Bitcoin mining capitulation is one of the most misunderstood forces in the network’s economic cycle. Mainstream financial media treats it as a death signal — proof that Bitcoin mining is “unsustainable” or that the network is “collapsing.” They are wrong. Capitulation is not a bug. It is Bitcoin’s built-in immune system — a self-correcting mechanism that purges inefficiency, redistributes hashrate, and strengthens the network for the next cycle.

If you mine Bitcoin, plan to mine Bitcoin, or simply want to understand the mechanics that keep the most decentralized monetary network on Earth running, you need to understand capitulation at a deep level. Not the surface-level “miners are selling” narrative. The real mechanics.

What Bitcoin Mining Capitulation Actually Means

At its core, mining capitulation occurs when the all-in cost of producing a bitcoin exceeds the revenue that bitcoin generates. When electricity bills, facility leases, hardware depreciation, and cooling costs add up to more than the block subsidy and transaction fees return, miners face a binary choice: operate at a loss or shut down.

Most choose to shut down. Many are forced to liquidate their bitcoin reserves to cover fixed costs — debt payments, power contracts, facility overhead. This liquidation creates sell pressure on the market, which can push the bitcoin price lower, which makes mining even less profitable, which forces more miners to capitulate. It is a feedback loop.

But here is what the panic narratives miss: this feedback loop is self-limiting. Bitcoin has a built-in pressure valve called the difficulty adjustment.

The Difficulty Adjustment: Bitcoin’s Immune Response

Every 2,016 blocks — roughly every two weeks — the Bitcoin protocol recalibrates its mining difficulty to target a 10-minute average block interval. When miners capitulate and hashrate drops, difficulty drops with it. Blocks that were expensive to find become cheaper to find. The remaining miners see their per-hash revenue increase. Profitability returns.

This is not a theory. It has played out in every single capitulation event since Bitcoin’s inception. The difficulty adjustment is arguably the most elegant piece of economic engineering in the protocol. It ensures that Bitcoin keeps producing blocks, keeps processing transactions, and keeps being Bitcoin regardless of how many miners are online at any given moment.

In 2026, the network hashrate hovers above 800 EH/s with difficulty exceeding 110 trillion. These are staggering numbers. But even at this scale, the fundamental mechanism is identical to when Satoshi was solo mining on a CPU: if hashrate drops, difficulty drops, and the network adapts.

The Three Flavors of Capitulation

Not all capitulation events are created equal. Understanding the trigger matters because it determines the severity, duration, and recovery trajectory.

Price-Driven Capitulation

The most violent form. A sharp drop in the bitcoin price slashes revenue overnight while costs remain fixed. The 2018 crash from nearly $20,000 to under $4,000 is the textbook example — entire mining operations went dark within weeks. The March 2020 COVID crash cut the price in half in days, triggering an acute but short-lived wave of miner shutdowns.

Price-driven capitulation hits fastest and hardest, but it also resolves fastest once the price stabilizes or recovers. The miners who survive tend to be those with the lowest energy costs and the most efficient hardware.

Cost-Driven Capitulation

This creeps in slowly. Energy prices rise. Hosting contracts renegotiate upward. Governments impose new tariffs or taxes on mining operations. Hardware ages and loses efficiency relative to newer ASIC generations. None of these kill profitability overnight, but they erode margins until the math no longer works.

