Empowering Home Bitcoin Mining with Innovative Solutions

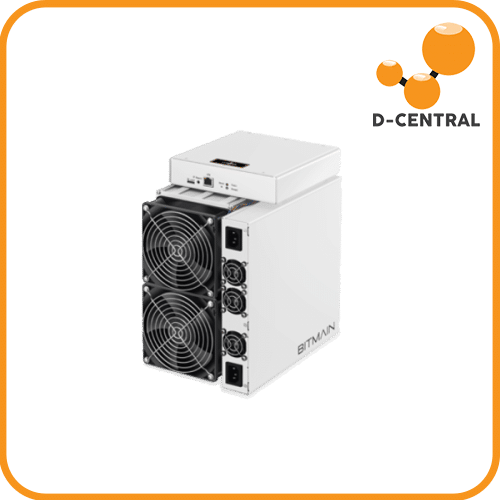

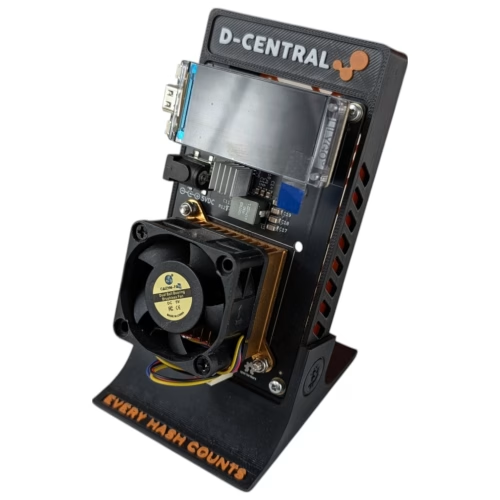

Discover D-Central’s latest breakthroughs in home Bitcoin mining. Quiet, efficient, and compact solutions tailored for your residential mining needs. We’re here to help you turn your home into a quiet, efficient mining hub, whether you’re looking to heat your home while earning Bitcoin or searching for the most energy-efficient mining rigs for residential use. Explore our range of products including the innovative Antminer Slim, Bitaxe, and our Bitcoin Space Heaters—all designed to bring the power of cryptocurrency mining into your home.

Pioneering the Bitcoin Mining Revolution with Expertise and Innovation

At D-Central, we not only provide top-tier Bitcoin mining hardware but also end-to-end support for all your mining needs. Whether you’re navigating the complexities of setting up a home miner or looking to optimize the performance of your equipment, we have the expertise and solutions to guide you.

Mining Consulting

We cater to mining operations of all sizes with our diverse range of high-quality hardware. Get personalized advice from our expert team on how to improve your mining operation.

Mining Hosting

If you need a space to run your miners, our state-of-the-art hosting facilities in Quebec and Alberta offer flexible on-grid and off-grid options with 90%-95% uptime.

ASIC Repair

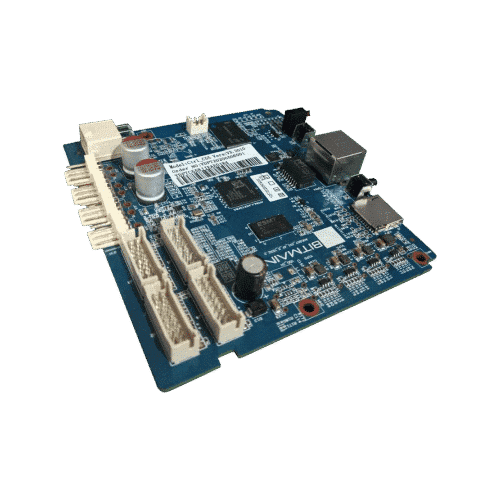

As Canada’s largest ASIC repair center, we ensure your equipment stays in top condition. Our skilled technicians use advanced diagnostics and high-quality parts to extend the life of your mining hardware.

Precision, Reliability, and Expertise

At D-Central Technologies, we provide top-tier ASIC repair services, catering to miners of all sizes. Our skilled technicians use advanced diagnostics to ensure accurate repairs, from simple fixes to complex component replacements, guaranteeing peak performance. We also offer preventative maintenance to minimize downtime and keep your operations running smoothly. With a customer-centric approach, competitive pricing, and quick turnaround times, we deliver tailored solutions that set us apart from the competition.

