In a world where financial systems pivot predominantly around traditional banking structures, a staggering number of individuals across the globe still find themselves excluded from this framework, residing in what we term as ‘unbanked’ countries. These nations, characterized by a significant portion of their population lacking access to conventional banking services, inadvertently foster environments where economic growth and financial stability are perpetually stifled. The figures are startling: Morocco with 71%, Vietnam at 69%, Egypt with 67%, Philippines at 66%, Mexico with 63%, Nigeria at 60%, Peru with 57%, Colombia at 54%, and both Indonesia and Argentina at 51% unbanked populations, illuminate a pervasive issue that demands an innovative, inclusive, and globally applicable solution.

Enter the Bitcoin Standard. A concept that transcends mere cryptocurrency trading and delves into a revolutionary financial paradigm, where Bitcoin is not just a digital asset but a foundational base for a new kind of monetary system. The Bitcoin Standard seeks to address the myriad of challenges faced by the unbanked, offering a decentralized, accessible, and egalitarian approach to finance. It presents a robust alternative to traditional banking, especially in regions where economic instability and inflation have eroded trust in conventional financial systems.

In this exploration, we delve into the profound implications of adopting a Bitcoin Standard in unbanked countries, unraveling its potential to not only democratize access to financial resources but also to catalyze economic empowerment and foster financial inclusion on a global scale. Through the lens of data, real-world applications, and forward-thinking, we embark on a journey to decipher how the amalgamation of technology and finance via Bitcoin could pave the way for a future where financial autonomy is not a privilege but a basic right, accessible to all.

The Surge of Bitcoin Adoption Globally

In the intricate tapestry of global finance, Bitcoin has emerged, not merely as a disruptive force but as a potential harbinger of a new era, particularly evident in its burgeoning adoption across the globe. The digital currency, once relegated to niche communities of tech enthusiasts and financial anarchists, has now permeated the mainstream consciousness, sparking a global movement that transcends borders, cultures, and economic statuses.

The surge in Bitcoin adoption is not an isolated phenomenon but a response to a myriad of factors that collectively underscore its significance in the contemporary financial landscape. From the affluent corridors of Wall Street to the modest dwellings in developing nations, Bitcoin is being embraced with unprecedented vigor, and the reasons are as varied as they are compelling.

A Beacon of Financial Sovereignty

In countries beleaguered by economic instability, hyperinflation, and depreciating national currencies, Bitcoin has emerged as a beacon of financial sovereignty. It offers a refuge from the tumultuous seas of traditional finance, providing individuals with a means to preserve wealth, engage in global commerce, and attain a degree of financial autonomy hitherto unattainable.

The Technological Vanguard

On the technological front, Bitcoin stands as a vanguard, embodying the pinnacle of blockchain technology with its decentralized, transparent, and immutable ledger. It facilitates peer-to-peer transactions, obliterating the need for intermediaries and offering a level of financial inclusivity that is particularly poignant in regions where traditional banking infrastructures are either absent or inaccessible.

The Macro-Economic Perspective

From a macro-economic perspective, the adoption of Bitcoin signals a paradigm shift in how nations and individuals perceive and interact with money. Countries like El Salvador have not only embraced Bitcoin but have also accorded it the status of legal tender, thereby embedding it within their economic frameworks and presenting a viable alternative to traditional fiat currencies.

A Magnet for Innovation and Investment

Furthermore, Bitcoin has proven to be a potent magnet for innovation and investment. Nations adopting Bitcoin position themselves as pioneers in a nascent yet rapidly evolving domain, attracting investments, technological advancements, and establishing themselves as hubs for digital innovation.

The Social and Cultural Impact

On a social and cultural level, the global adoption of Bitcoin is dismantling long-standing barriers, enabling cross-border transactions, and fostering a globalized economy where individuals, regardless of their geographical locale or socio-economic status, can participate in the global financial ecosystem.

In essence, the surge of Bitcoin adoption globally is not merely a trend but a multifaceted movement that encapsulates technological, economic, and social dimensions. It is a testament to the collective recognition of Bitcoin’s potential to redress the imbalances of traditional finance, offering a pathway towards a future that champions inclusivity, autonomy, and global solidarity in our pursuit of economic prosperity.

In-depth Analysis of Unbanked Countries

Navigating through the global financial landscape reveals a stark disparity in access to banking services, particularly pronounced in countries where a substantial portion of the population remains unbanked. The implications of this are profound, affecting not only individual financial autonomy but also impeding national economic development. Let’s delve into an in-depth analysis of several unbanked countries, exploring their economic status, financial infrastructure, and the potential that Bitcoin adoption could unfold within these nations.

