Decoding Bitcoin’s Energy Dilemma: A Comprehensive Analysis of Electricity Consumption

The advent of Bitcoin and its underlying technology, blockchain, has transformed the financial landscape, paving the way for a new

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

The cryptocurrency market is renowned for its dynamic nature, characterized by rapid price movements and inherent volatility. This landscape, while offering substantial opportunities for growth and innovation, also presents a unique set of challenges for investors and miners alike. The unpredictable swings and shifts in the market demand a robust strategy that goes beyond mere resilience or resistance to stress.

Enter the concept of antifragility, a term coined by Nassim Nicholas Taleb in his seminal work, “Antifragile: Things That Gain from Disorder.” Antifragility transcends mere robustness; it describes systems that actually thrive and grow stronger in the face of chaos, volatility, and stress. In the financial realm, and particularly within the cryptocurrency market, antifragility is not just a desirable trait but a crucial strategy for navigating the tumultuous waters.

Bitcoin, the progenitor of all cryptocurrencies, stands as a prime example of antifragility in action. Unlike its counterparts, Bitcoin’s decentralized nature, coupled with its fixed supply and global consensus mechanism, equips it to not only withstand market adversities but to emerge stronger from them. Each challenge, be it regulatory scrutiny, technological hurdles, or market downturns, has only served to reinforce Bitcoin’s resilience and validate its value proposition to investors and miners.

For investors, Bitcoin’s antifragility offers a hedge against traditional market uncertainties and the inflationary policies of fiat currencies. Miners, on the other hand, engage in a process that is bolstered by Bitcoin’s adaptive difficulty adjustments and the network’s cumulative security, ensuring that their contribution to the network’s infrastructure is both rewarded and integral to its antifragile nature.

In embracing Bitcoin, participants in the cryptocurrency market engage with a system designed not just to survive chaos but to capitalize on it, turning volatility into an opportunity for growth and innovation. This introduction to Bitcoin’s antifragility sets the stage for a deeper exploration of how individuals and entities can leverage this unique characteristic to navigate and succeed in the ever-evolving cryptocurrency landscape.

Antifragility goes beyond the commonly understood concepts of robustness and resilience. While robustness refers to the ability to resist shocks and stresses without changing, and resilience to the capacity to recover quickly from difficulties, antifragility is about benefiting and growing stronger from such adversities. An antifragile system thrives on chaos, volatility, and disorder, using these conditions as catalysts for improvement, adaptation, and growth.

Nassim Nicholas Taleb’s Contributions

The term “antifragility” was introduced and extensively explored by Nassim Nicholas Taleb in his book “Antifragile: Things That Gain from Disorder.” Taleb’s work delves into how certain systems, organizations, and even ideas can be constructed or understood in a way that allows them to benefit from variability, uncertainty, and stressors. Taleb argues that in complex systems, attempts to eliminate volatility can actually make these systems more vulnerable to catastrophic failure. Instead, building in mechanisms that allow for adaptation and growth in response to stressors can create truly antifragile systems.

Relevance of Antifragility to Financial Markets

In the context of financial markets, antifragility is a powerful concept for understanding how certain assets and strategies can outperform and gain from market volatility and economic downturns. Traditional financial systems, built on leverage and optimization for stable conditions, often prove fragile when faced with the unexpected. In contrast, antifragile assets and strategies are designed to adapt, evolve, and strengthen in response to market stresses.

Focus on Cryptocurrencies

Cryptocurrencies, and Bitcoin in particular, embody the principle of antifragility in the financial domain. The decentralized, open-source nature of Bitcoin allows it to adapt and improve through community consensus in response to external pressures and challenges. Its fixed supply and deflationary model contrast sharply with the inflationary tendencies of fiat currencies, offering a hedge against economic instability. Moreover, Bitcoin’s history is marked by its resilience to regulatory pressures, technological challenges, and market volatility, each time emerging stronger and more widely adopted.

Bitcoin’s mining process further illustrates antifragility. The difficulty adjustment algorithm ensures that the network remains secure and functional regardless of the number of miners or the external environment, adjusting to maintain a consistent block time. This adaptive mechanism ensures that Bitcoin not only survives but thrives under varying conditions, making the mining process an integral part of its antifragile nature.

The essence of antifragility, as explored by Nassim Nicholas Taleb, offers a profound lens through which to view the cryptocurrency market. Bitcoin, with its unique properties and adaptive mechanisms, stands as a prime example of how antifragility can be harnessed to navigate and excel in the volatile and unpredictable world of financial markets.

