A Deep Dive Into Rejected Shares in Mining

In the ever-evolving world of blockchain technology, cryptocurrency mining stands as a cornerstone process, vital for the maintenance and expansion

4479 Desserte Nord Autoroute 440, Laval, QC H7P 6E2

As the world of cryptocurrencies continues to evolve, understanding the potential future price of Bitcoin has become a topic of great interest for investors, businesses, and individuals alike. Predicting the value of this digital asset not only allows for informed decision-making but also helps to shape expectations for the broader crypto market. In this article, we will delve into an analysis framework that emphasizes the role of block subsidy, network difficulty, and hashrate growth in determining the future price of Bitcoin. By examining these critical factors and their interplay, we aim to provide a comprehensive perspective on what might drive the value of Bitcoin in the years to come.

In this article, we explore the Bitcoin Mining Dynamics Model (BMDM), initially proposed by @CJKonstantinos on Twitter in a simpler form. The BMDM focuses on several key components that have a significant influence on the future price of Bitcoin. It is important to note that while the BMDM does not claim that the price of Bitcoin is directly driven by mining, it emphasizes that mining dynamics are a valuable aspect to consider, as they have historically maintained a consistent ratio and offer an intriguing perspective on Bitcoin’s value.

Currently the #Bitcoin block subsidy is 6.25 $BTC or $187,500

ASSUMING THE NETWORK & DIFFICULTY REMAIN THE SAME (they 100% will not because the hashrate is growing exponentially)

The 2032 bitcoin block subsidy is 0.78 BTC or $187,500 (has to be in order to maintain the cost… pic.twitter.com/6aYUUogQ3j

— CJK (@CJKonstantinos) April 16, 2023

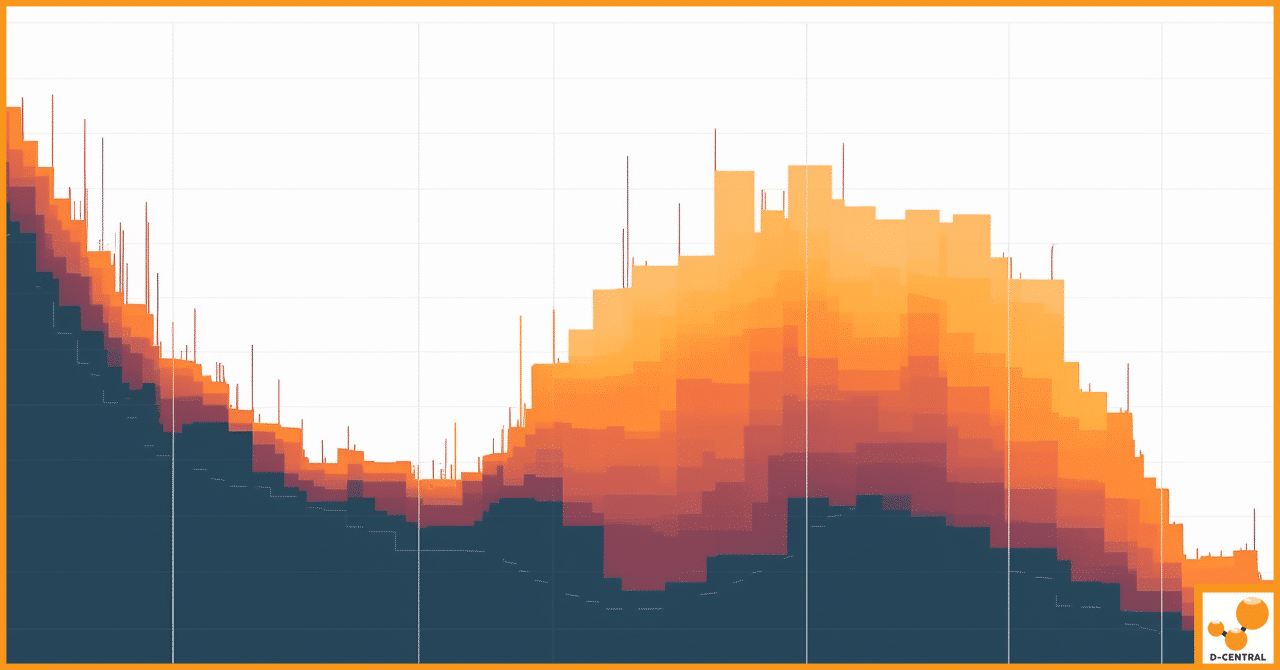

Firstly, the BMDM examines the block subsidy, which is the reward miners receive for validating transactions and adding new blocks to the blockchain. Currently, the block subsidy stands at 6.25 BTC, equating to a substantial monetary value. As per the Bitcoin protocol, this reward is halved approximately every four years, leading to a projected block subsidy of 0.78 BTC by 2032. This reduction in block subsidy is designed to maintain the cost structure of the Bitcoin network, implying a minimum price of $240,384 for Bitcoin in 2032 if the network and difficulty remain constant.

