Understanding the Myths and Facts About Bitcoin Mining & Environmental Impact

It’s no secret that Bitcoin mining can be a controversial topic. From its significant energy consumption to its potential environmental

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

Application-Specific Integrated Circuits (ASICs) are at the heart of technological innovation, particularly in the realm of Bitcoin mining, where they serve as the backbone for processing and validating blockchain transactions. ASICs are specifically designed to perform the hash calculations required by Bitcoin protocols much more efficiently than general-purpose hardware, such as CPUs or GPUs. This efficiency has made ASICs indispensable in the competitive field of cryptocurrency mining, where speed and energy consumption directly influence profitability.

This article will delve into the economics of ASIC production with a particular emphasis on their use in Bitcoin mining. We will explore the costs involved in designing and manufacturing these specialized chips, the broader impact of these costs on the Bitcoin mining industry, and how these factors shape market dynamics and competitive strategies. Additionally, we will look ahead to emerging trends and technologies that could influence the future landscape of ASIC production and mining. A key focus will be on the estimated costs per wafer for companies like Bitmain, a leading player in the mining sector, which significantly impacts the economics of ASIC production and the overall viability of Bitcoin mining operations.

Application-Specific Integrated Circuits (ASICs) are specialized hardware designed explicitly for Bitcoin mining. Unlike general-purpose processors that handle a wide range of tasks, ASICs are engineered to perform the specific cryptographic calculations required by the Bitcoin protocol, known as SHA-256 hashing. This specialization enables ASICs to offer unmatched efficiency and performance in Bitcoin mining operations, drastically outperforming earlier generations of mining hardware in both speed and energy consumption.

Why ASICs are Preferred Over Other Hardware for Bitcoin Mining

ASICs have become the hardware of choice for Bitcoin mining for several key reasons:

The transition to ASICs in Bitcoin mining reflects the broader trend towards specialized hardware in various technology sectors, where performance and efficiency are optimized for specific tasks. This shift has profound implications for the economics of Bitcoin mining, influencing everything from the profitability of mining operations to the competitive landscape of the industry.

The design and development phase of ASICs for Bitcoin mining encapsulates a considerable portion of the production costs. This stage requires highly specialized engineering expertise and significant investments in research and development (R&D) to create efficient and effective mining chips. The design process involves extensive simulations and optimization techniques to ensure that the ASICs can handle the rigorous demands of continuous Bitcoin mining operations. These costs are also amplified by the need for intellectual property (IP) licenses and the integration of sophisticated electronic design automation (EDA) tools, which are crucial for laying out the ASIC designs before fabrication.

Manufacturing Costs

Once the design is finalized, manufacturing begins, and this is where economies of scale come into play. The fabrication of ASICs, particularly for Bitcoin mining, involves advanced semiconductor manufacturing processes, which are cost-intensive due to the precision and technology required. For example, Bitmain, a leading producer of cryptocurrency mining ASICs, faces significant expenses in securing silicon wafers and processing them at foundries. The cost per wafer can be substantial, especially as manufacturers like Bitmain opt for advanced nodes like 5nm or 7nm technologies, which offer superior efficiency and performance but at higher production costs. As the volume of production increases, however, the cost per ASIC can decrease, allowing for better margins on a larger scale of operation.

Testing and Quality Assurance

Testing and quality assurance are critical in ASIC production, especially for devices intended for Bitcoin mining, where reliability and operational continuity are paramount. Each ASIC must undergo rigorous testing to ensure it meets the specific performance criteria without failure. This stage is vital to prevent costly recalls or failures in the field, which can undermine the profitability and reputation of mining operations. The testing phase involves both in-situ tests (under real operational conditions) and accelerated life testing to predict long-term reliability under continuous use. These procedures ensure that each ASIC chip will perform optimally over its intended lifespan, thereby securing the investment of mining operators in the technology.

Each of these cost factors plays a crucial role in the economics of ASIC production for Bitcoin mining, influencing everything from pricing strategies to the overall competitiveness of mining hardware producers in the global market. As the demand for Bitcoin and other cryptocurrencies continues to grow, the efficiency, cost-effectiveness, and reliability of ASICs will remain central to the economic landscape of the mining industry.

