In recent years, the exponential growth in demand and adoption of cryptocurrencies has led to the rise of various digital assets and technologies. Among these, tokenization has emerged as an attractive alternative for businesses and developers looking to exploit blockchain’s usability. However, tokenization comes with its own set of complexities that seemingly lack the elegance and simplicity of Bitcoin. In this article, we will explore the concept of tokenization and delve into its complexities, while comparing it to the straightforwardness of Bitcoin.

What is Tokenization?

Tokenization is the process of converting real-world assets, such as stocks, real estate, or commodities, into digital tokens on a blockchain. These tokens represent a specific value, right, or ownership claim on the underlying asset, allowing for secure, efficient, and transparent transactions. Tokenized assets can be traded, bought, or sold on various decentralized platforms, presenting new investment opportunities and liquidity for previously illiquid assets.

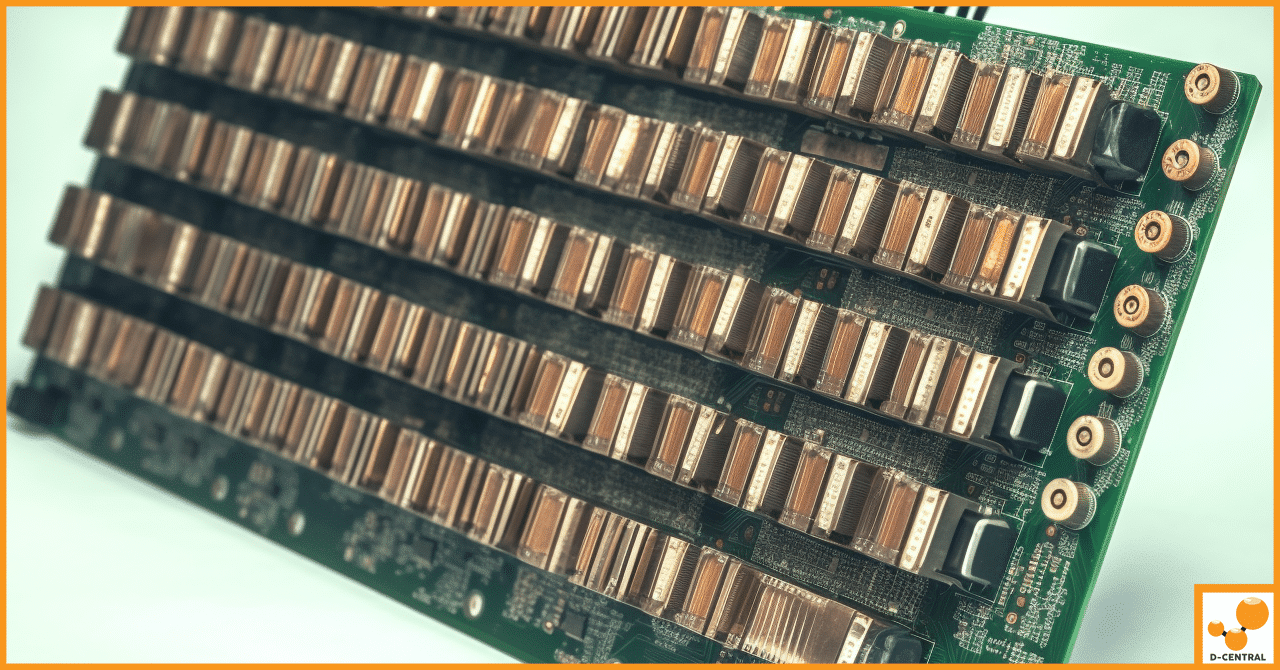

How Tokenization works

The process of tokenization varies depending on the asset class and specific use case, but the general steps include:

- Asset selection and evaluation: The first step involves identifying and valuing the real-world asset to be tokenized.

- Token creation: The asset’s value and ownership rights are divided into multiple digital tokens, which are issued on a blockchain platform.

- Regulatory compliance: Ensuring the tokenization process adheres to relevant legal frameworks and requirements.

- Token sale and distribution: Tokens can be sold to investors either through an initial coin offering (ICO) or other fundraising methods.

- Asset management and trading: Token holders can participate in the management of the underlying asset and trade their tokens on decentralized exchanges or other platforms.

The complex nature of Tokenization

Though tokenization presents various advantages, it also comes with several complexities, which make it less accessible to the average user than cryptocurrencies like Bitcoin. Some of these complexities include:

- Regulatory compliance: Tokenization requires strict adherence to the legal requirements of various jurisdictions, making it challenging to navigate the regulatory landscape.

- Security concerns: As with any digital asset, tokenized assets are subject to cybersecurity threats and require robust security measures to protect against attacks and theft.

- Asset custody: The custody and management of tokenized assets require specialized third-party providers, adding additional layers to the ownership and investment process.

- Valuation and price discovery: Determining the value of tokenized assets can be more complicated than traditional assets due to their nascent nature and limited trading data.

- Interoperability: Tokenized assets may not be easily transferable or compatible across different blockchain platforms, leading to potential siloing and cumbersome exchanges.

Advantages and disadvantages of Tokenization

Some of the advantages of tokenization include:

- Increased liquidity: Tokenization can facilitate trading and make previously illiquid assets more accessible.

- Fractional ownership: By converting assets into smaller units, tokenization allows for increased accessibility and affordability.

- Transparency: The blockchain technology underlying tokenization ensures transparency in asset management and ownership.

- Lower transaction costs: The peer-to-peer nature of blockchain can reduce intermediaries and transaction fees.

However, tokenization also has its disadvantages:

- Complexity: As highlighted earlier, tokenization comes with multiple complex layers compared to cryptocurrencies like Bitcoin.

- Regulatory uncertainty: The evolving regulatory landscape for tokenized assets can add risks and uncertainty for investors and issuers.

- Potential manipulation: Market manipulation and fraud can occur in ill-regulated token markets.

A comparison with Bitcoin’s simplicity

Bitcoin, as the first and most well-known cryptocurrency, is widely considered simple and elegant due to its decentralized nature, limited supply, and robust consensus mechanism. Bitcoin allows for peer-to-peer transactions without intermediaries, releasing the user from burdensome regulations and complexities associated with tokenization. Additionally, the price discovery and valuation process for Bitcoin is typically more transparent and straightforward compared to tokenized assets.

Conclusion

While tokenization is an innovative method for digitizing and trading assets, it is not without its complexities and challenges. The cumbersome nature of tokenization stands in contrast to the simplicity and elegance of Bitcoin. As the cryptocurrency market continues to evolve, it is vital for investors and businesses to weigh the benefits and drawbacks of tokenization against the straightforward functionality offered by Bitcoin. Ultimately, the choice between tokenization and Bitcoin will depend on individual preferences and specific use cases.