Bitcoin, the first and most well-known cryptocurrency, has revolutionized the financial landscape since its inception in 2009. At its core, Bitcoin operates on a decentralized network, utilizing a distributed ledger technology known as blockchain. This decentralization is vital, ensuring that no single entity has control over the network, thereby enhancing security, privacy, and resistance to censorship. It’s this foundational principle that has attracted a diverse community of users, developers, and investors, all drawn to the promise of a more open and accessible financial system.

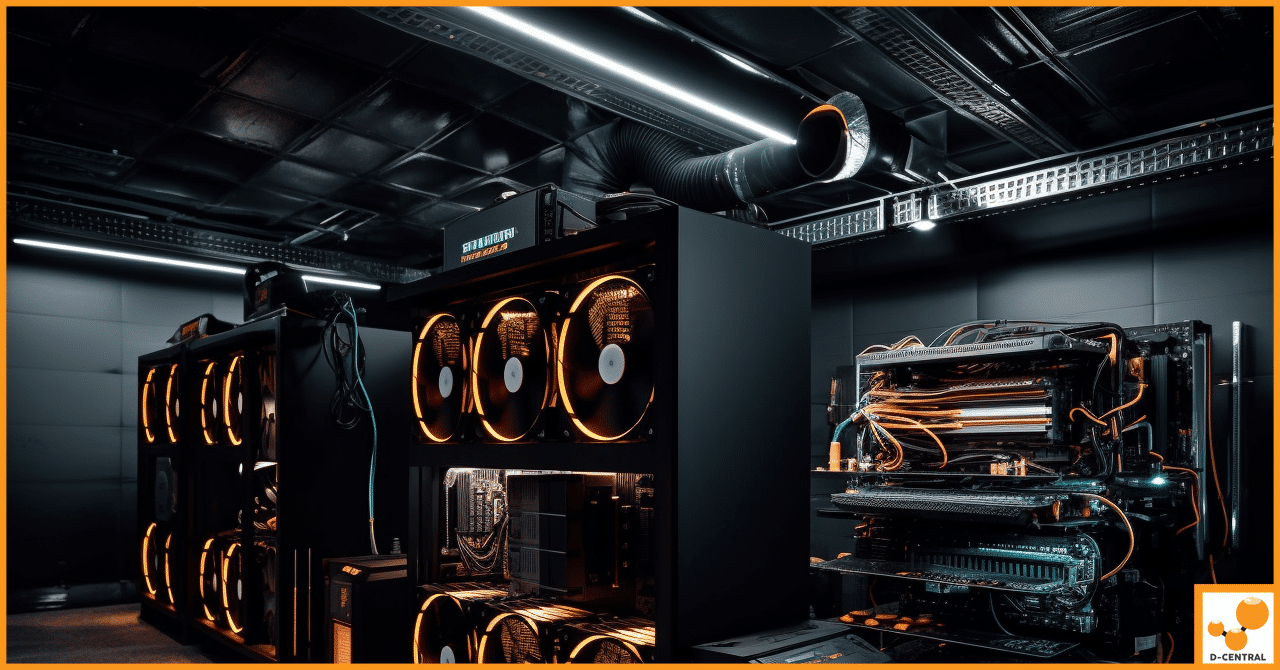

Enter ASIC (Application-Specific Integrated Circuit) mining, a development that has significantly shaped the landscape of Bitcoin mining. ASIC miners are specialized hardware designed exclusively for mining cryptocurrencies. Unlike their predecessors—CPUs (Central Processing Units) and GPUs (Graphics Processing Units)—ASICs are engineered to perform the complex calculations required for mining Bitcoin at unprecedented speeds and with greater energy efficiency. This specialization has made ASIC miners the gold standard in the competitive world of Bitcoin mining, drastically outperforming other hardware in terms of hash rate and energy consumption.

However, the advent of ASIC mining brings with it a complex set of challenges. While these powerful machines contribute to the network’s security and overall efficiency by solving blocks more quickly and reliably, they also centralize mining power in the hands of those who can afford the significant investment in this specialized equipment. This concentration of mining power threatens the very essence of Bitcoin’s decentralized ethos. Large mining pools and companies now dominate the landscape, raising concerns about the network’s vulnerability to manipulation, censorship, and even potential regulatory pressures.