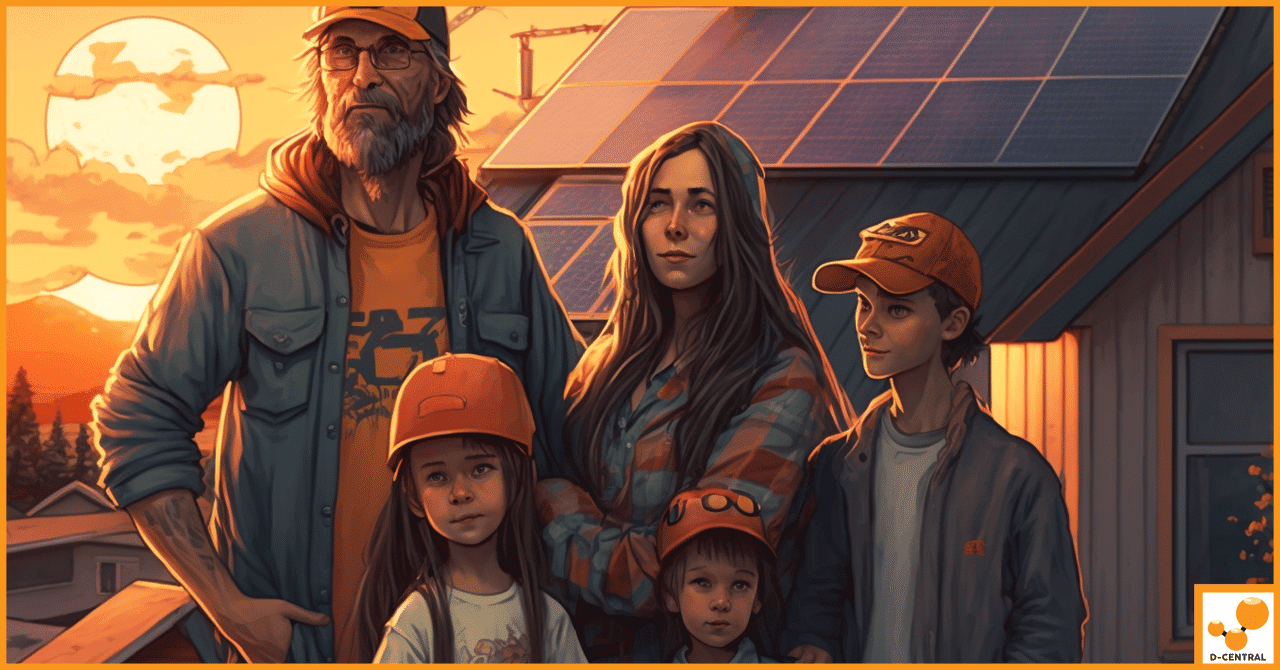

Cost-driven capitulation is particularly relevant for home miners and small operators who may not have access to industrial power rates. It is also why dual-purpose mining setups like Bitcoin space heaters have become a powerful hedge — when your miner is also your home heating system, the energy cost equation changes fundamentally.

Time-Based Capitulation

The slow grind. The bitcoin price does not crash dramatically but stays flat or slightly below the profitability threshold for months. Miners with cash reserves can endure weeks or even months of unprofitable operation, betting on a recovery. But capital is finite. One by one, operators who cannot subsidize their losses any longer shut down and sell.

Time-based capitulation is psychologically the most brutal because there is no clear inflection point — just a slow bleed. The 2022-2023 period following the FTX collapse exhibited this pattern, with miners gradually exiting over many months.

Why Capitulation Strengthens the Network

Here is where the cypherpunk perspective diverges sharply from the mainstream financial narrative. Wall Street sees miners shutting down and panics. Bitcoiners see miners shutting down and recognize the protocol doing exactly what it was designed to do.

It Purges Inefficiency

Capitulation eliminates the least efficient operators — those running outdated hardware, those paying above-market energy rates, those with bloated operational overhead. What remains after a capitulation cycle is a leaner, more efficient mining ecosystem. The hashrate that comes back online runs on better hardware consuming less energy per terahash.

It Redistributes Hashrate

When large, centralized mining operations capitulate, their share of the network’s hashrate goes to zero. As difficulty adjusts downward, smaller and more distributed miners become relatively more profitable. Home miners, Bitaxe solo miners, and operators running lean setups in their basements and garages gain a slightly larger slice of the pie. This is good for decentralization.

It Resets the Hardware Market

Capitulation floods the secondary market with used ASICs at steep discounts. Machines that cost $10,000 at peak demand become available for $2,000 or less. This lowers the barrier to entry for new miners and for repair operations that can refurbish and redeploy this hardware. At D-Central, we have seen this cycle play out repeatedly — capitulation events are when we source some of the best hardware for our customers.

It Proves Bitcoin’s Antifragility

Every capitulation event Bitcoin survives makes the “Bitcoin is fragile” argument weaker. The network has endured multiple 80%+ price drawdowns, government crackdowns, exchange collapses, and global pandemics. Each time, the difficulty adjusted, blocks kept coming, and the network emerged stronger. That track record, stretching back to 2009, is the most powerful argument for Bitcoin’s durability.