However, the network difficulty and hashrate growth are unlikely to remain constant. Network difficulty refers to the measure of how challenging it is for miners to solve the cryptographic puzzle required to add a new block to the blockchain. As the hashrate—the total computational power of the network—grows exponentially, the network difficulty continually adjusts upwards. This dynamic directly affects the cost structure of the Bitcoin network, which in turn influences the price of Bitcoin.

Another crucial element in the BMDM is the commodity cycle for store of value assets. Historically, store-of-value assets, such as gold and other precious metals, have experienced cyclical price fluctuations. Bitcoin, being a digital store of value, is expected to follow a similar pattern, reinforcing the importance of considering commodity cycles in price projections.

Lastly, the BMDM takes into account additional demand drivers that could potentially boost the price of Bitcoin. One such driver is the potential use of Bitcoin as a credit default swap (CDS) insurance on government debt, providing a hedge against the risks associated with traditional financial instruments. Another driver is the role of Bitcoin as pristine collateral in the global financial system, offering a highly secure and liquid asset that can be used for various purposes, such as lending and borrowing.

By taking these factors into consideration, the Bitcoin Mining Dynamics Model, as readapted by D-Central, aims to provide a comprehensive understanding of the forces that could shape the future price of Bitcoin.

The future price of Bitcoin is subject to a multitude of factors, one of which is market demand and adoption. As public perception evolves and the cryptocurrency becomes more accessible, demand for Bitcoin will likely rise, increasing its value. Additionally, the regulatory environment plays a critical role in shaping the market. Governments worldwide are imposing regulations on cryptocurrencies, with stricter regulations potentially deterring investors, while favourable ones could promote broader adoption and enhance Bitcoin’s value.

Technological advancements also have the potential to impact Bitcoin’s future price, as improvements to the protocol may increase efficiency, security, and scalability, thus attracting more users. However, stalled technological progress or failure to address existing issues could negatively affect its value. Furthermore, competition from other cryptocurrencies offering unique features or lower transaction costs could influence Bitcoin’s market share and price. Lastly, global economic and political factors can impact Bitcoin’s value, as investors may turn to it as a hedge during economic instability or political turmoil, while periods of economic growth and stability may lead investors to favour traditional assets over cryptocurrencies, decreasing demand for Bitcoin.

While the Bitcoin Mining Dynamics Model (BMDM) emphasizes the role of block subsidy, network difficulty, and hashrate growth in determining the future price of Bitcoin, it is essential to consider various factors for a holistic understanding of the cryptocurrency’s potential value. Market demand, adoption, regulatory environment, technological advancements, competition, and global economic and political factors all play a role in shaping Bitcoin’s future price. By taking into account the counterarguments, investors can gain a more comprehensive perspective on the forces that may drive Bitcoin’s value in the years to come.

The analysis framework and counterarguments are not mutually exclusive. In fact, the interplay between them may significantly influence Bitcoin’s future price. For instance, technological advancements and improvements to the Bitcoin protocol may increase its utility and demand, which in turn could impact the network difficulty and hashrate growth. Similarly, the regulatory environment and global economic factors could affect the demand for Bitcoin as a store of value, indirectly influencing the commodity cycle dynamics considered in the BMDM. By understanding the potential interactions between the BMDM and counterarguments, one can form a more nuanced view of Bitcoin’s future price trajectory.

The BMDM serves as a strong predictor of future price as it focuses on the underlying fundamentals of the Bitcoin network, specifically mining dynamics. Mining forms the backbone of the Bitcoin network, securing transactions and maintaining its decentralized nature. As such, the factors that influence the cost structure and incentives for miners directly affect the value of Bitcoin. Additionally, the BMDM accounts for the cyclical nature of store-of-value assets and considers additional demand drivers, which have the potential to boost Bitcoin’s price. By focusing on these core aspects, the analysis framework offers a solid foundation for understanding the forces that may shape the future price of Bitcoin, while acknowledging the importance of considering the broader context provided by the counterarguments.

