Car Garages Heating Up Their Game with Bitcoin Mining

In an era where the realms of technology and sustainability intersect more than ever, the innovative fusion of cryptocurrency mining

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

Bitcoin, the pioneering cryptocurrency, has captivated the financial world since its inception in 2009. As the forerunner of the digital currency revolution, Bitcoin has not only introduced the concept of decentralized finance but has also challenged traditional notions of currency and investment. Its significance in the cryptocurrency world is unparalleled, serving as the benchmark against which all other cryptocurrencies are measured. With its unique blend of technology, economics, and social dynamics, Bitcoin has become more than just a digital asset; it’s a phenomenon that has sparked debates, inspired innovations, and led to the creation of an entirely new industry.

At the heart of Bitcoin’s fluctuating popularity and market dynamics are feedback cycles, a concept well-known in financial markets but uniquely potent in the volatile realm of cryptocurrencies. Feedback cycles refer to the self-reinforcing loops where certain market behaviors or sentiments lead to outcomes that further amplify the original behavior or sentiment. In financial markets, these cycles can significantly influence asset prices, investor behavior, and market trends, often leading to rapid appreciations or depreciations in value.

This article aims to delve into the intricate world of feedback cycles within the Bitcoin ecosystem. We will explore how these cycles, driven by a combination of technological advancements, social dynamics, and economic factors, contribute to the cryptocurrency’s soaring popularity and, at times, dramatic market movements. By understanding the mechanisms of these feedback loops, we can gain deeper insights into Bitcoin’s enduring allure and its impact on the broader financial landscape.

Feedback cycles are fundamental mechanisms that occur in various systems, including economic, ecological, and social systems. They play a crucial role in amplifying or dampening changes within these systems, leading to significant outcomes that can either stabilize or destabilize the system.

Definition and Explanation: A feedback cycle occurs when the output of a system is fed back into the system as input, creating a loop of cause and effect. In economic and social systems, this loop can significantly influence behaviors, trends, and outcomes. The essence of a feedback cycle is its self-reinforcing nature, where an initial change leads to a series of events that further amplify or reduce the change.

Types of Feedback Cycles:

Specific Characteristics: Cryptocurrency markets, known for their high volatility and rapid changes, are particularly susceptible to feedback cycles. The decentralized nature of cryptocurrencies, combined with their global accessibility and the digital environment in which they operate, creates unique feedback loops not commonly seen in traditional financial markets.

The Role of Investor Sentiment, Media Coverage, and Market Trends:

Understanding feedback cycles in cryptocurrency markets is crucial for investors, traders, and enthusiasts to navigate the complexities of these digital assets. By recognizing the signs of these cycles, stakeholders can make more informed decisions and potentially mitigate the risks associated with the volatile nature of cryptocurrencies.

The Bitcoin ecosystem is a complex interplay of technology, economics, and human behavior. Within this ecosystem, feedback loops play a pivotal role in shaping Bitcoin’s value, market position, and overall popularity. These loops are driven by network effects, market sentiment, and technological advancements, each contributing uniquely to the dynamics of Bitcoin’s growth and market fluctuations.

Network Effects and Value: The value of Bitcoin is intrinsically linked to its network effects, where the utility and, consequently, the value of Bitcoin increase as more people use and accept it. This phenomenon is akin to social networks where the platform becomes more valuable as the user base grows. In Bitcoin’s case, the growing user base enhances the currency’s liquidity, making it more attractive for transactions and investments, which in turn attracts more users.

Impact on Market Position: The network effects not only bolster Bitcoin’s value but also solidify its market position as the leading cryptocurrency. As the first and most widely adopted cryptocurrency, Bitcoin benefits from a first-mover advantage, further amplified by network effects. This creates a reinforcing loop: as Bitcoin’s adoption grows, its dominance in the cryptocurrency market is reinforced, making it a de facto standard and the primary entry point for new entrants into the cryptocurrency world.

