The Settlement Layer of Banking: How Bitcoin & Lightning Network Work

In the intricate world of financial transactions, the settlement layer serves as the backbone of traditional banking systems, ensuring the

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

Bitcoin mining stands as the backbone of the blockchain network, a critical process that not only introduces new bitcoins into circulation but also plays a pivotal role in maintaining and securing the blockchain ledger. Through the intricate mechanism of proof-of-work, miners compete to solve complex mathematical puzzles, a task that requires significant computational power and energy. The first miner to solve the puzzle gets the privilege to add a new block to the blockchain and, in return, receives a reward in the form of bitcoins along with transaction fees. This incentivized system ensures the continuous growth and integrity of the blockchain, making every transaction within the network transparent, immutable, and secure.

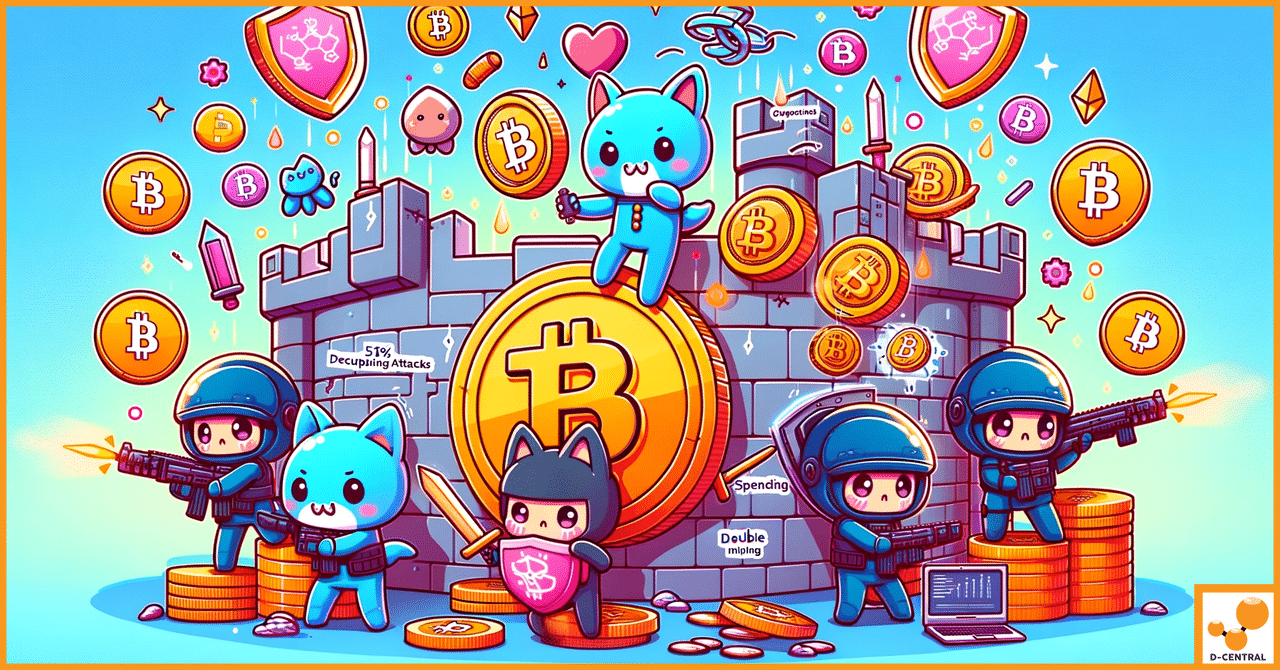

However, the decentralized and competitive nature of Bitcoin mining opens the door to various potential attacks. These attacks, if successful, can undermine the security, fairness, and efficiency of the network, posing significant risks not only to the miners’ potential rewards but also to the trust and reliability of the entire Bitcoin ecosystem. Understanding these mining attacks is crucial for miners, network participants, and anyone involved in the cryptocurrency space. It equips them with the knowledge to safeguard their operations, contribute to the network’s resilience, and ensure the long-term stability and security of the blockchain.

In this comprehensive guide, we delve into the intricate world of Bitcoin mining attacks. We aim to unravel the complexities behind each type of attack, from the well-known 51% attack to more nuanced strategies like selfish mining and eclipse attacks. Our exploration will not only shed light on how these attacks are orchestrated but also discuss their implications on the network and the broader cryptocurrency community. By providing a detailed examination of these potential threats, we equip miners and network participants with the insights needed to fortify their defenses, ensuring the continued strength and integrity of the Bitcoin blockchain.

