In the intricate web of global finance, the monetary system stands as the backbone, orchestrating the flow of money, facilitating trade, and anchoring economic policies. This system, comprising various currencies managed by respective central banks, ensures a semblance of economic stability and predictability essential for both everyday transactions and long-term investments. The stability of this system is paramount; any significant disruption can lead to dire consequences, as evidenced by historical episodes of hyperinflation and financial crises that have eroded wealth and trust in traditional monetary mechanisms.

Enter Bitcoin, a pioneering digital currency introduced in 2009 by an enigmatic figure or group known as Satoshi Nakamoto. Bitcoin emerged as a revolutionary alternative to the conventional monetary system, promising a decentralized framework free from the control of any central authority. Its underlying technology, blockchain, ensures transparency, security, and immutability of transactions, appealing to those disillusioned by the opaque operations of traditional financial institutions. Bitcoin’s capped supply of 21 million coins also presents a stark contrast to fiat currencies, which can be printed in unlimited quantities by governments, often leading to inflation.

However, Bitcoin’s ascent as a viable alternative to traditional money is not without its controversies, the most prominent being its substantial energy consumption. The process of Bitcoin mining, essential for transaction verification and network security, requires significant computational power, leading to concerns about its environmental impact and sustainability. Critics argue that the energy expended in mining Bitcoin, especially when sourced from non-renewable resources, could exacerbate climate change and divert energy from essential services. Proponents, however, contend that the energy consumption is a necessary trade-off for a secure, decentralized monetary system and that the network increasingly relies on renewable energy sources.

This debate underscores a critical examination of Bitcoin’s role in the broader context of monetary stability and economic sustainability. As we delve deeper into the nuances of Bitcoin’s energy consumption, it’s imperative to weigh its costs against the potential it holds in fortifying a stable, inclusive, and resilient monetary system for the digital age.

The Importance of a Stable Monetary System

A stable monetary system is the bedrock of a healthy economy, facilitating seamless trade, preserving wealth, and underpinning financial policies. At its core, this system hinges on three fundamental functions: serving as a medium of exchange, a store of value, and a unit of account.

Medium of Exchange: Money allows goods and services to be traded without the cumbersome process of bartering, where each party needs to have what the other desires. A widely accepted medium of exchange simplifies transactions and fosters economic activity.

Store of Value: For money to be effective, it must reliably preserve wealth over time, enabling individuals and businesses to save and plan for the future. This function is compromised when inflation erodes purchasing power, diminishing money’s value.

Unit of Account: Money provides a common measure for valuing goods and services, making it easier to compare prices, record debts, and conduct accounting. This standardization is crucial for economic planning and decision-making.

Historical instances of monetary instability vividly illustrate the catastrophic consequences of a failing monetary system. Zimbabwe’s hyperinflation in the late 2000s is a stark example, where the government’s excessive printing of money to finance debts led to an astronomical inflation rate, peaking at a staggering 79.6 billion percent month-on-month in November 2008. This hyperinflation rendered the Zimbabwean dollar virtually worthless, wiping out savings and pensions, and plunging millions into poverty.

Similarly, Venezuela has been grappling with hyperinflation since 2014, triggered by a combination of factors including plummeting oil prices, fiscal mismanagement, and excessive money printing. The Venezuelan bolívar has lost nearly all its value, devastating the economy and leading to widespread shortages of basic necessities, a humanitarian crisis, and a mass exodus of the population.

These examples underscore the pivotal role of trust and security in a monetary system. Trust ensures that money is accepted in exchange for goods and services and that it will retain its value over time. Security, both physical and digital, protects against counterfeiting, fraud, and cyber-attacks, maintaining the integrity of the monetary system. Without trust and security, the very foundation of the economy is at risk, leading to instability, loss of confidence, and potentially, a complete collapse of the monetary system.

In this light, the quest for a stable monetary system is not just an economic concern but a fundamental prerequisite for societal well-being and prosperity. The advent of digital currencies like Bitcoin presents new opportunities and challenges in this quest, promising enhanced security and decentralization but also raising questions about energy consumption and environmental sustainability.