Influence of Market Sentiment: Market sentiment is a powerful driver of Bitcoin’s price dynamics. Positive sentiment, driven by factors such as successful technological upgrades, regulatory clarity, or institutional adoption, can lead to increased buying pressure, driving up prices. Conversely, negative sentiment, possibly due to regulatory crackdowns or security breaches, can lead to selling pressure and price declines.

Behavior, Media, and Volatility: The relationship between investor behavior, media coverage, and price volatility is a complex feedback loop within the Bitcoin ecosystem. Media coverage can significantly influence investor behavior, with positive news leading to hype and increased buying, and negative news causing fear and selling. This media-driven investor behavior can lead to significant price volatility, especially in a market as sentiment-driven as Bitcoin. The volatility itself becomes news, perpetuating the cycle.

Role of Technological Advancements: Technological advancements within the Bitcoin ecosystem, such as improvements in blockchain scalability, security enhancements, and the development of second-layer solutions like the Lightning Network, play a crucial role in its evolution. These advancements address critical challenges facing Bitcoin, making it more usable, secure, and scalable, which in turn attracts more users and investors, feeding into the network effects.

Innovations and Positive Feedback Loops: Innovations within the Bitcoin ecosystem often lead to positive feedback loops. For example, the introduction of more user-friendly wallets and payment systems lowers the barrier to entry, allowing more people to use Bitcoin. As usage increases, so does the demand for Bitcoin, driving up its value and encouraging further innovation in the space. This cycle of innovation, adoption, and value increase is a hallmark of the Bitcoin ecosystem, driving its continuous growth and evolution.

In summary, the Bitcoin ecosystem is characterized by a series of interconnected feedback loops involving network effects, market sentiment, and technological advancements. These loops interact in complex ways, driving Bitcoin’s adoption, shaping its price dynamics, and spurring continuous innovation, which collectively contribute to the cryptocurrency’s enduring popularity and market dominance.

The popularity and value of Bitcoin are significantly influenced by various feedback cycles. These cycles, driven by events within the Bitcoin ecosystem, media narratives, and regulatory changes, create patterns that have historically impacted Bitcoin’s market dynamics and investor behavior.

Explanation of the Bitcoin Halving Event: The Bitcoin halving is a predetermined event that occurs approximately every four years, or after every 210,000 blocks are mined. During this event, the reward for mining new blocks is halved, effectively reducing the rate at which new bitcoins are created and released into circulation. This event is significant because it directly impacts Bitcoin’s supply side, introducing a deflationary mechanism into its economic model.

Market Impact and Historical Perspective: Historically, halving events have been followed by significant price movements in the Bitcoin market. The anticipation of reduced new supply often leads to speculative demand increases as investors predict that a lower supply rate will lead to higher prices, assuming demand remains constant or increases. Looking back, each halving event has been a precursor to a bull market phase, characterized by substantial price appreciation in the months following the halving. However, it’s crucial to note that while halvings tend to create bullish sentiment, other market factors also play significant roles in determining price movements.

Influence of Media Coverage: Media coverage plays a pivotal role in shaping public perception and, by extension, the popularity of Bitcoin. Positive media coverage, such as reports on Bitcoin adoption by major companies or favorable comparisons to traditional assets, can lead to increased interest and investment in Bitcoin. Conversely, negative coverage, such as highlighting security breaches or regulatory crackdowns, can lead to fear, uncertainty, and doubt (FUD), impacting investor sentiment negatively.

Case Studies of Media-Induced Hype: Several instances highlight the impact of media-induced hype on Bitcoin’s market dynamics. For example, during the late 2017 bull run, extensive media coverage contributed to a frenzy of speculative investment, driving prices to all-time highs. Similarly, media reports on institutional adoption of Bitcoin by major corporations have led to price surges, demonstrating the significant influence of media narratives on market behavior.

Impact of Regulatory Announcements: Regulatory announcements have a profound impact on Bitcoin’s market. Positive regulatory developments, such as the approval of Bitcoin ETFs or favorable legal frameworks for cryptocurrencies, can boost investor confidence and lead to price increases. On the other hand, negative regulatory news, such as bans or restrictive regulations in significant markets, can cause substantial price declines and investor withdrawal.

