The Role of Blockchain Technology in Cryptocurrency Transactions

In the digital age, the concept of currency has evolved beyond physical money to include digital currencies, a revolutionary form

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

Bitcoin, the first and most prominent cryptocurrency, has revolutionized the financial world since its inception in 2009. At its core, Bitcoin operates on blockchain technology, a decentralized ledger that records all transactions across a network of computers. This technology ensures transparency, security, and immutability, making Bitcoin a unique and powerful form of digital currency.

The blockchain is a chain of blocks, each containing a list of transactions. These transactions are verified by network participants, known as miners, who use powerful computers to solve complex mathematical problems. Successfully solving these problems, a process known as proof-of-work, allows miners to add a new block of transactions to the blockchain. In return, miners are rewarded with newly minted bitcoins, incentivizing them to maintain and secure the network.

The decentralized nature of the blockchain means that it is not controlled by any single entity, making Bitcoin resistant to censorship and fraud. This feature has led to widespread adoption and interest in Bitcoin and other cryptocurrencies, as they offer an alternative to traditional financial systems.

While the Bitcoin blockchain is renowned for its robustness and security, it is not infallible. One of the critical challenges in maintaining the integrity of the blockchain is the occurrence of invalid blocks. An invalid block is a block that does not comply with Bitcoin’s strict protocol rules and is therefore rejected by the network. Understanding these invalid blocks is crucial for several reasons.

Firstly, for miners, creating an invalid block can result in significant financial losses. Miners invest substantial resources in terms of energy and computing power to mine a block. If a block is deemed invalid, the miner loses the block reward and transaction fees, which can amount to a considerable sum.

Secondly, invalid blocks can impact the overall trust and efficiency of the Bitcoin network. Although rare, the occurrence of invalid blocks can lead to temporary confusion within the network, potentially affecting transaction processing times and network reliability.

Lastly, a comprehensive understanding of invalid blocks is vital for the ongoing development and improvement of the Bitcoin protocol. By analyzing the causes and consequences of invalid blocks, developers can enhance the network’s protocols, making Bitcoin more secure and efficient.

In summary, understanding invalid blocks is essential for miners, developers, and users of the Bitcoin network. It ensures the continued security, reliability, and advancement of this groundbreaking technology.

In the realm of Bitcoin and blockchain technology, an invalid block refers to a block that fails to meet the specific consensus rules set by the Bitcoin protocol. These blocks are rejected by the network and do not form part of the blockchain, ensuring the integrity and trustworthiness of the entire system. Characteristics of invalid blocks include:

Invalid blocks can occur due to various reasons, each highlighting a different aspect of the blockchain’s operational protocol.

Understanding these causes is crucial for miners and participants in the Bitcoin network. It helps in identifying potential pitfalls and reinforces the need for strict adherence to the protocol rules, ensuring the network’s security and efficiency.

One of the most notable incidents involving an invalid block occurred with Marathon Digital, a major player in the Bitcoin mining industry. In 2023, Marathon Digital inadvertently mined an invalid block at height 809478. The issue was traced back to a transaction ordering error within the block. This incident not only resulted in the loss of the block reward for Marathon but also highlighted the importance of meticulous adherence to Bitcoin’s mining protocols. The incident had a ripple effect, causing concern among investors and stakeholders about the reliability of mining operations and the importance of rigorous protocol compliance.

Another significant incident took place in June 2019, involving Bitmain’s Antpool, one of the largest Bitcoin mining pools. Antpool mined an invalid block, which led to the loss of a substantial block reward, estimated to be around $150,000. The invalid block was a result of a transaction that did not comply with Bitcoin’s consensus rules. This incident served as a costly reminder of the financial stakes involved in Bitcoin mining and the critical need for constant vigilance and compliance with the network’s rules.

The Bitcoin network has witnessed several other incidents where invalid blocks played a central role:

These incidents, while rare, underscore the complexities and challenges inherent in Bitcoin mining. They serve as important case studies for miners, developers, and participants in the Bitcoin network, emphasizing the need for strict adherence to protocols and continuous vigilance to maintain the integrity and security of the blockchain.

The creation of an invalid block can have significant financial repercussions for miners. Mining involves substantial investment in hardware, electricity, and other resources. When a block mined by a participant is declared invalid, the miner loses out on the block reward and transaction fees, which can amount to a considerable sum of money. For instance, in the case of Bitmain’s Antpool, the loss was estimated to be around $150,000. Such incidents not only result in immediate financial loss but can also affect the miner’s reputation and operational efficiency.

Invalid blocks can also influence market perceptions and investor confidence in the Bitcoin network. When high-profile incidents like Marathon Digital’s invalid block occur, they can lead to temporary market volatility. Investors and stakeholders, particularly those new to the cryptocurrency domain, might perceive these events as indicative of underlying vulnerabilities in the Bitcoin network. This can lead to short-term fluctuations in Bitcoin’s price and can affect the investment strategies of individuals and institutions alike.

