The Importance of Professional ASIC Repair Services in Canada

In the dynamic world of cryptocurrency mining, Application-Specific Integrated Circuits (ASICs) have revolutionized the landscape, offering unparalleled efficiency and processing

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

Bitcoin mining is the backbone of the Bitcoin network, a critical process that involves validating transactions and adding them to the blockchain, Bitcoin’s public ledger. This process is performed through a combination of computational power and cryptography. Miners compete to solve complex mathematical puzzles, and the first to solve the puzzle gets the opportunity to add a new block of transactions to the blockchain. In return for their efforts, miners are rewarded with newly minted bitcoins and transaction fees. This incentivized system not only introduces new bitcoins into circulation but also secures the network against fraudulent activities.

Bitcoin mining plays a pivotal role in maintaining the integrity and security of the Bitcoin network. It is the mechanism that ensures decentralization, one of the fundamental principles of Bitcoin. By distributing the task of validating transactions across a global network of miners, Bitcoin remains resistant to censorship and centralized control. Furthermore, mining is essential for the confirmation and immutability of transactions, making Bitcoin a trustless and transparent system. The mining process also regulates the introduction of new bitcoins, adhering to a predetermined issuance schedule, which is crucial for maintaining Bitcoin’s value and scarcity.

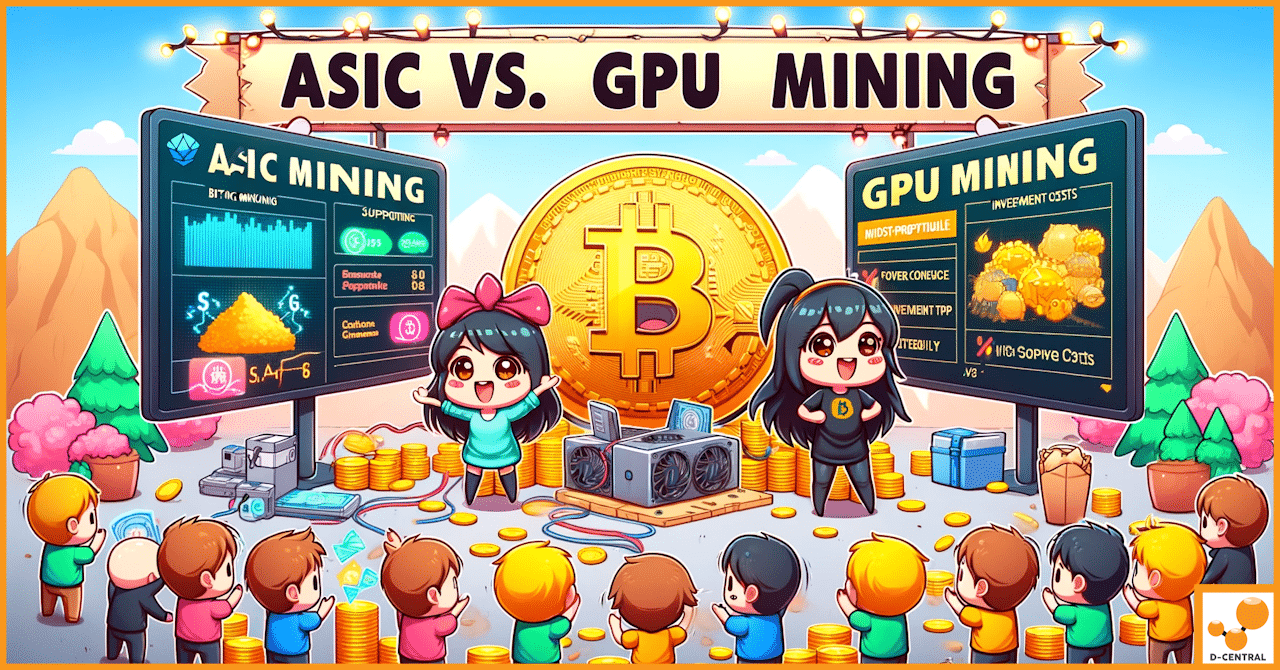

In the realm of cryptocurrency mining, two main types of hardware are commonly discussed: ASICs (Application-Specific Integrated Circuits) and GPUs (Graphics Processing Units). ASICs are specialized hardware designed explicitly for Bitcoin mining. They are highly efficient and powerful, making them the preferred choice for Bitcoin mining. On the other hand, GPUs are versatile and used for various applications, including gaming and graphic design, but they are less efficient for Bitcoin mining. It’s important to note that at D-Central Technologies, our focus is solely on Bitcoin mining using ASICs. While GPU mining is popular for altcoins (alternative cryptocurrencies other than Bitcoin), we neither condone nor encourage it. Our commitment is to the Bitcoin blockchain, the original and most significant cryptocurrency network, where ASICs play an indispensable role in maintaining its robustness and efficiency.

Bitcoin mining is the process by which new bitcoins are created and transactions are added to the blockchain, Bitcoin’s decentralized ledger. Miners use powerful computers to solve complex mathematical problems, a process that requires significant computational power and energy. When a miner successfully solves a problem, they are allowed to add a new block of transactions to the blockchain. This process not only introduces new bitcoins into circulation through a reward system but also ensures the security and integrity of the Bitcoin network.

