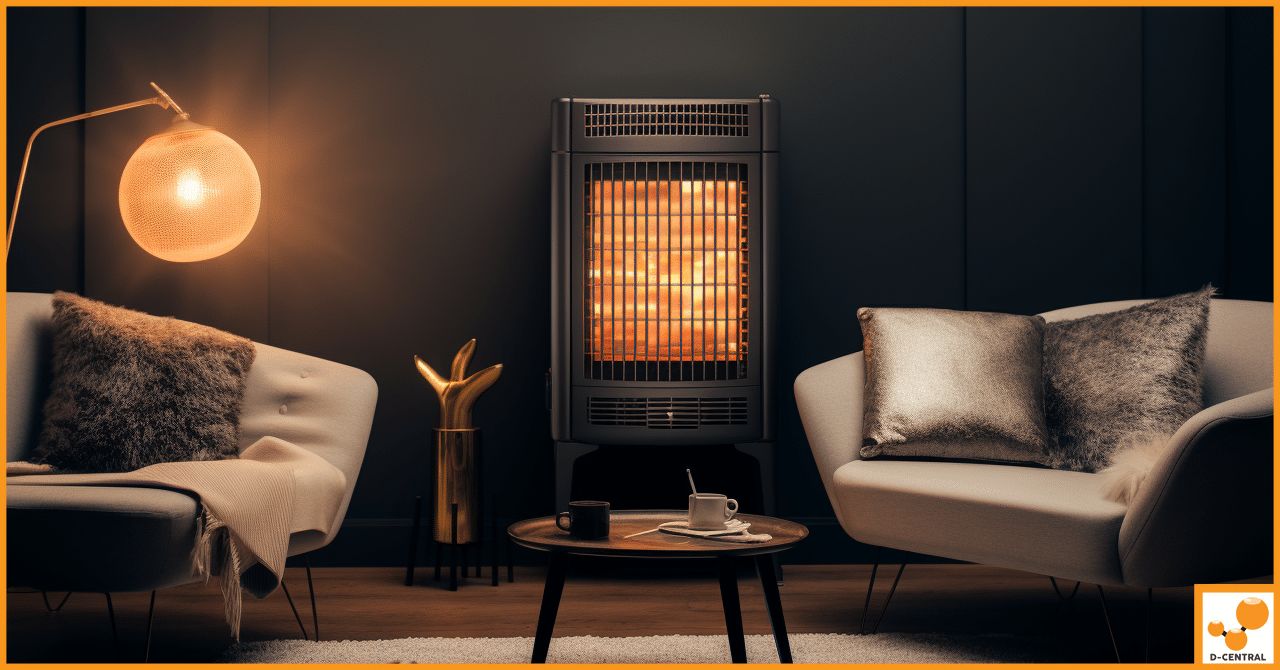

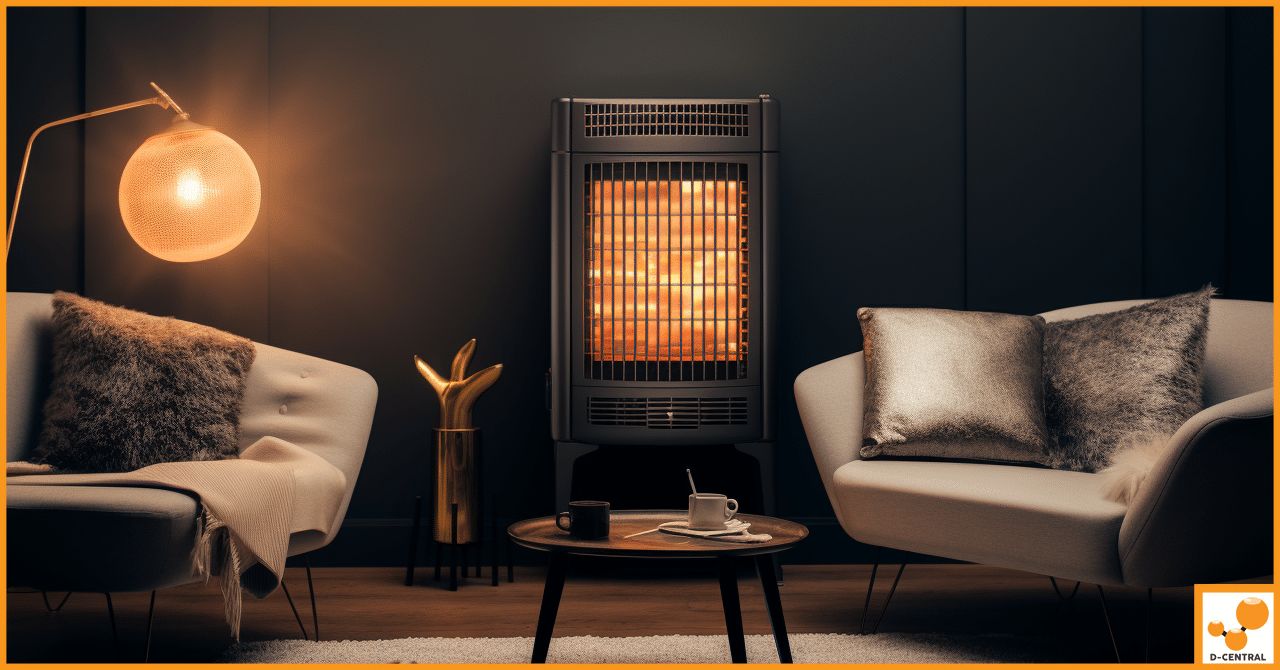

The Scientifically Smart Way to Stay Warm: Investing in Bitcoin Space Heaters This Winter

Welcome to the fascinating world of Bitcoin space heaters, a groundbreaking innovation that promises to redefine how we perceive home

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

Bitcoin has taken the world by storm since its inception in 2009. As the first successful implementation of a decentralized digital currency, it has the potential to revolutionize the financial industry by providing a trustless system for borderless transactions. Gold, on the other hand, has been a reliable financial asset and store of value for thousands of years. With its rich history and timeless appeal, gold has always been synonymous with wealth preservation and financial security.

In the digital age, the role of gold in the traditional financial world is being challenged by the rise of cryptocurrencies, with Bitcoin leading the charge. As the cryptocurrency market continues to grow and mature, investors and financial experts are increasingly drawn to the comparison between Bitcoin and gold. This article will explore the similarities and differences between these two financial assets, and how each can contribute to financial independence and wealth preservation in the face of the ongoing digital revolution.

In the following sections, we will examine the evolution of Bitcoin as a digital currency, the role of gold in the traditional financial world, and how they compare as stores of value, investments, and tools for financial security. We will also delve into the impact of financial technology and decentralized finance on both assets, and how they can be used for portfolio diversification, inflation hedging, and as safe havens in times of market volatility.