The 2024 Halving and Post-Halving Capitulation

The April 2024 halving cut the block subsidy from 6.25 BTC to 3.125 BTC. Overnight, miner revenue from the block reward was cut in half. This was not a surprise — halvings are programmed into the protocol and announced years in advance — but the impact was still real.

Miners who were marginally profitable at 6.25 BTC per block became unprofitable at 3.125 BTC. The expected wave of post-halving capitulation materialized, particularly among operators running older-generation hardware like the Antminer S19 series at energy costs above $0.06/kWh.

However, the 2024-2025 cycle also demonstrated something important: the mining industry has become more sophisticated at preparing for halvings. Many large operators had already upgraded to next-generation machines, locked in long-term power contracts, and built cash reserves. The capitulation was real but less severe than previous cycles.

For home miners, the halving reinforced a critical truth: your energy cost is your survival metric. If you can mine using energy you would otherwise waste — excess solar, off-peak rates, or heat recovery with Bitcoin space heaters — you can survive conditions that kill industrial operators paying market rates.

Capitulation Metrics: Reading the On-Chain Signals

Several on-chain indicators help identify when capitulation is underway or approaching.

Hash Ribbons

Developed by Charles Edwards, the Hash Ribbon indicator compares the 30-day and 60-day moving averages of Bitcoin’s hashrate. When the 30-day average crosses below the 60-day average, it signals that miners are shutting down — capitulation is in progress. When the 30-day crosses back above the 60-day, capitulation has ended. Historically, the end of Hash Ribbon capitulation events has marked some of the best periods to accumulate bitcoin and deploy mining hardware.

Miner Revenue per Terahash

This metric tracks how much revenue each unit of hashrate generates. When it drops below the operating cost for mainstream ASIC models, capitulation pressure builds. In 2026, with the hashrate above 800 EH/s and the block reward at 3.125 BTC, revenue per terahash is compressed tighter than ever — making efficiency and low energy costs non-negotiable.

Difficulty Ribbon

Similar to Hash Ribbons but applied to the difficulty adjustment itself. Compressing difficulty ribbons indicate that difficulty growth is stalling or reversing — a sign that miners are leaving the network.

Miner Outflows to Exchanges

When miners send bitcoin to exchanges in volumes significantly above their normal selling patterns, it signals forced liquidation. This is the capitulation sell pressure that depresses the market price.

Home Mining: The Capitulation-Resistant Strategy

Here is why D-Central has been evangelizing home mining and pleb mining since 2016. Large-scale industrial mining operations carry enormous fixed costs — facility leases, staff, cooling infrastructure, debt service. When revenue drops, those costs do not. Industrial miners are the first to face the capitulation math.

Home miners operate on a fundamentally different cost structure:

Zero or near-zero marginal facility cost. Your home already exists. You are already paying for space and basic utilities. Adding a miner to your home does not require a lease or a construction loan.

Dual-purpose energy utilization. A Bitcoin miner converts electricity into heat with near-perfect efficiency. In a cold climate like Canada, running a miner as a space heater means the electricity cost is not purely a mining expense — it is also your heating bill. This changes the profitability equation dramatically. Check out our Bitcoin space heater lineup to see how this works in practice.

No debt service. Most home miners buy their equipment outright. No monthly loan payments eating into margins during downturns.

Flexibility. Home miners can turn machines on and off based on conditions — running at night when electricity rates are lower, shutting down during heat waves when the heat output is unwanted, adjusting overclock settings to optimize for current profitability.

Sovereignty. Home mining is mining that no government, corporation, or landlord can shut down with a single phone call. Your keys, your hardware, your hashrate.

This is why open-source solo mining devices like the Bitaxe represent something much larger than a hobby gadget. They are capitulation-resistant mining infrastructure. A Bitaxe running on your home network, pulling 15 watts, is never going to capitulate. The cost is negligible. The sovereignty is absolute. Every hash counts.

What Miners Should Do During Capitulation

If you are mining during a capitulation period — or preparing for one — here are concrete strategies that work.

