Mining Rig Noise Reduction: How to Soundproof Your Home Mining Rig with Antminer Shrouds

Bitcoin mining is a crucial component of the Bitcoin network’s function and sustainability. It refers to the process of verifying

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

The landscape of cryptocurrency mining has undergone a remarkable transformation since the inception of Bitcoin in 2009. Initially, enthusiasts could mine cryptocurrencies using standard Central Processing Units (CPUs) found in everyday personal computers. This phase represented the nascent stage of mining, where the barrier to entry was relatively low, and the mining community was limited to a small group of pioneers and tech enthusiasts.

As the cryptocurrency market expanded and the competition among miners intensified, the need for more efficient mining hardware became evident. This led to the adoption of Graphics Processing Units (GPUs), which offered significantly higher processing power compared to CPUs. GPUs marked the first major leap in mining technology, enabling miners to hash data at a faster rate and increase their chances of earning mining rewards.

However, the relentless quest for efficiency didn’t stop with GPUs. The mining community witnessed the advent of Field-Programmable Gate Arrays (FPGAs), which provided further customization and efficiency in mining operations. Despite their advantages, FPGAs were soon overshadowed by a groundbreaking innovation that would redefine the mining landscape: Application-Specific Integrated Circuit (ASIC) miners.

ASIC miners represent the pinnacle of mining technology, designed with a singular purpose: to mine cryptocurrencies with unparalleled efficiency. Unlike their predecessors, ASICs are not general-purpose devices; they are engineered specifically for the cryptographic calculations required in mining a particular cryptocurrency, such as Bitcoin. This specialization allows ASIC miners to outperform CPUs, GPUs, and FPGAs in both speed and energy consumption, making them the most sought-after hardware in the competitive arena of cryptocurrency mining.

The introduction of ASIC miners has significantly altered the mining landscape, raising the stakes and the computational power required to mine profitably. Today, ASIC miners are synonymous with professional mining operations, offering the cutting-edge technology needed to stay ahead in the race for cryptocurrency rewards. Their significance in the mining ecosystem cannot be overstated, as they continue to push the boundaries of what is possible in cryptocurrency mining, shaping the future of this ever-evolving industry.

ASIC miners, short for Application-Specific Integrated Circuit miners, are specialized hardware designed exclusively for cryptocurrency mining. Unlike versatile computing devices like CPUs (Central Processing Units) and GPUs (Graphics Processing Units), ASICs are engineered with a singular focus: to execute the specific cryptographic algorithms used in the mining process of certain cryptocurrencies, most notably Bitcoin.

An ASIC miner is essentially a microchip tailored for the efficient execution of a particular hashing algorithm. This specialization allows it to perform mining tasks with a level of efficiency that general-purpose hardware cannot match. Each ASIC miner is built to mine a specific cryptocurrency, making it incompatible with algorithms outside its design parameters.

Initially, mining was accessible to anyone with a standard computer, as it required only a CPU to compute the cryptographic puzzles. However, as the difficulty of mining increased and the competitive landscape grew, miners sought more powerful alternatives, leading to the adoption of GPUs. GPUs, primarily designed for rendering graphics, proved to be more efficient than CPUs due to their ability to perform parallel operations, making them better suited for the repetitive tasks involved in mining.

The transition from CPUs to GPUs marked a significant leap in mining efficiency, but the quest for even greater performance led to the development of FPGAs and, eventually, ASICs. FPGAs offered improved efficiency over GPUs by allowing miners to configure the hardware to optimize mining of specific cryptocurrencies. However, ASICs took this specialization a step further by being custom-built from the ground up for mining, offering unparalleled efficiency and performance.

The primary advantage of ASIC miners lies in their unmatched efficiency in mining specific cryptocurrencies. By being designed for a particular hashing algorithm, ASIC miners can achieve significantly higher hash rates while consuming less power than general-purpose hardware like CPUs and GPUs. This efficiency translates to a higher probability of solving the cryptographic puzzles and earning mining rewards.

ASIC miners boast incredibly high hash rates, which is the speed at which they can perform the cryptographic calculations necessary for mining. This speed is crucial in a competitive mining environment, as it increases the chances of being the first to validate a new block and secure the associated rewards.

