Ensuring Quality and Performance: Key Factors to Consider When Buying a Used Antminer S19

As the world of cryptocurrency continues to evolve and expand, the demand for efficient and powerful mining equipment has grown

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

Bitcoin mining, the process of validating transactions and creating new bitcoins by solving complex mathematical problems, rewards miners with newly minted bitcoins and transaction fees. However, mining is not a guaranteed source of income due to various challenges and uncertainties affecting revenue. Two primary factors limit the control of Bitcoin miners over their revenue: the volatility of Bitcoin price and the difficulty of mining. This lack of control over revenue generation highlights the importance of controlling costs for miners to remain profitable and competitive in the Bitcoin network. With revenue generation being uncertain, it is crucial for miners to focus on cost reduction and cost-effective power sources to ensure their operations’ profitability and sustainability. By doing so, they can maximize profits while contributing to more environmentally friendly practices within the industry.

The revenue of Bitcoin miners is significantly affected by the cost of mining, which is heavily influenced by electricity and hardware expenses required to run mining machines. To maximize profits, miners must control costs through various means, including improving the watts per terahash (w/TH) efficiency of their equipment, which measures the amount of processing power generated per unit of energy consumed. More efficient mining equipment results in reduced energy consumption and lower operating costs, ultimately contributing to higher profitability.

Another crucial aspect of cost control is reducing electricity costs. Miners can achieve this by seeking regions with cheaper electricity rates, negotiating better deals with power suppliers, or utilizing alternative energy sources. Lower electricity costs lead to improved profit margins and competitiveness within the industry.

Miners should also consider other cost factors, such as Power Usage Effectiveness (PuE), land, and labor. PuE measures the energy efficiency of a data center, with lower values indicating better efficiency. Land and labor costs can vary depending on the mining facility’s location and size, and local wages, respectively. By managing these costs, miners can optimize their operations.

To evaluate the effectiveness of cost control measures, miners can monitor their daily cost of compute, measured in USD/TH. This metric represents the combined impact of w/TH efficiency, electricity costs, and other contributing factors on the total cost of mining. Tracking this value over time can help miners identify trends, areas for improvement, and potential opportunities for cost reduction, ensuring that they remain profitable and competitive in the Bitcoin network.

The profitability of Bitcoin mining operations is significantly impacted by electricity costs, as they constitute a major expense for miners. High electricity costs can quickly erode profit margins, rendering mining less viable even with highly efficient equipment. Consequently, miners must prioritize finding cost-effective power sources to maintain profitability in an industry where electricity costs often surpass the benefits of w/TH efficiency improvements.

Profit maximalists play a crucial role in seeking cheaper power sources for the sustainability and competitiveness of Bitcoin mining. These miners focus on maximizing profits by minimizing costs, particularly electricity costs. They actively search for more affordable and efficient power sources, including renewable energy options like hydro, geothermal, and solar power, or other under-utilized and economically sustainable alternatives. By doing so, profit maximalists not only enhance their profit margins but also contribute to environmentally friendly practices in the Bitcoin mining industry. This natural incentive to use more cost-effective and sustainable power sources benefits both miners and the environment, as it reduces the industry’s overall energy footprint.

Electricity costs vary significantly depending on the location and source of electricity, which miners must consider and compare with potential mining revenue. Strategies employed by profit maximalists to reduce costs and increase profits include relocating to regions with cheaper or abundant electricity, using renewable energy sources to lower bills and reduce environmental impact, negotiating with power providers or local authorities for discounts or subsidies, and sharing or leasing excess power capacity with other miners or businesses to optimize power usage.

Bitcoin mining can be powered by various energy sources, some of which are overlooked, under-utilized, or lack infrastructure. These sources may offer advantages or disadvantages for miners depending on their availability, cost, efficiency, and environmental impact. A comparative analysis of different power sources can assist miners in selecting the best option for their operations.

Overlooked, under-utilized, or infrastructure-lacking power sources: In pursuit of cost-effective energy, Bitcoin miners often explore power sources that are overlooked, under-utilized, or lacking infrastructure. By utilizing these energy sources, miners can secure cheaper energy, maximizing profits for themselves and the energy suppliers.

NewCastle coal index comparison: Analyzing the NewCastle coal index against the equivalent value of coal tonnes converted to Bitcoin using the Antminer S19j Pro reveals that coal is not a profitable option for Bitcoin miners.

Profitability status: Primarily due to high fuel costs and other operational expenses, including CO2 emissions taxes, coal has not been a profitable energy source for Bitcoin mining since the Luna crash.

Henry Hub prices comparison: Comparing the Henry Hub natural gas prices to the equivalent value of MMBTU (with genset 35%, turbine 40%, combined cycle 60% efficient) when converted to Bitcoin with the S19j Pro shows that natural gas can still be profitable.

Profitability status and volatility: Although natural gas remains a viable option for Bitcoin miners, the profit margins are highly volatile and can become very tight when natural gas prices increase and mining revenues decline.

Price comparison: Examining the price of a pound of Uranium against its equivalent value when converted to Bitcoin with the S19j Pro indicates that nuclear power offers substantial profit margins for Bitcoin miners.

Profitability status and low volatility: Nuclear power provides not only high profit margins but also low volatility in fuel costs. Due to its low fuel costs, nuclear power is comparable to other sustainable energy sources like hydro and geothermal in terms of operating expenses.

In conclusion, controlling costs is essential for Bitcoin miners to ensure profitability and sustainability in an industry where revenue generation can be uncertain due to factors beyond their control. By optimizing w/TH efficiency, reducing electricity costs, and considering other cost factors, miners can improve their profit margins and maintain competitiveness within the industry.