At the heart of the Bitcoin network lies the process of mining, a distributed consensus system that accomplishes several critical functions: it confirms transactions in a trustless manner, secures the network, and introduces new bitcoins into circulation. The essence of Bitcoin mining revolves around the proof-of-work (PoW) algorithm, a mechanism that requires miners to solve complex mathematical puzzles to validate transactions and create new blocks.

Proof-of-work is designed to be computationally demanding, ensuring that the process of finding a solution (often referred to as the “nonce”) that satisfies a specific condition is both challenging and resource-intensive. This condition usually involves generating a hash value for the block that is below a certain target. The difficulty of this task ensures that the addition of new blocks to the blockchain occurs at a relatively constant rate, approximately every 10 minutes.

The first miner who successfully solves the puzzle and validates the block is rewarded with newly minted bitcoins — known as the “block reward” — and the transaction fees associated with the transactions included in the new block. This reward system not only incentivizes miners to contribute their computational power to the network but also serves as the mechanism through which new bitcoins are introduced into the system, adhering to the predetermined issuance rate set forth by the Bitcoin protocol.

Given the competitive nature of mining and the increasing difficulty of puzzles, individual miners often find it challenging to consistently solve blocks and earn rewards. This challenge has led to the formation of mining pools, collaborative groups where miners combine their computational resources to increase their collective chances of solving blocks. When a pool successfully mines a block, the reward is distributed among its participants, typically in proportion to the amount of computational power each miner contributed.

Mining pools play a significant role in the Bitcoin ecosystem by democratizing the mining process. They allow individual miners with limited resources to participate in the mining process and earn a more steady and predictable stream of income. However, the centralization of mining power within large pools raises concerns about network security and the potential for certain types of attacks, as a pool with a majority of the network’s hash rate could, in theory, exert undue influence over the blockchain.

In summary, Bitcoin mining, underpinned by the proof-of-work algorithm and the mining reward system, is fundamental to the operation and security of the Bitcoin network. Mining pools, while instrumental in making mining accessible to a broader range of participants, introduce considerations regarding the distribution of mining power and the implications for network security. Understanding these foundational elements is crucial for anyone involved in the Bitcoin mining ecosystem.

The Bitcoin consensus mechanism is a cornerstone of the cryptocurrency’s underlying technology, ensuring that all participants in the network agree on a single version of the truth, despite the absence of a central authority. This consensus is achieved through a combination of the proof-of-work (PoW) algorithm and the longest chain rule, which together facilitate agreement on the state of the blockchain and the validity of transactions.

At the heart of Bitcoin’s consensus mechanism lies the longest chain rule, also known as the “longest valid chain” rule. This rule stipulates that among multiple versions of the blockchain, the one with the greatest cumulative proof of work, manifested as the longest chain of blocks, is considered the valid and authoritative version of the blockchain. This principle ensures network integrity by making it prohibitively expensive and technically challenging to alter confirmed transactions.

The importance of the longest chain rule cannot be overstated. It serves as the final arbitrator in situations where two miners solve a block at nearly the same time, leading to a temporary fork in the blockchain. Nodes in the network will choose to extend the chain they first receive, but eventually, as subsequent blocks are added and one chain becomes longer, the network converges on this longer chain. Transactions in the blocks of the shorter, abandoned chain are returned to the pool of unconfirmed transactions, waiting to be included in future blocks.

Miners play a pivotal role in extending the blockchain and ensuring the security of transactions. By solving complex mathematical puzzles through the proof-of-work process, miners validate and confirm transactions, packaging them into blocks that are added to the blockchain. This process not only prevents double-spending by ensuring that each bitcoin is spent only once but also secures the network against fraudulent transactions and potential attacks.

Each new block mined adds to the cumulative proof of work of the blockchain, reinforcing the security of all preceding blocks. The deeper a particular block is within the chain, the more secure it becomes, as altering it would require recomputing the proof of work for it and all subsequent blocks — a task that would require an astronomical amount of computational power and energy, making such an endeavor economically unfeasible for would-be attackers.

Moreover, miners contribute to the decentralized nature of the Bitcoin network. By distributing the task of transaction validation and block creation across numerous miners around the world, Bitcoin avoids the pitfalls of centralization that could lead to single points of failure or manipulation. This decentralized consensus mechanism ensures that no single entity can control the Bitcoin network, preserving its integrity and trustlessness.