In addition to their speed, ASIC miners are also designed to maximize energy efficiency. Mining is a power-intensive process, and the ability to maintain high hash rates with lower power consumption directly impacts profitability. ASICs’ energy efficiency makes them the most cost-effective option for miners aiming to maximize their returns in the long run.

In summary, ASIC miners represent the cutting edge of cryptocurrency mining technology, offering specialized hardware that outperforms earlier mining equipment in both speed and efficiency. Their development has significantly professionalized the mining industry, making them indispensable for those serious about cryptocurrency mining.

When venturing into the realm of ASIC mining, several critical factors must be weighed to ensure the success and profitability of your mining operation. Understanding these considerations can help you make an informed decision that aligns with your mining goals and budget.

The hash rate of an ASIC miner, measured in terahashes per second (TH/s), is a pivotal factor in its mining capability. It indicates the number of cryptographic calculations the miner can perform in one second. A higher hash rate significantly increases your chances of solving the mathematical puzzles that validate transactions and, consequently, earning block rewards.

The relationship between hash rate and earnings is direct; the higher the hash rate, the greater your share of the network’s total mining power. This increased share improves your likelihood of successfully mining a block and receiving cryptocurrency rewards. However, it’s essential to balance the hash rate with other factors like power efficiency and cost, as these also impact overall profitability.

Power efficiency is a crucial consideration due to the significant energy demands of continuous mining. An ASIC miner’s efficiency is often gauged by its power consumption relative to its hash rate, typically expressed in watts per gigahash (W/GH).

Watts per gigahash is a metric that reveals how much electrical power the miner requires to perform a billion hash calculations. A lower W/GH indicates a more energy-efficient miner, which is vital for maintaining profitability, especially in regions with high electricity costs. Efficient power usage not only reduces operational expenses but also lessens the environmental impact of mining.

The upfront cost of an ASIC miner can vary widely, influenced by factors such as hash rate, power efficiency, and the miner’s brand and model. While a higher-priced ASIC might offer superior performance, it’s essential to consider whether the potential increase in mining rewards justifies the additional expense.

Return on Investment (ROI) is influenced by several factors, including the miner’s cost, operational expenses (primarily electricity), and the current and projected value of the mined cryptocurrency. Calculating ROI involves estimating how long it will take for the mining rewards to cover the initial investment and operational costs, bearing in mind the volatile nature of cryptocurrency prices.

Given the continuous operation required for profitable mining, the build quality and durability of an ASIC miner are paramount. High-quality components and robust construction help ensure the miner can withstand the rigors of non-stop operation, potentially extending its useful life and protecting your investment.

The operational environment can significantly affect an ASIC miner’s performance and longevity. Factors such as cooling, ventilation, and dust can impact efficiency and risk hardware failure. Ensuring a suitable mining environment is crucial for maintaining optimal performance and maximizing the lifespan of your mining equipment.

Opting for ASIC miners from reputable manufacturers can mitigate risks associated with quality, performance, and support. Established brands are more likely to produce reliable, efficient miners and stand behind their products with customer service and technical support.

Strong customer support and comprehensive warranties are invaluable, especially for newcomers to ASIC mining. They provide peace of mind and assurance that you’ll have assistance in resolving any issues that may arise, from technical difficulties to hardware defects, ensuring your mining operation continues smoothly.

In summary, selecting the right ASIC miner involves a careful analysis of hash rate, power efficiency, cost, durability, and the reputation of the manufacturer. Balancing these factors according to your specific mining goals and operational conditions is key to achieving a successful and profitable mining operation.

The ASIC miner market is dominated by a few key players, each with its flagship models designed to offer competitive advantages in terms of efficiency, power, and reliability. Below, we delve into three leading ASIC miner manufacturers: Bitmain, MicroBT, and Canaan, highlighting their popular models and contributions to the mining industry.

Bitmain Technologies Ltd., established in 2013, is a renowned player in the cryptocurrency mining industry, primarily known for its Antminer series. The company has consistently led the market by developing high-performance ASIC miners that cater to a wide range of mining needs, from entry-level enthusiasts to large-scale mining operations.

The Antminer S19 Pro stands out as one of Bitmain’s most powerful and efficient models. Boasting a hash rate of up to 110 TH/s and a power efficiency of around 29.5 J/TH, the S19 Pro is designed for miners seeking maximum productivity and profitability. Its robust build and advanced cooling systems further ensure durability and consistent performance, making it a top choice for serious miners.

