Understanding the Industry Impact of Halving on Bitcoin

Bitcoin, the pioneering cryptocurrency, has introduced a unique monetary policy mechanism known as “halving.” This event, occurring approximately every four

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

Bitcoin mining stands as a cornerstone of the cryptocurrency ecosystem, a process that not only introduces new bitcoins into circulation but also secures the network and validates transactions. At its core, mining involves solving complex cryptographic puzzles, a task that requires significant computational power and energy. Miners, the individuals and companies who undertake this process, are rewarded for their efforts with newly minted bitcoins and transaction fees. This incentivization model ensures that the Bitcoin network remains decentralized, secure, and free from the influence of any single authority.

However, the profitability of Bitcoin mining is closely tied to the market price of Bitcoin, operational costs, and the network’s mining difficulty—a measure of how hard it is to find a new block. These factors create a dynamic environment where miners are constantly adjusting their operations based on current market conditions. It’s within this context that the concept of mining capitulation emerges, a phenomenon that has significant implications for Bitcoin’s price and the overall health of its network.

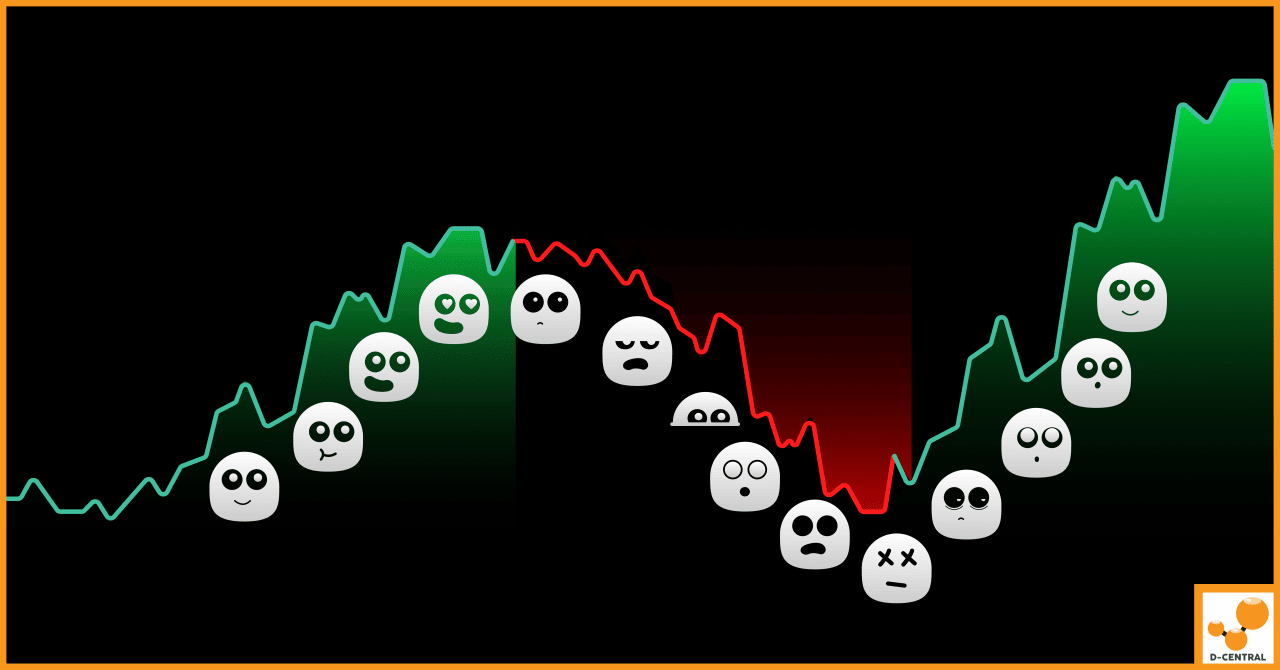

Mining capitulation occurs when the cost of mining bitcoins exceeds the value of the reward, leading miners to shut down their operations and, in many cases, sell off their mined bitcoins to cover operational costs. This selling pressure can exacerbate downward trends in Bitcoin’s price, leading to further capitulation in a cyclical effect. However, capitulation also serves as a self-correcting mechanism within the Bitcoin ecosystem. By forcing the least efficient miners out of the market, it reduces the overall hash rate—a measure of the network’s computational power—thereby lowering the mining difficulty and making it easier and potentially more profitable for remaining miners to find new blocks.

The relevance of mining capitulation extends beyond immediate economic considerations. It tests the resilience of the Bitcoin network, highlighting the importance of decentralization and the distributed nature of mining power. In the long term, these capitulation events can be seen as natural “reset” points, clearing the way for more efficient mining operations and contributing to the maturation of the Bitcoin ecosystem. Understanding mining capitulation is crucial for anyone involved in the cryptocurrency space, whether they are miners, investors, or enthusiasts, as it offers insights into the complex interplay between market dynamics, network security, and the ongoing evolution of Bitcoin.