Miners are the custodians of the Bitcoin network’s security and integrity. They perform critical functions including transaction validation, network security, and consensus building. By solving cryptographic puzzles to mine new blocks, miners validate and confirm transactions, preventing issues like double-spending. Their role is central to maintaining the decentralized nature of the network, ensuring that no single entity has control over Bitcoin’s transaction history or ledger.

The mining process begins with miners collecting a set of transactions from the Bitcoin network’s memory pool. They then assemble these transactions into a block and attempt to generate a specific cryptographic hash that meets the network’s difficulty target. This process involves guessing multiple nonce values (a random number used once) until the correct hash is found. The first miner to find a valid hash gets to add the new block to the blockchain and is rewarded with newly minted bitcoins and transaction fees from the transactions included in the block. This process repeats approximately every ten minutes, continually securing and updating the Bitcoin blockchain.

ASICs, or Application-Specific Integrated Circuits, are specialized hardware designed explicitly for Bitcoin mining. They are crucial in the mining process due to their efficiency and speed. Unlike general-purpose hardware like CPUs or GPUs, ASICs are tailored to perform the specific cryptographic calculations required for mining Bitcoin. This specialization allows them to mine Bitcoin much faster and with significantly less energy consumption than other types of hardware. The advent of ASICs has dramatically increased the computational power of the Bitcoin network, making it more secure against attacks while also raising the difficulty level of mining. Their role is so significant that ASICs have become synonymous with professional Bitcoin mining, representing a substantial investment in both hardware and operational costs for miners.

Bitcoin mining has undergone significant evolution since the inception of Bitcoin in 2009. In the early days, mining was a relatively simple task that could be performed on regular personal computers. This was the period when the concept of cryptocurrency was new, and the competition among miners was minimal. The primary purpose of mining during this phase was to validate transactions and maintain the blockchain, with the added incentive of earning bitcoins as a reward. As Bitcoin gained popularity and value, more people were drawn to mining, leading to increased competition and a need for more efficient mining methods.

The increasing difficulty of mining tasks led to the evolution of mining hardware:

As individual mining became less viable due to the high costs and computational requirements, the concept of mining pools emerged. Mining pools are groups of miners who combine their computational resources to increase their chances of successfully mining a block. When a pool successfully mines a block, the reward is distributed among the pool members based on the amount of computational power each contributed. This collaborative approach allows individual miners to receive a more consistent and predictable return on their investment, as opposed to the high variance of solo mining. Mining pools have become a fundamental aspect of the Bitcoin mining ecosystem, allowing for more democratized participation in mining activities.