Global Regulatory Trends: The global nature of Bitcoin means that regulatory developments in key markets can have widespread effects. For instance, regulatory clarity and supportive frameworks in countries like Japan and Switzerland have contributed to increased adoption and investment in Bitcoin. Conversely, regulatory uncertainties or hostile stances in countries like China have led to market volatility and shifts in the global Bitcoin mining landscape, affecting investor confidence and market dynamics.

In summary, the halving cycle, media and public perception cycle, and regulatory feedback loop are key drivers of Bitcoin’s popularity and market dynamics. Understanding these feedback cycles provides insights into the factors that influence Bitcoin’s price movements and the broader cryptocurrency market trends.

The intricate feedback cycles within the Bitcoin ecosystem not only shape its market dynamics but also significantly influence investor behavior and the broader perception of Bitcoin. These cycles, intertwined with market phases and amplified by social media, create a complex landscape that drives Bitcoin’s popularity and volatility.

Overview of Bitcoin Market Cycles: Bitcoin’s market cycles can be broadly categorized into four phases: Accumulation, Continuation, Parabolic, and Correction. Each phase represents a distinct market trend and investor sentiment.

Feedback Loops and Investor Behavior: Feedback loops play a crucial role in each of these market phases, influencing investor behavior and market sentiment.

Amplification by Social Media: Social media platforms significantly amplify feedback cycles in the Bitcoin market. Positive news or bullish sentiment shared on platforms like Twitter, Reddit, and Telegram can quickly go viral, reaching a global audience and attracting new investors to the market. This viral spread of information can accelerate the phases of market cycles, particularly during the Parabolic phase.

Impact of Online Communities: Online communities, such as cryptocurrency forums and discussion groups, serve as echo chambers that reinforce prevailing market sentiments, whether bullish or bearish. These communities can:

In summary, feedback cycles, amplified by social media and online communities, play a pivotal role in shaping investor behavior across different market cycles. Understanding these dynamics is crucial for navigating the volatile landscape of the Bitcoin market and making informed investment decisions.

The Bitcoin ecosystem, characterized by its dynamic feedback loops, presents both challenges and opportunities for investors, developers, and participants. Understanding and navigating the induced volatility, alongside anticipating future developments, are crucial for leveraging Bitcoin’s potential.

Strategies for Investors: To navigate the volatility induced by feedback loops in the Bitcoin market, investors can adopt several strategies:

Understanding Market Sentiment and Behavioral Finance: A deep understanding of market sentiment and the principles of behavioral finance is essential for navigating Bitcoin’s volatility. Recognizing patterns of herd behavior, overreaction to news, and other cognitive biases can help investors make more rational decisions and potentially capitalize on market inefficiencies created by feedback loops.

Throughout this article, we’ve delved into the intricate world of feedback cycles and their profound impact on Bitcoin’s ecosystem. From the halving events that shape supply dynamics to the media narratives that sway public perception, and the regulatory landscapes that frame the operational boundaries, feedback cycles are at the heart of Bitcoin’s market dynamics and its overarching popularity.

Feedback cycles, both positive and negative, serve as the underlying mechanisms driving the volatility and growth patterns observed in Bitcoin’s market. These cycles, fueled by network effects, investor behavior, technological advancements, and external influences like media and regulation, create a complex yet fascinating ecosystem that is unique to Bitcoin and the broader cryptocurrency market.

As we look to the future, it’s evident that Bitcoin and the cryptocurrency market will continue to evolve, influenced by ongoing developments in technology, finance, and regulatory frameworks. The adaptability of the Bitcoin network, coupled with the innovative spirit of its community, suggests a promising trajectory despite the inherent challenges posed by market volatility and regulatory uncertainties.

Staying informed and actively engaging with the Bitcoin community can provide valuable insights and opportunities, whether you’re an investor, developer, or enthusiast. The collaborative and open-source nature of Bitcoin encourages participation and contribution, fostering a vibrant ecosystem that thrives on shared knowledge and collective advancement.