Morocco: Bridging the Financial Divide

With a staggering 71% of its population unbanked, Morocco faces a formidable challenge in bridging its financial divide. The prevalent lack of access to traditional banking services has stifled economic participation among large swathes of the population. Bitcoin, with its decentralized and accessible nature, presents a viable solution, enabling Moroccans to bypass conventional banking barriers, engage in global commerce, and potentially stimulate microeconomic activity at a grassroots level.

Vietnam: A Fertile Ground for Digital Finance

Vietnam, where 69% of citizens lack bank accounts, has witnessed a burgeoning interest in cryptocurrencies. The country’s youthful demographic, coupled with a rapidly expanding digital economy, creates a fertile ground for Bitcoin adoption. The digital currency could serve as a catalyst, propelling financial inclusion, fostering entrepreneurial ventures, and facilitating cross-border transactions, thereby injecting vitality into the nation’s economic ecosystem.

Egypt: Navigating Economic Challenges

In Egypt, 67% of the population remains unbanked, navigating through economic challenges without the safety net of financial services. Bitcoin offers a beacon of financial empowerment, providing Egyptians with a mechanism to safeguard their wealth against inflation, engage in global trade, and access digital financial services, potentially driving socio-economic upliftment.

Philippines: Leveraging Remittances

With 66% unbanked, the Philippines faces a critical need to enhance financial accessibility. Given the country’s heavy reliance on overseas remittances, Bitcoin could revolutionize the remittance sector, providing a cost-effective, swift, and secure means for overseas Filipinos to send money home, thereby supporting local economies and individual financial stability.

Mexico: Aiming for Financial Inclusivity

Mexico, where 63% of the populace is unbanked, stands at a pivotal juncture where Bitcoin could significantly enhance financial inclusivity. By providing a decentralized financial framework, Bitcoin could enable Mexicans to access global markets, safeguard assets, and participate in the digital economy, thereby contributing to economic development and reducing financial disparity.

Nigeria: Embracing Digital Wealth

In Nigeria, 60% of individuals lack access to banking, yet the nation has witnessed a surge in cryptocurrency adoption. Bitcoin, in this context, serves as a medium to preserve wealth, engage in international trade, and access digital financial services, thereby providing Nigerians with a means to navigate through economic uncertainties and participate in global economics.

Peru: Addressing Economic Volatility

Peru, with a 57% unbanked population, grapples with economic volatility and a palpable need for stable financial infrastructure. Bitcoin offers a robust alternative to traditional finance, providing Peruvians with a stable and accessible means to engage in economic activities, protect against inflation, and participate in the burgeoning digital economy.

Colombia: Fostering Economic Participation

With 54% unbanked, Colombia faces the imperative to enhance financial accessibility and foster economic participation among its citizens. Bitcoin, with its decentralized and globally accessible nature, could serve as a mechanism to facilitate economic engagement, enhance financial security, and stimulate local economies.

Indonesia & Argentina: Nurturing a Digital Economy

Both with 51% of their populations unbanked, Indonesia and Argentina present compelling cases for Bitcoin adoption. The digital currency could serve to enhance financial inclusion, stimulate local economies, and provide a stable and secure means for individuals to engage in the global digital economy.

Case Studies

The global narrative of Bitcoin adoption is punctuated by countries that have boldly stepped into the digital currency arena, each with its unique socio-economic context, challenges, and aspirations. Let’s delve into some pivotal case studies that illuminate the varied pathways and implications of embracing a Bitcoin Standard.

El Salvador: The Pioneer in Bitcoin Adoption

El Salvador has etched its name in the annals of financial history by becoming the first country to adopt Bitcoin as legal tender. The decision, spearheaded by President Nayib Bukele, was driven by a multifaceted desire to enhance financial inclusion, stimulate economic development, and establish the nation as a hub for digital innovation. The move to integrate Bitcoin into the country’s economic framework has not only provided its citizens with a new avenue for wealth preservation and global trade but also positioned El Salvador as a trailblazer in the global adoption of digital currencies. The nation’s experiment with Bitcoin will undoubtedly serve as a critical reference point for other countries contemplating a similar path.

