In the ever-evolving landscape of digital currencies, mining stands as a cornerstone, pivotal to the functioning and growth of this revolutionary financial ecosystem. At its core, digital currency mining is the process by which transactions are verified and added to a blockchain, a public ledger. This intricate process involves solving complex cryptographic puzzles, a task that demands significant computational power and expertise.

The importance of mining in the cryptocurrency ecosystem cannot be overstated. It serves as the backbone of blockchain networks, ensuring security, integrity, and consensus. Without mining, the decentralized structure of cryptocurrencies like Bitcoin would be untenable, leaving the network vulnerable to fraud and double-spending. Mining is not just a process of record-keeping; it is the beating heart that pumps life into the digital currency’s circulatory system, distributing new coins while reinforcing the trust and reliability of the entire blockchain.

The Genesis of Digital Currency Mining

Before the advent of Bitcoin, the landscape of digital cash was marked by various attempts to create a secure, digital form of money. These early concepts laid the groundwork for what would eventually become the decentralized cryptocurrencies we know today.

- Pre-Bitcoin Digital Cash Technologies: The journey towards digital currency began with visionaries like David Chaum, who in the 1980s introduced the concept of digital cash through his creation of DigiCash. This early form of digital money was based on cryptographic protocols, aiming to ensure privacy and security in digital transactions. However, DigiCash and similar technologies like e-gold faced challenges, primarily due to their centralized nature, which ultimately led to their downfall.

- The Vision of Decentralized Digital Currency: The idea of a decentralized digital currency was a response to the limitations of these early systems. The goal was to create a form of money that was not controlled by any central authority, immune to censorship, and secure against fraud. This vision was driven by the principles of the cypherpunk movement, a group of activists advocating for the use of cryptography as a route to social and political change. They believed in a future where financial transactions could be private and secure, free from the oversight of governments and corporations.

Birth of Bitcoin and the First Block

The theoretical foundations laid by early digital cash technologies and the cypherpunk movement paved the way for the birth of Bitcoin, the first successful implementation of decentralized digital currency.

- Satoshi Nakamoto’s Whitepaper: In 2008, an individual or group of individuals under the pseudonym Satoshi Nakamoto published the Bitcoin whitepaper. Titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” this seminal document proposed a revolutionary system for electronic transactions without relying on trust. Nakamoto’s whitepaper introduced the concept of a decentralized ledger – the blockchain – which would record all transactions transparently and immutably.

- Mining the Genesis Block: Significance and Technical Details: The mining of the Genesis Block, or Block 0, in January 2009, marked the inception of Bitcoin’s blockchain. This first block was mined by Satoshi Nakamoto, setting the Bitcoin network into motion. The Genesis Block is unique because it has a 50 BTC reward that cannot be spent, serving as a symbolic gesture and a technical quirk. Mining at this stage was relatively simple compared to today’s standards, as it required minimal computational power. The message embedded in the Genesis Block, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” not only serves as a timestamp but also as a poignant remark on the financial instability of the era, highlighting Bitcoin’s underlying ethos.

The Evolution of Mining Technology

The early days of Bitcoin mining were marked by a simplicity that is almost unimaginable today. Miners used what was most readily available to them: the Central Processing Unit (CPU) of their personal computers. This phase was characterized by a level of accessibility and democratization, as virtually anyone with a computer could participate in mining.

- Early Mining Setups and the Transition to More Powerful Hardware: Initially, mining was conducted using CPUs, the general-purpose processors of computers. However, as the Bitcoin network grew, the difficulty of mining increased, necessitating more powerful hardware. This need led to the adoption of Graphics Processing Units (GPUs), commonly used for gaming and graphic-intensive applications. GPUs, with their ability to perform parallel operations, proved to be significantly more efficient for the computational demands of mining.

- Impact on Mining Efficiency and the Mining Community: The shift from CPUs to GPUs marked the first major leap in mining technology, dramatically increasing mining efficiency. This transition also began to change the mining landscape. What was once an activity accessible to individual hobbyists started to lean towards a more competitive arena, favoring those who could invest in more sophisticated equipment. This period saw the first inklings of a professionalization and commercialization of Bitcoin mining, setting the stage for future developments.

The Rise of ASICs and Mining Farms

The relentless pursuit of efficiency in Bitcoin mining led to the development and adoption of Application-Specific Integrated Circuits (ASICs), a technology that would come to define the modern era of mining.

- Introduction of ASICs and Their Dominance: ASICs are specialized hardware designed explicitly for Bitcoin mining. Unlike GPUs, which are multipurpose, ASICs are tailored for the specific task of mining, making them exponentially more efficient. Introduced around 2013, ASICs rapidly became the standard in Bitcoin mining due to their superior hashing power and energy efficiency. This technology significantly raised the bar for what was required to mine profitably.