In summary, the Bitcoin consensus mechanism, through the longest chain rule and the critical role of miners, ensures the integrity of the blockchain and the security of transactions. This decentralized system of agreement allows the Bitcoin network to function smoothly, securely, and without the need for a central authority, embodying the principles of decentralization and trustlessness that are central to the philosophy of Bitcoin.

The decentralized and competitive nature of Bitcoin mining, while being one of its strengths, also opens up the network to a variety of potential attacks. Understanding these threats is crucial for maintaining the security and integrity of the Bitcoin network.

Definition and Mechanics: A double spend attack occurs when an entity manages to spend the same bitcoins more than once. This is achieved by broadcasting one transaction to the network, waiting for it to be confirmed, and then creating an alternative transaction using the same coins but directed to a different recipient. The attacker then attempts to have the second transaction confirmed, ideally replacing the first in the blockchain, effectively “double-spending” the bitcoins.

Real-World Implications: Double spend attacks undermine the trust in the Bitcoin network’s transaction finality. If successful, they can lead to financial losses for merchants or individuals who accept the invalidated transaction.

Strategies for Detection and Prevention: Network participants can mitigate the risk of double spend attacks by waiting for multiple confirmations before considering a transaction final. More confirmations mean greater security, as altering deeper transactions in the blockchain becomes exponentially more difficult.

Explanation: A majority attack, also known as a 51% attack, occurs when a single entity or collaborative group controls more than half of the total hashing power of the network. This dominance allows them to prevent new transactions from gaining confirmations, halt payments between some or all users, and even reverse transactions that were completed while they controlled the network, leading to double spending.

Feasibility and Economic Implications: While technically possible, executing a 51% attack on Bitcoin is economically prohibitive due to the immense amount of computational power and electricity required. The costs associated with amassing such power often outweigh the potential gains from the attack, making it an unattractive option for rational actors.

Overview: Selfish mining is a strategy where a miner finds a new block but deliberately withholds it from other miners. By secretly building a longer chain in private, the selfish miner can invalidate the honest miners’ work, eventually publishing their secret chain to become the longest chain that others must accept.

Impact and Countermeasures: Selfish mining can lead to reduced network efficiency and fairness, as honest miners waste resources on blocks that will not be included in the blockchain. Countermeasures include network-level strategies that make it less profitable or more difficult to execute such attacks, such as altering the reward system or enhancing the propagation of blocks to reduce the advantage of hidden chains.

Description: In an eclipse attack, an attacker takes control of a node’s view of the blockchain by monopolizing all of its incoming and outgoing connections. This isolation allows the attacker to filter and manipulate the victim’s view of the blockchain, potentially leading to double spending or other fraudulent activities.

Mitigation Techniques: Nodes can protect themselves from eclipse attacks by ensuring they connect to a diverse and reliable set of peers. Network-level solutions include implementing more robust peer discovery mechanisms and limiting the influence any single node can have over another’s view of the blockchain.

Explanation: Empty block mining involves miners solving the proof-of-work puzzle and creating new blocks without including any transactions except for the block reward transaction. While not inherently malicious, this practice can reduce the network’s transaction throughput and increase the time it takes for transactions to be confirmed.

Discussion: Miners might mine empty blocks due to network latency issues or as a strategy to earn block rewards without the additional effort of processing transactions. Encouraging the inclusion of transactions through better reward mechanisms or improving network protocols to reduce latency can discourage the practice of empty block mining.

Understanding and mitigating these attacks are essential for the security and efficiency of the Bitcoin network. Continuous vigilance, research, and protocol improvements are vital to safeguarding the network against these potential threats.

As the Bitcoin network evolves, so too do the strategies employed by those looking to exploit its mechanisms. While the more common attacks like double spending and 51% attacks are well-understood and guarded against, the Bitcoin ecosystem must remain vigilant against less common, yet potentially disruptive, threats. Among these are timejacking and Finney attacks, each presenting unique challenges to network security.

Exploration: Timejacking refers to a network-level attack where malicious nodes manipulate the timestamp of a peer node’s system clock. By skewing a node’s perception of time, an attacker can potentially alter the order of transactions and blocks, leading to inconsistencies in the blockchain. This manipulation can disrupt the network’s consensus mechanism, leading to double spends or delayed transaction confirmations.

Mitigation Strategies: To counter timejacking, nodes can implement more robust time-checking mechanisms, such as referencing a median time past from a sample of peers rather than relying on a single source. Additionally, enhancing the security protocols for time synchronization within the network can help prevent such attacks.

