Exploring the Trust Factor in Bitcoin vs. Traditional Asset Classes

In the world of finance, the quest for a reliable store of wealth has led investors to consider various asset

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

In the rapidly evolving world of cryptocurrency, mining remains a critical backbone, not just for creating new coins but also for maintaining and securing blockchain transactions. As the digital currency landscape becomes increasingly competitive, the importance of efficiency in crypto mining has never been more pronounced. Efficiency, in this context, refers to the ability to maximize output—be it in terms of mined coins or transaction validations—while minimizing input costs, primarily energy consumption and hardware investment. This delicate balance between cost and productivity is what sets successful miners apart from the rest.

The impact of optimization on profitability and sustainability is profound. For one, optimized mining operations can significantly reduce electricity usage, which not only lowers operational costs but also mitigates the environmental impact of mining—a concern that has grown in importance as digital currencies have become more mainstream. Furthermore, by maximizing the efficiency of their hardware, miners can extend the lifespan of their equipment, thereby enhancing sustainability and profitability over time. In essence, optimization is not just a strategy for increasing immediate returns; it’s a comprehensive approach to ensuring long-term viability in the volatile world of cryptocurrency mining.

This article aims to delve deep into the realm of “Crypto Mining Optimization Mastery: Boosting Efficiency for Unrivaled Performance.” We will explore the pillars of mining efficiency, from hardware and software optimization to advanced techniques that can push your mining operation to the forefront of efficiency. We’ll also touch on risk management strategies, future trends and technologies that could reshape mining, and real-world success stories to inspire and guide your optimization efforts. Whether you’re a seasoned miner or just starting, this comprehensive guide is designed to equip you with the knowledge and tools needed to achieve unrivaled performance in your mining endeavors.

Crypto mining is the process by which transactions for various forms of cryptocurrency are verified and added to the blockchain digital ledger. It involves complex computational algorithms where miners solve cryptographic puzzles to validate transaction blocks. The first miner to solve the puzzle gets to add the block to the blockchain and is rewarded with a specific amount of cryptocurrency, incentivizing the mining process.

This process is not just about creating new coins but also plays a crucial role in maintaining the security and integrity of the blockchain. Mining ensures decentralization by distributing the task of verifying transactions across a global network of computers, making it nearly impossible for any single entity to manipulate the transaction data. As such, crypto mining is foundational to the trust and functionality of cryptocurrencies.