For those looking to dive deeper into the world of Bitcoin mining and cryptocurrency solutions, D-Central Technologies offers a gateway to expertise and innovation. With a range of services tailored to support the Bitcoin community, from mining solutions to educational resources, D-Central Technologies is committed to empowering individuals and organizations to navigate the cryptocurrency landscape effectively.

In conclusion, the interplay of feedback cycles within the Bitcoin ecosystem underscores the dynamic and interconnected nature of this digital currency. By understanding these cycles and staying engaged with the community, participants can navigate the complexities of the market and contribute to the ongoing evolution of Bitcoin and the broader cryptocurrency space. Explore the possibilities with D-Central Technologies and become part of the journey shaping the future of finance.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

In an era where the realms of technology and sustainability intersect more than ever, the innovative fusion of cryptocurrency mining

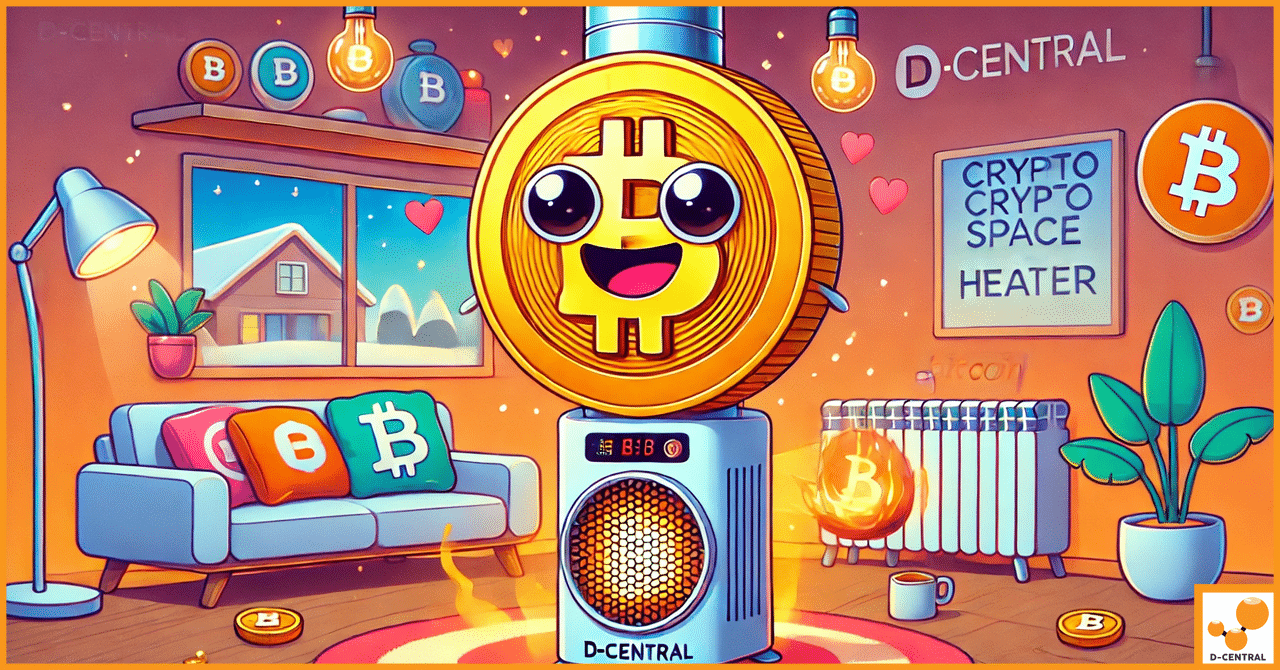

In the ever-evolving landscape of cryptocurrency and energy efficiency, D-Central’s Crypto Space Heaters stand out as a revolutionary solution. These

Bitcoin, the first and most renowned cryptocurrency, has captivated the financial world since its inception in 2009. Emerging as a