While the immediate economic impact of invalid blocks is most acutely felt by the miners, there are broader long-term consequences for the Bitcoin ecosystem. Repeated occurrences of invalid blocks, although rare, could potentially challenge the perception of Bitcoin as a secure and reliable digital asset. This could influence the rate of adoption of Bitcoin by new users and businesses.

Moreover, these incidents highlight the need for ongoing improvements in mining technology and protocols. The economic incentives to avoid invalid blocks drive innovation in mining practices and software, contributing to the overall health and advancement of the Bitcoin network. In the long run, these technological advancements and the lessons learned from past incidents strengthen the resilience of the Bitcoin blockchain, ensuring its sustainability as a leading cryptocurrency.

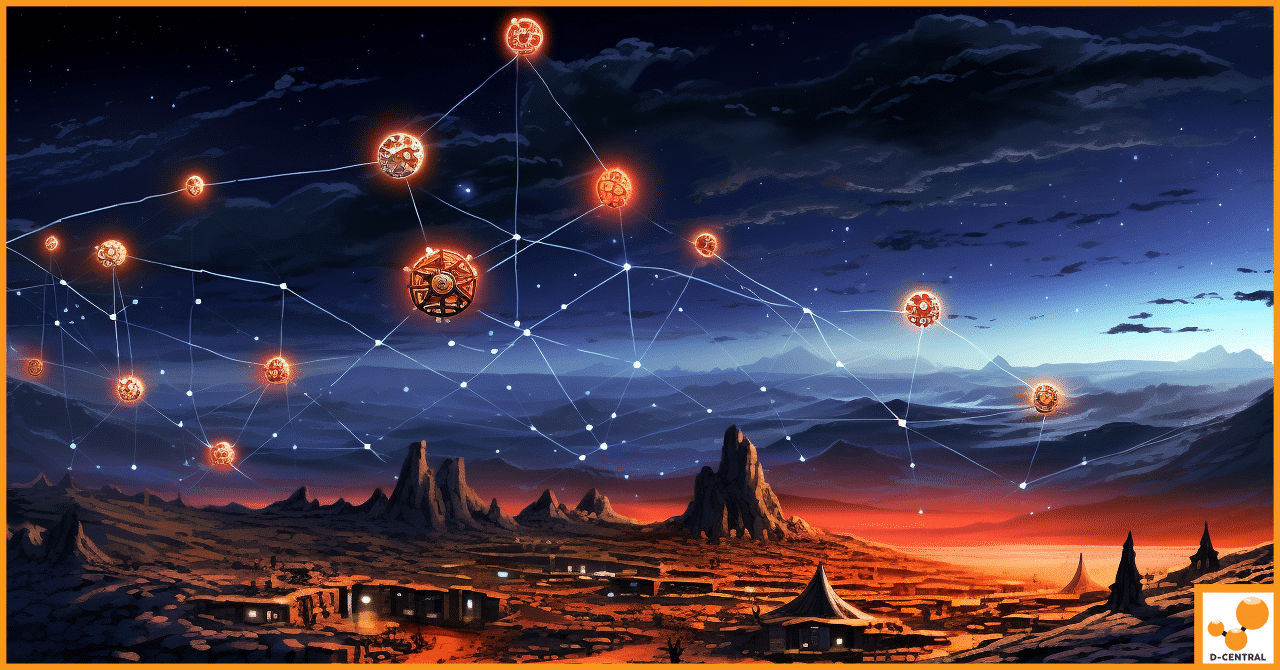

Bitcoin nodes are integral to the functioning and security of the Bitcoin network. A node is any computer that connects to the Bitcoin network and uses the Bitcoin protocol to validate transactions and blocks. These nodes come in various forms, including full nodes, which fully validate transactions and blocks, and lightweight or SPV (Simplified Payment Verification) nodes, which rely on full nodes for transaction information.

The primary function of Bitcoin nodes is to maintain a copy of the entire blockchain and to independently verify every transaction and block against the network’s consensus rules. This decentralized verification process is crucial for several reasons:

When a new block is proposed to the network, Bitcoin nodes perform a series of checks to ensure that the block complies with all the consensus rules. These checks include verifying that the transactions within the block are valid, that the block size does not exceed the set limit, and that the block’s hash meets the required difficulty level.

If a block fails any of these checks, it is rejected by the node and not added to the blockchain. This rejection is communicated across the network, ensuring that other nodes do not add the invalid block to their version of the blockchain. This process is critical in maintaining the integrity and trustworthiness of the Bitcoin blockchain.

The collective effort of nodes in verifying and maintaining the blockchain is a cornerstone of Bitcoin’s security model. This decentralized approach ensures that no single point of failure can compromise the network. It also makes the network more resilient to attacks, as an attacker would need to control a majority of the nodes to manipulate the blockchain, a feat that is extremely difficult and costly to achieve.