Paraguay: Harnessing Hydroelectric Power for Bitcoin

Paraguay, blessed with abundant hydroelectric power, has eyed Bitcoin mining as a potential avenue to leverage its energy resources. Congressman Carlitos Rejala has been vocal about his support for Bitcoin, advocating for the nation to advance with the new generation and explore the economic potentials that Bitcoin and blockchain technology could unfold. The country is exploring legislative frameworks to facilitate Bitcoin adoption, with a keen eye on utilizing its energy surplus to attract Bitcoin mining operations and potentially establish itself as a global player in the digital currency domain.

Panama: Envisioning a Crypto-forward Future

Panama has expressed its intent to not be left behind in the global Bitcoin movement. Congressman Gabriel Silva has spotlighted the imperative for Panama to embrace digital currencies to establish itself as a technological and entrepreneurial hub. The nation is exploring legislative proposals to integrate Bitcoin and other cryptocurrencies into its economic ecosystem, aiming to enhance financial inclusion, stimulate economic activity, and position Panama as a leader in digital finance.

Brazil: Political Endorsements and Public Sentiment

Brazil has witnessed a groundswell of support for Bitcoin, not just among its populace but also within its political corridors. State Deputy Fabio Ostermann and Federal Deputy Gilson Marques have publicly endorsed Bitcoin, symbolizing a growing recognition of its potential within the nation’s socio-economic context. Brazil’s exploration of Bitcoin is underscored by a desire to enhance financial autonomy, safeguard against economic uncertainties, and potentially leverage the digital currency to stimulate economic growth and global trade.

Mexico: A Senatorial Nod to Bitcoin

Mexico has seen Senator Indira Kempis express her support for Bitcoin, reflecting a growing interest within the nation to explore digital currencies. The senatorial nod to Bitcoin signifies a potential shift in the nation’s financial outlook, exploring how the digital currency could enhance financial stability, attract investments, and potentially serve as a catalyst for economic development, particularly in regions where traditional banking infrastructures are limited or non-existent.

Argentina: Political Expressions and Economic Considerations

In Argentina, where economic volatility and inflation have long plagued the financial landscape, Bitcoin is being eyed as a potential stabilizer. National Deputy Francisco Sánchez has expressed his support for Bitcoin, symbolizing a growing recognition of its potential to offer economic stability, preserve wealth, and facilitate international trade. Argentina’s exploration of Bitcoin is underscored by both economic and social considerations, seeking ways to leverage the digital currency to enhance financial security and economic participation among its citizens.

Challenges and Criticisms

Embarking on the journey towards widespread Bitcoin adoption is not without its complexities and challenges. While the decentralized digital currency offers a plethora of potential benefits, it also brings forth a spectrum of concerns and criticisms that need to be meticulously addressed to facilitate a smooth transition and ensure sustainable integration into various economies.

1. Economic Stability Concerns

Bitcoin, with its notorious volatility, raises concerns regarding economic stability. The fluctuating value of the cryptocurrency can potentially impact pricing, trade, and economic planning. Addressing this challenge requires robust regulatory frameworks, stabilization mechanisms, and perhaps the integration of stablecoins to mitigate risks associated with volatility.

2. Technological and Infrastructural Challenges

The technological infrastructure required to support widespread Bitcoin adoption, especially in unbanked regions, is substantial. Ensuring access to internet services, providing secure and user-friendly platforms, and safeguarding against cyber threats are pivotal to fostering a secure and accessible digital financial ecosystem.

3. Regulatory and Legal Hurdles

Developing comprehensive regulatory frameworks that safeguard interests without stifling innovation is a delicate balance to strike. Legal structures need to address issues related to taxation, anti-money laundering (AML) protocols, and consumer protection while ensuring that they do not inhibit technological and financial advancements.

4. Environmental Concerns

Bitcoin mining has been under scrutiny for its environmental impact, particularly concerning its substantial energy consumption and carbon footprint. Adopting sustainable mining practices, exploring alternative consensus mechanisms, and leveraging renewable energy sources are crucial to mitigating environmental concerns.

5. Social and Cultural Adoption

The social and cultural aspects of transitioning to a Bitcoin standard, particularly in terms of public perception, understanding, and trust, cannot be overlooked. Educational initiatives, transparent communication, and creating an inclusive digital financial environment are vital to facilitating smooth social and cultural adoption.

6. Political Resistance and Global Relations

Political resistance, especially from nations with robust fiat currencies and those that leverage financial control as a means of governance, poses a significant challenge. Navigating international relations, especially concerning trade and global financial interactions, requires strategic diplomacy and cooperative international frameworks.