Bitcoin’s journey began with the publication of the whitepaper “Bitcoin: A Peer-to-Peer Electronic Cash System” by the mysterious figure known as Satoshi Nakamoto. The whitepaper detailed a groundbreaking solution to the double-spending problem, which had plagued previous attempts at creating digital currencies. By using a decentralized network of nodes and a public ledger called the blockchain, Bitcoin was able to achieve a trustless system without the need for a central authority.

Over the years, Bitcoin has evolved from a niche experiment to a recognized financial asset. Its growing adoption has been fueled by the digital age’s demand for faster, cheaper, and more secure ways of transferring value. The cryptocurrency has also gained increasing acceptance from traditional financial institutions, with major players like Fidelity, Grayscale, and the CME Group offering Bitcoin-based investment products.

Despite regulatory challenges and skepticism from some quarters, Bitcoin has continued to grow in both value and adoption. Its market capitalization, which was once a mere fraction of the gold market, has now reached over a trillion dollars, making it a force to be reckoned with in the financial world.

Gold has been a cornerstone of the global financial system for thousands of years. Its unique properties, such as its scarcity, durability, and universal recognition, have made it a highly sought-after store of value, medium of exchange, and unit of account. Throughout history, gold has been used as a hedge against inflation, currency devaluation, and geopolitical uncertainty.

In the modern financial world, gold continues to play a significant role. It is a key component of central bank reserves, and its price is often seen as a barometer of global economic health. Gold is also widely held by investors, both as physical bullion and through financial instruments such as exchange-traded funds (ETFs), as a means of diversifying their portfolios and guarding against market volatility.

