SATO Technologies: Leading the Convergence of Bitcoin Mining, AI, and HPC

SATO Technologies Corp., a trailblazer in the digital asset mining industry, is making waves from its base in Quebec, Canada.

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

Bitcoin, the first and most prominent cryptocurrency, has always been more than just a digital asset. To many, it represents a new paradigm in financial sovereignty, enabling individuals to take control of their wealth without intermediaries.

A Bitcoin ETF, or Exchange Traded Fund, is a type of investment fund traded on stock exchanges. It tracks the price of Bitcoin, allowing investors to invest in the cryptocurrency without the complexities of buying, storing, and managing Bitcoins themselves.

Bitcoin ETFs provide an entry point for traditional investors into the world of cryptocurrencies, making it more accessible and straightforward for those unfamiliar with the technical aspects of Bitcoin.

Being traded on regulated stock exchanges, Bitcoin ETFs bring an additional layer of oversight to the cryptocurrency market, potentially making it more attractive to institutional investors.

By simplifying the investment process, Bitcoin ETFs could help drive mainstream adoption of Bitcoin, bridging the gap between the traditional financial world and the realm of cryptocurrencies.

Bitcoin ETFs could represent a new frontier in the battle for financial sovereignty. They merge the disruptive potential of Bitcoin with the familiarity of traditional investment vehicles, potentially accelerating the adoption of a decentralized financial system.

Critics argue that Bitcoin ETFs, by bringing Bitcoin into the traditional financial system, may detract from the decentralization ethos that Bitcoin was founded upon.

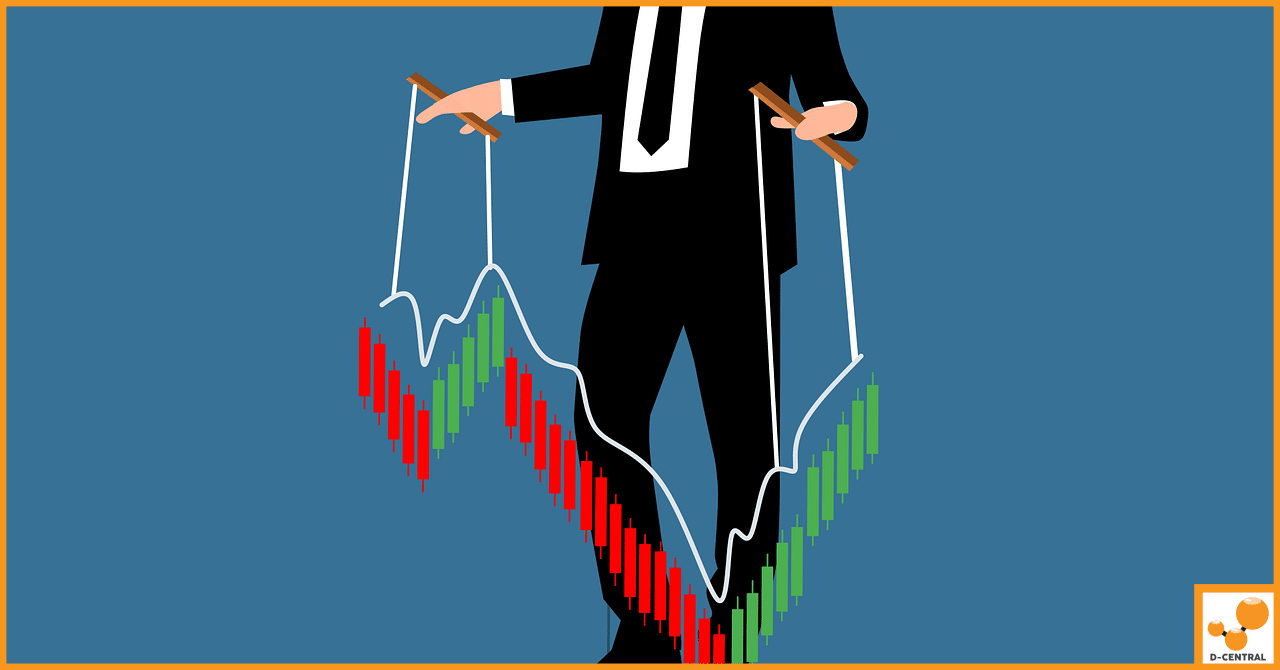

There are also concerns that the introduction of Bitcoin ETFs could lead to market manipulation, as has been seen in other financial markets.

As regulatory bodies around the world grapple with the implications of Bitcoin ETFs, the future of this financial instrument remains a topic of intense debate. Whether they will usher in a new era of financial sovereignty or become just another investment tool remains to be seen.

The advent of Bitcoin ETFs presents a complex scenario – one that challenges us to strike a balance between the quest for financial sovereignty and the push for mainstream adoption. As proponents of Bitcoin and its potential, we are at the forefront of this fascinating discourse, shaping the future of finance and beyond.

Q: What is a Bitcoin ETF?

A: A Bitcoin ETF, or Exchange Traded Fund, is a type of investment fund traded on stock exchanges. It tracks the price of Bitcoin, allowing investors to invest in the cryptocurrency without the complexities of buying, storing, and managing Bitcoins themselves.

Q: What is the significance of Bitcoin ETFs in the cryptocurrency market?

A: Bitcoin ETFs provide an entry point for traditional investors into the world of cryptocurrencies, making it more accessible and straightforward for those unfamiliar with the technical aspects of Bitcoin. They also offer greater regulation, being traded on regulated stock exchanges, and can stimulate mainstream adoption by simplifying the investment process.

Q: Do Bitcoin ETFs represent a new frontier in financial sovereignty?

A: Bitcoin ETFs could represent a new frontier in the battle for financial sovereignty. They merge the disruptive potential of Bitcoin with the familiarity of traditional investment vehicles, potentially accelerating the adoption of a decentralized financial system.

Q: What is the controversy surrounding Bitcoin ETFs?

A: Critics argue that Bitcoin ETFs may detract from the decentralization ethos that Bitcoin was founded upon by bringing it into the traditional financial system. There are also concerns that the introduction of Bitcoin ETFs could lead to market manipulation, as has been seen in other financial markets.

Q: What is the future of Bitcoin ETFs?

A: As regulatory bodies around the world grapple with the implications of Bitcoin ETFs, the future of this financial instrument remains a topic of intense debate. Whether they will usher in a new era of financial sovereignty or become just another investment tool remains to be seen.

Q: How can we strike a balance between financial sovereignty and mainstream adoption in the context of Bitcoin ETFs?

A: The advent of Bitcoin ETFs presents a complex scenario – one that challenges us to strike a balance between the quest for financial sovereignty and the push for mainstream adoption. As proponents of Bitcoin and its potential, such as D-Central Technologies, we are at the forefront of this fascinating discourse, shaping the future of finance and beyond.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

SATO Technologies Corp., a trailblazer in the digital asset mining industry, is making waves from its base in Quebec, Canada.

Bitcoin, the pioneering cryptocurrency, has captivated the financial world since its inception in 2009. As a decentralized digital currency, it

In the dynamic world of Bitcoin mining, the efficiency and longevity of mining hardware are paramount. At the heart of