Construction Sites Can Save Money on Heating Costs with Bitcoin Miners’ Heat

If you’ve ever been to a construction site, you know that maintaining a comfortable temperature is essential for workers and

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

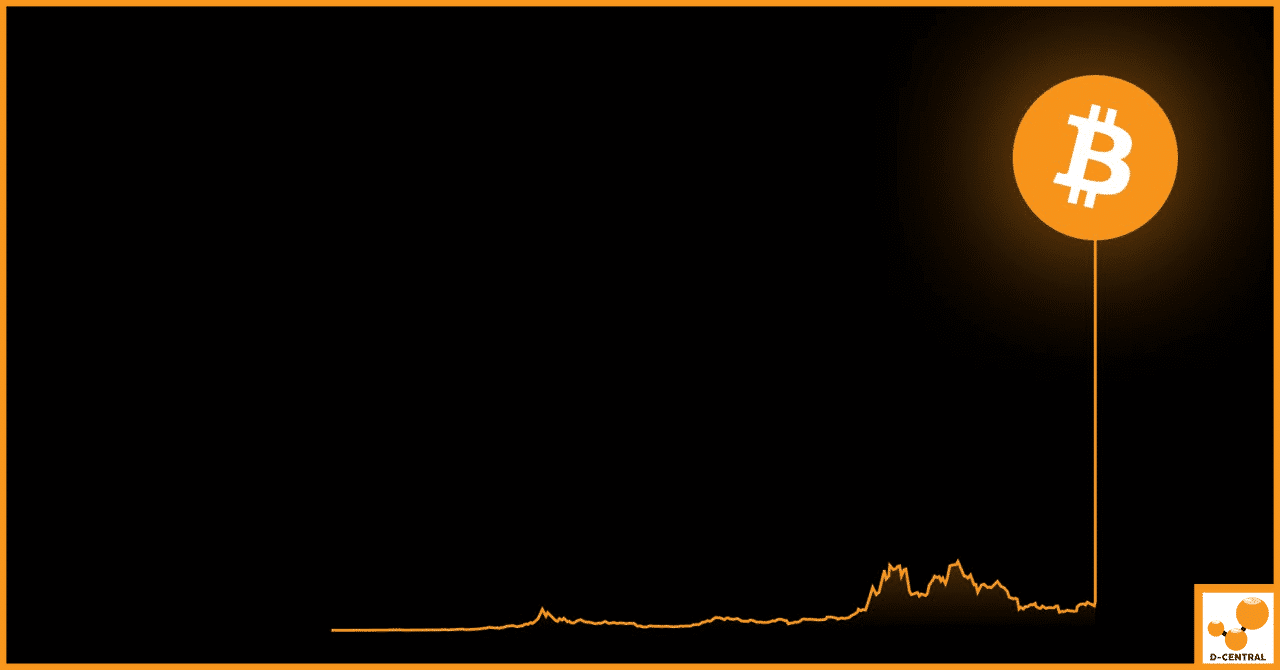

Are you aware of the “stealth financial crisis” that is looming on the horizon? Technology entrepreneur Balaji Srinivasan has issued an alarming warning in the form of a “BitSignal Alert”. This alert is intended to raise awareness about this potential crisis and its consequences, as well as promote Bitcoin as a protective measure. In this blog post, we will discuss the BitSignal Alert, what it means for our financial security, and why there is an urgent need for Bitcoin.

The BitSignal Alert is an urgent warning technology entrepreneur Balaji Srinivasan issued about a looming financial crisis. The alert claims that banks have been using accounting tricks to hide their insolvency, while regulators have been aware of the situation but failed to notify the public. These events suggest that banks have fewer assets than liabilities, which could lead to a global financial collapse if not addressed.

The BitSignal

How do you ring the fire alarm on the internet?

How do you show it’s not a false alarm?

I am putting up the BitSignal.

$1M in BTC to alert us to the stealth financial crisis.

$1000 per tweet, for the best 1000.

Reply with your charts, graphs, stats, memes!

Bring… pic.twitter.com/yV7cjCXVcY— Balaji (@balajis) March 16, 2023

To draw attention to this stealth financial crisis, Srinivasan has launched the BitSignal Alert campaign offering a monetary reward for the best 1000 tweets with evidence of the crisis. The goal of this initiative is to spread awareness about the issue and educate people on alternative financial solutions, such as Bitcoin, that can provide greater security and stability during times of economic turmoil.