As the world becomes increasingly interconnected and digital, gold’s role in the financial world is evolving. While it remains an essential asset for central banks and investors, it faces competition from new financial innovations, such as cryptocurrencies and other digital assets.

One of the key similarities between Bitcoin and gold is their use as stores of value. Both assets are scarce, with Bitcoin’s supply capped at 21 million coins and gold’s supply limited by the Earth’s finite resources. This scarcity, combined with their widespread recognition and demand, underpins their ability to store value over time.

However, there are some crucial differences between the two assets that can affect their use as stores of value. Bitcoin’s digital nature means that it can be easily transferred and stored, making it more accessible and practical for everyday use. Gold, on the other hand, is a physical asset that requires storage, transportation, and insurance, which can be costly and cumbersome.

Another key difference between the two is their price volatility. Bitcoin is known for its frequent and sometimes extreme price fluctuations, which can make it a risky store of value for those who are risk-averse. Gold, on the other hand, has a long history of price stability and is generally considered to be a more conservative investment.

As financial assets, both Bitcoin and gold offer investment opportunities for those looking to grow their wealth or preserve it against inflation and economic uncertainty. With its meteoric rise in value since its inception, Bitcoin has generated significant returns for early adopters and continues to attract new investors seeking high growth potential.

Gold has historically been a reliable store of value and a hedge against inflation, making it an attractive investment for those looking to preserve their wealth. While it may not offer the same explosive growth potential as Bitcoin, it has a proven track record of providing steady, long-term returns.

When considering the investment potential of Bitcoin versus gold, it is essential to consider factors such as risk tolerance, investment horizon, and portfolio diversification. Each investor’s situation is unique, and the optimal asset allocation will depend on their individual needs and objectives.

The rapid development of financial technology and the rise of decentralized finance (DeFi) are reshaping the financial landscape, with profound implications for both Bitcoin and gold. DeFi refers to an ecosystem of financial applications built on blockchain technology, which enables users to access financial services without traditional intermediaries like banks and brokerages.

Bitcoin, as the pioneer of blockchain technology, stands to benefit from the growth of DeFi, as it can be used as collateral for borrowing and lending, as well as a settlement token for various financial transactions. Additionally, the development of second-layer solutions like the Lightning Network will further enhance Bitcoin’s utility as a medium of exchange, making it more competitive with traditional payment systems.

Gold, on the other hand, faces challenges in adapting to the digital age. While there are efforts to tokenize gold and integrate it with blockchain technology, it remains to be seen how successful these efforts will be and whether they can enhance gold’s utility and relevance in the evolving financial world.

In times of economic uncertainty and market volatility, portfolio diversification is essential for managing risk and safeguarding wealth. Both Bitcoin and gold can play a role in diversifying a portfolio, as they are generally uncorrelated with traditional financial assets like stocks and bonds.

Bitcoin’s unique properties as a digital asset make it an attractive addition to a diversified portfolio, as it can potentially offer high returns and act as a hedge against traditional financial system risks. However, its price volatility can also introduce additional risk, making it important to allocate it judiciously within a portfolio.

Gold has long been considered a safe-haven asset and an effective portfolio diversifier, as it tends to perform well during periods of economic stress and market turmoil. By allocating a portion of a portfolio to gold, investors can potentially reduce their overall risk exposure and improve their portfolio’s risk-adjusted returns.

In an environment of unprecedented monetary stimulus and rising inflation concerns, both Bitcoin and gold are often touted as inflation hedges and safe-haven assets. As fiat currencies lose purchasing power due to inflation, scarce assets like Bitcoin and gold can preserve their value and even appreciate over time.

Gold has a long history of acting as an inflation hedge and a store of value during periods of currency devaluation. Its price often moves inversely to the value of fiat currencies, making it a reliable counterweight to inflationary pressures.

Bitcoin, as a relatively new asset, does not have the same track record as gold in this regard. However, its fixed supply and decentralized nature make it an attractive alternative to fiat currencies, which are subject to central bank manipulation and inflationary pressures. As Bitcoin gains more widespread acceptanceas a store of value and a medium of exchange, it has the potential to provide a safe-haven option for investors looking to hedge against inflation and currency devaluation.