Bitcoin’s decentralized architecture is the cornerstone of its antifragile characteristics. Unlike centralized financial systems, where a single point of failure can lead to systemic collapse, Bitcoin operates on a distributed network of nodes and miners. This decentralization ensures that the system is not reliant on any single entity for its functioning, making it inherently resistant to attacks, censorship, and regulatory pressures. Each node in the network holds a copy of the blockchain, ensuring that the ledger is maintained and updated in a trustless and transparent manner. This not only enhances security but also distributes risk, ensuring that the system becomes more robust and adaptable with each challenge it faces.

Benefiting from Volatility and Market Dynamics

Bitcoin thrives on the very volatility that characterizes the cryptocurrency market. Price fluctuations, while perceived as a risk in traditional markets, are a source of opportunity and growth for Bitcoin. Volatility attracts attention, driving adoption, and innovation within the ecosystem. Each market cycle brings in new participants, technologies, and capital, contributing to the network’s growth and resilience. Furthermore, Bitcoin’s fixed supply and halving events introduce a deflationary aspect that contrasts with the inflationary policies of fiat currencies, making it an attractive store of value over the long term.

Resilience to Regulatory Challenges

Regulatory challenges, often seen as threats to the cryptocurrency space, have paradoxically served to strengthen Bitcoin’s antifragile nature. Each regulatory hurdle prompts the community to innovate and adapt, finding new ways to secure the network, enhance privacy, and ensure accessibility. For instance, regulatory pressures have led to the development of more robust and decentralized exchanges, improved wallet technologies, and enhanced cryptographic techniques, all of which contribute to the ecosystem’s resilience and growth.

The Role of the Bitcoin Community and Development Ecosystem

The Bitcoin community and its development ecosystem play a pivotal role in its antifragility. The open-source nature of Bitcoin allows developers from around the world to contribute to its codebase, ensuring continuous improvement and adaptation. This collaborative and meritocratic environment fosters innovation and ensures that Bitcoin remains at the forefront of technological advancements. The community’s commitment to the core principles of decentralization, privacy, and security drives the network’s evolution, making it more adaptable and resilient to external pressures.

Network Effects and Antifragility

Bitcoin’s antifragility is further enhanced by network effects. As more individuals and institutions adopt Bitcoin, its value and utility increase, attracting even more participants to the ecosystem. This virtuous cycle not only strengthens the network’s security through increased mining activity but also enhances liquidity and market depth, making Bitcoin more resilient to market shocks and volatility. The growing acceptance of Bitcoin as a legitimate asset class by mainstream financial institutions and the integration of Bitcoin into payment systems and financial products contribute to its antifragility, ensuring its continued growth and adoption.

Bitcoin’s decentralized nature, resilience to volatility and regulatory challenges, and vibrant community and development ecosystem contribute to its antifragile characteristics. These elements ensure that Bitcoin not only withstands the chaos and unpredictability of the financial markets but also thrives on them, continually adapting and evolving to emerge stronger from each challenge it faces.

Navigating the cryptocurrency market with an antifragile mindset requires a strategic approach that leverages volatility and uncertainty for growth and resilience. Participants, including investors and miners, can adopt specific strategies to not only withstand the market’s inherent unpredictability but also to benefit from it.

Adopting an Antifragile Mindset

Risk Management and Diversification

Long-Term Thinking and Adaptability

By integrating these antifragile strategies, cryptocurrency participants can position themselves to not just survive but thrive amid the complexities and volatilities of the market. Embracing an antifragile approach means viewing challenges as opportunities for growth, adaptation, and innovation, ensuring long-term success in the dynamic world of cryptocurrency.

