The Risks of ASIC Mining: Is it Worth It?

In the ever-evolving landscape of cryptocurrency, ASIC (Application-Specific Integrated Circuit) mining has emerged as a cornerstone of digital currency extraction.

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

In an era marked by unprecedented economic fluctuations and geopolitical uncertainties, individuals and institutions alike are on a relentless quest for strategies that can shield their assets from the unpredictable tides of the global financial landscape. The traditional bastions of safety—gold, real estate, and government bonds—while still relevant, are now being joined by a digital contender that promises not just preservation, but also a paradigm shift in asset protection. Enter Bitcoin, the pioneering cryptocurrency that has captivated the financial world with its revolutionary attributes. With its decentralized nature, capped supply, and immunity to conventional monetary policies, Bitcoin emerges not merely as an investment opportunity, but as a beacon of stability in a sea of economic turmoil. This article delves into the essence of Bitcoin, unraveling its potential as a safe haven asset that stands resilient in the face of uncertainties that beleaguer traditional financial systems.

Bitcoin, the first and most well-known cryptocurrency, was introduced to the world in 2008 through a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” authored by an individual or group under the pseudonym Satoshi Nakamoto. The genesis block, or the first block of the Bitcoin blockchain, was mined in January 2009, marking the inception of a decentralized digital currency that was independent of any central authority, government, or financial institution. The creation of Bitcoin was motivated by the desire to establish a system of electronic transactions that was both secure and transparent, without the need for intermediaries.

Key Features of Bitcoin

Bitcoin vs. Traditional Currencies: A Comparative Analysis

In summary, Bitcoin distinguishes itself from traditional currencies through its decentralized structure, limited supply, and innovative use of blockchain technology, offering a novel approach to financial sovereignty, security, and efficiency in transactions.

Safe haven assets are investments that are expected to retain or increase in value during times of market turbulence or economic downturns. These assets are sought after by investors looking to protect their portfolios from losses that can be caused by crises such as financial crashes, geopolitical instability, or other systemic risks. The key characteristics of safe haven assets include stability, reliability, and the ability to act as a hedge against inflation or currency devaluation.

Historical Examples

Criteria for a Safe Haven Asset

Safe haven assets play a crucial role in investment strategies, especially for those looking to preserve capital in uncertain times. While traditional safe havens like gold and U.S. Treasury Bonds have stood the test of time, the evolving financial landscape continues to introduce new assets, such as Bitcoin, into the conversation about what constitutes a modern safe haven.

The notion of Bitcoin as a safe haven asset has gained traction among investors and analysts, particularly as its market maturity evolves. This section delves into Bitcoin’s performance during periods of economic downturns and geopolitical tensions, supported by case studies and expert insights.

Analysis of Bitcoin’s Performance During Economic Downturns and Geopolitical Tensions

Bitcoin’s behavior in times of economic stress has been a subject of keen interest. Unlike traditional safe haven assets, Bitcoin’s relatively short history presents a limited, albeit compelling, dataset for analysis. Notably, Bitcoin has shown resilience and even growth during certain crises, although its response has not been uniformly predictable. For instance, during the stock market volatility in late 2018, Bitcoin’s value initially fell but then stabilized, suggesting a decoupling from traditional market movements. Similarly, amidst the geopolitical tensions involving the US and Iran in early 2020, Bitcoin’s price saw a significant uptick, reinforcing its potential as a crisis asset.

Case Studies

Expert Opinions and Research Findings on Bitcoin’s Safe Haven Status

The academic and financial community remains divided on Bitcoin’s status as a safe haven. Some experts, like those from the University of Cambridge, argue that Bitcoin’s characteristics, such as its independence from traditional financial systems and limited supply, align with safe haven criteria. Research published in reputable journals has presented evidence of Bitcoin acting as a safe haven in certain markets and periods, particularly in emerging economies or during specific events that undermine confidence in traditional financial systems.