Furthermore, the decentralized nature of node operation allows for a diverse range of participants, from individual enthusiasts to large mining operations, contributing to a robust and democratic network. This diversity further enhances the security and resilience of the Bitcoin network, making it one of the most secure digital asset platforms in existence.

One of the key measures to prevent the creation of invalid blocks is the use of advanced transaction validation software. This software is designed to meticulously check each transaction for compliance with Bitcoin’s consensus rules before it is included in a block. This includes verifying the digital signatures, ensuring that the inputs of the transactions are unspent, and confirming that the transaction format is correct. By automating these checks, the software significantly reduces the risk of invalid transactions being included in a block.

To adhere to the block size limits set by the Bitcoin protocol, miners use block size checking tools. These tools ensure that the size of a block does not exceed the current maximum block size limit (1 MB for standard blocks). This is crucial because oversized blocks are automatically rejected by the network. By using these tools, miners can avoid the costly mistake of mining a block that will ultimately be deemed invalid due to its size.

Miners follow a set of protocols and best practices to minimize the risk of creating invalid blocks. These include:

Continuous monitoring of the Bitcoin network is essential for identifying potential issues that could lead to the creation of invalid blocks. Developers and miners closely monitor the network for unusual activities, such as spikes in orphaned blocks or reorganizations, which could indicate problems.

In addition to monitoring, the Bitcoin network undergoes regular updates and improvements. These updates, often implemented through soft forks, introduce new features or adjustments to the consensus rules to enhance the network’s security and efficiency. Miners and node operators are encouraged to participate in these updates to ensure the network remains robust against the creation of invalid blocks.

Together, these preventive measures and protocols form a comprehensive approach to maintaining the integrity of the Bitcoin blockchain. By adhering to these practices, miners and participants in the Bitcoin network can significantly reduce the occurrence of invalid blocks, ensuring the network’s stability and reliability.

The Bitcoin network is designed with several self-correction mechanisms that enhance its resilience and robustness. These mechanisms ensure that the network remains secure and functional, even in the face of potential threats like invalid blocks.

Several incidents in the history of Bitcoin demonstrate the network’s ability to respond effectively to invalid blocks:

The Bitcoin community, including miners, developers, and users, plays a crucial role in maintaining the network’s integrity:

The resilience and robustness of the Bitcoin network are a testament to its well-designed protocols, the self-correcting nature of its blockchain, and the active participation of its community. These factors collectively ensure that the network continues to operate securely and reliably, even in the face of challenges like invalid blocks.

Blockchain technology, while revolutionary, is inherently complex. This complexity presents several challenges:

Bitcoin mining, a critical component of the blockchain network, faces its own set of technical challenges:

Despite these challenges, the future of Bitcoin and blockchain technology is bright, with several potential solutions on the horizon:

In conclusion, while there are challenges and technical considerations in the realm of Bitcoin and blockchain technology, the continuous efforts of the community, developers, and miners, coupled with technological advancements, present a promising path forward. These efforts are likely to lead to more efficient, accessible, and environmentally friendly blockchain and mining practices in the future.

Invalid blocks in the Bitcoin network, while rare, serve as important reminders of the intricate balance and precision required in blockchain technology. These blocks, rejected by the network due to non-compliance with Bitcoin’s consensus rules, highlight the critical role of each participant in maintaining the network’s integrity. From transaction validation errors to oversized blocks and mining anomalies, the causes of invalid blocks are diverse, each contributing valuable lessons to the Bitcoin community.

The incidents involving invalid blocks underscore the paramount importance of diligence and strict compliance in Bitcoin mining. Miners bear the responsibility of adhering to the network’s protocols, not only to safeguard their financial investments but also to uphold the trust and security of the entire Bitcoin ecosystem. The financial implications of mining invalid blocks – loss of block rewards and transaction fees – are significant, but the broader impact on market confidence and network stability is even more profound. This necessitates a continuous commitment to best practices, advanced validation software, and adherence to mining protocols.

Looking ahead, the resilience and robustness of the Bitcoin network remain strong. The network’s self-correcting mechanisms, combined with the vigilant and collaborative efforts of the Bitcoin community, continue to fortify its security and reliability. Challenges such as scalability, energy consumption, and mining centralization are being actively addressed through technological innovations and community-driven initiatives.

The future of Bitcoin’s blockchain integrity is promising, bolstered by ongoing advancements in technology, a committed global community, and a collective dedication to upholding the highest standards of operation. As the network evolves, it is poised to become even more secure, efficient, and accessible, solidifying its position as a leading digital currency and a pioneering force in the world of blockchain technology.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

In the digital age, the concept of currency has evolved beyond physical money to include digital currencies, a revolutionary form

Bitcoin mining, the process of validating transactions and creating new bitcoins by solving complex mathematical problems, rewards miners with newly

In the digital age, Bitcoin has emerged as a revolutionary form of currency, challenging traditional financial systems with its decentralized