Bitcoin operates independently from traditional banking systems, enabling users to protect their wealth from hyperinflation and other economic downturns. With its decentralized nature and secure encryption protocols, Bitcoin gives investors more control over their finances and allows them to bypass traditional banking structures entirely.

The BitSignal Alert serves as an essential reminder for individuals to be aware of potential risks posed by traditional banking practices, as well as explore alternative methods of protecting one’s wealth. Moving towards digital currencies such as Bitcoin appears to be one viable solution in an ever-evolving landscape where technology will continue to shape our financial future.

The looming financial crisis that Balaji Srinivasan has warned of results from banks using accounting tricks to hide their insolvency. This means that these banks have liabilities, such as loans and debts, that exceed their assets, leading to a situation in which they cannot pay back their creditors and depositors. Despite being aware of this issue, regulators have failed to notify the public, creating a sense of urgency among those affected by this hidden crisis.

The consequences of these events can be grave. If not addressed immediately, the lack of proper resources and capital could lead to an even deeper financial collapse on a global scale. This is why individuals need to be aware of potential risks posed by traditional banking systems and explore other solutions, such as digital currencies like Bitcoin.

Bitcoin offers many advantages over traditional banking systems, including automated security protocols and decentralized networks that allow users greater control over their finances. As Bitcoin does not rely on central banks or governments for its stability, investors can avoid potential losses due to hyperinflation or economic downturns that can occur in traditional financial markets. Additionally, with its secure encryption protocols and low transaction fees, Bitcoin offers an efficient way for people to store their wealth without worrying about the possibility of theft or fraud.

In light of this urgent need for alternative financial solutions, Balaji Srinivasan has launched the BitSignal Alert campaign offering a $1 million reward in Bitcoin for the best 1000 tweets providing evidence of the crisis in the form of charts, graphs, stats, or memes. By drawing attention to this stealth financial crisis and educating people on alternatives like Bitcoin, Srinivasan hopes to help protect individuals from experiencing similar issues in the future.

Hyperinflation is a rapid increase in prices, resulting in the devaluation of a currency. This phenomenon can often be seen as a result of economic instability and could lead to a rapid financial collapse if not addressed quickly. In times like these, traditional banking systems become increasingly unreliable and unable to protect individuals from the effects of hyperinflation.

For example, in Zimbabwe during the 2000s, inflation peaked at 79 billion percent between August 2008 and November 2008. At this point, the US dollar had surpassed their currency as the preferred payment method as it was much more stable and reliable than the Zimbabwe dollar. This extreme case of hyperinflation shows how quickly economic issues can spiral out of control and cause drastic changes in the value of individuals’ savings or investments.

In recent years, there has been concern that rampant inflation could be on the horizon for many countries due to uncertainty surrounding global economies, increasing debt levels and other factors. If these trends continue without intervention, there is potential for widespread economic instability leading to public unrest or even an outright financial collapse.

Therefore, individuals must be aware of the possible risks of traditional banking systems and find alternative methods to protect their wealth from hyperinflation or other economic downturns. Moving towards digital currencies such as Bitcoin offers investors more control over their finances while also avoiding traditional banking structures entirely. With its decentralized nature and secure encryption protocols, Bitcoin provides users with greater security and stability during economic turmoil.

The urgent need for Bitcoin stems from its ability to provide a haven from traditional banking systems and their limitations. As Bitcoin is not tied to any central authority, it is not susceptible to economic collapses caused by governmental or institutional mismanagement. This means that even in times of crisis, users of digital currencies such as Bitcoin can continue to access their funds without suffering losses due to hyperinflation or other economic downturns.

Moreover, digital currencies are secure and encrypted using sophisticated protocols that ensure that transactions cannot be reversed once completed and that user funds are protected from hackers and fraudsters. Additionally, with low transaction fees, Bitcoin offers a cost-effective way for individuals to store their wealth without fear of theft or loss.

Unlike traditional banking systems, digital currencies offer users complete control over their finances, allowing them to make instantaneous transfers between different accounts without waiting days or weeks for processing times. This quick access makes them ideal for online commerce, where buyers and sellers may need access to funds quickly to keep business moving forward.

In light of these advantages, it is clear why investing in digital currencies like Bitcoin has become increasingly popular in recent years as more people realize the potential benefits it can provide during times of economic uncertainty. With its decentralized structure and secure encryption protocols, investors can feel confident knowing their funds will remain safe no matter what happens in the world markets.