While ASIC mining has undeniably contributed to increased network security and efficiency, it poses significant challenges to the foundational principle of decentralization in Bitcoin. This article will explore the intricate balance between the benefits and drawbacks of ASIC mining, examining its impact on the Bitcoin network’s decentralization and considering the future of mining technology within this pioneering cryptocurrency ecosystem.

Understanding ASIC Mining

ASIC miners, or Application-Specific Integrated Circuits, are specialized hardware designed exclusively for cryptocurrency mining. Unlike general-purpose computing devices, ASICs are engineered to perform a single type of computation extremely efficiently. In the context of Bitcoin, ASIC miners execute the SHA-256 hashing algorithm, which is the basis for securing the Bitcoin network and processing transactions. These devices offer unparalleled performance in terms of hash rate—a measure of mining power—and energy efficiency compared to multi-purpose hardware.

Historical Context: The Evolution from CPU, GPU, to ASIC Mining in Bitcoin

The journey of Bitcoin mining hardware has seen a remarkable evolution, mirroring the cryptocurrency’s growth and the increasing complexity of blockchain computations. In Bitcoin’s early days, mining was accessible to enthusiasts using CPUs found in standard personal computers. As the network grew, the limited processing power of CPUs could no longer keep up with the increasing difficulty of mining tasks.

The next phase saw the adoption of GPUs, commonly used for graphics rendering in gaming. GPUs, with their ability to perform parallel operations, represented a significant leap in mining efficiency and power. However, as the Bitcoin network continued to expand, even GPUs began to fall behind in terms of energy efficiency and computational speed.

This ongoing quest for more efficient mining solutions led to the development of ASIC miners. Introduced around 2013, ASICs represented a seismic shift in mining technology, offering dedicated hardware optimized solely for Bitcoin mining. This specialization allowed for exponential increases in hashing power and energy efficiency, setting a new standard in the mining industry.

The Technological Advantages of ASIC Miners Over Traditional Mining Hardware

ASIC miners boast several technological advantages over their CPU and GPU predecessors. Firstly, their single-minded design for executing the SHA-256 algorithm allows them to mine Bitcoin at a rate several orders of magnitude faster than general-purpose hardware. This efficiency translates to a higher probability of solving the cryptographic puzzles required to mine new blocks and earn mining rewards.

Secondly, ASICs are significantly more energy-efficient. Their specialized nature means that less electrical power is wasted on non-essential computations, reducing operational costs and minimizing the environmental impact of mining. This efficiency is crucial, given the often-cited concerns about the energy consumption of cryptocurrency mining operations.

Lastly, the advent of ASIC mining hardware has contributed to the professionalization and scaling of Bitcoin mining. It has enabled the establishment of large-scale mining farms, which, while contributing to network security, have also sparked debates about the centralization of mining power.

In summary, ASIC miners have dramatically transformed the landscape of Bitcoin mining, setting new benchmarks for speed and efficiency. However, their dominance also raises important questions about the future of Bitcoin’s decentralization and the accessibility of mining to the broader community.

The Role of Decentralization in Bitcoin

Decentralization is the dispersion of power away from a central authority. In the context of Bitcoin, it refers to the distribution of network control across a wide array of participants rather than being concentrated in the hands of a few. This principle is foundational to Bitcoin’s design and appeal, offering a stark contrast to traditional financial systems governed by central banks and financial institutions.

Decentralization is crucial for Bitcoin for several reasons. It ensures that no single entity can control the Bitcoin network, making it more democratic and resistant to manipulation. This distributed nature also enhances the security and robustness of the network, as decisions and verifications are made collectively by consensus among participants. Furthermore, decentralization aligns with Bitcoin’s ethos of providing a transparent, open financial system that is accessible to anyone, anywhere, without needing permission from a central authority.

The Relationship Between Mining and Network Decentralization

Mining is the process through which transactions are verified and added to the Bitcoin blockchain. It involves solving complex cryptographic puzzles to create new blocks, a task that requires significant computational power. Miners are rewarded for their efforts with newly minted bitcoins and transaction fees.