Gear Up Your Bitcoin Adventure: Discover Our Bitcoin Treasure Trove

Discover a vast selection of Bitcoin and Bitcoin mining products at D-Central Technologies, where we cater to miners of all sizes. Our store offers high-quality accessories, chips, cables, DIY kits, merchandise, ASICs, parts, and consumables. Each product is carefully selected to meet the diverse needs of your mining operation, ensuring peak performance and reliability. Explore our comprehensive range and find the perfect solutions to optimize your mining efficiency today.

-

Accessories46 Products

-

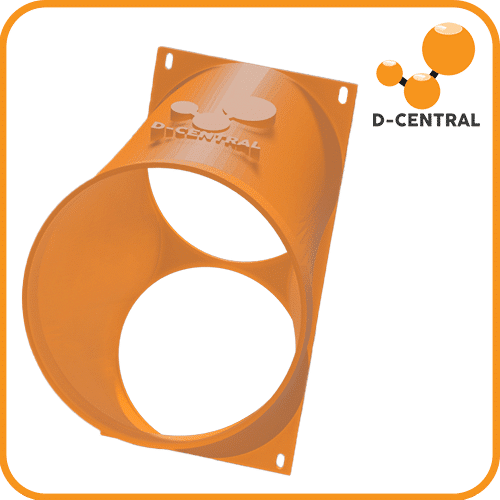

Adapters and Shrouds21 Products

-

ASIC Chips62 Products

-

Bitcoin Mining Heaters9 Products

-

Cables and Connectors23 Products

-

Consumables12 Products

-

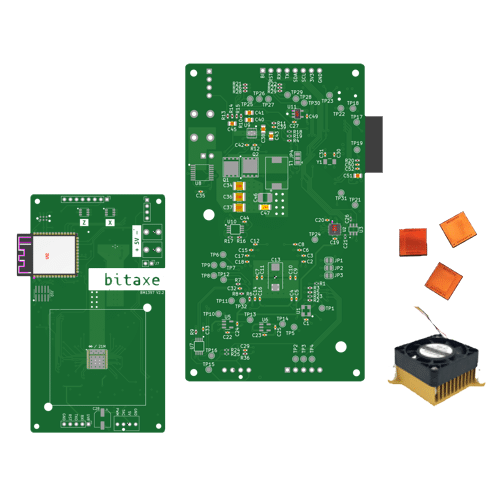

DIY Kits10 Products

-

Gaming Gear1 Product

-

Merchandise110 Products

-

Mining Hardware41 Products

-

Mining Hardware Parts64 Products

-

Open Source17 Products

-

Others8 Products

-

Pleb Mining46 Products

-

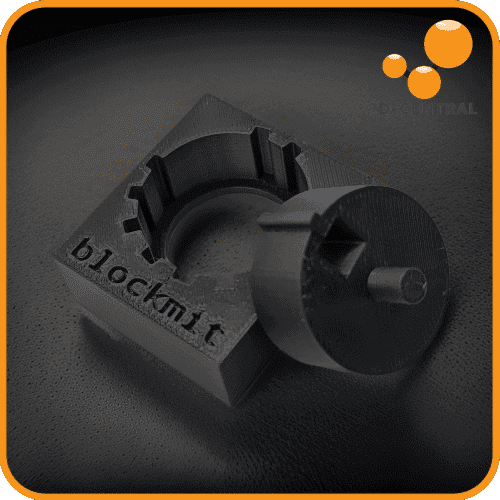

Tools28 Products

We offer a wealth of educational resources to help you understand the ins and outs of Bitcoin mining.

At D-Central Technologies, we provide a rich library of educational resources to help you master Bitcoin mining. Our comprehensive articles, guides, tutorials, and videos cover everything you need to know, from mining hardware and software to profitability calculations and network protocols. Whether you’re a beginner seeking foundational knowledge or an experienced miner looking to stay ahead of the curve, our resources cater to all expertise levels. If our resources leave you needing more support, you can reach out for training classes or 1-on-1 sessions, available both physically and remotely.

Our latest articles

Plug-and-Play WiFi for Antminers: Introducing the Vonets Adapter Power Cable

For Bitcoin miners using Antminer units, setting up a

The Complete Bitaxe Overclocking Guide: From 1.2 TH/s to 2+ TH/s

The Bitcoin mining landscape has witnessed an extraordinary transformation.

Maximizing ASIC Mining Profitability: Key Tips and Strategies for 2025

Curious about ASIC mining profitability in 2025? This article