Bitcoin presents a myriad of advantages for individuals aiming to safeguard their wealth amidst economic instability. As digital currencies are not linked to any central authority, they remain immune to the risks and vulnerabilities that plague traditional banking systems. This ensures that users can rely on the security and stability of their funds while enjoying low transaction fees and not having to fret over exchange rate fluctuations or other economic downturns.

Moreover, digital currencies offer users enhanced control over their finances compared to conventional banking systems. Transactions facilitated by digital currencies are immediate, enabling buyers and sellers to access funds swiftly without enduring prolonged processing times spanning days or weeks. Furthermore, robust encryption protocols shield user data from hackers and fraudsters, instilling confidence in individuals that their funds are safeguarded against theft or loss.

Bitcoin also empowers investors to diversify their portfolios in a manner unattainable through traditional stocks or bonds. By allocating a portion of their capital to digital currencies, investors can insulate themselves from market volatility typically associated with other investment vehicles while potentially reaping substantial gains during periods of heightened demand or value appreciation.

In summary, Bitcoin provides a plethora of potential benefits for individuals seeking a secure and dependable method to preserve their wealth during uncertain economic periods. By granting enhanced control over finances and immediate access to funds, digital currencies are fast becoming an attractive option for those aiming to diversify their portfolios and counter the potential risks inherent in traditional banking systems.

In conclusion, Bitcoin offers a secure and reliable way to protect wealth during economic uncertainty. With its decentralized structure, low transaction fees, and instantaneous access to funds, investing in digital currencies can help individuals diversify their portfolios while mitigating potential risks posed by traditional banking systems. As more people become aware of the benefits these alternative financial solutions provide over traditional options, investment in digital currencies will likely continue to grow as an increasingly popular option for those seeking to safeguard their finances against market volatility. In light of this trend, banks, regulators, and central banks must scrutinize the implications of embracing digital currency technology. Hence, they are better prepared for any future financial crisis or downturn.

What is the BitSignal Alert?

The BitSignal Alert is an urgent warning issued by technology entrepreneur Balaji Srinivasan about a looming financial crisis. It highlights the use of accounting tricks by banks to hide their insolvency and the failure of regulators to notify the public about this issue.

Why is Bitcoin being promoted as a protective measure?

Bitcoin is being promoted as a protective measure because it operates independently from traditional banking systems. It allows users to protect their wealth from hyperinflation and economic downturns. Its decentralized nature and secure encryption protocols provide greater security and stability.

What are the consequences of banks’ insolvency and regulators’ failure to notify depositors?

The consequences of banks’ insolvency and regulators’ failure to notify depositors can be severe. It could lead to a global financial collapse if not addressed. Depositors may face losses as banks may not be able to pay back their liabilities, such as loans and debts.

What is hyperinflation, and why is it a concern?

Hyperinflation is a rapid increase in prices that devalues a currency. It is a concern because it can lead to economic instability and a rapid financial collapse. Traditional banking systems may become unreliable in such situations, making alternative financial solutions like Bitcoin more attractive.

What are the advantages of Bitcoin over traditional banking systems?

Bitcoin offers advantages such as automated security protocols, decentralized networks, and greater control over finances. It is not reliant on central banks or governments, making it more resistant to hyperinflation or economic downturns. Bitcoin also provides secure encryption protocols and low transaction fees.

What is the BitSignal Alert campaign?

The BitSignal Alert campaign is an initiative launched by Balaji Srinivasan. It offers a monetary reward for the best 1000 tweets with evidence of the financial crisis. The campaign aims to spread awareness about the issue and educate people on alternative financial solutions like Bitcoin.

Why is there an urgent need for alternative financial solutions like Bitcoin?

There is an urgent need for alternative financial solutions like Bitcoin because traditional banking systems may not be able to protect individuals from hyperinflation or other economic downturns. Bitcoin provides greater security and stability, allowing users to have more control over their finances.

What are the benefits of embracing Bitcoin?

Embracing Bitcoin offers benefits such as security, low transaction fees, and immediate access to funds. It allows individuals to diversify their portfolios and protect their wealth from market volatility. Bitcoin also provides enhanced control over finances and robust encryption protocols for data protection.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

If you’ve ever been to a construction site, you know that maintaining a comfortable temperature is essential for workers and

In the dynamic world of Bitcoin mining, Blockstream has established itself as a significant player. Founded by Dr. Adam Back,

The cryptocurrency revolution is transforming the global economy, and Quebec is at the forefront of this trend. With its abundant