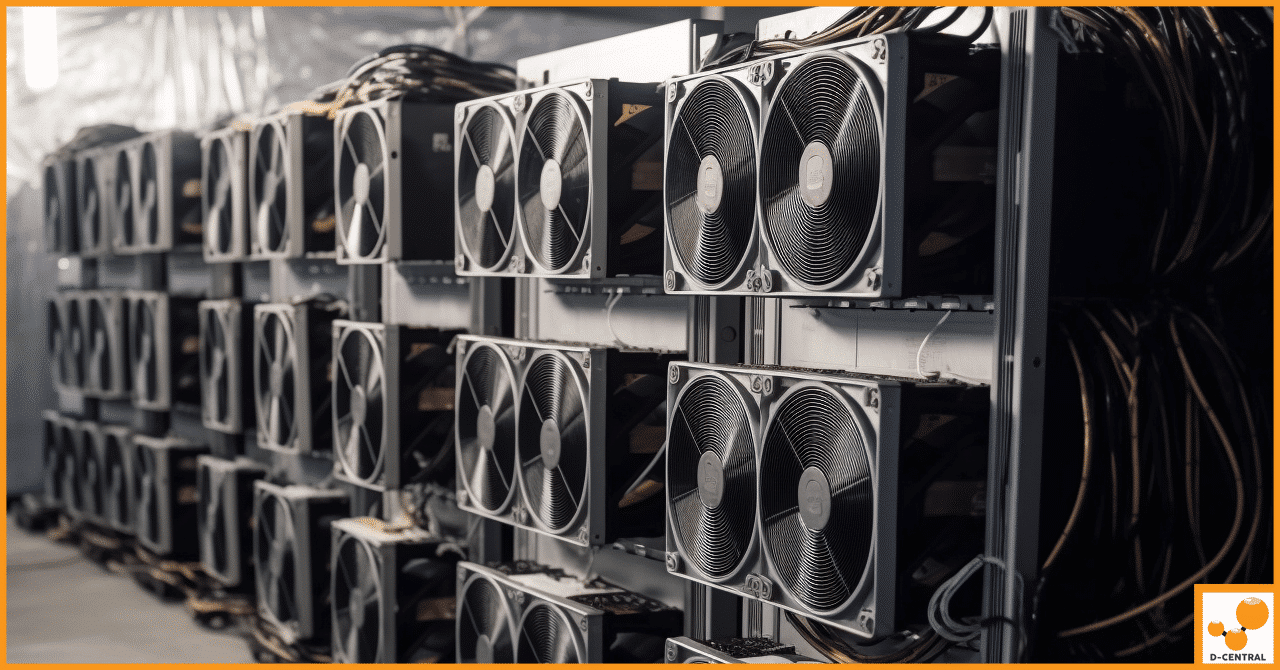

The evolution of mining hardware is a testament to the increasing complexity and competitiveness of crypto mining. Initially, mining was possible with standard Central Processing Units (CPUs) found in home computers. However, as mining algorithms became more complex, the need for more powerful and efficient hardware led to the adoption of Graphics Processing Units (GPUs) and later Application-Specific Integrated Circuits (ASICs).

Electricity consumption is a critical factor in the profitability of crypto mining. The process is energy-intensive, with the global crypto mining industry consuming power on the scale of entire countries. The cost of electricity can significantly impact the net profit from mining operations, making location a crucial consideration for miners. Regions with lower electricity costs are more attractive for mining operations.

Moreover, the efficiency of the mining hardware plays a vital role in managing electricity costs. ASICs, while expensive, consume less power per unit of cryptocurrency mined compared to GPUs and CPUs, offering long-term savings on electricity bills. Consequently, the choice of hardware and mining location are pivotal decisions that directly affect the profitability and sustainability of mining operations.

In summary, understanding the mechanics of crypto mining, the evolution of mining hardware, and the critical role of electricity costs are foundational elements for anyone looking to engage in or optimize their mining operations. These factors not only influence the immediate returns from mining activities but also the long-term viability and environmental impact of the blockchain ecosystem.

Optimizing your crypto mining operation involves a multifaceted approach, focusing on hardware optimization, software efficiency, and energy management. Each of these pillars plays a crucial role in enhancing the overall efficiency and profitability of mining activities.

Selecting the Right Mining Hardware

The choice of mining hardware is pivotal to the success of your mining operation. ASICs, GPUs, and CPUs each have their strengths and weaknesses, and selecting the right one depends on the specific cryptocurrency you intend to mine, your budget, and your long-term mining strategy. ASICs offer unparalleled efficiency for specific algorithms, GPUs provide versatility across different cryptocurrencies, and CPUs are generally not recommended due to their lower efficiency.

The Balance Between Power and Performance

Finding the right balance between power consumption and mining performance is key. High-performance hardware that consumes a lot of power may not always be the best choice if electricity costs cut significantly into profits. Efficiency, measured in watts per gigahash (W/Gh), becomes a critical metric in selecting hardware that offers the best performance for the least power consumption.

Hardware Lifespan and Maintenance Tips

Maximizing the lifespan of your mining hardware not only ensures sustained mining operations but also protects your investment. Regular maintenance, including cleaning dust from components and ensuring adequate cooling, can prevent overheating and prolong hardware life. Additionally, operating your hardware at optimal settings rather than pushing it to its limits can prevent wear and tear, extending its usable life.

Choosing and Configuring Mining Software

The right mining software can make a significant difference in your mining efficiency. The software should be compatible with your hardware and the specific cryptocurrency you are mining. It should also offer user-friendly interfaces for monitoring and managing your mining operations. Configuring your software to optimize hash rates while maintaining stability is crucial.

Importance of Software Updates and Patches

Keeping your mining software up to date is essential for security and efficiency. Developers regularly release updates that improve software performance, add support for new cryptocurrencies, and patch security vulnerabilities. Regular updates ensure that your mining operation remains efficient and secure against potential threats.