Understanding Bitcoin’s Fundamentals

Bitcoin, the first and most well-known cryptocurrency, was introduced to the world in 2009 through a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” by an individual or group under the pseudonym Satoshi Nakamoto. The inception of Bitcoin was timely, emerging in the wake of the 2008 financial crisis, a period marked by significant distrust in traditional banking systems and financial institutions. The primary problem Bitcoin aimed to solve was the creation of a decentralized digital currency that could facilitate peer-to-peer transactions without the need for a central authority, thereby reducing the reliance on and risk associated with traditional financial intermediaries.

Differences from Traditional Fiat Currencies

- Decentralization: Unlike fiat currencies, which are issued and regulated by central banks, Bitcoin operates on a decentralized network of computers (nodes). This decentralization means no single entity, government, or organization controls Bitcoin, making it resistant to censorship and immune to centralized points of failure.

- Limited Supply: Bitcoin has a capped supply of 21 million coins, a stark contrast to fiat currencies, which can be printed in unlimited quantities by central banks, often leading to inflation. This fixed supply is encoded in Bitcoin’s protocol and is intended to mimic the scarcity and value preservation characteristics of precious metals like gold.

- Blockchain Technology: Bitcoin transactions are recorded on a public ledger known as the blockchain. This technology ensures transparency, as all transactions are visible to anyone on the network, and immutability, meaning once a transaction is recorded, it cannot be altered or deleted. This feature is crucial for building trust among participants in the absence of a central authority.

The Process of Bitcoin Mining

Bitcoin mining is the process by which new bitcoins are created and transactions are verified and added to the blockchain. Miners use specialized hardware to solve complex mathematical puzzles, a process that requires significant computational power and, consequently, energy. The first miner to solve the puzzle gets the right to add a new block of transactions to the blockchain and is rewarded with newly minted bitcoins (the block reward) and transaction fees.

The purpose of mining extends beyond the creation of new bitcoins. It is integral to the security and integrity of the Bitcoin network. By requiring miners to solve cryptographic puzzles, Bitcoin employs a consensus mechanism known as Proof of Work (PoW), which makes it prohibitively expensive and difficult for any malicious actor to alter the blockchain. To successfully conduct a fraudulent transaction or reverse a confirmed transaction, an attacker would need to control more than 50% of the network’s mining power, a feat that is practically unfeasible given the vast and distributed nature of the mining network.

In summary, Bitcoin’s fundamentals lie in its innovative use of blockchain technology to offer a decentralized, transparent, and secure monetary system. Its mining process not only facilitates the creation of new bitcoins and the verification of transactions but also underpins the entire network’s security, making Bitcoin a pioneering force in the realm of digital currencies.

The Energy Dynamics of Bitcoin Mining

Bitcoin mining, the engine of the Bitcoin network, is both a critical and energy-intensive process. It involves miners using powerful computers to solve complex mathematical puzzles, a mechanism known as Proof of Work (PoW). This process secures the network, validates transactions, and introduces new bitcoins into circulation.

How Bitcoin Mining Works and Its Energy Requirements

At the heart of Bitcoin mining is the PoW algorithm, which requires miners to compute hashes—unique digital signatures for blocks of transactions. The goal is to find a hash that meets a specific condition set by the network, known as the “difficulty target.” This target adjusts approximately every two weeks to ensure that the time it takes to find a new block remains about ten minutes, regardless of the total computational power on the network.

The energy-intensive part of mining lies in the sheer number of calculations miners’ computers must perform to find the correct hash. These specialized computers, known as ASICs (Application-Specific Integrated Circuits), are designed solely for mining Bitcoin and consume significant amounts of electricity to operate 24/7. The energy consumption of the Bitcoin network is a direct result of the cumulative energy used by all miners worldwide in their quest to secure the network and mine new bitcoins.

Comparison with Other Industries and Global Energy Usage

Bitcoin’s energy consumption has been a topic of much debate, often compared to the energy usage of entire countries. According to the Cambridge Bitcoin Electricity Consumption Index, Bitcoin’s annualized energy consumption hovers around the energy usage of smaller countries. While these comparisons highlight Bitcoin’s significant energy footprint, it’s essential to contextualize this within the broader scope of global energy consumption.

When compared to other industries, Bitcoin’s energy usage is on par with or less than sectors like gold mining, banking systems, and even the energy lost through transmission and distribution in traditional power grids. It’s also worth noting that the global IT industry, including data centers, internet services, and personal devices, consumes a substantial portion of the world’s energy, far exceeding Bitcoin’s consumption.