Exploration: A Finney attack is a sophisticated form of double spending where an attacker pre-mines a block containing a transaction that spends certain bitcoins. Before broadcasting this block to the network, the attacker makes another transaction using the same bitcoins to purchase goods or services. Once the second transaction is accepted, the attacker releases the pre-mined block to the network, which contains the first transaction, effectively reversing the second transaction.

Mitigation Strategies: The best defense against Finney attacks is for recipients to wait for multiple confirmations before considering a transaction final. This requirement makes it significantly harder for an attacker to successfully execute the attack, as they would need to outpace the network in finding subsequent blocks.

The landscape of mining attacks is continually evolving, driven by advancements in technology, changes in network protocols, and the increasing value of Bitcoin. As such, the Bitcoin community must remain proactive in identifying potential vulnerabilities and developing adaptive security measures to address new threats as they arise.

Importance of Adaptive Security Measures: The continuous adaptation of security measures is crucial for the resilience of the Bitcoin network. This includes ongoing research into potential attack vectors, regular updates to the Bitcoin protocol to address identified vulnerabilities, and the cultivation of a vigilant and informed community that can respond swiftly to emerging threats.

While advanced threats like timejacking and Finney attacks currently represent a relatively low risk to the Bitcoin network, their potential impact cannot be ignored. The community’s commitment to security, through both preventive measures and rapid response capabilities, will be vital in safeguarding the network against these and other emerging concerns.

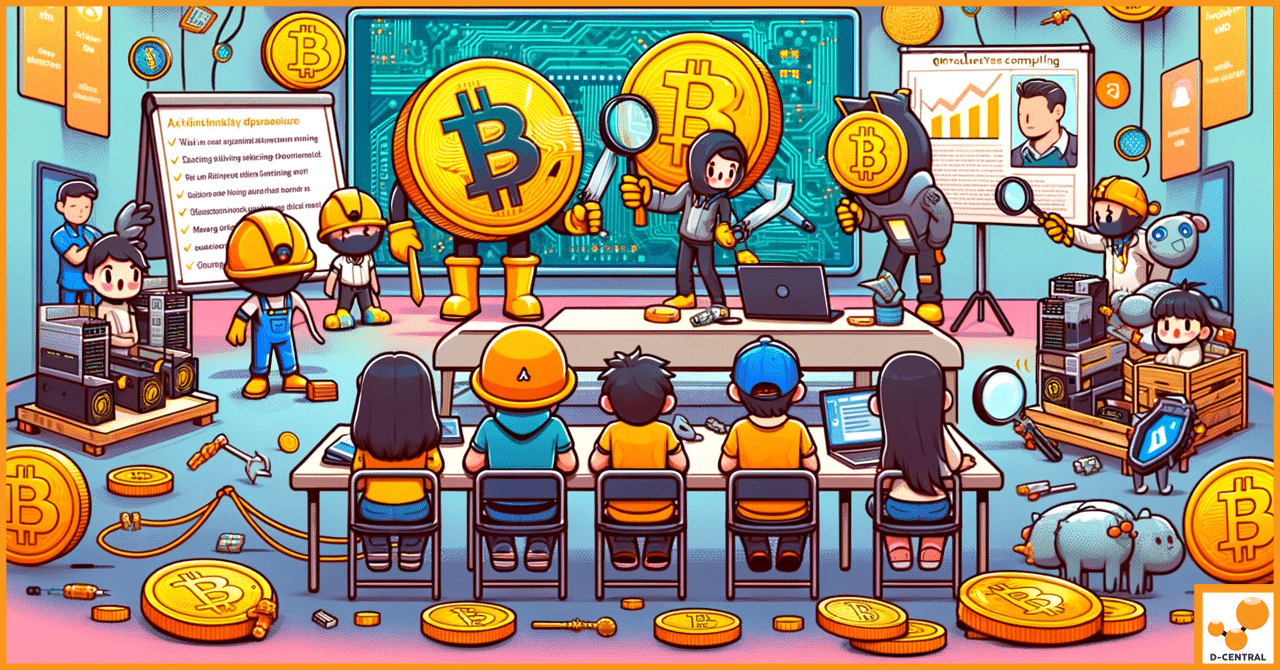

Ensuring the security and integrity of the Bitcoin network is a collective responsibility shared by miners, developers, and participants. Implementing best practices and staying vigilant against potential attacks are crucial steps in safeguarding the network. Here’s a comprehensive guide on strategies and practices to enhance network security.