Optimize Your Energy Cost

This is the single most impactful lever you have. Negotiate better rates. Switch to time-of-use billing if available. Install solar panels. Use your miners as heaters to offset heating costs. Explore hosting options in regions with cheap hydro power like Quebec, where D-Central operates our hosting facility.

Upgrade to Efficient Hardware

Older ASIC generations consume more watts per terahash. During capitulation, the secondary market floods with discounted hardware — but resist the urge to buy old-generation machines just because they are cheap. Focus on joules per terahash (J/TH). A modern machine at 20 J/TH will survive conditions that kill a machine running at 35 J/TH.

Get Your Machines Repaired, Not Replaced

A hashboard with a blown ASIC chip does not need to be scrapped. Professional ASIC repair can bring machines back to full operation at a fraction of replacement cost. D-Central has repaired over 2,500 miners since 2016 — we know that a $200 repair is often the difference between a profitable machine and an expensive paperweight.

HODL Through the Storm

If your operational costs are covered, do not panic-sell your mined bitcoin during a capitulation event. Historically, the end of capitulation periods has preceded significant price recoveries. The miners who held through the 2018-2019 capitulation and the 2022-2023 grind were rewarded when the price recovered.

Join a Mining Pool

Solo mining with industrial ASICs during capitulation means long stretches with zero revenue between blocks. Pool mining smooths out your income stream and gives you predictable cash flow to cover ongoing costs. Solo mining with a Bitaxe is a different story — the cost is so low that variance is irrelevant, and the dream of hitting a full block reward of 3.125 BTC makes every hash a lottery ticket worth holding.

Capitulation Is Not the End — It Is the Beginning

Every major capitulation event in Bitcoin’s history has been followed by a period of recovery, growth, and new all-time highs in both price and hashrate. The 2018 capitulation preceded the 2020-2021 bull run. The 2022-2023 grind preceded new hashrate records in 2024 and beyond.

This is not coincidence. It is the difficulty adjustment doing its job. It is inefficient operators being replaced by efficient ones. It is the market discovering a new equilibrium. It is Bitcoin working exactly as designed.

For home miners, for pleb miners, for anyone who believes that the decentralization of hashrate matters to Bitcoin’s long-term survival — capitulation is not something to fear. It is something to prepare for, survive through, and capitalize on.

The miners who are still hashing when the dust settles are the ones who carry the network forward. Be one of them.

Frequently Asked Questions

What exactly is Bitcoin mining capitulation?

Mining capitulation occurs when the total cost of mining bitcoin — electricity, hardware, cooling, facility overhead — exceeds the revenue earned from the block subsidy (currently 3.125 BTC) and transaction fees. Miners who cannot operate profitably shut down their machines and often sell their bitcoin reserves to cover fixed costs, creating sell pressure on the market.

What triggers a capitulation event?

Three primary triggers: a sharp drop in bitcoin’s price (reducing revenue overnight), rising operational costs like energy prices or new taxes, and increasing network difficulty that dilutes each miner’s share of block rewards. Halving events — which cut the block subsidy in half every 210,000 blocks — are also predictable capitulation catalysts.

How does capitulation affect Bitcoin’s network security?

When miners shut down, the total network hashrate decreases, which theoretically makes a 51% attack easier. However, the difficulty adjustment compensates within two weeks by lowering the mining difficulty. Additionally, Bitcoin’s hashrate is so massively distributed across the globe (currently above 800 EH/s) that even significant capitulation events do not bring the hashrate low enough to pose a realistic attack vector.

Is mining capitulation bad for Bitcoin?

No. Capitulation is Bitcoin’s self-correcting mechanism. It purges inefficient operators, redistributes hashrate toward more efficient and often more decentralized miners, resets the hardware market with cheaper ASICs, and proves the network’s antifragility. Every capitulation event Bitcoin has survived makes the network stronger.

How can home miners survive capitulation?

Home miners have structural advantages: no facility leases, no debt service, and the ability to use mining heat for home heating (effectively subsidizing energy costs). Focus on minimizing your energy cost per kWh, run efficient hardware, consider dual-purpose setups like Bitcoin space heaters, and avoid panic-selling mined bitcoin during downturns.

What is the Hash Ribbon indicator?