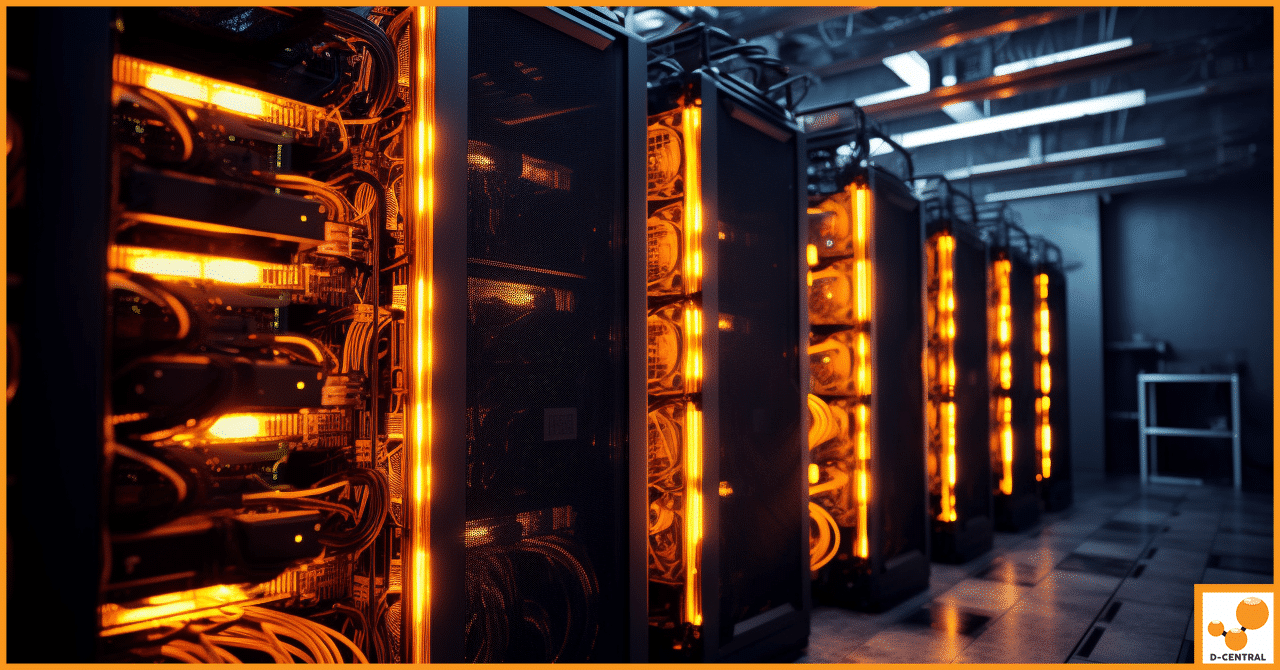

D-Central Technologies stands at the forefront of the Bitcoin mining industry, embodying the principles of antifragility through its innovative solutions and resilient infrastructure. With a mission to democratize access to Bitcoin mining and enhance the efficiency and sustainability of mining operations, D-Central is dedicated to supporting the growth and resilience of the Bitcoin network. By providing robust services and pioneering mining solutions, D-Central empowers miners to navigate the volatile cryptocurrency market with confidence and strategic advantage.

Overview of D-Central’s Services

D-Central Technologies offers a comprehensive suite of services designed to address the multifaceted needs of Bitcoin miners, from novices to seasoned professionals:

Innovative Contributions

D-Central Technologies distinguishes itself through its innovative contributions to the Bitcoin mining ecosystem, enhancing the antifragility of mining operations:

D-Central Technologies is not just a service provider but a partner in the antifragile journey of Bitcoin mining. By offering expert repairs, sourcing top-tier hardware, providing secure hosting, and innovating with products like Bitcoin Space Heaters, D-Central empowers miners to thrive in the dynamic and unpredictable world of cryptocurrency mining. Through its commitment to quality, innovation, and community, D-Central Technologies reinforces the antifragile nature of Bitcoin mining, ensuring that miners are well-equipped to turn market challenges into opportunities for growth and success.

In the realm of cryptocurrency investment, constructing an antifragile portfolio is about more than just surviving market volatility and uncertainty—it’s about leveraging these elements to your advantage. Central to this approach is the recognition of Bitcoin’s superior position within the cryptocurrency ecosystem. While diversification is a common strategy in traditional investment portfolios, within the cryptocurrency domain, a focused approach centered around Bitcoin can offer unparalleled benefits due to its proven resilience, historical performance, and foundational role in the market.

Strategies for an Antifragile Cryptocurrency Portfolio

The Role of Bitcoin in Achieving Portfolio Antifragility

Bitcoin’s inherent qualities—decentralization, fixed supply, and censorship resistance—make it uniquely positioned to serve as the backbone of an antifragile portfolio. Its proven ability to recover and reach new heights after periods of volatility and market corrections underscores its potential for long-term growth and resilience. By focusing on Bitcoin, investors can align with the most secure and established blockchain network, benefiting from its ongoing adoption and technological advancements.

Tips for Continuous Learning and Adaptation

Building an antifragile cryptocurrency portfolio centers around a strategic focus on Bitcoin, leveraging its unmatched stability and potential within the crypto space. By diversifying within the Bitcoin ecosystem, staying informed, and actively engaging with the community and innovations, investors can construct a portfolio that not only withstands market volatility but thrives on it.