However, skepticism persists, primarily due to Bitcoin’s price volatility and regulatory uncertainties. Critics argue that a true safe haven should not exhibit the same level of price swings as Bitcoin has historically. Yet, proponents counter that Bitcoin’s volatility is diminishing over time as the market matures and institutional adoption grows.

Bitcoin’s credentials as a safe haven asset are bolstered by its performance during specific crises and its inherent features that differentiate it from traditional assets. While its safe haven status may not be universally accepted, the growing interest from both retail and institutional investors suggests a shifting perception of Bitcoin’s role in a diversified investment portfolio, especially in an era characterized by digital transformation and economic unpredictability.

Bitcoin’s emergence as a potential safe haven asset is underpinned by several distinct advantages that set it apart from traditional safe haven assets like gold or government bonds. These advantages are particularly relevant in the context of modern financial challenges, including inflation, geopolitical tensions, and the increasing digitization of the economy.

Immunity to Inflation and Government Manipulation

One of the most compelling attributes of Bitcoin is its built-in resistance to inflation. Unlike fiat currencies, which can be printed in unlimited quantities by governments and central banks, Bitcoin has a fixed supply cap of 21 million coins. This scarcity is akin to precious metals like gold and is encoded into Bitcoin’s underlying protocol, making it immune to the dilutive effects of inflation. Furthermore, Bitcoin operates on a decentralized network, which means no single entity, including governments, can control or manipulate its supply and value. This decentralization ensures that Bitcoin remains unaffected by the monetary policies or economic instability that can erode the purchasing power of traditional currencies.

Global Accessibility and Liquidity

Bitcoin’s digital nature and the global infrastructure supporting it ensure that it is accessible to anyone with an internet connection, regardless of geographical location. This universal accessibility democratizes the ability to safeguard assets, especially in regions where access to traditional safe haven assets may be limited or subject to stringent controls. Moreover, the cryptocurrency market operates 24/7, providing unparalleled liquidity compared to traditional financial markets that adhere to set trading hours. This means investors can react and adjust their Bitcoin holdings in real-time in response to global events, enhancing its utility as a safe haven.

Potential for Appreciation During Market Volatility

While traditional safe haven assets are typically sought after for their stability rather than their growth potential, Bitcoin presents a unique proposition by offering both protective qualities and the potential for significant appreciation. Historical data shows that Bitcoin has experienced substantial price increases following periods of market volatility, outperforming many other asset classes. This potential for appreciation is particularly attractive during times of economic uncertainty, as investors not only seek to protect their wealth but also to capitalize on growth opportunities. Bitcoin’s historical performance, especially during times of inflationary pressure and declining confidence in traditional financial systems, underscores its dual role as both a safe haven and a speculative asset.

Bitcoin’s advantages as a safe haven asset lie in its immunity to inflation, global accessibility, and the potential for significant appreciation during times of market volatility. These attributes make it an increasingly attractive option for investors looking to diversify their portfolios and protect their assets against the backdrop of an evolving global financial landscape.

While Bitcoin presents unique advantages as a potential safe haven asset, it also comes with its own set of challenges and considerations. Investors must navigate these complexities to effectively leverage Bitcoin’s benefits while mitigating associated risks.

Price Volatility

One of the most significant challenges associated with Bitcoin is its price volatility. Unlike traditional safe haven assets, which are prized for their stability, Bitcoin can experience dramatic price swings over short periods. This volatility is attributed to various factors, including market sentiment, speculative trading, and liquidity levels. While volatility can present opportunities for significant gains, it also poses risks for investors seeking to preserve capital during uncertain times. Understanding and managing this volatility is crucial for those considering Bitcoin as part of a diversified safe haven strategy.

Regulatory Landscape

The regulatory environment surrounding cryptocurrencies, including Bitcoin, is another critical consideration. Regulations can vary significantly by country and are subject to change, impacting Bitcoin’s accessibility, usability, and overall market dynamics. Positive regulatory developments can enhance Bitcoin’s legitimacy and adoption, potentially bolstering its safe haven status. Conversely, restrictive or unclear regulations can hinder its utility and deter institutional and retail investors, affecting its perceived safety. Staying informed about the evolving regulatory landscape is essential for investors leveraging Bitcoin as a safe haven asset.