Bitcoin mining capitulation refers to a scenario where the operational costs of mining (including electricity, hardware maintenance, and other overheads) surpass the rewards earned from mining activities, measured in the value of Bitcoin. This imbalance makes mining unprofitable, compelling miners to halt their operations and, in many instances, liquidate their Bitcoin holdings to cover losses. This phenomenon is markedly different from normal mining operations, where miners can sustainably cover their costs and secure profits, contributing positively to the network’s security and transaction verification processes. Capitulation occurs under extreme market conditions that disrupt this balance, leading to a significant reduction in mining activity.

Several interrelated factors can precipitate mining capitulation, each contributing to the pressure experienced by miners:

Capitulation can manifest in several forms, each with distinct triggers and implications for the Bitcoin network:

Each type of capitulation underscores the delicate balance between the costs of mining and the value of Bitcoin rewards. Understanding these dynamics is crucial for miners to navigate the volatile landscape of cryptocurrency mining and for investors to gauge the health and security of the Bitcoin network.

Mining capitulation events have a nuanced impact on Bitcoin’s price, primarily exerting downward pressure. This pressure arises as miners, facing unprofitability, liquidate their Bitcoin holdings to cover operational costs, increasing the supply of Bitcoin on the market. The immediate effect is often a further decline in price, exacerbating the bearish sentiment among investors.

Historical Examples:

In the long term, capitulation events can cleanse the mining ecosystem, leaving more efficient operations and potentially setting the stage for future price recoveries as selling pressure eases and market sentiment improves.

Mining capitulation bears significant implications for Bitcoin’s network security. The primary concern is the reduction in hash rate, or computational power, dedicated to mining Bitcoin, as miners shut down their operations. A lower hash rate can theoretically increase the network’s vulnerability to 51% attacks, where an entity gains control of the majority of mining power and can manipulate transaction verifications.

Mining Distribution and Decentralization:

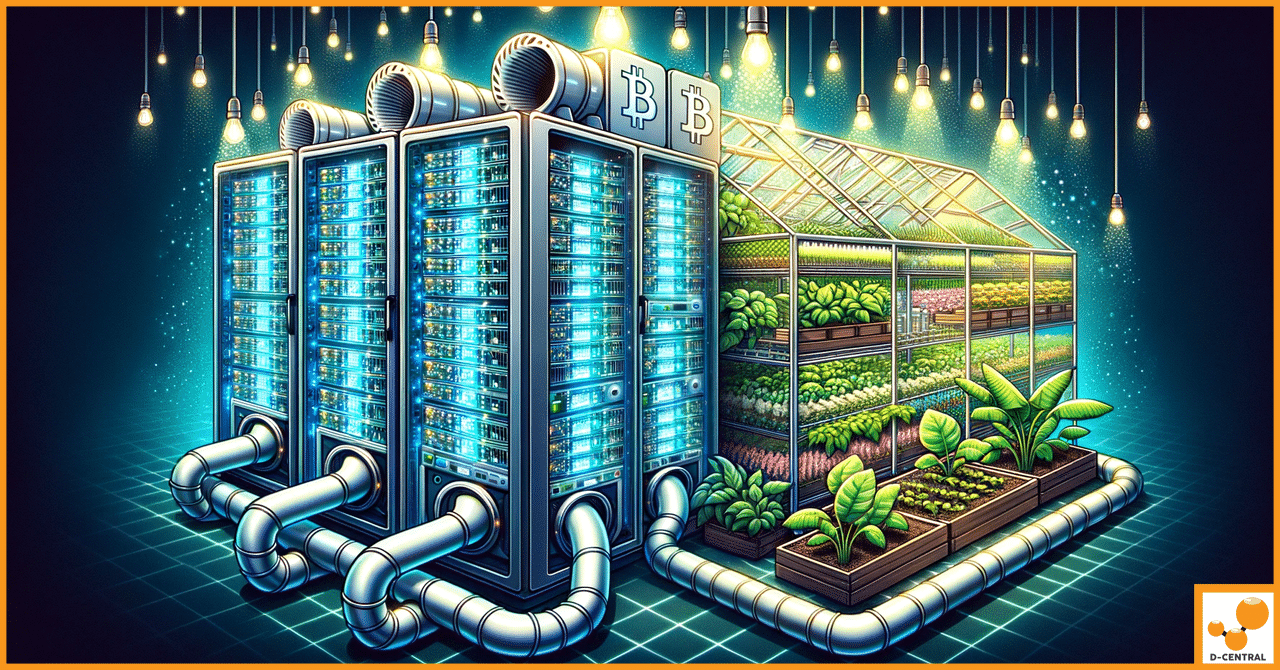

Capitulation events, while challenging, can serve as catalysts for innovation and efficiency improvements within the mining ecosystem. The exit of less efficient miners makes room for the adoption of more advanced mining technologies and practices, driving the evolution of the mining landscape.