7. Financial Inclusion and Equality

While Bitcoin offers the prospect of enhanced financial inclusion, ensuring that this does not inadvertently widen economic disparities is crucial. Strategies to ensure equal access to technology, safeguard against wealth concentration, and facilitate widespread participation in the digital economy are imperative.

8. Security and Privacy Issues

Ensuring the security and privacy of users within the Bitcoin network is paramount. Addressing concerns related to hacking, fraud, and privacy breaches requires the development of secure platforms, robust legal frameworks, and perhaps the integration of privacy-enhancing technologies within the blockchain.

Navigating through these challenges and criticisms necessitates a multi-faceted approach that amalgamates technological innovation, regulatory development, social engagement, and international cooperation. The pathway towards Bitcoin adoption is as complex as it is promising, requiring concerted efforts to navigate through the intricacies and ensure that the transition to a digital financial future is secure, inclusive, and sustainable.

The Potential Impact of Bitcoin Standard

The adoption of a Bitcoin Standard across nations, particularly those grappling with financial instability and significant unbanked populations, heralds a new era of economic, social, and technological evolution. The implications of such a monumental shift in financial paradigms are profound, permeating various facets of societies and potentially reshaping global economic landscapes.

Economic Implications

- Wealth Preservation: Bitcoin, often dubbed ‘digital gold,’ provides a mechanism for wealth preservation, offering a hedge against inflation and economic volatility.

- Global Trade Facilitation: The decentralized and borderless nature of Bitcoin could facilitate global trade, enabling seamless cross-border transactions and reducing dependency on foreign exchange.

- Financial Inclusion: By bypassing traditional banking barriers, Bitcoin has the potential to enhance financial inclusion, providing unbanked populations with access to digital financial services.

- Investment and Entrepreneurship: The adoption of Bitcoin could attract investments and stimulate entrepreneurship, particularly in the realms of fintech and blockchain technology.

Social Implications

- Empowerment and Autonomy: Bitcoin provides individuals with financial autonomy and empowerment, enabling them to have direct control over their wealth and transactions.

- Enhanced Transparency: The transparent and immutable nature of blockchain technology could foster enhanced transparency in economic transactions and governance.

- Job Creation: The burgeoning Bitcoin and blockchain sector could generate new job opportunities, spanning various domains including technology, finance, and regulatory compliance.

- Community Development: Bitcoin could facilitate community-driven economic development, particularly in regions where traditional financial infrastructures are lacking or inaccessible.

Technological Implications

- Innovation in Financial Technologies: The adoption of a Bitcoin Standard is likely to spur innovation in financial technologies, fostering the development of new platforms, services, and solutions.

- Cybersecurity Advancements: The integration of Bitcoin will necessitate advancements in cybersecurity, ensuring the secure and stable operation of digital financial infrastructures.

- Blockchain Integration: Beyond Bitcoin, the underlying blockchain technology could be leveraged across various sectors, including supply chain, healthcare, and governance, fostering transparency and efficiency.

- Digital Transformation: The shift towards a digital currency could accelerate digital transformation across various sectors, integrating digital technologies into various aspects of economic and social interactions.

Navigating the Path Forward

The potential impact of adopting a Bitcoin Standard is as varied as it is significant, intertwining economic, social, and technological threads into a tapestry of evolved financial interaction. However, navigating this path requires meticulous planning, robust regulatory frameworks, and strategic implementation to ensure that the transition to a Bitcoin Standard realizes its potential while mitigating associated risks.

As we delve deeper into the exploration of a Bitcoin Standard, it is imperative to consider the multifaceted implications, ensuring that the adoption of digital currency serves to enhance, empower, and elevate societies in a sustainable and inclusive manner.

Strategies for Implementing a Bitcoin Standard

The transition to a Bitcoin Standard is a multifaceted endeavor, requiring a confluence of strategic planning, technological deployment, and socio-economic considerations. Implementing a Bitcoin Standard necessitates a holistic approach that not only addresses the technical and economic aspects but also ensures social and regulatory alignment. Here, we explore potential strategies and methodologies that could guide nations and entities in adopting a Bitcoin Standard.

1. Legislative and Regulatory Frameworks

- Develop Comprehensive Regulations: Establish clear and comprehensive regulations that govern the use, trading, and mining of Bitcoin, ensuring stability and security in the digital financial ecosystem.

- International Collaboration: Engage in international dialogues and collaborations to establish global regulatory standards and facilitate cross-border Bitcoin transactions and trade.