- Emergence of Large-Scale Mining Operations: The advent of ASICs transformed the mining landscape. The high cost and specialized nature of ASICs meant that mining became less accessible to individuals and more viable for organized entities with significant resources. This shift led to the emergence of large-scale mining operations, or ‘mining farms.’ These facilities, often located in regions with cheap electricity, house vast arrays of ASICs, contributing a significant portion of the Bitcoin network’s total hashing power. This era of industrial-scale mining has raised questions about centralization, energy consumption, and the environmental impact of Bitcoin mining.

The Economic and Market Dynamics of Mining

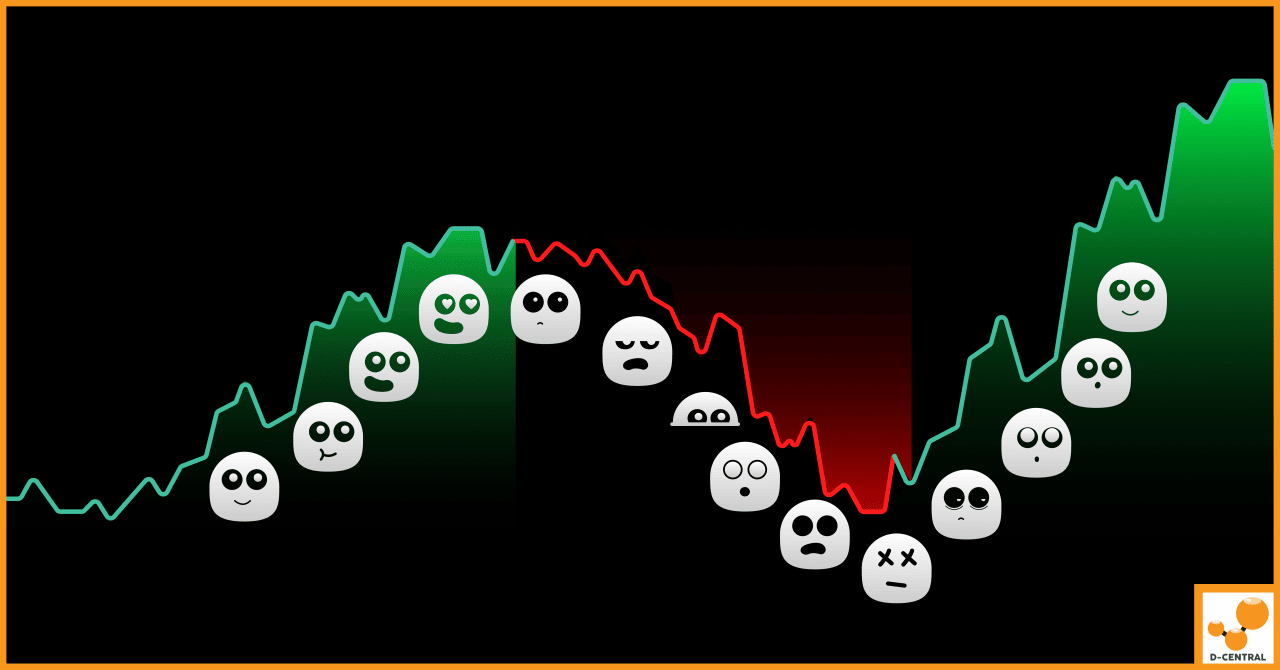

The allure of digital currency mining is largely rooted in its financial incentives, but these come with inherent risks, primarily due to the volatile nature of cryptocurrency prices.

- Bitcoin’s Price Volatility and Its Impact on Mining Profitability: The profitability of mining is inextricably linked to the price of Bitcoin. High Bitcoin prices can yield substantial rewards for miners, making the expensive endeavor of mining more appealing. Conversely, when prices fall, the thin margins on which many miners operate can quickly turn into losses. This volatility requires miners to be strategic, often necessitating a long-term perspective to weather the ups and downs of the market.

- The Economics of Mining: Costs, Rewards, and ROI: The economics of mining encompass a range of factors, including the cost of electricity, the efficiency of mining hardware, and the current mining difficulty. Miners must balance these costs against the rewards of newly minted bitcoins and transaction fees. The return on investment (ROI) in mining can be significant but is not guaranteed, as it depends on the fluctuating price of Bitcoin, the ongoing costs of operation, and the increasing difficulty of mining as more miners join the network.

Mining Pools and Decentralization Debates

As individual miners found it increasingly difficult to compete with large-scale operations, mining pools emerged as a solution to level the playing field, though not without sparking debates about centralization.