Redistribution of Mining Power:

Technological Innovation:

In summary, while mining capitulation presents immediate challenges to Bitcoin’s price stability and network security, it also plays a crucial role in the ongoing development and maturation of the mining ecosystem. By forcing adaptations to market conditions and technological advancements, capitulation events contribute to the long-term resilience and efficiency of Bitcoin mining.

Mining capitulation periods pose significant challenges for individual miners, particularly those with limited resources or operating on thin margins. However, several strategies can help mitigate the effects of low profitability and sustain operations during tough times.

The broader Bitcoin community plays a crucial role in supporting miners and ensuring the network’s resilience, especially during capitulation events. Community support mechanisms can help stabilize the mining ecosystem and maintain network security.

By implementing these strategies, individual miners and the broader Bitcoin community can work together to mitigate the effects of mining capitulation. Such collaborative efforts not only support the sustainability of mining operations but also contribute to the overall resilience and security of the Bitcoin network, ensuring its continued success and growth.

In this comprehensive exploration of Bitcoin mining capitulation, we’ve delved into the intricacies of what capitulation means for individual miners, the broader Bitcoin community, and the cryptocurrency market as a whole. We’ve outlined the causes and types of mining capitulation, examined its impact on Bitcoin’s price, network security, and the mining ecosystem, and offered strategies for mitigating its effects.

Key points to remember include the understanding that mining capitulation occurs when operational costs exceed mining rewards, leading to a sell-off that can exert downward pressure on Bitcoin’s price. We’ve also seen how capitulation events, while challenging, play a crucial role in the self-correction and maturation of the Bitcoin network by weeding out less efficient miners and encouraging technological innovation and efficiency improvements.

The cyclical nature of Bitcoin mining and capitulation events underscores the dynamic and evolving landscape of the cryptocurrency market. These cycles are not merely obstacles but are integral components of the market’s maturation process, testing the resilience of the Bitcoin network and its participants while paving the way for future growth and stability.

We encourage readers to engage with this content by sharing their thoughts, experiences, or questions in the comments section. Whether you’re a seasoned miner, a cryptocurrency investor, or simply curious about the world of Bitcoin mining, your insights and inquiries enrich the conversation and contribute to the collective understanding of this complex ecosystem.

For those interested in diving deeper into Bitcoin mining and cryptocurrency investment strategies, numerous resources are available. From detailed guides on setting up mining operations to analyses of market trends and investment advice, the wealth of information accessible online can help you navigate the challenges and opportunities presented by the cryptocurrency market.

As we continue to witness the evolution of Bitcoin and its mining community, staying informed and adaptable will be key to navigating the future of this exciting and unpredictable landscape.

What is Bitcoin mining capitulation?

Bitcoin mining capitulation occurs when the operational costs of mining, such as electricity and hardware maintenance, exceed the value of the mining rewards in Bitcoin. This leads miners to halt their operations and often sell their Bitcoin to cover costs, impacting the Bitcoin market and its network.

What triggers mining capitulation?

Mining capitulation can be triggered by falling Bitcoin prices, rising operational costs, and increasing network difficulty. These factors undermine the profitability of mining and can force miners to cease operations.

How does mining capitulation affect Bitcoin’s price?

Mining capitulation generally exerts downward pressure on Bitcoin’s price. Miners selling off their holdings to cover operational costs increase the supply of Bitcoin on the market, which can lead to further declines in price.

What are the types of mining capitulation?

There are several types of mining capitulation, including capitulation by consensus (collective decision to reduce operations), by price (direct response to Bitcoin price drops), and by time (extended periods of low Bitcoin prices eroding miners’ reserves).

What is the impact of mining capitulation on the Bitcoin network’s security?

A significant impact of mining capitulation is the reduction in the Bitcoin network’s hash rate, which can theoretically make the network more vulnerable to attacks. However, the decentralization of mining operations serves as a defense mechanism, preserving network security.

How can miners mitigate the effects of capitulation?

Miners can mitigate the effects of capitulation by joining mining pools, exploring alternative energy sources, optimizing costs and efficiency, and strategically holding on to their mined Bitcoin during low-price periods.

How can the Bitcoin community support miners during capitulation events?

The Bitcoin community can support miners through educational resources, advocacy for mining-friendly policies, encouraging technological innovation, and providing financial instruments and services tailored to miners’ needs.

What role do capitulation events play in the Bitcoin ecosystem?

Capitulation events serve as a natural correction and maturation mechanism within the Bitcoin ecosystem. They weed out less efficient miners and spur technological innovation, contributing to the long-term resilience and efficiency of Bitcoin mining.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

Bitcoin, the pioneering cryptocurrency, has introduced a unique monetary policy mechanism known as “halving.” This event, occurring approximately every four

Cryptocurrencies such as Bitcoin have the potential to revolutionize our financial systems, creating new opportunities for users and pushing us

In recent years, the world of Bitcoin mining has seen exponential growth, both in terms of popularity and energy consumption.