Sources of Energy for Bitcoin Mining

The type of energy sources powering Bitcoin mining operations is crucial in assessing the environmental impact. There’s a growing trend towards using renewable energy sources in mining, driven by economic incentives and environmental considerations. Regions with abundant and cheap renewable energy, such as hydroelectric power in Sichuan, China, or geothermal energy in Iceland, have become hotspots for Bitcoin mining. These renewable sources help mitigate the environmental concerns associated with Bitcoin’s energy consumption.

However, it’s undeniable that a portion of Bitcoin mining still relies on non-renewable sources, particularly in regions where coal or natural gas is abundant and cheap. The geographical distribution of mining activities is influenced by factors such as energy costs, climate (cool climates reduce cooling costs for mining equipment), and local regulations, leading to a diverse global landscape of energy sources for Bitcoin mining.

In summary, the energy dynamics of Bitcoin mining are complex, intertwining technological, economic, and environmental considerations. While Bitcoin mining consumes a significant amount of energy, it’s essential to compare this consumption to other industries and the global energy landscape. The shift towards renewable energy sources in mining is a positive trend, reflecting the Bitcoin community’s awareness and response to environmental concerns.

The True Cost of Bitcoin’s Energy Consumption

The energy consumption of Bitcoin mining has sparked intense debate, focusing on its environmental impact and sustainability. Critics argue that the substantial electricity usage contributes to carbon emissions, especially when sourced from fossil fuels, raising concerns about Bitcoin’s role in climate change. However, a nuanced examination reveals a more complex picture, involving the utilization of “wasted” energy and significant efficiency improvements over time.

Environmental Impact and Sustainability Concerns

The primary critique of Bitcoin’s energy consumption centers on its potential environmental impact. The carbon footprint of Bitcoin mining is contingent on the energy mix used; regions relying on coal or other fossil fuels for electricity generation exacerbate the environmental concerns. Critics contend that in the face of global efforts to combat climate change, the energy-intensive process of Bitcoin mining is unsustainable and detracts from the energy available for essential services and industries.

However, proponents argue that the security and decentralization provided by Bitcoin justify its energy expenditure. They highlight the need for a comparative analysis with the traditional financial sector, including the energy consumed by banks, ATMs, and the gold mining industry, which also have significant environmental footprints.