MicroBT, established in 2016, quickly emerged as a formidable competitor to Bitmain with its Whatsminer series. The company focuses on delivering high-quality mining equipment that combines excellent power efficiency with impressive hash rates, catering to both novice miners and large-scale mining farms.

The Whatsminer M30S+ is a testament to MicroBT’s commitment to innovation and performance. This model delivers a hash rate of up to 100 TH/s and maintains a power efficiency of around 34 J/TH, striking a balance between power and efficiency. Its reliability and ease of use make it a preferred choice for many in the mining community, offering a competitive alternative to Bitmain’s offerings.

Canaan Creative, founded in 2013, holds the distinction of pioneering the first commercial ASIC miner. The company’s dedication to research and development in blockchain technology and hardware has positioned it as a key player in the mining industry, with a focus on sustainability and user-friendly designs.

The AvalonMiner 1246 is Canaan’s answer to the high-performance mining demand, providing a hash rate of up to 90 TH/s and a power efficiency of around 38 J/TH. While it may not lead the pack in terms of raw power, the AvalonMiner 1246 is praised for its reliability and operational stability, offering a viable option for miners prioritizing consistent, long-term operation over peak performance.

When comparing ASIC miner brands and models, it’s crucial to consider not only the specifications but also the reliability, customer support, and overall reputation of the manufacturer. Bitmain’s Antminer S19 Pro, MicroBT’s Whatsminer M30S+, and Canaan’s AvalonMiner 1246 each offer unique advantages, catering to different preferences and mining strategies. By carefully evaluating these factors, miners can select the hardware best suited to their needs, optimizing their mining operations for maximum efficiency and profitability.