The capital investment required for ASIC technology in Bitcoin mining is significant, encompassing both the initial expenditure on hardware and the ongoing costs related to maintenance and electricity consumption. Investors and mining operations must consider the high upfront costs associated with purchasing ASICs, which are the most efficient but also the most expensive mining hardware available. The return on investment (ROI) is a critical metric, influenced by factors such as the price of Bitcoin, electricity rates, the efficiency of the ASICs, and the overall network difficulty.

ROI calculations must account for the depreciation of hardware over time, as newer and more efficient models inevitably enter the market. Additionally, the profitability of Bitcoin mining operations hinges on the ability to scale efficiently and manage operational costs effectively. For many, the large initial investment is justified by ASICs’ superior hashing power, which can lead to quicker recovery of capital through increased mining output and rewards.

Impact of Technological Advancements

Technological advancements in ASIC design directly impact the economics of Bitcoin mining. As ASIC manufacturers like Bitmain introduce newer models, such as those with improved energy efficiency ratios and enhanced processing capabilities, the dynamics of mining profitability are altered. Newer ASIC models can process more hashes per second while consuming less electricity, which significantly enhances their appeal as they lower the cost per Bitcoin mined.

These advancements also drive a cycle of obsolescence and innovation within the industry. As new ASICs set higher standards for efficiency and performance, older models become less economically viable due to higher operational costs and lower output. This rapid pace of technological improvement necessitates continuous investment in newer hardware, a factor that can strain the financial resources of smaller mining operations and consolidate mining power among larger entities with more capital.

Moreover, the development of cutting-edge ASICs can exacerbate the entry barriers for new miners, as the cost of competitive hardware increases. However, for those able to invest, the advancements offer a competitive edge by maximizing the profitability per unit of electricity consumed, which is often the largest variable cost in Bitcoin mining.

The introduction of ASICs has significantly reshaped the competitive landscape of Bitcoin mining. Initially, mining was accessible to enthusiasts using personal computers and graphics processing units (GPUs). However, the emergence of ASICs, which are exponentially more efficient at processing Bitcoin transactions, has centralized mining power to those who can invest in this high-cost technology. Large-scale mining operations with the capital to continually upgrade to the latest ASIC models dominate the industry, squeezing out smaller players and increasing the hash rate concentration in regions with lower electricity costs.

This technological arms race has led to a situation where the competitiveness of a mining operation hinges on having the latest and most efficient ASICs. The rapid pace of improvement in ASIC technology means that hardware can become obsolete within a year, forcing miners to reinvest substantial portions of their earnings into new equipment just to stay competitive.

Market Access and Entry Barriers: Effects of ASIC production costs on market entry barriers in Bitcoin mining

The high cost of ASIC production sets substantial barriers to entry for new participants in the Bitcoin mining industry. The financial outlay required for the latest ASIC technology can be prohibitive, preventing new miners from entering the market unless they have significant initial capital. This concentration of mining power not only affects competition but also raises concerns about network security and the decentralized nature of Bitcoin.

Furthermore, the complexity and cost of ASIC manufacturing mean that only a few companies can compete in this market, which in itself limits competition. These manufacturers have significant influence over the mining industry, controlling both the supply of new hardware and, indirectly, the economics of mining operations.