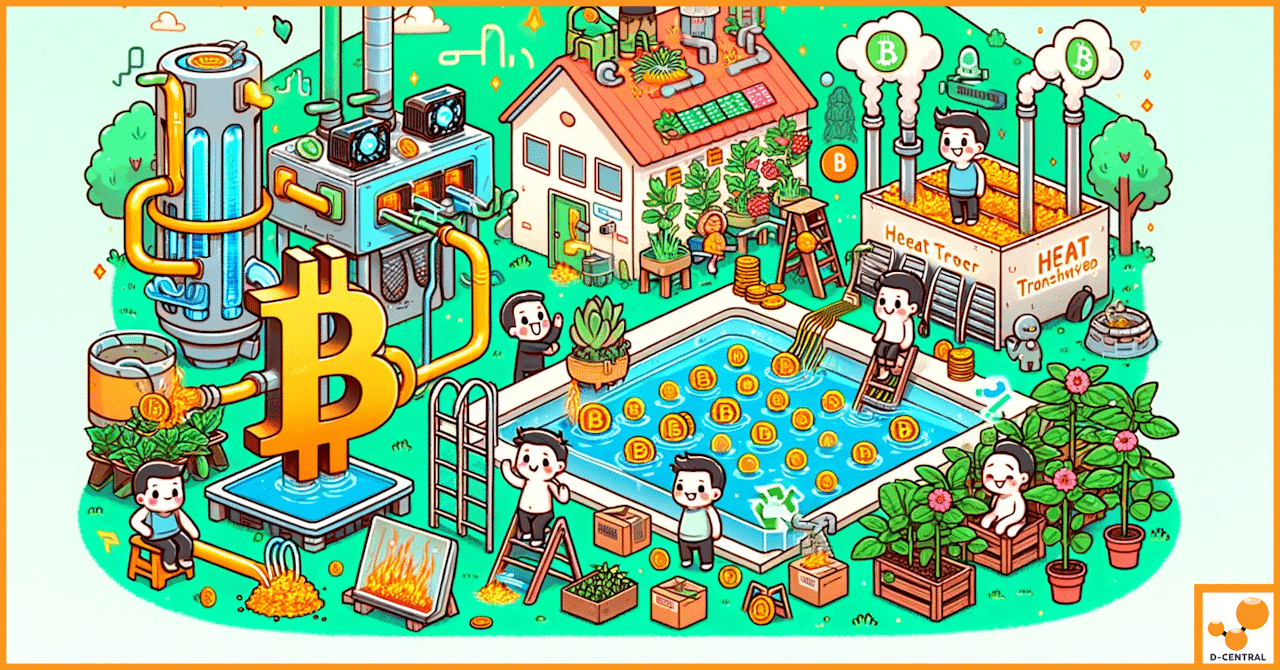

Utilization of “Wasted” Energy Resources

A counterpoint to the critique of Bitcoin’s energy usage is the concept of utilizing “wasted” energy. In many instances, Bitcoin mining operations are set up in locations where excess energy would otherwise go unused. For example, surplus hydroelectric power during rainy seasons or flared natural gas from oil extraction sites can be repurposed for Bitcoin mining. This not only reduces waste but also provides a revenue stream for energy producers, turning a potential environmental liability into an asset.

Moreover, Bitcoin mining can act as a “grid balancer” by consuming excess energy during low-demand periods and scaling back during peak times. This flexibility can enhance the stability of renewable energy grids, which often suffer from overproduction issues due to their intermittent nature.

Efficiency Improvements in Bitcoin Mining

Over the years, Bitcoin mining has seen significant advancements in efficiency, driven by technological innovation and economic incentives. The evolution from CPU and GPU mining to specialized ASIC miners has dramatically increased the computational power while reducing energy consumption per hash. Modern ASIC miners are designed to maximize hashes per watt of electricity, reflecting the industry’s push towards sustainability.

Mining operations have also become more sophisticated, with increased attention to energy sourcing and cooling techniques. Innovations such as immersion cooling and the use of renewable energy sources have further improved the efficiency and environmental footprint of Bitcoin mining.

While Bitcoin’s energy consumption is substantial, it’s essential to consider the broader context of its environmental impact, the innovative use of wasted energy, and the continuous improvements in mining efficiency. The true cost of Bitcoin’s energy usage must be weighed against the benefits it provides in terms of security, decentralization, and the potential for a more inclusive financial system. As the industry evolves, the focus on sustainability and efficiency is likely to increase, mitigating some of the concerns surrounding Bitcoin’s energy consumption.

Bitcoin’s Contribution to Economic Stability

Bitcoin, since its inception, has been posited as a revolutionary alternative to traditional financial systems, offering solutions to some of the inherent vulnerabilities of conventional banking. Its decentralized nature, finite supply, and global accessibility present a unique proposition for economic stability, especially in regions plagued by currency instability and financial repression.

An Alternative to Traditional Banking Vulnerabilities

Traditional banking systems, while foundational to modern economies, are not without their flaws. Centralized control, susceptibility to political interference, and the risk of systemic failures, as evidenced by the 2008 financial crisis, highlight the need for an alternative. Bitcoin, with its decentralized ledger and absence of central authority, offers a resilient system immune to single points of failure. Transactions on the Bitcoin network are irreversible and secure, reducing the risk of fraud and counterfeiting that can afflict traditional banking.

Moreover, Bitcoin’s transparent and open nature contrasts sharply with the often opaque operations of conventional financial institutions. This transparency fosters trust among users, who can verify transactions independently without relying on a third party.

Empowerment in Economically Unstable Regions

In countries where economic instability is the norm, and currencies are subject to rampant inflation, Bitcoin provides a lifeline. Nations like Venezuela, Zimbabwe, and Argentina, where hyperinflation has eroded the value of national currencies, have seen growing adoption of Bitcoin. It serves not only as a medium of exchange but, more importantly, as a store of value that is not subject to government devaluation or capital controls.

Financial repression, characterized by policies that lead to low or negative real interest rates, often forces savers to seek alternative stores of wealth. Bitcoin, with its capped supply and global market, offers an escape from the eroding effects of such policies, enabling individuals to preserve their purchasing power.