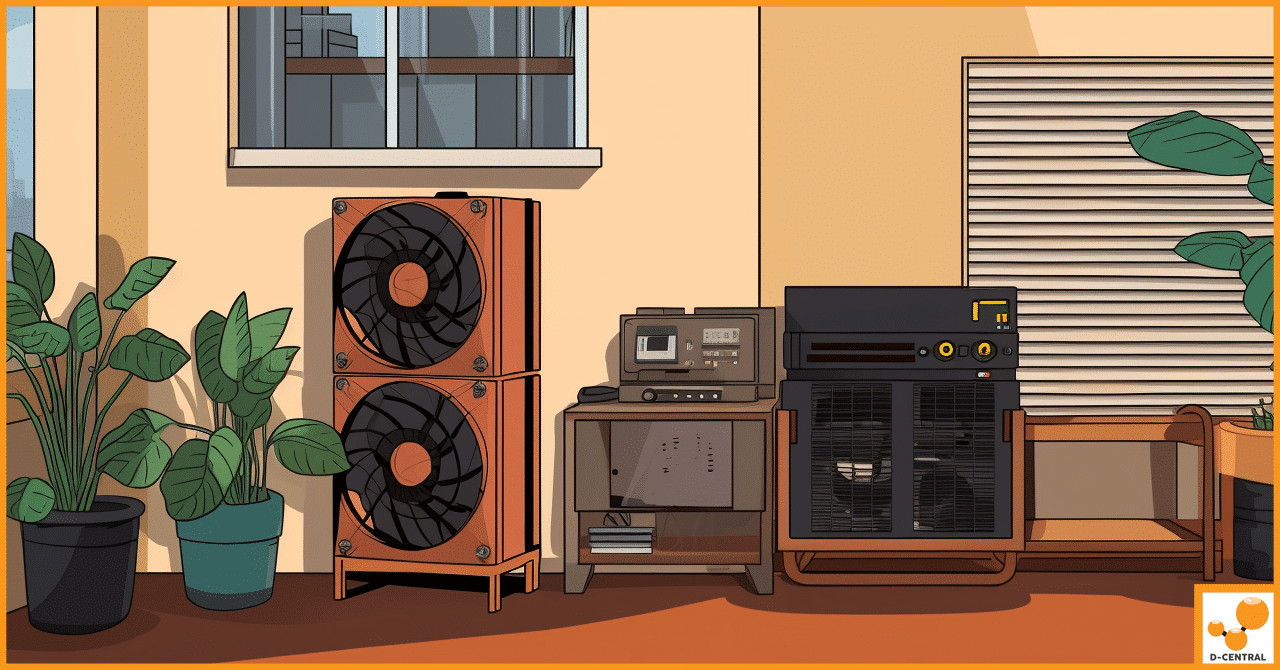

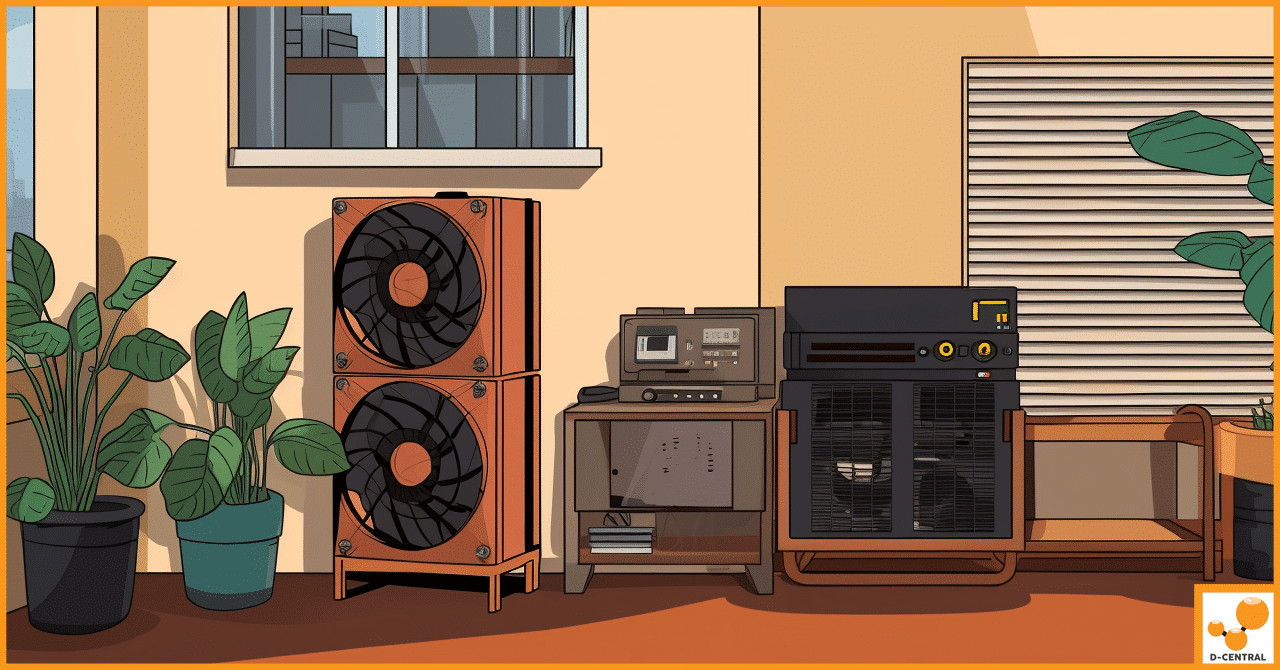

ASIC mining, while lucrative, comes with its set of challenges, particularly in terms of noise and heat management. Understanding and effectively addressing these issues is crucial for maintaining a sustainable and profitable mining operation.

ASIC miners are notorious for their noise output, which can be as loud as industrial machinery. The high decibel levels are primarily due to the powerful cooling fans required to maintain optimal operating temperatures. In a residential setting or a small-scale operation, this noise can be disruptive and may even violate local noise ordinances.

ASIC miners generate a substantial amount of heat due to the intense computational work they perform. Without proper heat management, this can lead to overheating, reduced efficiency, and even hardware failure. Moreover, the excess heat can make the mining environment uncomfortable and may require additional cooling solutions in warmer climates.

In conclusion, effective noise and heat management are critical for the success and sustainability of ASIC mining operations. By implementing the right solutions, miners can ensure their hardware operates efficiently and reliably, maximizing profitability while minimizing disruptions and environmental impact. Whether you’re running a single ASIC miner at home or managing a large-scale mining farm, addressing these practical considerations is essential for a smooth and successful mining venture.

The approach to purchasing ASIC miners can vary significantly depending on the scale of your mining operation and your objectives as a miner. Whether you’re a hobbyist looking to dip your toes into the mining world or a large-scale investor aiming to maximize profitability, understanding the best strategies for acquiring ASIC miners is crucial.