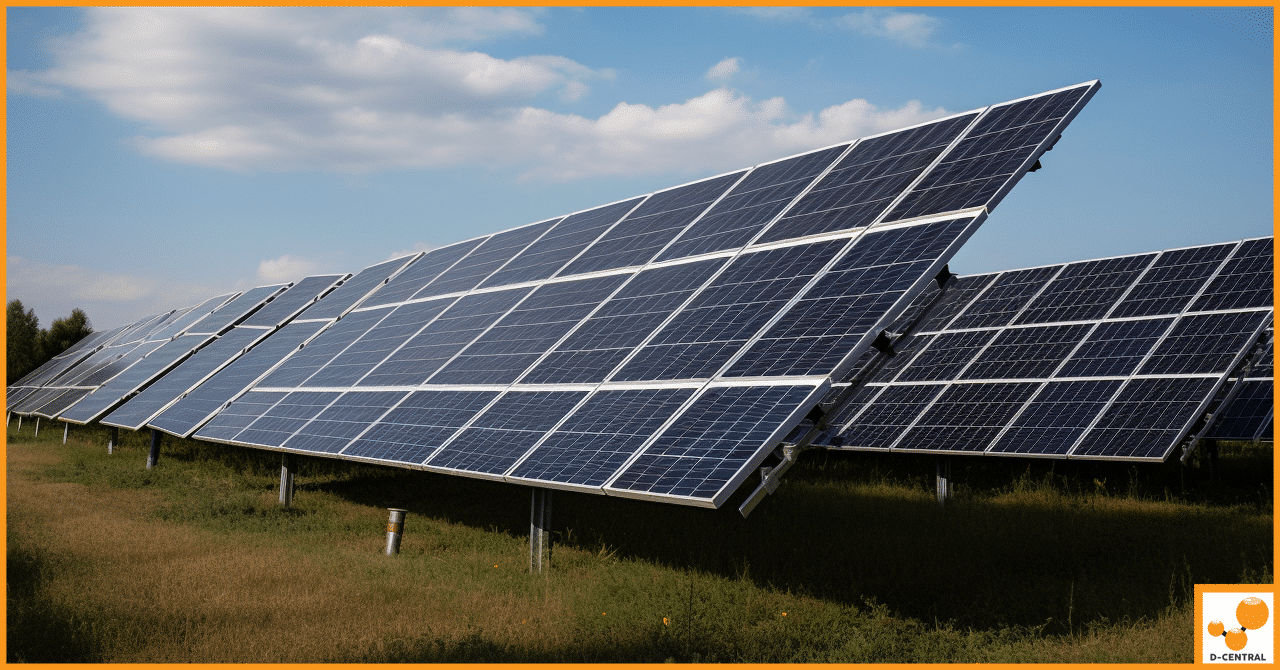

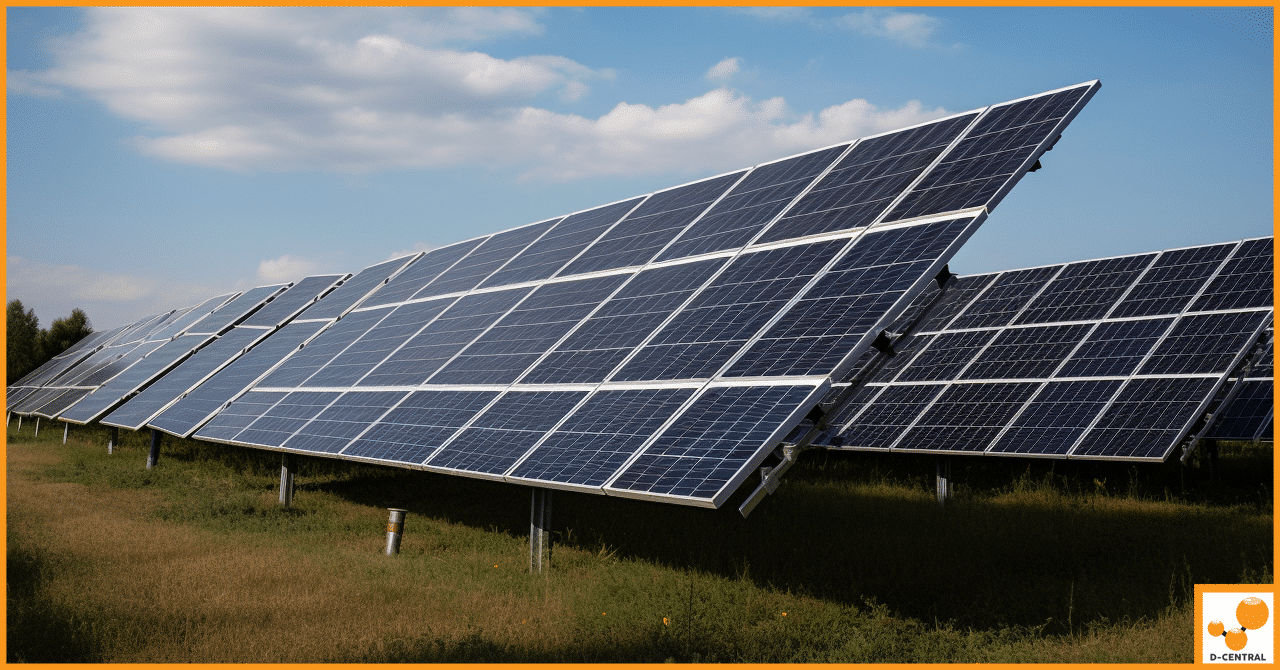

Sustainability and Energy Consumption: Examination of energy consumption issues related to ASIC mining and initiatives towards sustainability

ASICs, while more energy-efficient per hash than their predecessors, have contributed to an exponential increase in the energy consumption of the Bitcoin network due to the sheer scale of global mining operations. This surge in energy demand has sparked significant environmental concerns, given that much of the energy consumed by Bitcoin mining comes from non-renewable sources.