Hedging Against Inflation and Preserving Wealth

Bitcoin’s fixed supply of 21 million coins stands in stark contrast to fiat currencies, which can be printed in unlimited quantities by central banks, leading to inflation. This scarcity mimics the properties of gold, a traditional hedge against inflation, but with the added benefits of digital transferability and divisibility.

As a non-sovereign asset, Bitcoin is not tied to the economic policies of any single country, making it an attractive option for diversifying portfolios and hedging against currency devaluation. Its performance during periods of economic uncertainty, including inflation spikes in traditional economies, has bolstered its reputation as “digital gold.”

Bitcoin’s contributions to economic stability are multifaceted. It offers a secure, transparent, and decentralized alternative to traditional banking systems, provides a stable store of value in regions affected by economic instability and financial repression, and serves as a potential hedge against inflation. As the global financial landscape evolves, Bitcoin’s role in fostering economic stability and preserving wealth continues to gain recognition and acceptance.

The Trade-offs and Balancing Act

The ascent of Bitcoin as a pivotal player in the financial landscape brings to the fore a complex interplay of factors, notably the trade-offs between its energy consumption, the imperative of network security, and the overarching principle of economic freedom. This balancing act is at the heart of the ongoing discourse surrounding Bitcoin, as stakeholders strive to harmonize these elements in pursuit of a sustainable and equitable monetary system.

Navigating the Trade-offs

- Energy Consumption vs. Network Security: The security of the Bitcoin network, underpinned by the Proof of Work (PoW) consensus mechanism, is inextricably linked to its energy consumption. The process of mining, while energy-intensive, is what ensures the integrity and trustworthiness of the Bitcoin blockchain. This presents a trade-off where reducing energy consumption could potentially compromise network security. The challenge lies in maintaining an optimal level of security without imposing undue environmental costs.

- Economic Freedom vs. Environmental Responsibility: Bitcoin’s promise of economic freedom — a decentralized currency outside the control of any single entity — is tempered by concerns over its environmental footprint. Advocates of Bitcoin argue that the economic empowerment it offers, especially in regions with unstable currencies and financial repression, justifies its energy use. However, there’s a growing recognition of the need to balance this freedom with environmental stewardship, ensuring that the pursuit of financial autonomy does not come at the expense of ecological sustainability.

Efforts Towards Sustainable Bitcoin Mining

The Bitcoin community and broader industry are actively engaged in efforts to mitigate the environmental impact of mining and enhance its sustainability:

- Transition to Renewable Energy: There’s a concerted push towards powering Bitcoin mining operations with renewable energy sources. Regions rich in hydroelectric, geothermal, and wind energy are becoming increasingly attractive for mining operations, reducing the reliance on fossil fuels. This shift not only addresses environmental concerns but, in many cases, is economically advantageous due to the lower cost of renewable energy in certain areas.

- Mining Efficiency Innovations: Technological advancements in mining hardware are continually improving energy efficiency, reducing the amount of electricity required for each hash computed. Innovations in cooling technologies and mining farm management are also contributing to more sustainable practices, ensuring that the energy consumed is utilized as effectively as possible.

- Strategic Load Management: Some mining operations are exploring strategies to align their energy demand with the availability of renewable energy, such as ramping up mining activities during periods of excess supply (e.g., sunny or windy conditions for solar and wind power, respectively) and reducing them when energy is scarcer. This approach not only optimizes the use of renewable energy but also supports grid stability.

Future Outlook and Impact on the Monetary System

Looking ahead, the trajectory of Bitcoin’s energy consumption and its implications for the monetary system will be shaped by several factors:

- Regulatory Environment: As governments and regulatory bodies become more attuned to the environmental implications of Bitcoin mining, we may see policies that encourage or mandate the use of renewable energy sources, potentially influencing the geographical distribution of mining activities.

- Technological and Market Innovations: Continued innovation in mining technology and energy generation could further reduce the environmental impact of Bitcoin mining. Market mechanisms, such as carbon credits or green certificates for renewable energy usage in mining, could incentivize sustainable practices.

- Community and Industry Initiatives: The collective action of the Bitcoin community and industry stakeholders in prioritizing sustainability can drive significant change. Initiatives aimed at transparency in energy sourcing and collaborative efforts to increase the use of renewable energy can enhance the sustainability profile of Bitcoin mining.