In conclusion, predicting the future price of Bitcoin is an inherently uncertain endeavour due to the numerous factors that can influence its value in unforeseen ways. Market dynamics, regulatory changes, technological innovations, and global events all have a role to play in shaping the trajectory of this digital asset. While the Bitcoin Mining Dynamics Model (BMDM) and counterarguments offer valuable insights into potential price determinants, it’s crucial to approach these predictions with a healthy degree of skepticism and an understanding of the inherent volatility of the cryptocurrency market.

Despite the uncertainty, utilizing the BMDM as an analysis framework and considering counterarguments can help investors, businesses, and individuals make more informed decisions about their involvement with Bitcoin. By examining both the core fundamentals of the Bitcoin network, such as mining dynamics and the broader context provided by external factors, one can gain a comprehensive understanding of the forces that may drive Bitcoin’s value in the years to come. This holistic approach serves as a foundation for sound decision-making in a complex and rapidly changing market.

Given the constantly evolving nature of the cryptocurrency space, ongoing research and exploration into the factors that shape the future price of Bitcoin are essential. As new developments emerge, it’s crucial to continually reassess the interplay between mining dynamics, market forces, regulatory environment, and other relevant factors. By staying abreast of the latest trends, engaging in critical analysis, and considering a variety of perspectives, investors and enthusiasts can better navigate the complexities of the Bitcoin market and contribute to a deeper understanding of this revolutionary digital asset.

Q: What is the Bitcoin Mining Dynamics Model?

A: The Bitcoin Mining Dynamics Model (BMDM) is an analysis framework that emphasizes the role of block subsidy, network difficulty, and hashrate growth in determining the future price of Bitcoin. It takes into account the core fundamentals of the Bitcoin network, the cyclical nature of store-of-value assets, and additional demand drivers that may impact the value of Bitcoin. By considering these factors, the BMDM aims to provide a comprehensive understanding of the forces that could shape the future price of Bitcoin.

Q: What are some counterarguments to the BMDM price projections?

A: Factors such as market demand, adoption, regulatory environment, technological advancements, competition, and global economic and political factors can all impact the future price of Bitcoin. The interplay between these counterarguments and the BMDM may significantly influence the trajectory of Bitcoin’s value. By considering these factors, a more comprehensive perspective on the forces that drive Bitcoin’s future price can be achieved.

Q: How can the Bitcoin Mining Dynamics Model help investors in their decision-making?

A: The Bitcoin Mining Dynamics Model allows investors to gain a more comprehensive understanding of the forces that may drive Bitcoin’s value in the years to come. By examining the core fundamentals of the Bitcoin network, such as mining dynamics, and the broader context provided by external factors, a strong foundation for sound decision-making in a complex and rapidly changing market can be established. However, it is crucial to approach these predictions with a healthy degree of skepticism and an understanding of the inherent volatility of the cryptocurrency market.

Q: Why is ongoing research and exploration important in the cryptocurrency space?

A: Given the constantly evolving nature of the cryptocurrency space, ongoing research and exploration into the factors that shape the future price of Bitcoin are essential. As new developments emerge, it is crucial to continually reassess the interplay between mining dynamics, market forces, regulatory environment, and other relevant factors. By staying informed about the latest trends, engaging in critical analysis, and considering a variety of perspectives, investors and enthusiasts can better navigate the complexities of the Bitcoin market and contribute to a deeper understanding of this revolutionary digital asset.

DISCLAIMER: D-Central Technologies and its associated content, including this blog, do not serve as financial advisors or official investment advisors. The insights and opinions shared here or by any guests featured in our content are provided purely for informational and educational purposes. Such communications should not be interpreted as financial, investment, legal, tax, or any form of specific advice. We are committed to advancing the knowledge and understanding of Bitcoin and its potential impact on society. However, we urge our community to proceed with caution and informed judgment in all related endeavors.

Related Posts

In the ever-evolving world of blockchain technology, cryptocurrency mining stands as a cornerstone process, vital for the maintenance and expansion

In recent years, Bitcoin, the pioneering cryptocurrency, has captivated the world’s attention not just for its financial allure but also

Welcome to the ultimate guide on cooling solutions for home Bitcoin miners! Whether you’re a seasoned miner or just starting