However, it’s important to note that both Bitcoin and gold are subject to market volatility and are not immune to price fluctuations. While they may offer some protection against inflation and economic uncertainty, they should be viewed as part of a broader investment strategy that takes into account a range of risk factors and market conditions.

One of the fundamental similarities between Bitcoin and gold is their scarcity. Bitcoin’s supply is limited to 21 million coins, while gold’s supply is limited by the Earth’s finite resources. This scarcity underpins their value and makes them attractive as stores of value and investment assets.

However, the way in which their scarcity is enforced differs significantly. Gold’s scarcity is a result of its physical properties and the costs associated with mining and refining it. Bitcoin’s scarcity, on the other hand, is enforced by the protocol and the consensus mechanism that governs its supply.

This difference in scarcity has important implications for the monetary system. Gold has been used as a standard of value and a medium of exchange for thousands of years, and its scarcity has helped to prevent runaway inflation and maintain the stability of the global financial system.

Bitcoin, as a decentralized digital currency, offers a new paradigm for the monetary system. Its fixed supply and trustless system provide a potential solution to the problems of central bank manipulation and inflationary pressures. As the world becomes increasingly digital, Bitcoin’s scarcity and decentralization may make it an attractive alternative to traditional fiat currencies.

The rise of Bitcoin and other cryptocurrencies has heralded a new era of financial innovation and disruption. Blockchain technology and decentralized finance are transforming the way that value is transferred and stored, with profound implications for the global financial system.

As the digital economy continues to evolve, the role of Bitcoin and gold will likely continue to change. While gold may face challenges in adapting to the digital age, Bitcoin’s unique properties as a decentralized digital asset make it well-suited to the demands of the new economy.

The future of digital assets and financial disruption is still uncertain, but it’s clear that Bitcoin and other cryptocurrencies are here to stay. As investors and financial institutions continue to embrace these new technologies, the financial world will continue to evolve, and Bitcoin’s journey towards financial supremacy will likely continue.

Bitcoin’s journey from a niche experiment to a recognized financial asset has been nothing short of remarkable. As the first successful implementation of a decentralized digital currency, it has the potential to revolutionize the financial industry and provide a trustless system for borderless transactions.

Gold, on the other hand, has been a reliable financial asset and store of value for thousands of years. With its rich history and timeless appeal, it has always been synonymous with wealth preservation and financial security.

Comparing Bitcoin and gold reveals some important similarities and differences. Both assets offer investment potential and the ability to hedge against inflation and economic uncertainty. However, they differ in their price volatility, utility, and adaptability to the digital age.

As the financial world continues to evolve, Bitcoin’s journey towards financial supremacy will likely continue. With the rise of financial technology and the ongoing digital revolution, the role of Bitcoin and other digital assets in the global financial system will likely become increasingly important.

Investors and financial institutions should carefully consider the potential benefits and risks of investing in both Bitcoin and gold, and evaluate how each asset can contribute to their overall investment strategy and financial goals. By doing so, they can potentially achieve financial independence, wealth preservation, and portfolio diversification in the face of ongoing financial disruption and market volatility.

Q: The evolution of Bitcoin as a digital currency

A: Bitcoin’s journey began with the publication of the whitepaper ‘Bitcoin: A Peer-to-Peer Electronic Cash System’ by the mysterious figure known as Satoshi Nakamoto. The whitepaper detailed a groundbreaking solution to the double-spending problem, which had plagued previous attempts at creating digital currencies. By using a decentralized network of nodes and a public ledger called the blockchain, Bitcoin was able to achieve a trustless system without the need for a central authority.

Q: The role of gold in the traditional financial world

A: Gold has been a cornerstone of the global financial system for thousands of years. Its unique properties, such as its scarcity, durability, and universal recognition, have made it a highly sought-after store of value, medium of exchange, and unit of account. In the modern financial world, gold continues to play a significant role as a key component of central bank reserves and a barometer of global economic health. It is also widely held by investors as physical bullion and through financial instruments like exchange-traded funds (ETFs) to diversify their portfolios and guard against market volatility.