Navigating the cryptocurrency market demands more than just resilience; it requires an antifragile approach that turns volatility and uncertainty into avenues for growth and strength. This journey is underpinned by a deep understanding of antifragility, a concept that transcends mere robustness, enabling systems, and individuals to thrive amidst chaos and disorder. Central to this philosophy within the cryptocurrency realm is Bitcoin, which stands as a beacon of antifragility, demonstrating unmatched resilience and growth potential through its decentralized nature, fixed supply, and vibrant community.

Bitcoin’s role as the cornerstone of antifragile cryptocurrency practices cannot be overstated. Its ability to adapt, evolve, and strengthen in response to external pressures and challenges makes it an ideal anchor for any strategy aimed at navigating the cryptocurrency market’s inherent volatility. By focusing on Bitcoin, investors and miners align themselves with a network that is not just surviving but flourishing in the face of global economic shifts and technological advancements.

D-Central Technologies emerges as a pivotal ally in this antifragile journey, offering a suite of services and innovations designed to empower Bitcoin miners and investors. From expert ASIC repairs and mining hardware sourcing to hosting solutions and groundbreaking products like Bitcoin Space Heaters, D-Central provides the tools and support necessary to enhance the antifragility of cryptocurrency mining operations. Their commitment to customization, operational flexibility, and continuous innovation ensures that clients are equipped to turn market challenges into opportunities for efficiency, growth, and sustainability.

As we look to the future of cryptocurrency, the importance of adopting an antifragile approach becomes increasingly clear. Engaging with D-Central Technologies opens the door to a world of antifragile mining solutions and expert support, enabling miners and investors to not just navigate but thrive in the dynamic and unpredictable landscape of cryptocurrency.

We invite you to explore D-Central Technologies’ comprehensive range of services and to embrace the antifragile mindset that is essential for success in the cryptocurrency market. Whether you’re seeking to optimize your mining operations, explore innovative mining solutions, or simply gain expert advice on adopting an antifragile approach to cryptocurrency, D-Central is here to support your journey. Contact D-Central today to discover how we can enhance the resilience, efficiency, and profitability of your cryptocurrency endeavours, ensuring you are well-positioned to capitalize on the opportunities that volatility and uncertainty bring.

What is antifragility?

Antifragility is a term coined by Nassim Nicholas Taleb in his book “Antifragile: Things That Gain from Disorder,” describing systems that thrive and grow stronger in the face of chaos, volatility, and stress, surpassing mere robustness and resilience.

How does Bitcoin embody the principle of antifragility?

Bitcoin exemplifies antifragility through its decentralized nature, fixed supply, global consensus mechanism, and ability to adapt and strengthen in response to challenges such as regulatory scrutiny and market downturns.

What role does D-Central Technologies play in the Bitcoin mining industry?

D-Central Technologies is at the forefront of the Bitcoin mining industry, offering services such as ASIC repairs, mining hardware sourcing, hosting solutions, and innovative products like Bitcoin Space Heaters to strengthen the industry’s antifragility.

How can participants in the cryptocurrency market adopt an antifragile strategy?

Market participants can adopt antifragile strategies by embracing volatility as an opportunity, preparing for a wide range of outcomes, engaging in continuous learning, and employing risk management and diversification.

What strategies are recommended for building an antifragile cryptocurrency portfolio?

Building an antifragile cryptocurrency portfolio involves prioritizing Bitcoin, leveraging mining for portfolio growth, incorporating Bitcoin-backed financial products, and engaging with the cryptocurrency community for continuous learning and adaptation.

How does D-Central Technologies contribute to the antifragility of mining operations?

D-Central Technologies enhances mining operations’ antifragility through expert ASIC repairs, sourcing efficient mining hardware, offering bespoke hardware modifications, and products that convert mining byproducts into valuable resources like heat.

What are the benefits of focusing on Bitcoin in cryptocurrency investment?

Focusing on Bitcoin benefits cryptocurrency investment by aligning with a secure, widely adopted network known for its resilience to market corrections and its potential for long-term growth amidst economic and competitive pressures.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

The advent of Bitcoin and its underlying technology, blockchain, has transformed the financial landscape, paving the way for a new

Mining rig hosting has become an essential aspect of the cryptocurrency industry, as it allows individuals and organizations to set

Cryptocurrency mining in Canada has been steadily growing in popularity, thanks to the country’s favorable climate, low-cost electricity, and supportive