In response to these concerns, there has been a push within the industry towards more sustainable mining practices. Initiatives include the use of renewable energy sources such as hydroelectric, wind, and solar power in regions like Scandinavia, parts of Canada, and other areas with access to renewable resources. Companies are also exploring the re-use of waste heat generated by ASICs, turning what would be a byproduct into a resource for heating in colder climates.

The ASIC manufacturing sector, pivotal for Bitcoin mining, has faced significant challenges due to disruptions in the global supply chain. Key issues include shortages of silicon wafers and other semiconductor materials, delays in logistics, and geopolitical tensions affecting trade routes. These challenges are exacerbated during periods of high demand, particularly when new, more efficient ASIC models are released, leading to intense competition for limited resources. The impact on ASIC production includes increased costs and delayed delivery times, which can hinder the ability of mining operations to upgrade their equipment and maintain competitive efficiency levels.

Technological Evolution: Keeping up with rapid advancements in ASIC technology to stay competitive

The pace of technological advancement in ASIC design is relentless, with new models offering ever-greater efficiency and performance being developed at a rapid clip. For Bitcoin miners, staying competitive often means investing in the latest technology to maximize hash rates and energy efficiency. This constant cycle of upgrading is financially burdensome and technologically demanding, requiring miners to stay informed about advancements and quickly adapt their strategies to incorporate new hardware. The need for continual investment places additional strain on operational budgets, particularly for smaller miners who may struggle to keep pace.

Strategies Employed by Major Players: How leading companies like Bitmain adapt to these challenges

Leading companies such as Bitmain have developed several strategies to navigate the complexities of ASIC production and maintain their market dominance. One key strategy is vertical integration; Bitmain not only designs but also manufactures their ASIC chips, giving them greater control over their supply chain and reducing dependency on external foundries. They also invest heavily in R&D to ensure their ASICs are at the cutting edge of technology, thus appealing to miners looking for the most efficient solutions.

Bitmain and similar companies also engage in strategic partnerships with energy providers and mining farms to ensure steady demand for their products and secure energy resources at competitive rates. Moreover, they have diversified their operations geographically to mitigate risks associated with regulatory changes in any one market and to take advantage of lower energy costs in regions such as Northern Europe and North America.

These strategic responses enable major ASIC producers to not only overcome the challenges posed by supply chain disruptions and rapid technological evolution but also to strengthen their market position and influence within the Bitcoin mining industry.

The ASIC manufacturing sector, pivotal for Bitcoin mining, has faced significant challenges due to disruptions in the global supply chain. Key issues include shortages of silicon wafers and other semiconductor materials, delays in logistics, and geopolitical tensions affecting trade routes. These challenges are exacerbated during periods of high demand, particularly when new, more efficient ASIC models are released, leading to intense competition for limited resources. The impact on ASIC production includes increased costs and delayed delivery times, which can hinder the ability of mining operations to upgrade their equipment and maintain competitive efficiency levels.

Technological Evolution: Keeping up with rapid advancements in ASIC technology to stay competitive

The pace of technological advancement in ASIC design is relentless, with new models offering ever-greater efficiency and performance being developed at a rapid clip. For Bitcoin miners, staying competitive often means investing in the latest technology to maximize hash rates and energy efficiency. This constant cycle of upgrading is financially burdensome and technologically demanding, requiring miners to stay informed about advancements and quickly adapt their strategies to incorporate new hardware. The need for continual investment places additional strain on operational budgets, particularly for smaller miners who may struggle to keep pace.

Strategies Employed by Major Players: How leading companies like Bitmain adapt to these challenges

Leading companies such as Bitmain have developed several strategies to navigate the complexities of ASIC production and maintain their market dominance. One key strategy is vertical integration; Bitmain not only designs but also manufactures their ASIC chips, giving them greater control over their supply chain and reducing dependency on external foundries. They also invest heavily in R&D to ensure their ASICs are at the cutting edge of technology, thus appealing to miners looking for the most efficient solutions.