The Hash Ribbon compares the 30-day and 60-day moving averages of Bitcoin’s hashrate. When the short-term average drops below the long-term average, it signals active miner capitulation. When it crosses back above, capitulation has ended. Historically, the end of Hash Ribbon capitulation events has been a strong signal for bitcoin accumulation.

Do solo miners capitulate differently than pool miners?

Pool miners receive steady, predictable payouts proportional to their hashrate contribution, which smooths revenue and delays the capitulation threshold. Solo miners with industrial ASICs face high variance — potentially going weeks without a block reward — which accelerates capitulation pressure. Solo miners using low-power devices like the Bitaxe are functionally capitulation-proof because their operating costs are negligible.

Does D-Central offer services that help during capitulation periods?

Yes. Our ASIC repair service can restore underperforming or broken machines at a fraction of replacement cost — critical when capital is tight. Our shop stocks efficient open-source miners like the Bitaxe that operate at minimal cost. And our hosting facility in Quebec offers access to low-cost hydroelectric power for miners who need to reduce their energy expenses.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What exactly is Bitcoin mining capitulation?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Mining capitulation occurs when the total cost of mining bitcoin — electricity, hardware, cooling, facility overhead — exceeds the revenue earned from the block subsidy (currently 3.125 BTC) and transaction fees. Miners who cannot operate profitably shut down their machines and often sell their bitcoin reserves to cover fixed costs, creating sell pressure on the market.”

}

},

{

“@type”: “Question”,

“name”: “What triggers a capitulation event?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Three primary triggers: a sharp drop in bitcoin’s price (reducing revenue overnight), rising operational costs like energy prices or new taxes, and increasing network difficulty that dilutes each miner’s share of block rewards. Halving events — which cut the block subsidy in half every 210,000 blocks — are also predictable capitulation catalysts.”

}

},

{

“@type”: “Question”,

“name”: “How does capitulation affect Bitcoin’s network security?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “When miners shut down, the total network hashrate decreases, which theoretically makes a 51% attack easier. However, the difficulty adjustment compensates within two weeks by lowering the mining difficulty. Additionally, Bitcoin’s hashrate is so massively distributed across the globe (currently above 800 EH/s) that even significant capitulation events do not bring the hashrate low enough to pose a realistic attack vector.”

}

},

{

“@type”: “Question”,

“name”: “Is mining capitulation bad for Bitcoin?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “No. Capitulation is Bitcoin’s self-correcting mechanism. It purges inefficient operators, redistributes hashrate toward more efficient and often more decentralized miners, resets the hardware market with cheaper ASICs, and proves the network’s antifragility. Every capitulation event Bitcoin has survived makes the network stronger.”

}

},

{

“@type”: “Question”,

“name”: “How can home miners survive capitulation?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Home miners have structural advantages: no facility leases, no debt service, and the ability to use mining heat for home heating (effectively subsidizing energy costs). Focus on minimizing your energy cost per kWh, run efficient hardware, consider dual-purpose setups like Bitcoin space heaters, and avoid panic-selling mined bitcoin during downturns.”

}

},

{

“@type”: “Question”,

“name”: “What is the Hash Ribbon indicator?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The Hash Ribbon compares the 30-day and 60-day moving averages of Bitcoin’s hashrate. When the short-term average drops below the long-term average, it signals active miner capitulation. When it crosses back above, capitulation has ended. Historically, the end of Hash Ribbon capitulation events has been a strong signal for bitcoin accumulation.”

}

},

{

“@type”: “Question”,

“name”: “Do solo miners capitulate differently than pool miners?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Pool miners receive steady, predictable payouts proportional to their hashrate contribution, which smooths revenue and delays the capitulation threshold. Solo miners with industrial ASICs face high variance — potentially going weeks without a block reward — which accelerates capitulation pressure. Solo miners using low-power devices like the Bitaxe are functionally capitulation-proof because their operating costs are negligible.”

}

},

{

“@type”: “Question”,

“name”: “Does D-Central offer services that help during capitulation periods?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Yes. Our ASIC repair service can restore underperforming or broken machines at a fraction of replacement cost — critical when capital is tight. Our shop stocks efficient open-source miners like the Bitaxe that operate at minimal cost. And our hosting facility in Quebec offers access to low-cost hydroelectric power for miners who need to reduce their energy expenses.”

}

}

]

}