Mining plays a critical role in maintaining the decentralization of the Bitcoin network. Ideally, mining power should be distributed among many independent miners, ensuring no single miner or group of miners has enough power to unilaterally make changes to the network or its rules. This distributed mining power forms the backbone of Bitcoin’s security, as it makes it exceedingly difficult for any malicious actor to manipulate the blockchain or reverse transactions.

How Decentralization Protects Bitcoin from Censorship and Central Points of Failure

Decentralization protects Bitcoin from censorship and central points of failure in several ways. First, by distributing network control across a global array of miners, nodes, and users, Bitcoin becomes resistant to attempts by governments or institutions to censor transactions or freeze assets. Unlike traditional financial systems, where transactions can be blocked or accounts can be seized, Bitcoin’s decentralized nature ensures that transactions are immutable and cannot be censored once confirmed on the blockchain.

Second, decentralization eliminates single points of failure. In centralized systems, an attack on or failure of the central authority can jeopardize the entire system. In contrast, Bitcoin’s distributed network architecture means that the failure of any single node or miner does not affect the network’s overall functionality or security. This resilience makes Bitcoin a robust and reliable system, capable of withstanding various attacks and operational challenges.

In essence, decentralization is not just a technical feature of Bitcoin; it is a core philosophical principle that defines its identity and value proposition. It ensures that Bitcoin remains a secure, open, and censorship-resistant form of money, embodying the vision of its creator, Satoshi Nakamoto, for a decentralized digital currency.

The Impact of ASIC Miners on Network Decentralization

The introduction of ASIC (Application-Specific Integrated Circuit) miners into the Bitcoin ecosystem marked a significant turning point in the mining landscape. While these devices have undeniably enhanced the network’s efficiency and security, they have also introduced challenges to the core principle of decentralization that Bitcoin was built upon. This section delves into the nuances of how ASIC mining has influenced network decentralization, highlighting the concentration of mining power, the role of mining pools, and the economic barriers faced by new entrants.

Detailed Analysis of How ASIC Mining Has Led to a Concentration of Mining Power

ASIC miners, with their unparalleled efficiency and processing power, have gradually edged out less specialized hardware such as CPUs and GPUs from the mining competition. This shift has led to a significant concentration of mining power in the hands of those who can afford these expensive, high-performance machines. Unlike the early days of Bitcoin, when mining was accessible to enthusiasts with modest setups, the ASIC era has seen the rise of large-scale mining operations that can deploy vast arrays of these machines. This concentration of mining power threatens the decentralized ethos of Bitcoin, as a smaller group of miners controls a larger portion of the network’s hash rate, increasing the risk of central points of failure and potential for collusion.

Case Studies: The Emergence of Mining Pools and Their Influence on the Bitcoin Network

Mining pools have emerged as a direct consequence of the increasing difficulty of Bitcoin mining and the dominance of ASIC hardware. By pooling their computational resources, miners can increase their chances of solving blocks and receiving rewards, which are then distributed among pool participants based on their contributed hash power. While mining pools themselves are a rational response to the challenges of solo mining in an ASIC-dominated landscape, they further concentrate mining power. Large pools can wield significant influence over the network, potentially endangering Bitcoin’s decentralized decision-making process. Notable examples include instances where major pools have approached or exceeded the 51% hash rate threshold, sparking concerns within the community about the integrity of the network.

The Economic Barriers to Entry for New Miners Due to the High Cost of ASIC Hardware

The high cost of ASIC mining rigs represents a substantial barrier to entry for individuals and small-scale miners. This financial hurdle not only limits participation in mining to those with significant capital but also exacerbates the centralization of mining power among well-funded operations. The rapid pace of technological advancement in ASIC design further compounds this issue, as miners must continually invest in the latest hardware to remain competitive. This cycle of obsolescence and reinvestment can be prohibitively expensive, discouraging new participants and consolidating mining power among established players with the resources to keep pace with hardware advancements.

In summary, while ASIC miners have contributed to the technological advancement and security of the Bitcoin network, their impact on network decentralization is profound and multifaceted. The concentration of mining power, the emergence and influence of mining pools, and the economic barriers to entry for new miners pose significant challenges to the democratic and decentralized ideals that underpin Bitcoin. Addressing these challenges requires ongoing dialogue within the community, innovative technical solutions, and perhaps a reimagining of the incentives and structures that govern Bitcoin mining.