Strategies for Reducing Energy Consumption

Reducing energy consumption is vital for improving the profitability of mining operations and minimizing their environmental impact. Techniques such as undervolting, which reduces the voltage supplied to the hardware, can lower power consumption without significantly affecting performance. Efficient cooling solutions can also reduce the need for excessive power usage to manage heat.

Renewable Energy Sources and Their Impact on Mining

Incorporating renewable energy sources, such as solar or wind power, into mining operations can significantly reduce electricity costs and the carbon footprint of mining activities. Renewable energy can provide a sustainable and cost-effective power solution, especially in regions with high electricity costs or where there is a strong commitment to environmental sustainability.

By focusing on these pillars of mining efficiency, miners can optimize their operations to achieve higher profitability, longer hardware lifespans, and reduced environmental impact. The integration of efficient hardware, optimized software, and sustainable energy practices forms the foundation of a successful and responsible mining operation.

Optimizing a crypto mining operation goes beyond basic hardware and software adjustments. Advanced techniques can further enhance efficiency, reduce costs, and increase profitability. These include making algorithmic adjustments, implementing effective cooling solutions, and choosing between mining pools and solo mining.

Understanding Mining Algorithms

Each cryptocurrency operates on a specific algorithm that dictates how transactions are verified and blocks are added to the blockchain. Some of the most common algorithms include SHA-256 (used by Bitcoin), Ethash (used by Ethereum), and Scrypt (used by Litecoin). Understanding the intricacies of these algorithms is crucial as it influences the choice of hardware and software for mining.

Customizing Settings for Optimal Performance

Customizing your mining setup to suit the specific algorithm of the cryptocurrency you’re mining can significantly boost efficiency. This involves adjusting the hardware’s clock speed, power limit, and memory timings to optimize the hash rate while minimizing power consumption. Tools and software that allow for such fine-tuning can be invaluable, but it’s essential to proceed with caution to avoid hardware damage.

Importance of Effective Cooling

Effective cooling is paramount in mining operations to prevent hardware overheating, which can lead to reduced performance or even permanent damage. Overheating also increases the risk of system instability and unexpected downtimes, directly impacting mining profitability.

Comparison of Cooling Technologies

Cooling technologies vary from simple air cooling to more complex liquid or immersion cooling systems:

By employing these advanced optimization techniques, miners can significantly enhance their operations, balancing the quest for profitability with the realities of the competitive mining landscape. Whether through algorithmic adjustments, innovative cooling solutions, or strategic decisions around pool and solo mining, there’s a broad spectrum of opportunities for optimization.

The volatile and competitive nature of cryptocurrency mining necessitates a robust approach to risk management. Identifying potential risks and implementing strategies to mitigate them is crucial for sustaining profitability and ensuring the longevity of mining operations. Additionally, diversification strategies can play a pivotal role in managing investment risks associated with mining.

Hardware Failure and Obsolescence

Electricity Cost Fluctuations

Cryptocurrency Volatility

Regulatory Changes

Across Different Cryptocurrencies

Hybrid Investment Models

Technological Diversification

Effective risk management in crypto mining involves a proactive and strategic approach to identifying potential threats and implementing measures to mitigate them. By diversifying mining operations and investments, miners can protect themselves against the inherent uncertainties of the cryptocurrency market, ensuring a more stable and profitable mining venture.

The dynamic and complex nature of cryptocurrency mining necessitates the use of specialized tools and resources. These not only facilitate efficient mining operations but also foster a sense of community among miners, providing platforms for knowledge exchange and continuous learning. Below, we explore essential software tools, online communities, and educational resources that can significantly benefit miners at all levels of expertise.

CGMiner

NiceHash

Hive OS

MinerStat

BitcoinTalk Mining Section

r/BitcoinMining

CryptoCompare Mining Forum

Coursera and Udemy

CoinDesk and Cointelegraph

YouTube Channels

Blockchain and Cryptocurrency Books

Leveraging these tools and resources can significantly enhance a miner’s ability to optimize their operations, stay informed about the latest developments in the mining sector, and continuously improve their knowledge and skills. Whether through software tools for real-time monitoring and optimization, engaging with online communities for support and advice, or utilizing educational resources for deeper learning, miners have a wealth of options at their disposal to succeed in the competitive world of cryptocurrency mining.