For those just starting out or operating on a smaller scale, buying second-hand ASIC miners can be an attractive option. This approach allows hobbyist miners to:

When buying second-hand, it’s essential to:

Hobbyist miners need to strike a balance between the cost of the ASIC miner and its performance capabilities. Considerations should include:

Large-scale investors, with significant capital and the intent to establish or expand mining farms, often opt for direct purchases from ASIC manufacturers. This approach offers several benefits:

When buying directly, consider:

For investors looking to outfit large mining operations, bulk buying can provide significant advantages:

The strategy for purchasing ASIC miners should align with your scale of operation and mining goals. Hobbyist miners can benefit from the lower upfront costs of second-hand units, while large-scale investors might find direct and bulk purchases from manufacturers more aligned with their needs for efficiency, scalability, and support. Regardless of the scale, due diligence in assessing the condition, performance, and potential profitability of ASIC miners is key to making informed purchasing decisions.

Understanding and calculating the profitability of ASIC mining is crucial for both new and seasoned miners. The dynamic nature of cryptocurrency markets, combined with fluctuating operational costs, can significantly impact the potential earnings from mining. Here, we’ll explore the key factors influencing mining profitability and introduce tools and calculators designed to help assess potential earnings.

The hash rate of your ASIC miner directly affects your potential earnings. A higher hash rate increases your chances of solving cryptographic puzzles and, consequently, earning block rewards. However, it’s important to balance hash rate with power efficiency and cost.

Power efficiency, typically measured in watts per gigahash (W/GH), is a critical factor in mining profitability. More efficient miners consume less electricity for the same amount of work, reducing operational costs. Electricity costs vary by region and can significantly impact profitability; lower electricity costs favor higher profitability.

Mining difficulty, which adjusts over time based on the total network hash rate, affects how difficult it is to find a new block. As difficulty increases, more computational power is required to mine successfully, potentially reducing individual earnings if your mining hardware doesn’t keep pace.

The value of the cryptocurrency you’re mining plays a significant role in profitability. Higher cryptocurrency prices can translate to higher earnings, but volatility in the market can quickly change the profitability landscape.

Joining a mining pool can increase your chances of earning rewards, but it’s important to consider any associated pool fees. Additionally, the reward structure of the pool (e.g., pay-per-share, proportional) can affect your earnings.

The upfront cost of purchasing ASIC miners, along with ongoing operational expenses such as cooling, maintenance, and rent (if applicable), must be factored into profitability calculations. A quicker return on investment (ROI) is preferable.

Several online tools and calculators are available to help miners estimate potential earnings and assess the profitability of their mining operations. These tools typically require inputs such as hash rate, power consumption, electricity cost, and mining pool fees to provide an estimated profitability. Some popular options include:

When using these tools, it’s essential to regularly update your inputs to reflect current market conditions and operational costs. Cryptocurrency markets are highly volatile, and profitability can change rapidly.

Calculating mining profitability involves considering multiple factors, including hardware efficiency, operational costs, and market conditions. Utilizing online calculators can provide valuable insights, but miners should remain adaptable and continuously monitor their operations to ensure long-term profitability.

Investing in ASIC mining is a significant decision that requires careful consideration of various factors to ensure profitability and sustainability. Before committing to a purchase, it’s essential to summarize the key points and conduct thorough research to make an informed choice. Here’s a guide to help you navigate this process:

Making an informed decision to invest in ASIC mining involves a comprehensive evaluation of technical specifications, market conditions, and personal financial goals. By conducting thorough research and considering the points outlined above, you can optimize your mining strategy for success and sustainability in the dynamic world of cryptocurrency mining.

Choosing the right ASIC miner is a pivotal decision that can significantly influence the success and profitability of your cryptocurrency mining venture. The journey through understanding hash rates, power efficiency, operational costs, and the myriad other factors involved in selecting an ASIC miner underscores the complexity and dynamic nature of cryptocurrency mining. It’s a field where technological advancements and market fluctuations can rapidly change the landscape, making informed decision-making paramount.