Security Concerns

Securing Bitcoin investments is paramount, given the digital and decentralized nature of cryptocurrencies. Unlike traditional assets, which may be safeguarded by established financial institutions, Bitcoin requires investors to take proactive steps to secure their holdings. This includes understanding and implementing best practices for digital wallet security, such as using hardware wallets for cold storage, employing strong, unique passwords, and maintaining operational security to protect private keys. Additionally, the irreversible nature of Bitcoin transactions underscores the importance of transactional diligence to avoid losses due to errors or fraud.

Investors considering Bitcoin as a safe haven must weigh these challenges and considerations carefully. While its potential as a hedge against economic instability and inflation is compelling, the associated risks of price volatility, regulatory uncertainty, and security vulnerabilities require a proactive and informed approach to risk management. By addressing these considerations, investors can better position themselves to capitalize on Bitcoin’s unique attributes while minimizing potential downsides.

Incorporating Bitcoin into your asset protection strategy requires a thoughtful approach, blending traditional investment wisdom with the nuances of digital assets. Here’s a practical guide to help you navigate this process effectively.

Starting with Bitcoin

Diversification Strategies

Risk Management

By following these practical steps, you can effectively incorporate Bitcoin into your asset protection strategy, leveraging its potential as a safe haven while managing the associated risks. Remember, the key to successful Bitcoin investment is education, caution, and ongoing vigilance.

In this exploration of Bitcoin’s role as a potential safe haven asset, we’ve traversed the landscape of its unique attributes, including its immunity to inflation, global accessibility, and the potential for appreciation amidst market volatility. We’ve also navigated the challenges that accompany Bitcoin investments, such as its price volatility, the evolving regulatory landscape, and the paramount importance of security measures.

Bitcoin’s decentralized nature and fixed supply contrast sharply with traditional currencies, offering a novel approach to asset protection that is untethered from the whims of governmental monetary policies. Its performance during economic downturns and geopolitical tensions has sparked debates about its safe haven credentials, with case studies and expert opinions highlighting both its potential and the areas where caution is warranted.

For those considering Bitcoin as part of a diversified investment strategy, understanding the practicalities of starting with Bitcoin, from setting up a wallet to purchasing and securely managing your holdings, is crucial. Balancing Bitcoin with traditional safe haven assets and employing sound risk management practices can help mitigate the inherent risks of cryptocurrency investments.

As we stand at the confluence of traditional finance and the burgeoning digital economy, Bitcoin presents an intriguing option for those looking to safeguard their assets against the backdrop of global economic uncertainties. However, the journey into the realm of Bitcoin requires not just enthusiasm but informed diligence and careful risk assessment.

For investors and individuals seeking to fortify their portfolios against the unpredictable tides of the global economy, Bitcoin offers a compelling, albeit nuanced, avenue for asset protection. As you contemplate integrating Bitcoin into your asset protection strategy, remember the importance of due diligence, continuous education, and the balanced assessment of risks and opportunities. Embrace the potential of Bitcoin, but tread with caution, armed with knowledge and a clear understanding of your investment goals and risk tolerance.

What is Bitcoin and how does it work?

Bitcoin is a decentralized digital currency that operates on a peer-to-peer network. It was introduced in 2008 and functions without the need for intermediaries, using blockchain technology to record transactions transparently and securely.

What makes Bitcoin different from traditional currencies?

Bitcoin is distinguished by its decentralization, capped supply of 21 million coins, independence from sovereign control, and its use of blockchain technology. Unlike traditional currencies, it’s not subject to government or central bank policies.

Can Bitcoin be considered a safe haven asset?

Bitcoin is increasingly viewed as a safe haven asset due to its inherent features like capped supply and decentralization. Its performance during economic downturns and geopolitical tensions has highlighted its potential to retain or increase in value when traditional financial systems are under stress.

What are the advantages of Bitcoin as a safe haven asset?