In the intricate and ever-evolving landscape of cryptocurrency mining, achieving efficiency and maximizing profitability are paramount. Throughout this article, we’ve delved into the critical aspects of crypto mining optimization, covering the foundational pillars of hardware and software optimization, advanced techniques for fine-tuning operations, risk management strategies to safeguard investments, and the invaluable tools and resources available to miners.

The crypto mining sector’s dynamic nature requires miners to be proactive, continuously seeking ways to optimize and adapt their operations to changing conditions. Whether it’s technological advancements, shifts in cryptocurrency values, or regulatory changes, the ability to swiftly adjust strategies can make the difference between thriving and merely surviving.

We encourage miners at all levels, from novices to seasoned veterans, to apply the strategies discussed in this article to enhance the performance of their mining operations. The journey to mining mastery is one of constant learning, experimentation, and refinement. By embracing optimization and adaptation, miners can not only improve their profitability but also contribute to the sustainability and advancement of the broader cryptocurrency ecosystem.

For those eager to dive deeper into the world of crypto mining and optimization, our website offers a wealth of additional resources, guides, and tools designed to support your mining endeavors. We invite you to explore these resources to further your knowledge and skills.

The collective wisdom of the mining community is one of its greatest strengths. We encourage you to share your experiences, tips, and insights in the comment section below. Whether it’s a successful optimization technique, a lesson learned from a challenge, or a question seeking advice, your contributions can help foster a vibrant and supportive community of miners.

In conclusion, the path to crypto mining optimization mastery is both challenging and rewarding. By applying the strategies outlined in this article, continuously seeking knowledge, and engaging with the mining community, you can enhance your mining performance and contribute to the exciting and innovative field of cryptocurrency.

What is crypto mining?

Crypto mining is the process of verifying and adding transactions to a blockchain digital ledger by solving complex computational algorithms. Miners are rewarded with cryptocurrency for their efforts, playing a crucial role in maintaining the security and integrity of the blockchain.

What types of hardware are used in crypto mining?

Crypto mining utilizes three main types of hardware: Central Processing Units (CPUs), Graphics Processing Units (GPUs), and Application-Specific Integrated Circuits (ASICs). CPUs are basic and generally not efficient for serious mining, GPUs offer a balance of versatility and efficiency, and ASICs provide unparalleled efficiency for mining specific cryptocurrencies.

How does electricity consumption impact crypto mining profitability?

Electricity consumption is a significant factor in mining profitability due to the energy-intensive nature of the mining process. The cost of electricity can drastically affect net profits, making the choice of mining location and hardware efficiency crucial decisions for miners.

What are the pillars of mining efficiency?

The pillars of mining efficiency include hardware optimization, software optimization, and energy management. These pillars address selecting the right mining hardware, choosing and configuring mining software for optimal performance, and implementing strategies to reduce energy consumption.

What advanced optimization techniques can enhance crypto mining operations?

Advanced optimization techniques include making algorithmic adjustments to optimize hardware settings for specific mining algorithms, implementing effective cooling solutions to prevent hardware overheating, and strategically choosing between mining pools and solo mining to maximize rewards.

How can miners manage risks in crypto mining?

Miners can manage risks by identifying potential challenges like hardware failure, electricity cost fluctuations, cryptocurrency volatility, and regulatory changes. Strategies to mitigate these risks include regular maintenance, diversifying mining operations, using renewable energy sources, and staying informed about market and regulatory developments.

What tools and resources are available to help miners optimize their operations?

Miners can utilize software tools like CGMiner, NiceHash, Hive OS, and MinerStat for monitoring and optimization. Online communities on platforms like BitcoinTalk and Reddit, educational resources from Coursera, Udemy, and cryptocurrency news outlets, and YouTube channels provide valuable information and support for continuous learning and improvement.

Why is continuous optimization important in crypto mining?

Continuous optimization is crucial due to the dynamic nature of the cryptocurrency mining sector. Changes in technology, market conditions, and regulations require miners to adapt their strategies to maintain profitability and compete effectively in the mining landscape.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

In the world of finance, the quest for a reliable store of wealth has led investors to consider various asset

Methane emissions represent a significant environmental concern that requires thoughtful attention and action. While some view greenhouse gases (GHGs) as

As a cryptocurrency enthusiast, I have always been fascinated by the concept of Bitcoin mining. It is the process of