The Security and Efficiency Advantages of ASIC Mining

Despite the concerns regarding network decentralization, ASIC (Application-Specific Integrated Circuit) miners play a pivotal role in bolstering the security and efficiency of the Bitcoin network. These specialized devices, designed exclusively for mining Bitcoin, bring significant advantages to the table, enhancing the network’s resilience against attacks and improving the speed and reliability of transaction processing.

How ASIC Miners Contribute to the Overall Security of the Bitcoin Network

ASIC miners contribute to the security of the Bitcoin network primarily through their sheer computational power. The increased hash rate provided by ASICs significantly raises the difficulty for any malicious actor attempting to execute a 51% attack, where an attacker needs to control the majority of the network’s mining power to manipulate transactions or reverse confirmed blocks. By elevating the computational requirements to achieve such dominance, ASIC miners act as a formidable deterrent against potential attacks, ensuring the integrity and trustworthiness of the Bitcoin blockchain.

Moreover, the specialized nature of ASIC hardware means that it is less likely to be repurposed for attacks on the network. Unlike general-purpose computing devices that can be redirected towards malicious activities with relative ease, the investment in ASIC technology signifies a commitment to the network’s long-term security and success.

The Role of ASIC Mining in Enhancing the Efficiency of Block Validation and Transaction Processing

ASIC mining has markedly improved the efficiency of block validation and transaction processing within the Bitcoin network. By optimizing the hardware for the specific task of mining Bitcoin, ASICs can solve cryptographic puzzles faster and more energy-efficiently than their predecessors. This efficiency not only accelerates the rate at which blocks are mined and transactions are confirmed but also contributes to the network’s scalability by handling an increasing volume of transactions without a proportional increase in energy consumption or processing time.

The enhanced efficiency of ASIC miners also supports the network’s ability to maintain consistent block times. Despite fluctuations in the total network hash rate or the number of transactions, the superior processing power of ASICs helps stabilize the interval between blocks, ensuring a steady and predictable addition of new blocks to the blockchain.

The Balance Between Network Security and Decentralization

The introduction of ASIC miners into the Bitcoin ecosystem presents a nuanced trade-off between network security and decentralization. On one hand, the security enhancements brought about by ASIC mining are undeniable, providing a robust defense against attacks and contributing to the network’s overall reliability. On the other hand, the centralization of mining power among ASIC-equipped operations poses challenges to the decentralized ethos of Bitcoin.

Striking a balance between these two critical aspects requires ongoing innovation and dialogue within the Bitcoin community. Potential solutions include the development of more accessible ASIC technology, adjustments to the mining reward structure, or even changes to the consensus mechanism itself. The goal is to preserve the security benefits of ASIC mining while mitigating its impact on network decentralization.

ASIC mining has undeniably transformed the landscape of Bitcoin mining, offering significant advantages in terms of network security and transaction processing efficiency. However, the challenge lies in maintaining these benefits without compromising the decentralized nature of the network. As Bitcoin continues to evolve, finding a sustainable middle ground between security and decentralization will be crucial for its long-term success and resilience.

Challenges and Controversies Surrounding ASIC Mining

The advent of ASIC (Application-Specific Integrated Circuit) mining in the Bitcoin ecosystem has not been without its controversies and challenges. While ASICs have significantly enhanced the network’s efficiency and security, they have also sparked debates and concerns within the community. These range from discussions on ASIC resistance to fears about network centralization and environmental sustainability.

The Debate Within the Bitcoin Community Regarding ASIC Resistance

A significant portion of the Bitcoin community advocates for ASIC resistance, arguing that ASIC mining contradicts the decentralized ethos of Bitcoin by concentrating mining power in the hands of a few. This debate has led to discussions about modifying Bitcoin’s proof-of-work (PoW) algorithm to negate the advantages of ASIC miners, thereby leveling the playing field for all miners regardless of their hardware. Proponents of ASIC resistance believe that such measures would foster a more inclusive and decentralized mining landscape, reducing the risk of centralization and ensuring the network remains secure and accessible to a broader base of participants.