- Consumer Protection: Implement robust legal frameworks that safeguard consumer interests, ensuring security and transparency in Bitcoin transactions and services.

2. Technological Infrastructure and Security

- Build Robust Infrastructure: Develop and deploy secure and scalable technological infrastructure to support Bitcoin transactions, mining, and storage.

- Cybersecurity Protocols: Implement stringent cybersecurity protocols to safeguard against hacks, fraud, and unauthorized access to digital wallets and platforms.

- Develop and Promote Wallet Technologies: Foster the development and adoption of secure and user-friendly digital wallet technologies to facilitate easy access and transactions in Bitcoin.

3. Financial Inclusion and Accessibility

- Promote Digital Literacy: Launch initiatives to enhance digital literacy and awareness regarding Bitcoin, ensuring that populations are well-equipped to navigate the digital financial landscape.

- Ensure Accessibility: Develop platforms and services that ensure the accessibility of Bitcoin transactions, particularly focusing on unbanked and underbanked populations.

- Support Financial Products: Encourage the development of financial products and services that leverage Bitcoin, such as loans, insurance, and investment products.

4. Economic Stability and Growth

- Mitigate Volatility: Explore mechanisms to mitigate the volatility associated with Bitcoin, potentially through the integration of stablecoins or other financial instruments.

- Stimulate Economic Sectors: Leverage Bitcoin adoption to stimulate economic sectors, particularly in technology, finance, and innovation, fostering growth and job creation.

- Global Trade Strategies: Develop strategies that leverage Bitcoin to facilitate global trade, ensuring that cross-border transactions are seamless, secure, and efficient.

5. Social and Cultural Integration

- Community Engagement: Engage communities in dialogues and decision-making processes related to Bitcoin adoption, ensuring that strategies are aligned with social and cultural contexts.

- Educational Initiatives: Implement educational initiatives that enhance understanding and proficiency in Bitcoin and blockchain technology across diverse societal segments.

- Support Local Initiatives: Encourage and support local initiatives that leverage Bitcoin for community development, ensuring that the benefits of adoption permeate various social strata.

6. Environmental Sustainability

- Sustainable Mining Practices: Adopt and promote sustainable Bitcoin mining practices, leveraging renewable energy sources and optimizing energy utilization.

- Environmental Regulations: Implement regulations that ensure Bitcoin mining and transactions adhere to environmental standards and contribute to sustainability goals.

- Incentivize Green Practices: Provide incentives for adopting green practices in Bitcoin mining and transactions, encouraging the integration of sustainability into the digital currency domain.

Implementing a Bitcoin Standard requires a harmonized approach that intertwines technological, economic, social, and regulatory strands, crafting a pathway that is sustainable, inclusive, and forward-looking. As nations and entities explore this transformative journey, the strategies adopted must be reflective of the unique challenges, opportunities, and aspirations that characterize their socio-economic landscapes.

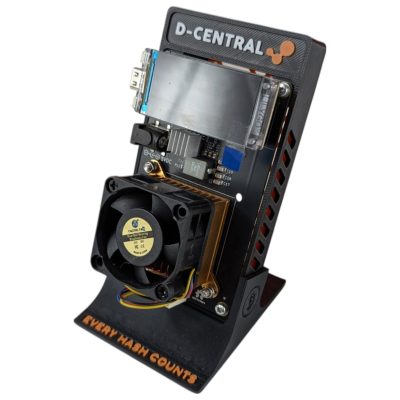

D-Central Technologies: Facilitating the Bitcoin Revolution

In the dynamic and ever-evolving landscape of digital currencies, D-Central Technologies emerges as a beacon of expertise, innovation, and unwavering support for the burgeoning Bitcoin ecosystem. As nations and entities explore the myriad possibilities of a Bitcoin Standard, we stand at the forefront, facilitating a seamless and empowered transition into the realm of decentralized finance.

Nurturing a Decentralized Future

At D-Central Technologies, we envision a future where financial autonomy, transparency, and inclusivity are not mere aspirations but tangible realities. Our array of services, spanning from Bitcoin mining to comprehensive consultation, is meticulously crafted to nurture this vision, providing a robust foundation upon which the decentralized future can thrive.

- Bitcoin Mining Services: Harnessing the power of cutting-edge technology, we offer unparalleled Bitcoin mining services, ensuring optimal performance, security, and profitability.

- ASIC Repairs: As the largest ASIC repair center in Canada, our expertise ensures that your mining operations are consistently efficient and your hardware is at its peak performance.