ASICs, or Application-Specific Integrated Circuits, are specialized hardware designed exclusively for a specific task. In the context of Bitcoin mining, ASICs are built to perform the complex cryptographic calculations required for mining Bitcoin. Unlike general-purpose processors like CPUs or GPUs, ASICs are tailored for the singular purpose of mining, making them incredibly efficient at this task. They are the culmination of technological advancement in the field of Bitcoin mining, representing a significant leap from the earlier days of CPU and GPU mining.

ASICs hold several key advantages over GPUs in the realm of Bitcoin mining:

As of 2023, several ASIC models stand out in the market for their efficiency, reliability, and performance. Some of the most popular models include:

These ASIC models represent the cutting edge of Bitcoin mining technology in 2023, offering miners the best tools to compete in the ever-evolving landscape of cryptocurrency mining.

Mining pools are a critical component of the Bitcoin mining ecosystem. They are essentially groups of miners who combine their computational resources to increase their collective hashing power and, consequently, their chances of successfully mining a block. When a pool successfully mines a block, the reward is distributed among its members based on the amount of computational power each contributed.

How They Work: In a mining pool, individual miners connect their mining hardware to the pool’s server, which coordinates the miners’ efforts. The pool assigns work units to each miner, and when one of these units leads to the successful mining of a block, the pool recognizes the contribution of each participating miner.

Why They Matter: Mining pools are important because they democratize Bitcoin mining. They allow individual miners, who might not have enough resources to compete independently, to contribute to the mining process and earn rewards more consistently. This pooling of resources helps maintain the decentralized nature of Bitcoin mining, preventing the dominance of large-scale miners and ensuring a more distributed and fair reward system.

Solo Mining: In solo mining, a miner performs the mining operations independently. The miner uses their own hardware to find new blocks and is solely responsible for all aspects of the mining process. The main advantage of solo mining is that the miner receives the entire block reward and transaction fees. However, the chances of successfully mining a block on one’s own are extremely low, especially given the current level of competition and the high difficulty of the Bitcoin network.

Pool Mining: Pool mining, as described earlier, involves joining forces with other miners. The primary advantage is the higher probability of earning regular, albeit smaller, rewards. This method is generally more predictable and stable compared to the high variance of solo mining.

As of 2023, several major mining pools dominate the Bitcoin mining landscape:

These pools represent a significant portion of the total hashing power of the Bitcoin network. They play a crucial role in maintaining the network’s health and security, ensuring that Bitcoin mining remains accessible and profitable for a wide range of miners.

The blockchain is the foundational technology behind Bitcoin. It is a decentralized, digital ledger that records all transactions across a network of computers. Each block in the blockchain contains a list of transactions, and once a block is added to the chain, the information it contains becomes immutable.

Transaction Verification: Miners play a crucial role in verifying transactions. When a user initiates a Bitcoin transaction, it is broadcast to the network and awaits confirmation. Miners collect these pending transactions from the memory pool and assemble them into a block. They then validate these transactions by ensuring they adhere to Bitcoin’s protocol and are not fraudulent.

Bitcoin mining relies on the SHA-256 hashing algorithm. This cryptographic algorithm converts input data of any size into a fixed 256-bit hash. The unique property of this algorithm is that it produces a unique hash for each unique input, but the process is unidirectional – meaning the original data cannot be easily derived from the hash.

Mining and SHA-256: In the context of mining, SHA-256 is used to create a puzzle that miners must solve. Miners use their computational power to generate hashes repeatedly, altering a small piece of the input data (the nonce) each time, until they find a hash that meets the network’s difficulty target.

Difficulty Adjustment: To maintain the blockchain’s integrity and the regular timing of block creation (approximately every 10 minutes), Bitcoin adjusts the mining difficulty. This adjustment occurs every 2,016 blocks, or roughly every two weeks. If blocks are being mined too quickly, the difficulty increases; if mining is too slow, it decreases.