- Formation and Role of Mining Pools: Mining pools are groups of miners who combine their computational resources to increase their chances of mining a block and earning rewards. When a pool successfully mines a block, the reward is distributed among its members, proportional to each member’s contribution of hashing power. This collaborative approach enables individual miners with less powerful hardware to receive a more steady and predictable return, albeit smaller, from their mining efforts.

- Centralization Concerns and Responses: The rise of mining pools and large-scale mining operations has led to concerns about the centralization of mining power. Centralization poses risks to the Bitcoin network, including vulnerability to censorship, fraud, and attacks. In response, the community has explored various solutions, such as the development of more decentralized pool protocols and the encouragement of geographically diverse mining operations. These efforts aim to preserve the decentralized ethos of Bitcoin and ensure the security and integrity of the network.

Major Milestones and Events in Mining History

The history of digital currency mining is punctuated by several significant market events that have profoundly impacted the mining landscape.

- The Great Bubble: One of the most notable events in the history of Bitcoin was the 2011 bubble, often referred to as “The Great Bubble.” During this period, the value of Bitcoin surged to unprecedented heights, only to plummet dramatically. This was a result of speculative trading and a series of security breaches, most notably the Mt. Gox hack. The bubble burst had a ripple effect on mining, as the sudden drop in Bitcoin’s value made mining less profitable, leading to a temporary but significant downturn in mining activity.

- Subsequent Market Crashes: Following the 2011 bubble, the Bitcoin market experienced several other crashes, each leaving its mark on the mining industry. Notable among these was the 2018 crash, where Bitcoin’s value dropped by about 65% in January. These market fluctuations have continually tested the resilience of miners, forcing many smaller operations out of business while presenting opportunities for larger, more efficient miners to consolidate their positions.

Regulatory Challenges and Geographic Shifts

The landscape of digital currency mining has also been shaped by regulatory challenges and geographic shifts, responding to the changing attitudes of governments and the search for favorable mining conditions.

- Government Regulations and Their Impact: Over the years, various governments have taken differing stances on Bitcoin and cryptocurrency mining. Some countries, like China, have imposed strict regulations or outright bans, citing concerns over financial risks, fraud, and environmental impact. These regulatory actions have significant implications for miners, often leading to the closure of operations and the migration of mining activities to more favorable jurisdictions.

- Migration of Mining Operations Globally: In response to regulatory pressures and the pursuit of lower energy costs, there has been a notable migration of mining operations. Countries with cheap electricity, such as Iceland, Canada, and parts of the United States, have become hotspots for Bitcoin mining. This geographic shift is not only a response to regulatory and economic pressures but also part of a broader trend towards seeking sustainable and renewable energy sources for mining operations, aligning with the growing environmental consciousness within the crypto community.

The Current State of Digital Currency Mining

The landscape of digital currency mining today is a testament to rapid technological progress and innovative solutions addressing both efficiency and environmental concerns.

- Latest Developments in Mining Hardware and Software: The continuous quest for efficiency has led to significant advancements in mining hardware. Today’s ASIC miners are far more powerful and energy-efficient than their predecessors. In software, we see the rise of sophisticated mining algorithms and user-friendly mining platforms that optimize the mining process, making it more accessible and efficient. Additionally, there’s a growing trend towards the development of hardware capable of mining multiple types of cryptocurrencies, offering miners more flexibility.

- Environmental Concerns and Sustainable Mining Solutions: One of the most critical issues facing the mining industry today is its environmental impact, particularly in terms of energy consumption. In response, there’s a growing movement towards sustainable mining practices. This includes the utilization of renewable energy sources, such as solar and hydroelectric power, and the development of more energy-efficient mining hardware. Innovations like heat recapture technologies, which use the excess heat generated by mining operations for other purposes, are also gaining traction.

The Role of Mining in Blockchain Security

Mining plays a crucial role in maintaining the security and integrity of blockchain networks.

- How Mining Contributes to Network Security and Integrity: Miners are responsible for validating transactions and adding them to the blockchain, a process that prevents fraud and double-spending. The decentralized nature of mining operations ensures that no single entity has control over the blockchain, making it resistant to manipulation and censorship. The proof-of-work system, which requires miners to solve complex mathematical problems, further secures the network by making it computationally expensive and time-consuming to attempt malicious activities.

Mining Beyond Bitcoin: Altcoins and Diversity

While Bitcoin remains the most prominent and valuable cryptocurrency, the mining landscape is diversifying with the rise of alternative cryptocurrencies (altcoins).