Q: Comparing Bitcoin and gold as stores of value

A: Both assets are scarce, with Bitcoin’s supply capped at 21 million coins and gold’s supply limited by the Earth’s finite resources. This scarcity, combined with their widespread recognition and demand, underpins their ability to store value over time. Bitcoin’s digital nature means that it can be easily transferred and stored, making it more accessible and practical for everyday use. Gold, on the other hand, is a physical asset that requires storage, transportation, and insurance, which can be costly and cumbersome.

Q: Investment potential of Bitcoin versus gold

A: As financial assets, both Bitcoin and gold offer investment opportunities for those looking to grow their wealth or preserve it against inflation and economic uncertainty. Bitcoin has generated significant returns for early adopters and continues to attract new investors seeking high growth potential. Gold has historically been a reliable store of value and a hedge against inflation, making it an attractive investment for those looking to preserve their wealth.

Q: The impact of financial technology and decentralized finance on both assets

A: The rapid development of financial technology and the rise of decentralized finance (DeFi) are reshaping the financial landscape, with profound implications for both Bitcoin and gold. Bitcoin stands to benefit from the growth of DeFi, as it can be used as collateral for borrowing and lending, as well as a settlement token for various financial transactions. Gold, on the other hand, faces challenges in adapting to the digital age, as efforts to tokenize gold and integrate it with blockchain technology are still uncertain.

Q: Portfolio diversification with Bitcoin and gold

A: In times of economic uncertainty and market volatility, portfolio diversification is essential for managing risk and safeguarding wealth. Both Bitcoin and gold can play a role in diversifying a portfolio, as they are generally uncorrelated with traditional financial assets like stocks and bonds. Bitcoin’s unique properties as a digital asset make it an attractive addition to a diversified portfolio, while gold has long been considered a safe-haven asset and an effective portfolio diversifier.

Q: Inflation hedging and safe haven status of Bitcoin and gold

A: Both Bitcoin and gold are often touted as inflation hedges and safe-haven assets. As fiat currencies lose purchasing power due to inflation, scarce assets like Bitcoin and gold can preserve their value and even appreciate over time. Gold has a long history of acting as an inflation hedge and a store of value during periods of currency devaluation. Bitcoin, as a relatively new asset, does not have the same track record but its fixed supply and decentralized nature make it anattractive alternative to fiat currencies.

Q: Scarcity and the monetary system: Bitcoin vs. gold

A: One of the fundamental similarities between Bitcoin and gold is their scarcity. Bitcoin’s supply is limited to 21 million coins, while gold’s supply is limited by the Earth’s finite resources. Gold’s scarcity is a result of its physical properties and the costs associated with mining and refining it. Bitcoin’s scarcity is enforced by the protocol and the consensus mechanism that governs its supply. This difference in scarcity has important implications for the monetary system.

Q: The future of digital assets and financial disruption in the digital economy

A: The rise of Bitcoin and other cryptocurrencies has heralded a new era of financial innovation and disruption. Blockchain technology and decentralized finance are transforming the way that value is transferred and stored, with profound implications for the global financial system. As the digital economy continues to evolve, the role of Bitcoin and gold will likely continue to change. While gold may face challenges in adapting to the digital age, Bitcoin’s unique properties as a decentralized digital asset make it well-suited to the demands of the new economy.

Q: Conclusion: Bitcoin’s journey towards financial supremacy

A: Bitcoin’s journey from a niche experiment to a recognized financial asset has been nothing short of remarkable. As the first successful implementation of a decentralized digital currency, it has the potential to revolutionize the financial industry and provide a trustless system for borderless transactions. Gold, on the other hand, has been a reliable financial asset and store of value for thousands of years. Investors and financial institutions should carefully consider the potential benefits and risks of investing in both Bitcoin and gold, and evaluate how each asset can contribute to their overall investment strategy and financial goals.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

Welcome to the fascinating world of Bitcoin space heaters, a groundbreaking innovation that promises to redefine how we perceive home

The landscape of cryptocurrency mining has undergone a remarkable transformation since the inception of Bitcoin in 2009. Initially, enthusiasts could

Welcome to the world of home Bitcoin mining! As cryptocurrency enthusiasts increasingly turn to home-based mining operations, it’s crucial to