By adhering to these best practices and supporting ongoing network enhancements, miners and participants can contribute to a more secure and resilient Bitcoin network. The collective effort to maintain security is not only vital for the protection of individual investments but also crucial for the long-term viability and trust in Bitcoin as a decentralized financial system.

In this comprehensive exploration of Bitcoin mining and its associated security challenges, we’ve delved into the intricate mechanisms that underpin the network’s operation, from the foundational proof-of-work algorithm to the critical role of miners in maintaining blockchain integrity. We’ve navigated through the spectrum of potential attacks, including double spend attacks, majority attacks, selfish mining, eclipse attacks, and empty block mining, each presenting unique threats to the network’s stability and fairness.

The advanced threats section highlighted less common but equally disruptive attacks like timejacking and Finney attacks, underscoring the evolving landscape of security challenges that miners and network participants must be prepared to confront. In response to these threats, we outlined a series of best practices and mitigation strategies, emphasizing the importance of network upgrades, protocol enhancements, and community vigilance in fortifying the network against potential vulnerabilities.

The critical takeaway from this discussion is the paramount importance of awareness, education, and proactive security measures in safeguarding the Bitcoin network. As participants in this decentralized ecosystem, it is incumbent upon us to stay informed about the latest developments in mining security, to adopt best practices in our operations, and to contribute to the collective effort to enhance network resilience.

We encourage readers to actively engage in community discussions, share knowledge, and collaborate on security initiatives. By fostering a culture of openness and cooperation, we can ensure the continued security and stability of Bitcoin mining.

For those looking to deepen their understanding and enhance their operational security, a wealth of resources, training programs, and tools are available. We invite you to explore these resources, to equip yourself with the knowledge and skills needed to navigate the complexities of Bitcoin mining with confidence and to contribute to the ongoing security and success of the Bitcoin network.

What is Bitcoin mining?

Bitcoin mining is the process by which new bitcoins are introduced into circulation and where transactions are confirmed by the network. Miners compete to solve complex mathematical puzzles, which allows them to add a new block to the blockchain and receive rewards in the form of newly minted bitcoins and transaction fees.

How does the proof-of-work algorithm function in Bitcoin mining?

The proof-of-work (PoW) algorithm requires miners to solve challenging mathematical puzzles to validate transactions and create new blocks. This process is designed to be computationally demanding to regulate the addition of new blocks to the blockchain at a constant rate and to ensure network security and integrity.

What role do mining pools play in the Bitcoin ecosystem?

Mining pools are collaborative groups where miners combine their computational resources to increase their chances of solving blocks and earning rewards. This setup democratizes the mining process, allowing individual miners to participate and earn a more steady and predictable income.

What are the potential security threats to Bitcoin mining?

Potential security threats to Bitcoin mining include double spend attacks, majority (51%) attacks, selfish mining, eclipse attacks, empty block mining, timejacking, and Finney attacks. These attacks can undermine network security and efficiency, posing risks to miners and the broader cryptocurrency community.

How can miners and network participants mitigate security risks?

To mitigate security risks, miners and participants should wait for multiple confirmations before accepting transactions, regularly update their software, use secure connections, diversify peer connections, monitor hash rate distribution, implement rate limiting, and stay informed about the latest threats and best practices.

Why is the decentralization of hash power important?

The decentralization of hash power is crucial for the security of the Bitcoin network because it prevents any single entity from gaining control over the blockchain. This reduces the risk of 51% attacks and ensures no one party can manipulate transaction confirmations or reverse transactions.

How does the Bitcoin community safeguard against advanced mining attacks?

The Bitcoin community safeguards against advanced mining attacks through continuous vigilance, research, protocol improvements, and the cultivation of an informed community. This includes the adoption of new protocols, network upgrades, and the sharing of knowledge and resources to develop robust defense mechanisms.

What is the significance of network upgrades and protocol enhancements for Bitcoin’s security?

Network upgrades and protocol enhancements are critical for Bitcoin’s security as they can introduce new features that mitigate vulnerabilities, improve the network’s resilience against attacks, and enhance overall efficiency. Participation in these upgrades by miners and network participants is essential for the continued strength and integrity of the Bitcoin network.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

In the intricate world of financial transactions, the settlement layer serves as the backbone of traditional banking systems, ensuring the

In the world of cryptocurrency, Bitcoin mining ASICs (Application-Specific Integrated Circuits) have revolutionized the way we secure and validate transactions

Bitcoin mining stands as a fundamental pillar that supports the entire Bitcoin ecosystem. Governed by the principles of proof of