equipment and electricity. If the rewards from mining do not offset the operational costs, these miners run the risk of incurring losses.

What is a public miner?

Public miners are mining entities that have gone public by offering shares on stock exchanges. They can secure substantial funding that allows them to scale operations, invest in cutting-edge technology, withstand market downturns, and operate more effectively than their private counterparts.

What are the potential implications of public miners for high-cost miners?

The emergence of public miners can provide high-cost miners with access to necessary capital through the fiat financial system. This can be used to upgrade equipment, invest in research and development, or hedge against unfavorable market conditions.

How does the rise of public miners affect the overall health and security of the Bitcoin network?

The rise of public miners, due to their significant capital and resources, can enhance the security of the Bitcoin blockchain by contributing to a surge in the network’s hash rate. However, too much power concentrated among few entities could pose risks to the network’s democratic ethos and its resistance to manipulation.

What is the predicted future of Bitcoin mining?

The future of Bitcoin mining might include a trend towards consolidation and more miners transitioning to public markets. Technological advancements, such as quantum computing, and the use of sustainable and renewable energy sources in mining operations are also expected to shape the future of Bitcoin mining.

What services does D-Central Technologies offer?

D-Central Technologies offers a range of services including consultation, sourcing of mining hardware, hosting mining operations, ASIC repairs, and maintenance training.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

Cryptocurrencies have taken the world by storm, offering a decentralized platform for financial transactions, free from government interference or central

As cryptocurrency mining continues to grow, so does the need for robust fire safety measures. ASIC miners, while powerful and

The Antminer S19j Pro+ is a cutting-edge Bitcoin mining machine from Bitmain, a leading manufacturer of cryptocurrency mining hardware. This