Potential Risks of Centralization: 51% Attacks, Regulatory Capture, and the Influence of Hardware Manufacturers

The centralization of mining power among ASIC-equipped operations poses several potential risks to the Bitcoin network:

- 51% Attacks: The concentration of hash power raises the specter of 51% attacks, where a single entity or colluding group could potentially control the majority of the network’s mining power. This control could allow them to double-spend coins, prevent certain transactions from being confirmed, or even reverse transactions in a blockchain reorganization, undermining the integrity and trustworthiness of the network.

- Regulatory Capture: Centralization also increases the risk of regulatory capture, where a small number of large mining operations could be targeted by governmental or regulatory bodies. This could lead to censorship, freezing of assets, or other forms of interference in the Bitcoin network, eroding its censorship-resistant properties.

- Influence of Hardware Manufacturers: The reliance on ASIC mining hardware grants significant power to a limited number of manufacturers. These entities could exert undue influence over the mining landscape, from determining hardware availability to potentially introducing backdoors or vulnerabilities.

The Environmental Impact of ASIC Mining

Another contentious issue surrounding ASIC mining is its environmental impact. The immense computational power of ASICs requires a substantial amount of electricity, contributing to the network’s carbon footprint. Critics argue that the energy consumption of ASIC mining operations, particularly those reliant on non-renewable energy sources, is unsustainable and poses significant environmental challenges. This has spurred discussions within the community about seeking renewable energy sources for mining operations and exploring more energy-efficient consensus mechanisms as alternatives to PoW.

In summary, while ASIC mining has brought undeniable benefits to the Bitcoin network in terms of security and efficiency, it also presents a complex array of challenges and controversies. The debate over ASIC resistance, the risks of centralization, and the environmental impact of ASIC mining operations are critical issues that the Bitcoin community continues to grapple with. Addressing these concerns requires a delicate balance between innovation, sustainability, and the preservation of Bitcoin’s foundational principles of decentralization and security.

Solutions and Alternatives to Preserve Decentralization

The challenges posed by ASIC mining to the decentralization of the Bitcoin network have spurred the community and developers to explore various solutions and alternatives. These efforts aim to mitigate the centralizing effects of ASIC hardware, ensuring that Bitcoin remains secure, inclusive, and true to its decentralized ethos. Here, we delve into ASIC-resistant algorithms, the potential of alternative consensus mechanisms, and community-driven initiatives designed to address these centralization concerns.

ASIC-Resistant Algorithms and Their Effectiveness

ASIC-resistant algorithms are designed to level the playing field between ASIC miners and those using general-purpose hardware, such as CPUs and GPUs. By adjusting the mining algorithm to require memory-intensive or otherwise ASIC-unfriendly tasks, these algorithms aim to diminish the efficiency gap between specialized and general-purpose hardware. Cryptocurrencies like Monero (XMR) have implemented ASIC-resistant algorithms with some success, periodically updating their mining algorithm to thwart the development of effective ASICs. However, the effectiveness of ASIC resistance is a subject of ongoing debate, as it can lead to a continuous arms race between ASIC manufacturers and developers, potentially diverting resources away from other areas of development.

The Potential of Alternative Consensus Mechanisms in Reducing Hardware Centralization

Alternative consensus mechanisms, such as Proof of Stake (PoS), offer a fundamentally different approach to achieving network consensus that does not rely on mining hardware. In a PoS system, the probability of validating a block and receiving rewards is proportional to the amount of cryptocurrency a participant holds and is willing to “stake” as collateral. This mechanism reduces the reliance on energy-intensive mining and the need for specialized hardware, potentially addressing the centralization concerns associated with ASIC mining. Ethereum’s transition to PoS through its Ethereum 2.0 upgrade is a high-profile example of a major cryptocurrency exploring this path to reduce hardware centralization and improve energy efficiency.

Community and Developer Initiatives to Address the Centralization Issue

The Bitcoin community and developers are actively engaged in discussions and initiatives aimed at preserving the network’s decentralization. These include proposals for protocol upgrades that enhance the network’s resistance to centralization, support for smaller mining operations through grants and funding, and educational efforts to raise awareness about the importance of decentralization. Additionally, some community members advocate for the use of renewable energy sources for mining operations, addressing both environmental concerns and the economic barriers to entry for new miners. Open-source projects and decentralized mining pools also contribute to these efforts, offering more democratic and transparent alternatives to traditional mining pools.