Block Rewards: Miners are incentivized through block rewards, which consist of newly created bitcoins and transaction fees. The block reward halves approximately every four years in an event known as the “halving.” This mechanism ensures a controlled supply of new bitcoins into the system, adhering to Bitcoin’s deflationary monetary policy.

The hash rate is a critical metric in Bitcoin mining. It represents the total computational power being used to mine and process transactions on the Bitcoin network. A higher hash rate means greater security and resistance to attacks, as it would require a tremendous amount of computational power to compromise the network.

Individual and Network Hash Rate: For individual miners, the hash rate indicates the performance of their mining hardware – how many hashes per second their setup can try. On a larger scale, the network hash rate is the sum of all miners’ computational power connected to the Bitcoin network. This rate is a key indicator of the network’s health and security.

The economics of Bitcoin mining are significantly influenced by the costs associated with the mining process, primarily hardware and electricity expenses.

Mining profitability is influenced by several factors, including the price of Bitcoin, mining difficulty, hash rate, and operational costs.

Investing in mining hardware is a critical decision that requires consideration of potential ROI (Return on Investment).

In summary, the economic aspects of Bitcoin mining in 2023 revolve around careful investment in efficient hardware, managing operational costs, particularly electricity, and staying adaptive to the changing dynamics of the Bitcoin market and mining technology.

Bitcoin mining is an energy-intensive process, primarily due to the computational power required for mining operations. This substantial energy consumption has raised concerns about the environmental impact, particularly in terms of the carbon footprint associated with mining activities.

In response to environmental concerns, there are growing initiatives aimed at making Bitcoin mining more sustainable and eco-friendly.

Renewable energy is increasingly becoming a viable solution for reducing the environmental impact of Bitcoin mining.

While the environmental impact of Bitcoin mining is a significant concern, there are concerted efforts and innovations underway to make mining more sustainable and less reliant on fossil fuels. The integration of renewable energy sources and the development of more efficient mining technologies are key to reducing the carbon footprint of Bitcoin mining.

Starting a Bitcoin mining operation involves several key steps, each crucial for establishing a successful and efficient mining setup.

Selecting the appropriate ASIC (Application-Specific Integrated Circuit) hardware is crucial for efficient and profitable mining.

Joining a mining pool can increase your chances of earning mining rewards, especially if you have limited hardware.

Getting started with Bitcoin mining requires careful planning, investment in the right hardware, and strategic decisions regarding mining pools. By considering these factors, you can set up a mining operation that is efficient, profitable, and sustainable in the long term.

Bitcoin mining is inherently tied to the fluctuations in the Bitcoin market, which is known for its high volatility.

Security is a paramount concern in Bitcoin mining, both in terms of protecting the mining infrastructure and safeguarding the mined bitcoins.

Operational risks in Bitcoin mining encompass a range of issues from hardware maintenance to regulatory compliance.

In summary, Bitcoin mining involves a variety of risks and challenges, from market volatility and security concerns to operational and environmental risks. Successful miners need to proactively manage these risks through strategic planning, robust security measures, efficient operational practices, and staying informed about regulatory changes.

This article has explored the multifaceted world of Bitcoin mining, covering its technicalities, economic aspects, environmental impacts, and the challenges it faces. We’ve delved into the evolution from CPU to ASIC mining, the significance of mining pools, and the crucial role of ASICs in enhancing mining efficiency. The economic considerations, including the costs and profitability of mining, were examined, alongside the environmental implications and the push towards sustainable practices. We also navigated the complex regulatory landscape and the operational risks inherent in Bitcoin mining.

Bitcoin mining remains a cornerstone of the Bitcoin network, essential for transaction validation, network security, and the introduction of new bitcoins into the system. Despite its challenges, mining continues to be a dynamic and evolving field, adapting to technological advancements, market changes, and regulatory shifts. Its ongoing importance lies in maintaining the decentralization and security of the Bitcoin network, making it a critical component of the cryptocurrency ecosystem.