Bitcoin offers immunity to inflation, global accessibility, liquidity due to a 24/7 market, and the potential for appreciation during market volatility. These factors make it an attractive option for asset protection in contemporary financial landscapes.

What challenges are associated with Bitcoin investments?

Investing in Bitcoin comes with considerations such as price volatility, the evolving regulatory landscape, and security measures to safeguard investments, including the management of private keys and the threat of hacking.

How can one start investing in Bitcoin for asset protection?

Starting with Bitcoin involves setting up a digital wallet, purchasing Bitcoin through exchanges or ATMs, and understanding key management for security. Diversification within a broader portfolio and adherence to sound risk management practices are also crucial.

Why is managing price volatility important in Bitcoin investments?

Due to Bitcoin’s price volatility, investors need to employ sound risk management strategies, such as setting stop-loss orders, to protect against potentially significant losses, making it essential for those considering it as a safe haven asset.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

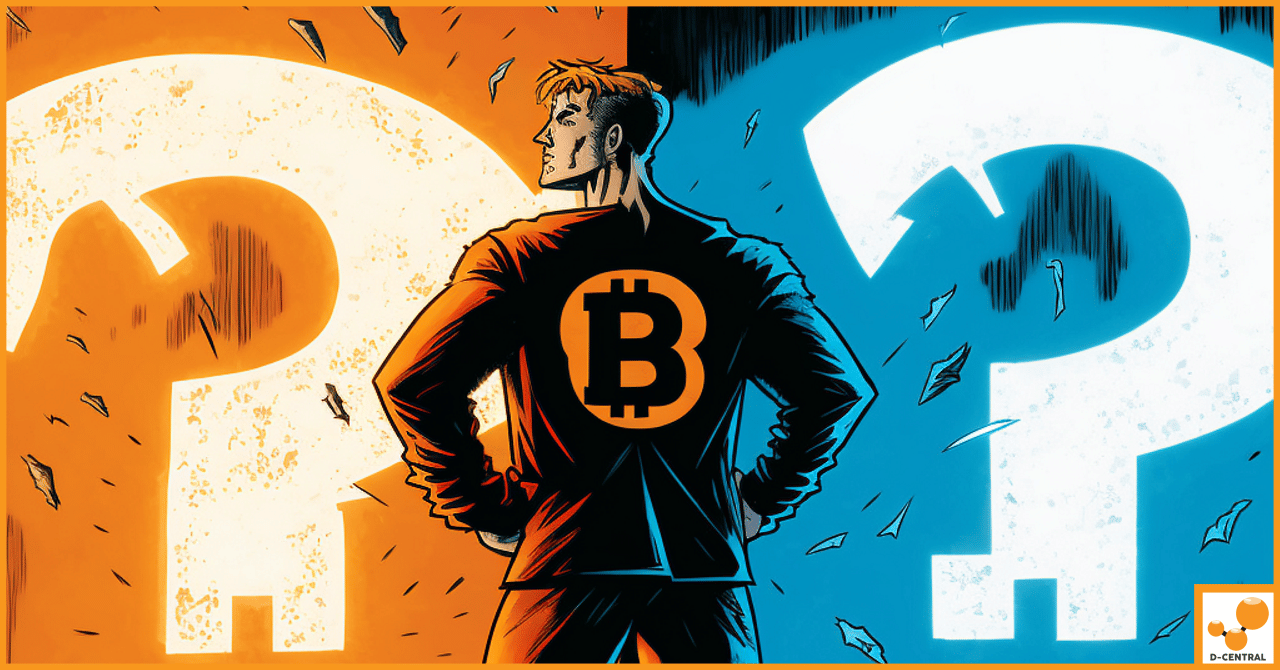

In the ever-evolving landscape of cryptocurrency, ASIC (Application-Specific Integrated Circuit) mining has emerged as a cornerstone of digital currency extraction.

The Antminer 17 series, including the Antminer T17, S17, T17+, S17+ and S17 Pro, have made a name for themselves

In the exciting world of cryptocurrencies, Bitcoin stands as the pioneering and most prominent digital asset. At the heart of