While the rise of ASIC mining has presented significant challenges to the decentralization of the Bitcoin network, a combination of technological innovations, alternative consensus mechanisms, and community-driven efforts offers promising pathways to address these issues. By exploring ASIC-resistant algorithms, embracing alternative consensus models like Proof of Stake, and fostering a culture of inclusivity and collaboration, the Bitcoin community can work towards a future where the network remains secure, efficient, and, most importantly, decentralized.

Conclusion

The introduction of ASIC (Application-Specific Integrated Circuit) mining into the Bitcoin ecosystem has undeniably transformed the landscape of cryptocurrency mining. While these specialized devices have significantly enhanced the network’s security and efficiency, they have also introduced complex challenges to the principle of decentralization—a cornerstone upon which Bitcoin was founded. The concentration of mining power in the hands of a few, the economic barriers to entry for new miners, and the environmental concerns associated with high energy consumption are among the critical issues that have emerged in the ASIC era.

The ongoing debate around ASIC mining and its impact on decentralization underscores the importance of community vigilance and innovation. It is the collective responsibility of the Bitcoin community—developers, miners, users, and stakeholders—to ensure that the network remains true to its decentralized ethos. This involves not only addressing the immediate challenges posed by ASIC mining but also fostering an environment where open dialogue, collaborative problem-solving, and technological innovation thrive.

Looking to the future, finding a sustainable balance between mining technology and network decentralization will be crucial. This balance may involve the development and adoption of ASIC-resistant algorithms, exploration of alternative consensus mechanisms like Proof of Stake, and community-driven initiatives aimed at promoting inclusivity and reducing centralization. As the Bitcoin network continues to evolve, so too will the strategies for maintaining its decentralized nature.

We encourage readers to actively engage in the ongoing discussion about ASIC mining and decentralization. By participating in forums, contributing to open-source projects, and supporting initiatives that aim to preserve the network’s core principles, everyone can play a part in shaping the future of Bitcoin.

As Bitcoin navigates the complexities of growth and technological advancement, the community’s commitment to its foundational principles will remain its guiding light. Through vigilance, innovation, and collective action, the Bitcoin network can continue to be a beacon of decentralization and security in the digital age.

FAQ

What is ASIC mining?

ASIC mining refers to the use of Application-Specific Integrated Circuits (ASICs), which are specialized hardware designed exclusively for the purpose of cryptocurrency mining. Unlike general-purpose hardware, ASICs are engineered to perform the specific calculations required for mining cryptocurrencies like Bitcoin with unprecedented speed and energy efficiency.

How does ASIC mining impact Bitcoin’s decentralization?

ASIC mining has significantly impacted Bitcoin’s decentralization by contributing to a concentration of mining power. This concentration raises concerns about the network’s resistance to manipulation, censorship, and regulatory pressures. The high cost of ASIC hardware also poses a barrier to entry for new miners, further centralizing mining power in the hands of those with significant financial resources.

What are the advantages of ASIC miners?

The technological advantages of ASIC miners over traditional hardware include significantly higher hash rates and greater energy efficiency. Their specialized design allows them to solve the cryptographic puzzles required for mining Bitcoin much faster and with less energy than CPUs or GPUs, contributing to the security and efficiency of the Bitcoin network.

Why is decentralization important for Bitcoin?

Decentralization is crucial for Bitcoin as it ensures that no single entity controls the network, making it more democratic, resistant to manipulation, and secure. Decentralization enhances the network’s robustness against attacks, avoids central points of failure, and aligns with Bitcoin’s ethos of providing a transparent, open financial system that is accessible to anyone.

What are the environmental concerns associated with ASIC mining?

The environmental concerns related to ASIC mining stem from the significant electricity consumption required by these powerful machines. Critics argue that the energy-intensive nature of ASIC operations, especially those relying on non-renewable energy sources, contributes to the cryptocurrency mining sector’s carbon footprint and poses sustainability challenges.

What solutions are being considered to address ASIC mining’s challenges?

Solutions to mitigate the challenges of ASIC mining include the development of ASIC-resistant algorithms, exploration of alternative consensus mechanisms such as Proof of Stake (PoS), and community-driven initiatives. These efforts aim to level the mining playing field, reduce hardware centralization, encourage the use of renewable energy, and maintain the network’s decentralized nature.