- Consultation and Training: Our seasoned experts provide insightful consultation and training, demystifying the complexities of the Bitcoin ecosystem and empowering you with knowledge and strategies.

- Outsourcing Solutions: We offer comprehensive mining support and outsourcing solutions, ensuring that your foray into the Bitcoin world is supported by reliability and expertise.

Bridging the Gap: Financial Inclusion and Empowerment

Our commitment extends beyond mere services; we are dedicated to bridging the gap between technological advancements and global communities. D-Central Technologies is not just a service provider but a facilitator of financial inclusion, ensuring that the benefits of Bitcoin permeate through various strata of society, particularly reaching those in unbanked regions.

Your Partner in the Bitcoin Journey

Whether you are a seasoned miner, a budding entrepreneur, or an entity exploring the potentials of a Bitcoin Standard, D-Central Technologies is your steadfast partner in this transformative journey. Our expertise, innovative solutions, and unwavering support ensure that your navigation through the Bitcoin ecosystem is seamless, secure, and strategically aligned with your objectives.

Explore the Future with D-Central Technologies

Embark on your Bitcoin journey with a partner that brings to the table a blend of expertise, innovation, and a profound understanding of the digital currency landscape. At D-Central Technologies, we are not just facilitating a revolution; we are shaping the future of finance, and we invite you to be a part of this transformative journey.

- Discover innovative and tailored solutions that propel your Bitcoin endeavors.

- Engage with our team of experts, harnessing our knowledge and insights to navigate the Bitcoin ecosystem effectively.

- Empower your operations, investments, and communities with our comprehensive services and solutions.

Connect with D-Central Technologies and step into a future where the potentials are limitless, the support is unwavering, and the journey towards a decentralized financial landscape is empowered and enlightened.

Conclusion

As we traverse through the intricate tapestry of the Bitcoin ecosystem, the potential for transformative change in global financial landscapes becomes increasingly palpable. The journey, albeit complex and laden with challenges, unveils a horizon where financial autonomy, inclusivity, and transparency are not mere utopian concepts but achievable realities.

Summarizing the Journey

- Unbanked Nations: The exploration of unbanked countries underscores a pressing need and a ripe opportunity for the adoption of a Bitcoin Standard, providing financial services and empowerment to vast populations currently outside the formal economy.

- Global Bitcoin Adoption: The surge of Bitcoin adoption across various nations, notably in Latin America, signals a paradigm shift, where decentralized digital currency becomes a pivotal player in national economies.

- Strategic Implementation: The strategic implementation of a Bitcoin Standard necessitates a harmonized approach, intertwining technological, regulatory, and social strategies to facilitate a smooth and sustainable transition.

- D-Central Technologies: As facilitators of the Bitcoin revolution, D-Central Technologies emerges as a partner and guide, providing expertise, solutions, and unwavering support to entities and individuals navigating the Bitcoin ecosystem.

Projecting Future Scenarios

- Widespread Adoption: The future may witness an accelerated adoption of Bitcoin, not just as a store of value, but as a medium of exchange, permeating various sectors of economies and becoming an integral part of daily transactions.

- Regulatory Evolution: As Bitcoin becomes more ingrained in global financial systems, regulatory frameworks will likely evolve, balancing the need for security and consumer protection with the preservation of the decentralized ethos of digital currencies.

- Technological Advancements: The technological infrastructure supporting Bitcoin will likely witness significant advancements, enhancing security, accessibility, and functionality, and potentially giving rise to new applications and platforms.

- Economic Transformations: Economies, particularly those of unbanked nations, may undergo transformative shifts, as Bitcoin provides a mechanism for wealth preservation, global trade facilitation, and financial inclusion.

The journey towards a Bitcoin Standard is as promising as it is complex, requiring concerted efforts, strategic planning, and collaborative initiatives across various sectors and nations. As we stand at the precipice of this potential transformation, the path forward invites us to explore, innovate, and shape a future where the decentralized, transparent, and inclusive nature of Bitcoin becomes a cornerstone of global financial landscapes.

In this future, entities like D-Central Technologies will continue to play a pivotal role, guiding, supporting, and facilitating the journey towards a decentralized financial future, ensuring that the transition is not just technologically sound but also socially equitable and economically empowering.

As we conclude this exploration, the dialogue continues, inviting further discussions, explorations, and collaborative efforts in shaping a future where Bitcoin is not just a currency but a catalyst for global change and empowerment.