Looking ahead, Bitcoin mining is poised to undergo further evolution. Technological advancements, particularly in ASIC hardware, are expected to continue, potentially making mining more efficient and environmentally friendly. The industry may also see more widespread adoption of renewable energy sources and innovative solutions to address environmental concerns. As the regulatory environment matures, clearer frameworks could emerge, providing stability and fostering growth in the mining sector.

For those intrigued by the potential of Bitcoin mining, now is an opportune time to explore this dynamic field. Whether you’re considering small-scale operations or large-scale mining farms, the world of Bitcoin mining offers a unique blend of technological engagement and potential economic rewards.

We invite you to explore the world of Bitcoin mining further with D-Central Technologies. As a leader in providing Bitcoin mining solutions, D-Central offers a range of services, from hardware sourcing to mining support and consultation.

What is Bitcoin mining?

Bitcoin mining is the process of validating transactions and adding them to the blockchain ledger. It involves solving complex mathematical problems using computational power and cryptography. Miners compete to solve these problems and the first to do so gets to add a new block to the blockchain, earning new bitcoins and transaction fees as a reward.

How does Bitcoin mining ensure the security of the network?

Bitcoin mining maintains the integrity and security of the Bitcoin network by distributing the validation of transactions across a global network of miners. This decentralized system makes Bitcoin resistant to censorship and centralized control while confirming and securing transactions.

What are ASICs and how do they relate to Bitcoin mining?

ASICs, or Application-Specific Integrated Circuits, are specialized hardware designed exclusively for Bitcoin mining. They are highly efficient and powerful, outperforming CPUs and GPUs in mining due to their ability to perform specific cryptographic calculations required for Bitcoin mining.

What are the advantages of ASICs over GPUs for Bitcoin mining?

ASICs are more efficient and faster than GPUs in terms of hash rate per unit of electricity consumed, are tailored for Bitcoin’s hash function, and overall offer better return on investment and lower operational costs due to their targeted mining capabilities.

What is a mining pool, and why do miners join them?

A mining pool is a group of miners who combine their computational resources to increase their chances of mining a block and receiving rewards. Miners join pools to receive more consistent and predictable returns rather than facing the high variance of solo mining.

What is the significance of the hash rate in Bitcoin mining?

The hash rate is a measure of the total computational power used to process transactions and mine new blocks on the Bitcoin network. A higher hash rate indicates a more secure network and for individual miners, it represents the performance capacity of their mining setup.

What are the main economic factors affecting Bitcoin mining profitability?

Mining profitability is influenced by Bitcoin’s market value, mining difficulty, hash rate, electricity costs, and hardware efficiency. Miners need to carefully manage these factors to remain profitable.

What is the environmental impact of Bitcoin mining?

Bitcoin mining’s environmental impact primarily derives from its high energy consumption, which poses concerns about carbon emissions, especially in regions reliant on fossil fuels. This has led to initiatives for sustainable mining using renewable energy sources and more efficient hardware.

How can someone start with Bitcoin mining?

To start Bitcoin mining, research the process, select a location with low electricity costs and cool climate, set up the necessary infrastructure, ensure a stable internet connection, apply safety measures, choose the right ASIC hardware, and consider joining a mining pool.

What are the risks and challenges associated with Bitcoin mining?

Risks in Bitcoin mining include Bitcoin market volatility affecting profitability, investment risks due to high setup and operation costs, security threats to the mining infrastructure and stored bitcoins, and potential regulatory changes impacting the mining landscape.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

In the dynamic world of cryptocurrency mining, Application-Specific Integrated Circuits (ASICs) have revolutionized the landscape, offering unparalleled efficiency and processing

The landscape of cryptocurrency mining has undergone significant transformations since the inception of Bitcoin in 2009. What began as a

Cryptocurrency mining, the process by which transactions are verified and added to the public ledger (blockchain), and new coins are