Furthermore, as profit maximalists, Bitcoin miners are naturally incentivized to seek out cost-effective and sustainable power sources. This drive for cheaper energy not only benefits the miners but also contributes to environmentally friendly practices within the industry, reducing the overall energy footprint.

Contrary to Greenpeace’s claims that coal is the “largest source of electricity” for Bitcoin miners, a comparative analysis of different power sources reveals that coal is, in fact, the least profitable and smallest source of energy. This analysis debunks the notion that Bitcoin miners primarily rely on coal for their energy needs.

The ongoing pursuit of more sustainable and cost-effective power sources by profit maximalists benefits both the environment and the industry as a whole. This effort encourages the adoption of environmentally friendly energy sources and fosters innovation in the quest for efficiency and cost reduction, promoting a more sustainable future for Bitcoin mining.

1. What is the impact of watts per terahash (w/TH) efficiency on mining revenue?

Improving the watts per terahash efficiency of mining equipment reduces energy consumption and operating costs, leading to higher profitability for miners.

2. How can miners reduce electricity costs in Bitcoin mining?

Miners can reduce electricity costs by seeking regions with cheaper rates, negotiating better deals with power suppliers, and utilizing alternative energy sources such as renewable options or other cost-effective alternatives.

3. What factors should miners consider to control costs in Bitcoin mining?

Miners should consider factors such as watts per terahash efficiency, electricity costs, Power Usage Effectiveness (PuE), land and labor costs to optimize their operations and control costs.

4. How can miners evaluate the effectiveness of cost control measures?

Miners can monitor their daily cost of compute in USD/TH, which reflects the combined impact of efficiency, electricity costs, and other contributing factors. Tracking this metric over time helps identify trends, areas for improvement, and potential opportunities for cost reduction.

5. How do electricity costs impact Bitcoin mining profitability?

High electricity costs can significantly reduce profit margins in Bitcoin mining. Miners must find cost-effective power sources to maintain profitability, which often surpasses the benefits of improving w/TH efficiency.

6. What are profit maximalists in Bitcoin mining?

Profit maximalists are miners who prioritize minimizing costs, particularly electricity costs, to maximize profits. They seek cheaper power sources, including renewable energy options, negotiate discounts or subsidies, and optimize power usage to enhance profit margins and promote environmentally friendly practices.

7. What are some overlooked or under-utilized power sources for Bitcoin mining?

Overlooked or under-utilized power sources for Bitcoin mining include coal, natural gas, and uranium (nuclear power). These sources have different profitability statuses and varying environmental impacts, and miners should evaluate them based on availability, cost, efficiency, and sustainability.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

As the world of cryptocurrency continues to evolve and expand, the demand for efficient and powerful mining equipment has grown

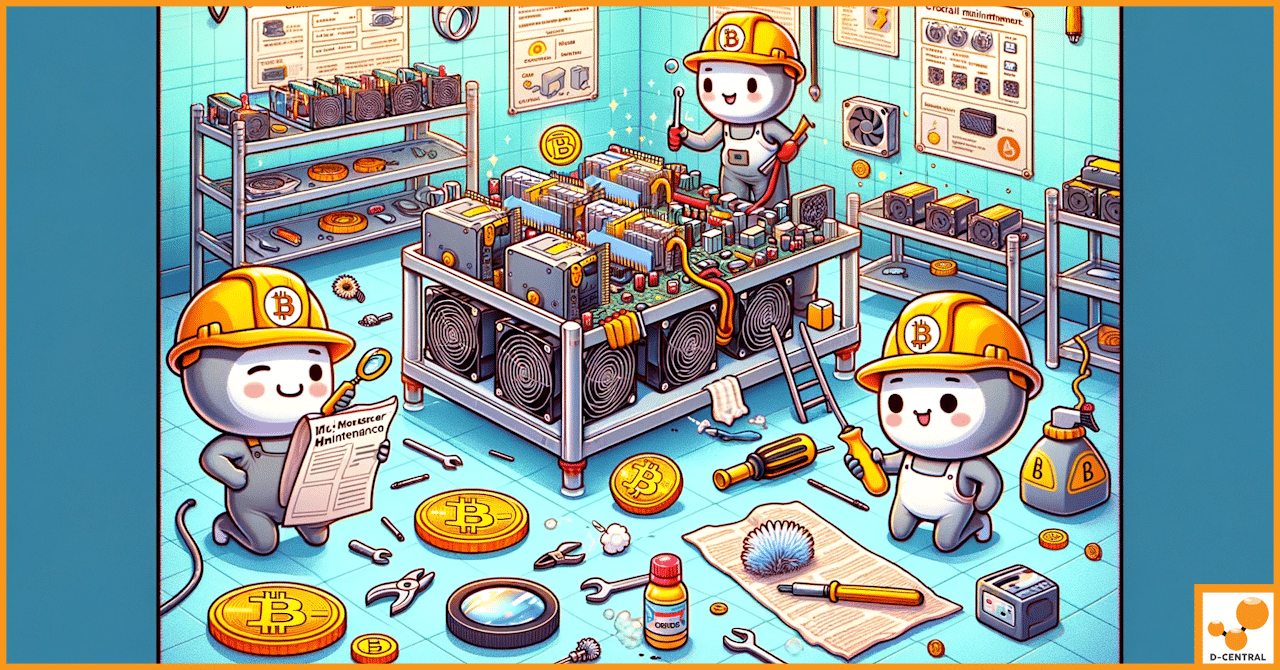

In the ever-evolving landscape of cryptocurrency, home miners stand as the unsung heroes of Bitcoin’s decentralized network. This comprehensive guide

In the dynamic world of cryptocurrency, Bitcoin mining stands as a cornerstone activity, driving the decentralized network that supports the