Bitmain and similar companies also engage in strategic partnerships with energy providers and mining farms to ensure steady demand for their products and secure energy resources at competitive rates. Moreover, they have diversified their operations geographically to mitigate risks associated with regulatory changes in any one market and to take advantage of lower energy costs in regions such as Northern Europe and North America.

These strategic responses enable major ASIC producers to not only overcome the challenges posed by supply chain disruptions and rapid technological evolution but also to strengthen their market position and influence within the Bitcoin mining industry.

The economics of ASIC production for Bitcoin mining encompasses several key factors that critically influence the sustainability and profitability of mining operations. This article has highlighted the intensive capital and technological investments required to develop and produce ASICs, which are tailored for the high-efficiency demands of Bitcoin mining. The challenges in the supply chain, rapid technological advancements, and strategies employed by industry leaders like Bitmain illustrate the complex interplay of factors that drive the competitive landscape of this industry.

The continued evolution of ASIC technology is likely to further intensify the arms race in Bitcoin mining hardware. As the efficiency of ASICs improves, the pressure on miners to upgrade equipment frequently will persist, potentially squeezing smaller players out and centralizing mining power further. This centralization could have profound implications for the decentralization ethos of Bitcoin.

Moreover, the environmental impact of increasing ASIC deployment will continue to be a contentious issue. As the global focus on sustainability intensifies, the Bitcoin mining industry will likely face greater scrutiny and pressure to adopt greener practices. This could accelerate the adoption of renewable energy sources in mining operations and spur innovations such as more energy-efficient ASIC designs.

In conclusion, the economics of ASIC production are not just reshaping the landscape of Bitcoin mining; they are also setting the stage for broader changes in regulatory, environmental, and economic policies related to cryptocurrency mining globally. As such, stakeholders in the Bitcoin ecosystem must navigate these complexities with a strategic approach that balances efficiency, profitability, and sustainability.

What is an ASIC in the context of Bitcoin mining?

An Application-Specific Integrated Circuit (ASIC) in Bitcoin mining is a specialized hardware device designed specifically for processing and validating blockchain transactions by performing hash calculations efficiently.

Why are ASICs preferred for Bitcoin mining over other types of hardware?

ASICs are preferred over CPUs, GPUs, or FPGAs for Bitcoin mining due to their superior efficiency in processing SHA-256 hashing problems, significantly lower energy consumption, cost-effectiveness over the long term, and compactness that benefits scaling operations.

What are the key factors in the production costs of ASICs for Bitcoin mining?

Key factors in ASIC production costs include the design and development phase, which involves significant R&D and IP licenses, manufacturing costs influenced by advanced semiconductor processes, and testing and quality assurance to ensure device reliability.

How do technological advancements in ASICs impact Bitcoin mining?

Technological advancements in ASIC design, such as improved energy efficiency and enhanced processing capabilities, alter mining profitability dynamics by enabling newer models to process more hashes per second at lower electricity costs, thus setting new standards for efficiency.

What strategies are employed by major ASIC producers like Bitmain?

Bitmain employs strategies such as vertical integration, heavy investment in R&D, strategic partnerships with energy providers and mining farms, and geographic diversification of operations to navigate challenges in ASIC production and maintain market dominance.

What are the economic implications of ASIC manufacturing for Bitcoin mining?

The economic implications include significant capital investment requirements for the latest and most efficient ASIC technology, a cycle of obsolescence and innovation demanding continuous investment, and a market landscape where competitive mining power is centralized among those who can afford these investments.

What are the environmental concerns associated with ASIC-based Bitcoin mining?

The environmental concerns stem from the significant energy consumption of global ASIC-based Bitcoin mining operations, primarily fueled by non-renewable sources, leading to growing scrutiny and pressure for the industry to adopt more sustainable practices and renewable energy sources.

How do supply chain disruptions affect ASIC production for Bitcoin mining?

Supply chain disruptions, such as shortages of silicon wafers and other semiconductor materials, affect ASIC production by increasing costs, causing delays in delivery times, and hindering mining operations’ ability to upgrade equipment and maintain efficiency.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

It’s no secret that Bitcoin mining can be a controversial topic. From its significant energy consumption to its potential environmental

In the ever-expanding universe of cryptocurrencies, Bitcoin stands as the pioneering giant, a beacon that has sparked widespread curiosity and

Are you ready to dive into the exciting world of Bitcoin lottery mining? This comprehensive guide will walk you through