In sum, the trade-offs inherent in Bitcoin’s operation — between energy consumption, network security, and economic freedom — are the subject of an ongoing balancing act. The path forward involves a collaborative effort to harness technological innovation, regulatory frameworks, and community initiatives to ensure that Bitcoin can fulfill its promise as a secure, decentralized currency while upholding the principles of environmental sustainability and economic empowerment.

Conclusion

Bitcoin’s emergence as a pioneering digital currency has undeniably reshaped the contours of the global monetary system, presenting a decentralized alternative that promises enhanced security, transparency, and resilience against the vulnerabilities inherent in traditional financial infrastructures. Its unique proposition of a finite supply, coupled with the immutable and transparent nature of blockchain technology, underscores Bitcoin’s potential to serve as a bulwark against inflation and financial instability, thereby contributing to a more stable economic landscape.

However, the discourse surrounding Bitcoin’s ascent is inextricably linked to concerns over its energy consumption, a topic that has polarized opinions and sparked rigorous debate. It is imperative to adopt a balanced perspective in this regard, one that meticulously weighs the environmental costs against the broader benefits that Bitcoin brings to the table in terms of economic empowerment, particularly in regions marred by currency devaluation and financial repression. The narrative should not be oversimplified but rather encompass a nuanced understanding of the trade-offs involved.

As we navigate the evolving landscape of cryptocurrencies, it is clear that they are poised to play a significant role in shaping the future of global finance. The dynamism of this domain, marked by rapid technological advancements and regulatory developments, calls for continuous learning and adaptation.

For those intrigued by the transformative potential of Bitcoin and the broader cryptocurrency ecosystem, the journey begins with education. Delving into the intricacies of blockchain technology and understanding the mechanics of cryptocurrencies are crucial steps in demystifying this complex yet fascinating world. Numerous resources, from online courses to scholarly articles, offer gateways to acquiring this knowledge.

Participation in the cryptocurrency ecosystem, however, should be approached with a sense of responsibility and sustainability. Prospective investors and enthusiasts are encouraged to consider the environmental implications of their engagements, seeking out platforms and initiatives that prioritize renewable energy sources and sustainable practices. The collective action of the community can significantly influence the trajectory towards a more environmentally conscious and sustainable cryptocurrency landscape.

In conclusion, Bitcoin, with its promise of decentralization and economic freedom, continues to captivate the imagination of many. Its role in the tapestry of global finance is evolving, marked by challenges and opportunities alike. As we stand at the cusp of this financial revolution, the onus is on us to foster a responsible and informed approach to navigating the cryptocurrency ecosystem, ensuring that its growth is aligned with the principles of sustainability and inclusivity.

FAQ

What is Bitcoin and how does it differ from traditional money?

Bitcoin is a digital currency introduced in 2009, offering a decentralized alternative free from central authority control, unlike traditional money managed by central banks. It’s built on blockchain technology, ensuring transparency and security, and has a capped supply of 21 million coins, contrasting with the limitless printing of fiat currencies.

What concerns surround Bitcoin’s energy consumption?

Concerns about Bitcoin’s energy consumption revolve around its environmental impact, particularly when the energy comes from non-renewable sources, raising sustainability and climate change issues. Critics argue this energy use is excessive, while proponents believe it’s justified for maintaining a secure, decentralized network.

How does Bitcoin mining work and why is it energy-intensive?

Bitcoin mining involves solving complex mathematical puzzles using specialized hardware (ASICs), a process that validates transactions and secures the network. This Proof of Work process is energy-intensive because it requires significant computational power and electricity to perform the needed calculations to find the correct hash for block addition.

Can Bitcoin contribute to economic stability?

Yes, Bitcoin can contribute to economic stability by offering a decentralized currency system immune to traditional banking vulnerabilities, acting as a hedge against inflation, and providing economic freedom, especially in regions experiencing currency instability and financial repression.

What are the potential environmental benefits of Bitcoin mining?

Bitcoin mining can utilize “wasted” energy resources, like surplus hydroelectric power or flared natural gas, turning a potential environmental liability into an asset. It also promotes the use of renewable energy sources and can act as a grid balancer by consuming excess energy during low-demand periods.

What measures are being taken to reduce Bitcoin’s environmental impact?

Efforts include transitioning to renewable energy sources, improving mining efficiency through technological innovations, and strategic load management to align energy demand with renewable supply availability. There’s also a push within the community and industry towards sustainability and environmental responsibility.