- Exploration of Mining in Other Cryptocurrencies: The growing interest in altcoins has expanded the mining ecosystem. Cryptocurrencies like Ethereum, Litecoin, and Zcash, each with their unique mining algorithms and network structures, offer miners alternatives to Bitcoin. This diversification not only provides miners with more options but also contributes to the overall resilience and robustness of the cryptocurrency market. As these altcoins continue to develop and gain traction, they present new opportunities and challenges for miners.

Conclusion

As we conclude our exploration of the story behind digital currency mining, we reflect on the key points that have shaped this dynamic and ever-evolving industry. From the early days of CPU mining to the current era dominated by specialized ASIC hardware and large-scale mining operations, the journey of digital currency mining is one of innovation, adaptation, and resilience.

The evolution of mining technology, from CPUs to GPUs and then to ASICs, highlights the industry’s continuous pursuit of efficiency and profitability. The economic and market dynamics, characterized by the financial incentives and risks associated with Bitcoin’s price volatility, have defined the mining landscape, influencing both individual miners and large-scale operations. The emergence of mining pools and the debates around decentralization underscore the ongoing challenges and the community’s efforts to maintain the foundational principles of cryptocurrency.

The current state of digital currency mining reflects a mature industry that is not only technologically advanced but also increasingly conscious of its environmental impact, seeking sustainable and innovative solutions. The role of mining in ensuring the security and integrity of blockchain networks remains as crucial as ever, reinforcing the trust and reliability of digital currencies. Moreover, the expansion into altcoin mining illustrates the industry’s adaptability and the growing diversity within the cryptocurrency ecosystem.

Looking ahead, the future of digital currency mining appears poised for further advancements and challenges. As the industry navigates regulatory landscapes, technological developments, and environmental considerations, its ability to adapt and innovate will be critical. The ongoing significance of mining in the digital currency realm cannot be overstated, as it continues to play a pivotal role in the growth and stability of cryptocurrencies.

For those intrigued by the world of digital currency mining and seeking to delve deeper, there is a wealth of knowledge and opportunities awaiting. Whether you are an aspiring miner, a seasoned veteran, or simply a curious observer, the journey into this fascinating aspect of the cryptocurrency world is both rewarding and enlightening.

We encourage you to explore more about digital currency mining and to consider the expertise and services offered by D-Central Technologies. As a leader in the Bitcoin mining industry, D-Central provides comprehensive solutions, from consultation and hardware sourcing to hosting and maintenance.

FAQ

What is digital currency mining?

Digital currency mining is the process of verifying and adding transactions to a blockchain public ledger. It involves solving cryptographic puzzles, which requires substantial computational power.

Why is mining important in the cryptocurrency ecosystem?

Mining is crucial as it ensures the security, integrity, and consensus of blockchain networks. It prevents fraud and double-spending, distributes new coins, and reinforces trust within the system.

What was the significance of the Genesis Block in Bitcoin mining?

The Genesis Block, mined by Satoshi Nakamoto, was the first block in Bitcoin’s blockchain, setting the network into motion. It represents the starting point of Bitcoin and contains a symbolic message highlighting the financial instability at the time.

How has Bitcoin mining technology evolved?

Bitcoin mining technology has evolved from using CPUs to GPUs, and then to ASICs, reflecting a continuous search for increased efficiency and profitability in mining technology.

What are the economic and market dynamics of mining?

The economics of mining involve the costs of electricity, hardware efficiency, and mining difficulty, balanced against rewards from new bitcoins and transaction fees. Market dynamics are heavily influenced by Bitcoin’s price volatility.

What are mining pools, and why have they emerged?

Mining pools are groups of miners who combine their resources to increase their chances of earning mining rewards, making mining more accessible for individuals with less powerful hardware.

How have government regulations affected digital currency mining?

Government regulations have had major impacts on mining, from imposing bans and restrictions due to financial and environmental concerns, to prompting the migration of mining operations to more favorable jurisdictions.

What are the latest developments in mining hardware and software?

Advancements in ASIC miners have greatly improved power and efficiency. In software, mining algorithms and platforms are optimized to increase accessibility and efficiency, with some hardware capable of mining multiple cryptocurrencies.

What are the environmental concerns around mining, and what are the sustainable solutions?

Environmental concerns focus on high energy consumption. Sustainable solutions include using renewable energy sources and developing energy-efficient mining hardware and heat recapture technologies.

How does mining contribute to network security and integrity?

Mining validates transactions, adding them to the blockchain, which prevents fraud and ensures no single entity has control over the ledger, preserving network security and integrity.

What is the role of altcoins in the mining industry?

Altcoins, such as Ethereum, Litecoin, and Zcash, provide diversification in the mining ecosystem, offering alternatives to Bitcoin mining.