For prospective miners, the path to successful mining is paved with research, careful planning, and continuous learning. The evolution from CPUs and GPUs to the specialized world of ASIC mining has professionalized the industry, requiring miners to be not only tech-savvy but also astute observers of the cryptocurrency market. However, the rewards of mining — both in terms of cryptocurrency earnings and the satisfaction of contributing to the blockchain ecosystem — can be substantial for those who navigate these waters wisely.

We encourage aspiring and seasoned miners alike to delve deeply into the nuances of ASIC mining, to weigh the pros and cons of various models and manufacturers, and to consider the long-term implications of their mining strategies. The commitment to staying informed and adaptable in the face of an ever-evolving industry is the hallmark of a successful miner.

For those seeking expert advice and a comprehensive range of mining solutions, D-Central Technologies stands ready to assist. Our expertise in the field, coupled with a wide selection of mining hardware and services, makes us a valuable partner in your mining journey. Whether you’re just starting out or looking to scale your operations, our team is here to provide the support and resources you need to achieve your mining goals.

We invite you to visit D-Central Technologies to explore our products and services and to connect with our team of experts. Together, we can navigate the complexities of cryptocurrency mining and pave the way for a profitable and sustainable mining operation.

Your success in cryptocurrency mining begins with the right choices — from the ASIC miner you select to the partners you trust. Let D-Central Technologies be your guide and ally in this exciting venture.

What is an ASIC miner?

An ASIC miner, or Application-Specific Integrated Circuit miner, is specialized hardware designed exclusively for cryptocurrency mining. Unlike general-purpose computing devices like CPUs or GPUs, ASICs are engineered for the specific cryptographic algorithms used in mining certain cryptocurrencies, offering unmatched efficiency and performance.

How do ASIC miners compare to CPUs and GPUs in mining?

ASIC miners far outperform CPUs and GPUs in both speed and energy efficiency for mining. They are custom-built to perform the specific cryptographic calculations required for mining a particular cryptocurrency, making them the most efficient option. Initially, mining was possible with CPUs, but as the need for efficiency grew, miners transitioned to GPUs and eventually to the more efficient ASIC miners.

What are the advantages of using ASIC miners for cryptocurrency mining?

The primary advantages of ASIC miners include unparalleled efficiency in mining specific cryptocurrencies, incredibly high hash rates, and superior energy efficiency. These benefits translate into a higher probability of earning mining rewards and achieving profitability, especially in a competitive mining environment.

What factors should be considered when choosing an ASIC miner?

Key considerations when selecting an ASIC miner include the hash rate, power efficiency, cost, durability, manufacturer’s reputation, and environmental conditions for operation. Balancing these factors according to specific mining goals and operational conditions is crucial for a successful and profitable mining operation.

How do environmental factors like noise and heat affect ASIC mining operations?

ASIC miners generate significant noise and heat due to their powerful cooling fans and intense computational work, respectively. Effective noise and heat management strategies, such as soundproof enclosures, upgraded cooling fans, and adequate ventilation, are essential for maintaining a sustainable mining operation and protecting the hardware from overheating or failure.

What are some strategies for purchasing ASIC miners?

Purchasing strategies vary based on the scale of the mining operation. Hobbyist miners might consider buying second-hand ASICs to reduce initial investment, while large-scale investors might opt for direct purchases from manufacturers to access the latest models, warranties, and support. Assessing condition, performance, and potential profitability is key in both cases.

How can mining profitability be calculated, and what factors influence it?

Mining profitability can be calculated using online tools that consider factors such as hash rate, power consumption, electricity cost, and mining pool fees. Influential factors include the ASIC miner’s efficiency, operational expenses, mining difficulty, and the value of the cryptocurrency being mined. Regular updates to these inputs reflect current conditions for accurate profitability estimation.

Where can individuals seek expert advice and resources for cryptocurrency mining?

Individuals can seek expert advice and a range of mining solutions from companies like D-Central Technologies, which offers expertise, mining hardware, and comprehensive services. Such partnerships provide valuable support for both newcomers and experienced miners aiming for success in cryptocurrency mining.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

Bitcoin mining is a crucial component of the Bitcoin network’s function and sustainability. It refers to the process of verifying

The evolution of Bitcoin mining has been profoundly influenced by the principles of open-source development. Open-source projects have democratized access

Delaminated chips have become a widespread concern for Antminer 17 Series users, particularly those employing BM1397 chips in their Bitcoin